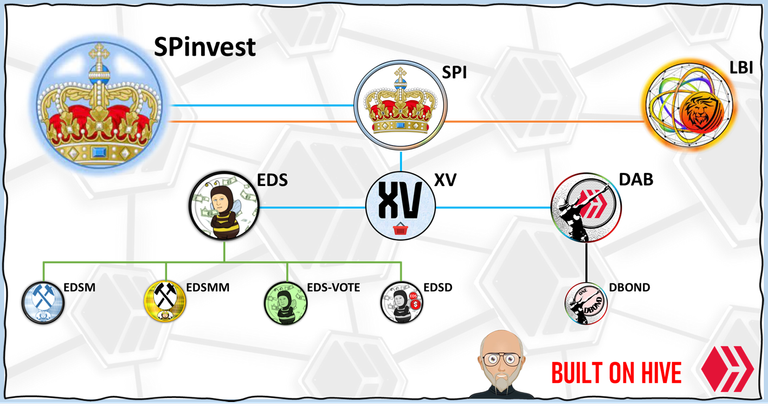

Hello SPIers, today we look at what SPI has done over the past year as we come toward the end of year 5. Can you believe 5 years are gone already?

When I start to think back over the past year, nothing springs to mind but the more I think the more I remember. It's funny how we forget things so quickly. Year 5 for us is the year of EDS. It has seen phenomenal growth in both community support and HP balance as we've grown out its eco-system with 2 add-ons.

PEPE

Bought 360M of Pepe for $150, sold back 60M in July for $200 and now we freeroll with 300M worth $2450. This is no question our best-performing investment of the year. My only regret is not buying us in for more but at the same time, it's not our style to dump $2-3k onto a new meme token and our investment was purely a punt.

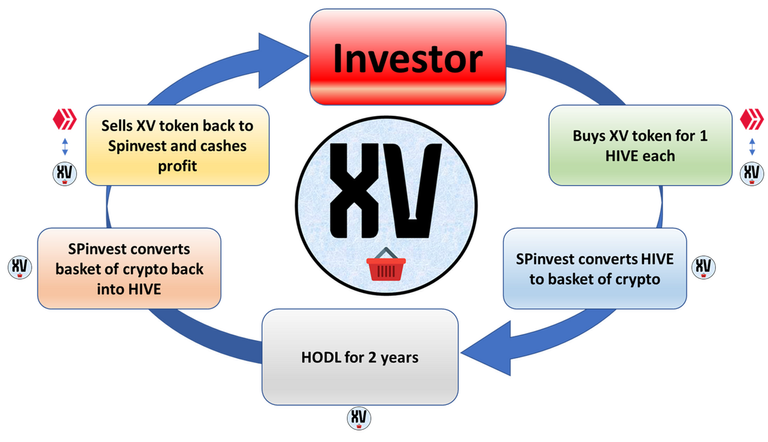

XV Token

We released the XV token having done a 10-week presale beforehand. The XV project has a lifespan of 2 years and will wrap up in May/June 2025. XV tokens were presold at 1 HIVE each with all HIVE raised being used to buy a basket of 15 cryptos ranked in the top 50 on coingecko. The idea is that top-ranked cryptos like BTC, ETH, SOL etc will outperform lower-ranked cryptos like HIVE for the first half of the bullrun. By wrapping up in June/July 2025, we are hopefully getting max HIVE value. Currently, the book value for XV tokens is 2.35 HIVE each giving investors a 135% HIVE profit in a year. I'd say things are going well for XV token holders.

