Good day dear community, I hope that you are all doing well so far and that you had a great day that has been full of numerous experiences! In this post, I would like to talk a little about a psychological topic and hope you are able to expand your knowledge.

The crypto markets are not so easy to understand from a psychological point of view and are characterized by numerous different influencing factors and when you are traveling in this world, it is important to look behind the scenes and also to understand the principle behind it. First of all, it is important to know that the markets have changed a lot in recent years and as a result the cryptocurrencies have gained more and more popularity and also the base of investors has changed a lot and through new developments of numerous products, it has become very easy and beginner-friendly to invest without that the most people understanding the psychology behind it. The markets are strongly influenced by emotions and combined with the own wishes it often happens that investors think irrationally and are inclined to make wrong decisions and especially new investors who are guided by the fear of being able to miss a trend are particularly vulnerable to it. Fear is one of the most dominant feelings within the markets and can be divided into different categories and the fear of missing things leads to making the wrong decisions without having analyzed the scenario beforehand and this phenomenon is also known as fear of missing out effect or FOMO for short and is strongly influenced by mass psychology and when investors see that other people have made profits, this is very contagious and leads to the fact that people often make wrong decisions and let them influenced by others.

Fear of losses can also be very strong and lead to the fact that people let themselves be guided by short-term price fluctuations and do things that they would otherwise not do and also conversely, rising prices can lead to becoming greedy yourself and especially this typical game of the markets of rising and falling prices and the resulting changing feelings can strongly manipulate investors and ensure that they make wrong short or long-term decisions. In addition, investors are not always the same and think differently at certain times and these feelings can be reinforced by external influences and especially this fusion with other things can lead to a strong pressure being built up and these psychological burdens by the markets are definitely not to be underestimated and here is the greatest danger that most people do not even know this and let themselves be influenced even more. Especially short-term ideas can have a particularly strong impact on feelings and if you know the psychology of the markets, it is easier to go into yourself and reflect and make the right decisions and in addition, the markets change again and again and are characterized by patterns or cycles. Especially the change of the market cycles leads to the fact that the mood among investors is also changing more and more and in certain scenarios it comes to the fact that patience and restraint is required and some tend to make the wrong decisions out of greed or act out of affect and there is also the fact that you always have to look at psychology individually and everyone reacts differently to things and is shaped by other values or beliefs.

The generated emotions lead to a whole series of reactions in the entire thought pattern, which can often lead to long-term reactions and the high attraction of some projects often leads to a change of the own attitude towards the markets and you often see in the crypto world that some coins have developed into a kind of religion, which means that people change their own way of thinking and let themselve be influenced. Especially for new investors, it is important to get to know the markets better first and to understand the psychology behind it as well as the various cycles of the markets and in order to reduce certain feelings, it is important to focus on things on long-term and also to relate this to the investment. It is also important to remain neutral and not to be manipulated by external influences and often a lot of fear is created over the media, which also leads to wrong decisions and if you believe a project yourself, you still believe in it in later times and investing in the long-term perspective is probably one of the best decisions from a strategic point of view. It can also be advisable to diversify and to divide the money into different projects and to bet on more cards and especially with new investors, it can be worthwhile to invest in small parts, so instead of investing in a project at a time, simply divide the money and make small purchases on a monthly basis and with this strategy, investors are more protected from price fluctuations and it is also easier to analyze the markets and get to know the cycles. I would like to mention at the end that my post should be about the psychology behind the markets and this should not be an advice for investments!

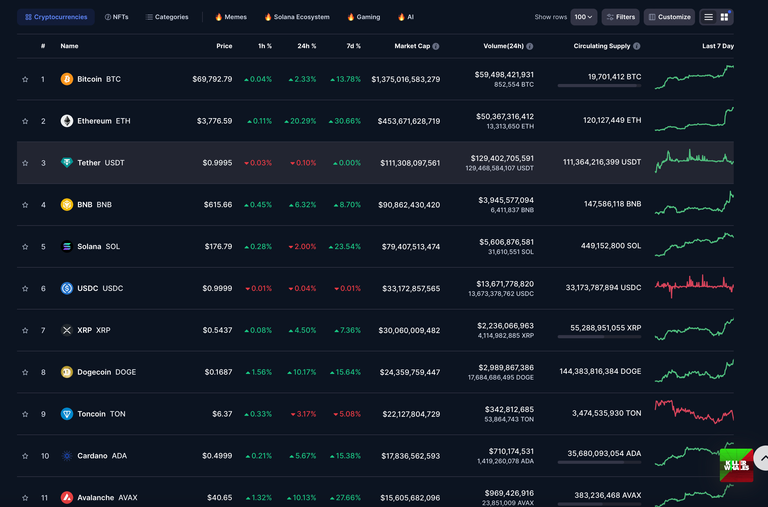

Many thanks for taking the time to read through my post and I hope you like it and can even learn something new about this interesting topic, I used artificial intelligence to create these works of art and took these screenshots form https://coinmarketcap.com.

Posted Using InLeo Alpha

The next time is Bitcoin and its price can go up to 100,000 this time.

I'm glad to hear your opinion!

Thanks alot dear.

#hive #posh

Congratulations @elevator09! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 17000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP