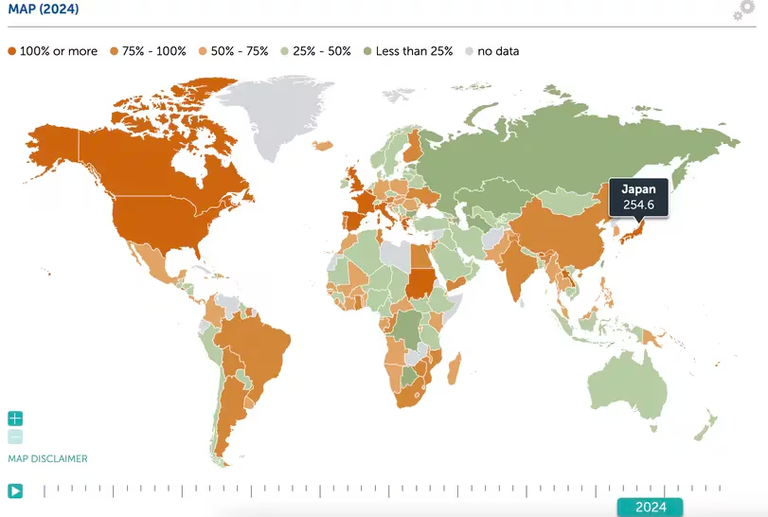

KEY FACT: Metaplanet has adopted bitcoin ($BTC) as a reserve asset to hedge against Japan’s debt burden and yen volatility. International Monetary Fund (IMF) says Japan's debt-to-GDP ratio is the highest among advanced countries at over 250%.

Edited on Corel Paint

Metaplanet Adopts Bitcoin as Reserve Asset

Metaplanet, a Japanese investment and consulting services company listed on the Tokyo Stock Exchange, has announced the adoption of Bitcoin as its strategic treasury reserve asset, during its recent strategic shift in its treasury management strategy. The shift is said to be inspired by the firm's recognition of challenges and opportunities within the current global financial landscape.

The move comes at a time when Japan is facing a high debt burden, resulting in volatility in the national currency - Yen. Metaplanet said in a press release on Monday that the company’s strategy “unequivocally prioritizes a Bitcoin-first, Bitcoin-only approach” with financial options such as long-dated yen liabilities and periodic share issuances.

This move is a direct response to sustained economic pressures in Japan, notably high government debt levels, prolonged periods of negative real interest rates, and the consequently weak yen. Metaplanet’s strategy unequivocally prioritizes a Bitcoin-first, Bitcoin-only approach for the Company, with the potential use of long-dated yen liabilities and periodic share issuances as strategic financial options to continually accumulate more Bitcoin instead of retaining the ever-weaker yen. This approach is designed to be accretive on a bitcoin-per-share basis, underpinning shareholder value on a long-term basis. - source

Metaplanet believes it can help its investors to secure the financial future with Bitcoin. Metaplanet is assuredly to continuously accumulate more Bitcoin instead of the ever-weaker Yen. Recently in April, the company disclosed plans to allocate a substantial sum of ¥200 Million ($1.25 million) to acquire Bitcoin.

In a post on X social media on May 10, Metaplanet announced the purchase of an additional 19.87 BTC bringing its recent acquisition since April to 117.7 BTC ($7.19 million). Metaplanet is following the strategy pursued by U.S.-listed MicroStrategy (MSTR), which has acquired several billion dollars worth of bitcoin, according to stats by Bitcointreasuries.net.

The investment by Metaplanet is significant because it comes at a time when Japan's fiscal crisis is said to be playing out in the currency market. Crypto propounders have long hailed Bitcoin as a hedge against fiscal and monetary imprudence.

Japan has the highest debt-to-GDP ratio among advanced countries (IMF)

Japan’s Debt Burden as Catalyst for Metaplanet's Pivot to Bitcoin

The International Monetary Fund (IMF) has published data that reveals that the ratio between Japan's gross debt and gross domestic product (GDP) currently exceeds 254%, which is the highest in the advanced world. The U.S. debt-to-GDP ratio has exceeded 123%. This relatively higher debt has kept the Bank of Japan (BOJ) from raising interest rates in lockstep with the Federal Reserve (Fed) and other major central banks.

Moreover, data from the charting platform TradingView show that the Japanese Yen has depreciated by 50% against the U.S. dollar since early 2021. The yen recently slipped past 155 per U.S. dollar, reaching a 34-year low. In response, Metaplanet said that BOJ's strategy of keeping rates low while intervening in the FX markets represents an "unsustainable monetary paradox," hence the need for Metaplanet to shift to Bitcoin which is believed to continue growing in value in the coming years.

"As the yen continues to weaken, Bitcoin offers a non-sovereign store of value that has, and may continue, to appreciate against traditional fiat currencies..."

japan is not alone in the fight against its debt burden, Nigeria to is in that class with over 150% depreciation in the Naira against U.S. dollar in the last two years. All of these are pointers that the reign of fiat money is coming to an end, as cryptocurrency adoption continues to grow despite regulation challenges in some countries.

What are your thoughts on this development? For how long will fiat money survive?

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

Crypto always keep getting the grounds, thanks for dropping this. Can i have your discord channel boss, wanna ask you something in private.

That's fine.

Discord: uyobong#5966

That's boss, I will

Via Tenor

lolztoken.com

ERROR: Joke failed.

@bpcvoter3, You need more $LOLZ to use this command. The minimum requirement is 0.0 LOLZ.

You can get more $LOLZ on HE.

Credit: rickonthemoun10

Earn Crypto for your Memes @ HiveMe.me!

Thank you Bilpcoin