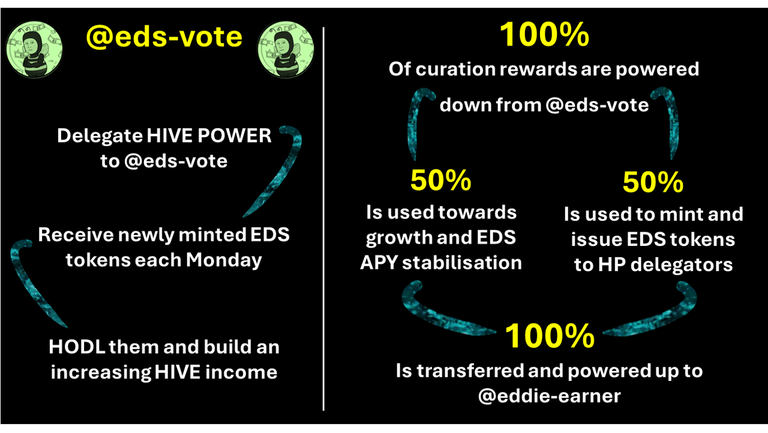

EDS-vote

We launched this incentive and it's been doing well and growing almost week on week since launch. EDS-vote was set up to mint and distribute EDS tokens to people who delegate HP to the @eds-vote account. We use half the curation rewards to mint new EDS and the other half is powered up directly to @eddie-earner resulting in a larger HIVE income pool for EDS token holders. The account currently has 300k HP being delegated to it and is minting over 200 EDS per week.

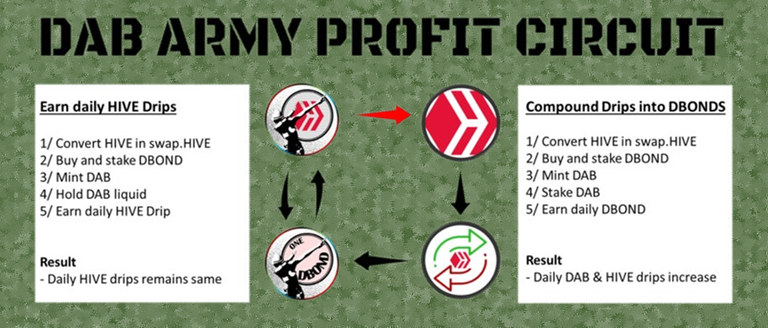

DAB

This is a HIVE drip project we've launched in partnership with BRO. It's same same as EDS but different 😆. Same because its a HIVE income project 1005 focused on HIVE/HP but different because if its token distribution and reward structure. The project sold over 100k HIVE worth of DBOND tokens and is growing at a slow pace. I have plans to grow this project out this coming year so maybe next year will be the year of DAB for us.

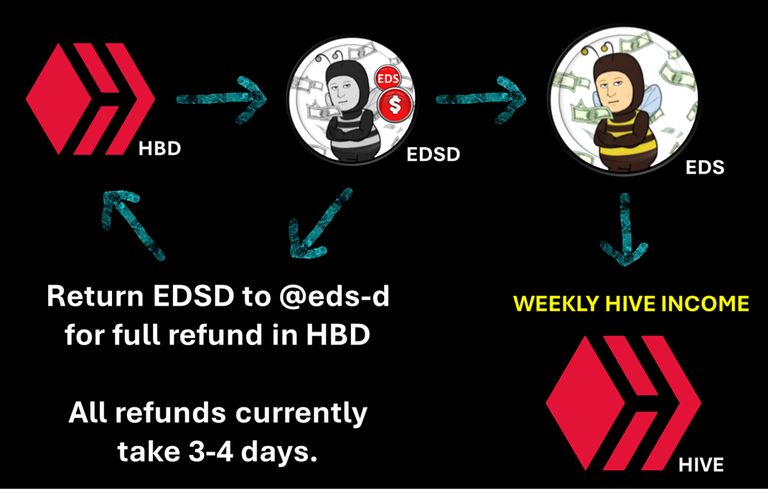

EDSD

I have for the longest time wanted to release a HBD-backed token and last year after seeing the success of eds-vote and the support from the community it seemed like EDS opened that door for me. The USP for EDSD is we convert the interest earned from the HBD balance into HIVE and the amount of EDS minted each week goes up and down with the market.

EDS now covers the 3 main ways to invest on HIVE through

HIVE = EDS and EDS miners,

HIVE POWER= @EDS-VOTE

HBD = EDSD

FET and others

At the start of 2024, we converted a bunch of our HBD into HIVE and went on a spending spree before the bullrun started. During this time we bought FET, DOGE, BONK and KAVA spending $6k in total.

