The biggest story of the year in crypto has been how the US government suddenly woke up and began to heavily attack the industry. Going from seemingly ignoring it to it becoming enemy number 1. They have claimed that due to the FTX fraud, they need to protect users from this market which is a giant casino or Ponzi scheme. That people will lose their money here. They have also claimed that crypto was a main contributor to the banking collapses that have begun to take place. These are just a few reasons why the government has begun to attack the Bitcoin market, but they are all lies. The possible truth is much darker.

Put on your conspiracy theory hats, things are about to get heated.

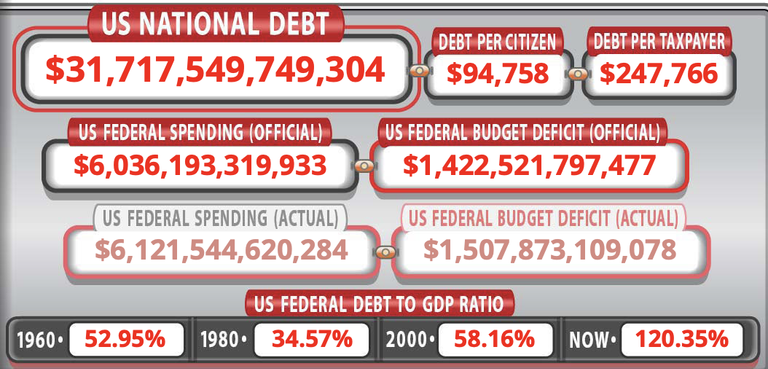

While I have been happy to grow up in the US, there is no denying that it currently has many flaws. One of the biggest is the amount of debt that the country has. Now over 31 trillion dollars. Up more than 30 in only a few years. An amount that is increasingly becoming more impossible to pay back as each year goes by.

Up until now, the US has had the benefit of being in control of the world reserve currency, the US dollar. This has resulted in other countries around the world being more than willing to buy the US debt. A luxury that no other country currently has. Their debt didn’t matter, because they could just print whatever they needed.

But, things are beginning to change. If you have been paying attention, other countries such as China and Russia are forming the BRICS alliance which aims to take power away from the US dollar. Once more countries are no longer depending on the dollar, the power that the US can exert on them through sanctions will decrease.

As inflation is rising, interest rates are increasing, the US is using a large percentage of its budget to simply pay the interest that is accumulating on its debt. Something that will hamstring the economy as the years goes by.

The only way that the US can escape its debt is through a period of hyperinflation. By printing an extreme amount of money to pay off its debt. While in the long-term this could be a good move for the country, and essentially give it a clean slate. However, in the short term, it would cause absolute chaos. Overnight people’s wealth would evaporate. Simply buying food and paying for expenses would become an impossible task for many.

This leads us to “Operation Choke Point 2.0.”

The government has made it no secret that they are attempting to not only penalize banks for working with cryptocurrency companies. But they are attempting to cut off the on/off ramps to crypto. Even driving away US crypto companies offshore. They have claimed that they are only trying to protect US customers. But what if the “hyper-inflation” event is being planned, and is coming? What if their true intention is to block the exits and keep people from escaping the US dollar ecosystem before this happens?

If people are able to escape to Bitocin during this time, it could quickly cause hyperbitcoinization, and its value reaching millions of dollars. However, if they can trap people in the dollar, there is still hope the dollar could maintain its power over people and other countries.

This is the scenario that Balaji has been trying to warn people about, and why he made the outlandish $1 million dollar Bitcoin price bet. He was trying to warn people to head for the exit to Bitcoin while they still can. While I hope this mass dollar inflation event doesn’t happen. The truth is that it seems everything is lining up, and the chances of this actually happening are gradually increasing every day.

How about you? Why do you think the US is attacking Bitcoin?

Read Exclusive Articles 1st on

or

As always, thank you for reading!