When it comes to cryptocurrency, Bitcoin is the name of the game. The overall goal for everyone in this market should be to accumulate as much of it as they possibly can. There will only ever be 21 million Bitcoin created and there is a shockingly small amount of it still available on the market. This is the philosophy I have when it comes to building my portfolio, but it doesn’t mean that I only hold Bitcoin. I also own Ethereum and a few other altcoins. These altcoins are my long-term strategy tools in order to accumulate more BTC and ETH.

When it comes to making money in the short term in cryptocurrency, you’re greatest advantage is having extreme flexibility, an open mind, and willing to change your strategy in an instant. If you paid attention close attention to the crypto market over the last few years, you will have noticed 4 main trends that you could have capitalized on.

DeFi Summer

After the shock of the covid price drop in March 2020, the market began to recover. The Bitcoin halving that took place soon after compounded that recovery. But then a few months went by with sideways price action. That is when DeFi summer took place.

Any crypto that was related to DeFi on Ethereum went up parabolically. Coins soared hundreds and thousands of percent in days. This was also the period that cemented Uniswap’s popularity. Before this period, most in the industry had no idea what DeFi was. If it was just the latest hype bubble, or if it would be around for the long term. However, those who paid attention to the market and acted promptly were rewarded handsomely.

Meme Coins

DeFi summer soon cooled down largely due to the expensive Ethereum gas fees, but a few months later the next hype cycle began; Meme coins. Led by Dogecoin, food coins, Shiba Inu, and then several other copies. We all knew that these tokens didn’t have any real value and were incredibly risky. It was like playing with fire.

But there is no denying that there was money to be made. Before the hype movement began, Dogecoin was only worth a small percentage of a cent. But with the hype caused by Elon Musk’s enthusiasm for the project, its price would rise to over $0.70.

Sometimes people overthink the crypto market too much. Thinking about use cases, real value, and so on. But they ignore the momentum of the market, and forget that anything can pump no matter how silly it is. That is the cryptocurrency market.

Alternative Layer 1s

The last cycle will forever be known as the cycle led by VCs, and insolvencies. There is no better example of that than alternative Layer 1 blockchains causing the next hype phase. Solana, Luna, Avalanche, and several others were the talk of the market. They were labeled the Ethereum killers, that would finally overtake it.

Today we recognize that this was VCs trying to shill their investments. But projects like Solana went from being valued at $2.00, all the way up to $250. If you were paying attention to the trends, and were able to adjust. Large amounts of money could have been made.

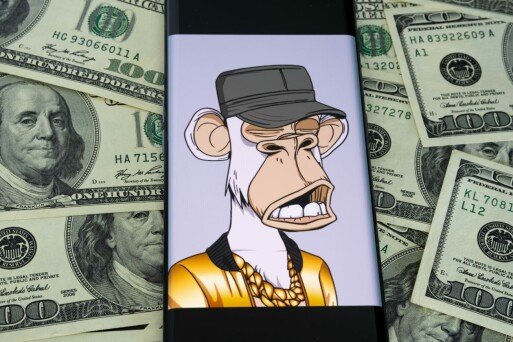

NFTs

The next hype cycle was caused by NFTs. Crypto Punks and Bored Apes were being sold for millions of dollars. Movie rights were being sold, and NFT restaurants were being made. This was touted as the crypto movement that would finally take this industry mainstream.

And for a while, it did.

We saw some of the biggest celebrities sporting their NFTs as their profile pictures on Twitter. Companies such as Starbucks, Nike, and even Disney began entering the NFT space. Those who had an open mind and recognized the potential that NFTs presented were once again able to make a lot of money in this market.

Airdrops

The most recent trend has been crypto airdrops. Receiving free crypto for participating or testing a network, performing tasks, connecting wallets to a DEX, or being active on their social channels. Kicked off by Uniswap, the airdrop craze has surged in popularity even more after the recent Optimism, Aptos, and Aribitrum airdrops. There are still potential opportunities on the horizon with zkSync.

If you recognized the momentum that airdrops were having, and began to hunt them. You could have earned tens of thousands of dollars. As always, seeing an opportunity and quickly reacting to it is vital in this market.

In the Future

Layer 2s

As we move into the future, we should always be looking ahead to our next great opportunity. One of those possible opportunities could be Layer 2s on Ethereum. Projects built on Arbitrum, Optimism, and zkSync could cause a similar hype cycle reminiscent of what we saw during DeFi summer. I have been planning accordingly.

No matter how you feel about the current trends in crypto, you can still use them to your advantage to help you move further along with your own goals. I have done several of the above in order to accumulate more Bitcoin and Ethereum.

How about you? Which hype cycle did you participate in?

Read my articles first on

or

As always, thank you for reading!

Congratulations @johnwege! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: