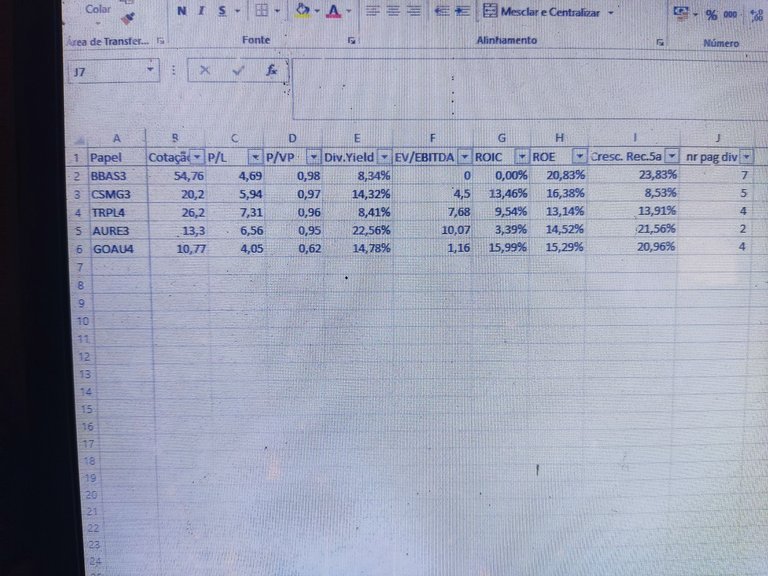

I use the fundamentus website https://www.fundamentus.com.br as a basis to create an Excel spreadsheet.

1- I select shares with liquidity above 1000000

2- stocks with earnings growth over the last 3 years

3- stocks with a dividend yield above 6%

4- stocks with price per book value per share below 1

I manually add another filter which is the number of dividend payments per year equal to or greater than 2

After selection, My spreadsheet indicate

Banco do Brasil (BBAS3),

Transmissão Paulista (TRPL4),

Auren Energia (AURE3),

Copasa (CSMG3),

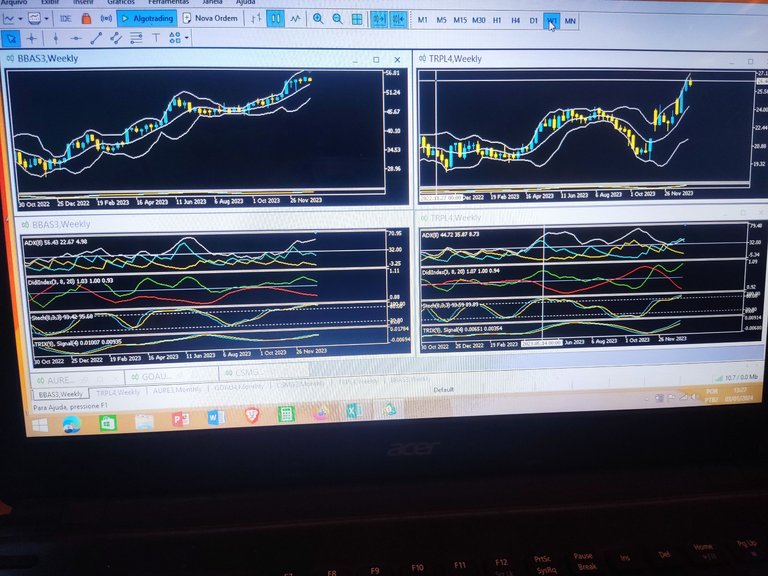

Metalúrgica Gerdau (GOAU4). I move on to graphical analysis to choose which shares are at the most favorable entry point.

I consider two factors, firstly the next expected dividend payment and secondly the trigger signaled by the setup created by Didi Aguiar that I will present to you in my next post.

"Disclaimer: This post about my stock picking setup is for informational and educational purposes only. It does not constitute financial advice. All investment decisions should be made after research and consultation with a qualified financial professional. Past performance is not indicative of future results. I am not responsible for any decisions made based on the information provided in this post."

Hoje vou compartilhar como eu filtro as ações que vou comprar para compor a minha carteira de investimentos.

Atendendo ao meu objetivo de possuir ações que me proporcionem um rendimento passivo em dividendos com uma rentabilidade acima de 6% ao ano eu uso o site fundamentus https://www.fundamentus.com.br como base para criar uma planilha no Excel.

1- Seleciono ações com liquidez acima de 1000000

2- ações com crescimento nos lucros nos últimos 3 anos

3- ações com dividend yeld acima de 6%

4- ações com preço por valor patrimonial por ação abaixo de 1

Acrescento manualmente mais um filtro que é o número de pagamentos de dividendos por ano igual ou superior a 2

Após a seleção minha folha de cálculo do Excel indicou Banco do Brasil (BBAS3), Transmissão Paulista (TRPL4), Auren Energia (AURE3), Copasa (CSMG3), Metalúrgica Gerdau (GOAU4).

Passo para a análise gráfica para escolher quais ações estão no ponto de entrada mais favorável.

Considero dois fatores, primeiro o próximo pagamento de dividendos previsto e segundo o gatilho sinalizado pelo setup criado por Didi Aguiar que vou apresentar para vocês no meu próximo post.

"Disclaimer:

Este post sobre o meu setup para escolha de ações é apenas para fins informativos e educacionais. Não constitui aconselhamento financeiro. Todas as decisões de investimento devem ser feitas após pesquisa e consulta a um profissional financeiro qualificado. O desempenho passado não é indicativo de resultados futuros. Eu não me responsabilizo por quaisquer decisões tomadas com base nas informações fornecidas neste post."

Gif by @aleister

Gif by @aleister

All photos by @pataty69

Gif by @doze

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thank you for suport

I think you've given me important tips to make wise decisions regarding choosing stocks to invest in.

This is very helpful for someone like me who doesn't have experience investing in stocks.

That is good but will you like to show your PC or laptop build to us someday. I saw a laptop in your pictures, do you not plan to buy a big screen monitor as that will give you next level feel.

!DHEDGE

!bbh

A big multiple screen monitor was my dream.

I am personally not familiar with these companies, however, I like your setup where you receive 6% in dividend payments. In an inflationary environment we are currently in, it's very important to maintain your purchasing power. 👍

Obrigado por promover a Língua Portuguesa em suas postagens.

Vamos seguir fortalecendo a comunidade lusófona dentro da Hive.

Your post was manually curated by @Shiftrox.

Delegate your HP to the hive-br.voter account and earn Hive daily!

🔹 Follow our Curation Trail and don't miss voting! 🔹

This post has been selected for upvote from our token accounts by @kahkashan! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.leo

- @dhedge.pob

@kahkashan has 0 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.