16 Years ago, when I was a young guy and still in high school I bought my first share: One Berkshire Hathaway class B for about 2000 EUR. One single share costing that much is quite unusual, but this added to the mystery of this outstanding company and convinced me that this was a good stock pick. (Later in 2010 there was a split 1:50).

Berkshire Hathaway is the company of the great investment legend Warren Buffett. At the time around 2000, when I bought the share, he was already well known by a lot of investors and the best times were already behind him.

Don't get me wrong. Berkshire Hathaway is still a great company and Warren Buffett's gigantic knowledge about stock markets still grows year after year. But as he puts himself, he has reached an age where he doesn't want to take huge risks anymore.

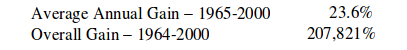

And so his compounded annual performance was mediocre the last years and deteriorated from 23% when I bought his share to 19%.

But this is still a very good performance compared to almost all professional bank traders, who nearly destroyed the financial system in 2009 and then were bailed out by tax payers.

In 2014, after 14 years, I have sold all my Berkshire Hathaway B shares that I have accumulated over the years, with a nice win. If there will be a real stock market crash and I mean a real one, I will probably buy again some BRK shares, who knows? But nevertheless Warren Buffett will stay my first and most important investment role model.

In my next articels I will talk a little bit about Warren Buffetts investment strategies and also his life. Everyone who invests his money in the stock market should study Warren Buffett first, because 19.2 % annually over 50 years is the high score in the #investments area.

My name is cryptix. I am a software developer and a hobby investor for about 16 years now.

Picture under Creative Common License: Poster Boy – Motherfuckn' Bailout Association

Who will be the successor to Warren Buffett? In JP. Morgan is betting on this man

https://steemit.com/warrenbuffett/@erez7770/who-will-be-the-successor-to-warren-buffett-in-jp-morgan-is-betting-on-this-man