When you invest in the crypto market, there is a general investing strategy that is given to you. Invest over the long-term, dollar-cost-average, and survive the peaks and valleys of the market. Those who survive and can stay in the market often are the most successful. This is great advice and works well for most people. Generally, time in the market is better than trying to time the market.

However, there is something that they don’t tell you. That there are a few select days when crypto prices have fallen in such an extreme manner, that they are life-changing opportunities. Days that will allow you to jumpstart your portfolio and accumulate amounts that might have otherwise taken years. These are the most important days of your crypto journey, but most people don’t take advantage of them and instead sit on the sidelines.

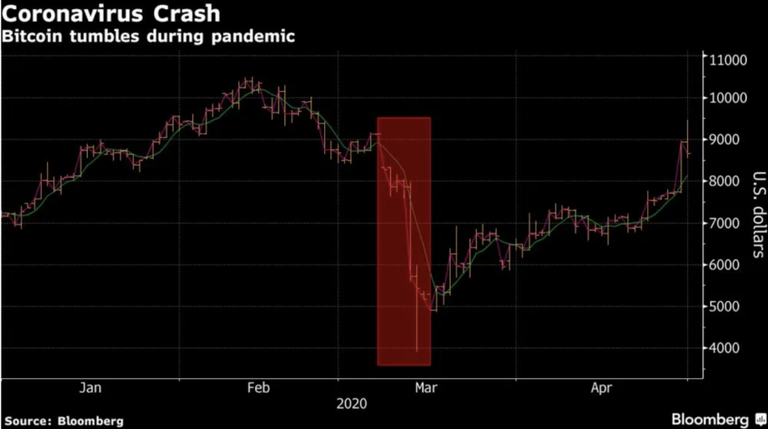

One of the most famous recent examples of this was on March 12, 2020. Due to the fear surrounding covid panic spread across the globe. In mere hours, Bitcoin’s price had dropped by 50%. There’s a rumor that due to BitMex’s empty order book, if they hadn’t unplugged their system, Bitcoin could have gone to zero. But they did and potentially prevented the death of Bitcoin. We now know that this was a once-in-a-lifetime opportunity for investors. Buying Bitcoin at $3,500; or Ethereum at $80. Portfolios were made that day. People forget the real fear that was in the market. The worries were that this market was coming to an end. It took courage, conviction, and a little foolishness to buy when the market was dropping faster than gravity.

A more recent example was after the FTX fraud scandal in October 2022; causing a cascade of fear that eventually caused the price to drop to $15k. Unlike the Covid crash where BTC’s price recovered began recovering in a few hours. This crash was longer, which also meant people had much more time to take advantage of it.

But similarly to the Covid crash, there was once again fear that the FTX scandal would be the death blow to the crypto industry. That new all-time high prices would never be seen again, and even questioned if we could survive it. Potentially even more importantly, experts declared that the reputation of the crypto market was damaged so severely that it might never recover.

However, a year has passed and Bitcoin rose up to $49k before now settling in near $42k. Once again re-affirming the trend in crypto. When there is real fear that the market is about to end, those are the best buying opportunities.

We are now heading into the next bull run and price predictions have already begun to show up everywhere. People have declared that this time will be different. That this could be the Bitcoin super-cycle that we’ve all dreamed about. Many are expecting prices to go up only, and they will learn the hard way. Even during bull runs, Bitcoin and other cryptocurrencies have significant pullbacks. These are the opportunities that you need to take advantage of.

Having the courage to buy while the market is collapsing is only half the battle. The other main obstacle is actually having the cash to take advantage of these opportunities. My strategy has been to constantly heavily invest in crypto throughout the years, but always maintain cash on the side. This cash is reserved for these moments that I consider life-changing buying opportunities. When the Covid and FTX crashes came, I went all-in with my spare cash.

This strategy during the Covid crash ended up being a portfolio-defining moment for me and I expect years from now my buys after the FTX crash will be very similar.

Time in the crypto market is almost always the best strategy. But the cryptocurrency market in its short history has tended to present life-changing opportunities once every few years. Setting yourself up so you’re ready to pounce on these chances is one of the most important portfolio-defining things you can do.

How about you? Have you taken advantage of these crypto portfolio-defining moments?

and

As always, thank you for reading!