BTC to HIVE trade

I spoke for the best part of a year about SPI doing a BTC > HIVE trade to take advantage of the huge spread between the ratios top and bottom. Last cycle in Jan 2025 1 BTC got 330k HIVE and by Nov 2025 when HIVE was over $3 the ratio had dropped to under under 25k to 1 BTC. This cycle we said we would trade 1 BTC for 200k HIVE when it comes and then cash out that 200K HIVE when either HIVE hits $2 or the BTC to HIVE ratio drops to 50k HIVE for 1 BTC.

Around 4 weeks, the ratio dropped to 1 BTC for 200k and we pulled the trigger. This is our largest trade of this cycle and if we can get either exit we'll have got almost maximum value from the complete cycle putting SPI into a new level and cementing its position as the best-performing HIVE fund token.

ETH X5 Leverage Trade

Lastly and most recently, we've dipped out toe into leverage trading. We did a 5x margin trade with ETH for $500. We got in when ETH was around $3250 after a 8% dip. Seemed like a good time but it's dropped further since then and actually almost been liquidated 2 times. Luckily, we hold extra funds in a holding wallet to let auto-tops happen. Im tempted to double down on this cause I cant see the markets going down much more and ETH is set for an explosion as it's not been performing great compared to others so far. We'll look back on $3k this time next year and think, crap, should have doubled down 😈

I'll make more updates on this to show people how margin trades work in more detail. I'd plan for us to do some heavier leverage trades in the next bear market so doing this smaller one is a way to show SPI holders how it works from start to selling out. Our exit price is $6k ETH btw.

Thats our year in 1000 words

I swear to god, I never check the word counter until im done and it is always on 1000 words give or take 50.

Of course we have done much more this year. We've doubled our HIVE dividends since the BTC to HIVE trade, we took part in a few community fundraisers, tired a few things that never took off but all in all, it's been a great year, one of our best years for growth.

The fund will finish with 35% growth this year which is 75% over target. SPI being the flagship token for SPinvest will always remain simple, it'll never have curation trails, NFTs, create a tribe, miner tokens, none of that. We stick to the core plan outlined in the release post 5 years ago and because we do so, we continue to see growth year on year. Dont fix it or crap about with it if its not broken, right?

We will focus our time on continuing to build out the ecosystems to both EDS and DAB which add great value to SPI. We can make these projects more complex to include miners and other things without directly being connected to the ownership of SPI tokens. In other words it's better to run 3 projects separately instead of all under 1 token because if the crap hits the fan on 1 of them, the other 2 are not affected. Running different projects separately also makes it alot easier for investors to understand.

SPI = HIVE growth

EDS = HIVE income

DAB = Daily HIVE drip

These are the goals for each token. These goals never change are evolve. Simples.

Thank you to everyone who holds SPI tokens for the support given over the past year, past 5 years. We sadly lost an OG this year and I still miss not getting comments from @ericburgoyne but we grind on, something Eric did very well. This coming year will not make are break us, that will be year 7 but we should see alot of dollar growth over the next 52 weeks, to say the least.

Coming tomorrow = The plan for year 6

rough plan, not going into super detail because...well, I cant because it's not happened yet

Getting Rich Slowly from June 2019

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

Definitely not our style to dump 2-3k into a MEME token. Glad we recognize that!

XV token has been fun to partake in. I hope there's a XV2 to dump my XV+Profits into when the time comes. Maybe do this for three years as I have an XV party to pay for in three years (one can dream that I can pay for the whole thing with my crypto profits while keeping enough invested to keep a retirement fund).

I didn't know about the fetch.ai purchase. Good to know.

KISS. Keep it simple sweetie. You do a good job doing that took.

RIP @ericburgoyne <3<3<3

Very good!

Thank you!

i choose hive income for now 💪🤣

i miss erics posts too 😰😰

Sheet, with the amount of EDSMM you have, your stuck with HIVE INCOME 🤣

Eric was a G

great evaluation for another year in the books. Something funny I noticed over the last ~2 years is that most of the SPI related HE tokens crept up to the top of my HE wallet. And sure I invested and keep investing in some. But it's also because they gained a lot of value while others dropped of during the bear

Looking forward to the next and mostly year after this one!

RIP @ericburgoyne, haven't had a lot of interaction with him but I remember the times we did were very positive