Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

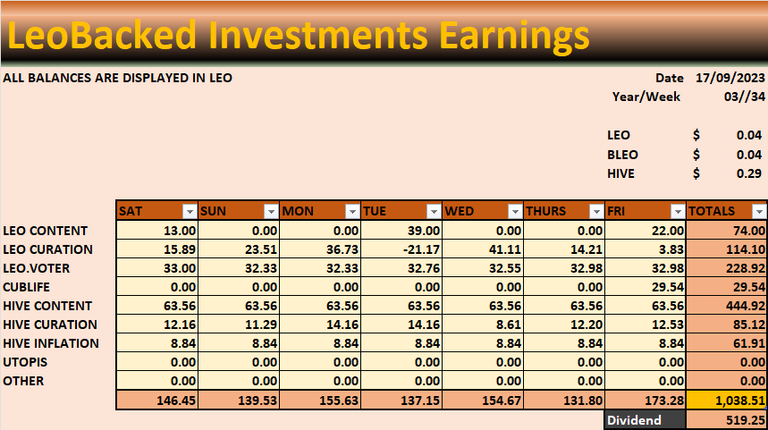

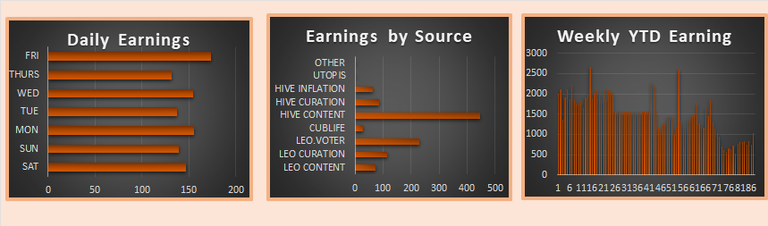

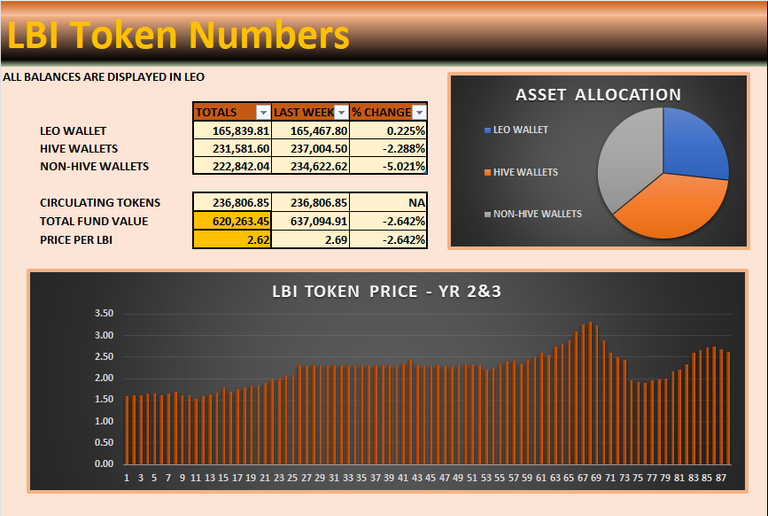

Earning this week were really good and over 1000 LEO for the first time in a long time, 16-17 weeks by the look of it from the chart. HIVE content was a top earner with 444 LEO, followed by leo.voter rewards at 228 LEO and 3rd was LEO curation with 114 LEO.

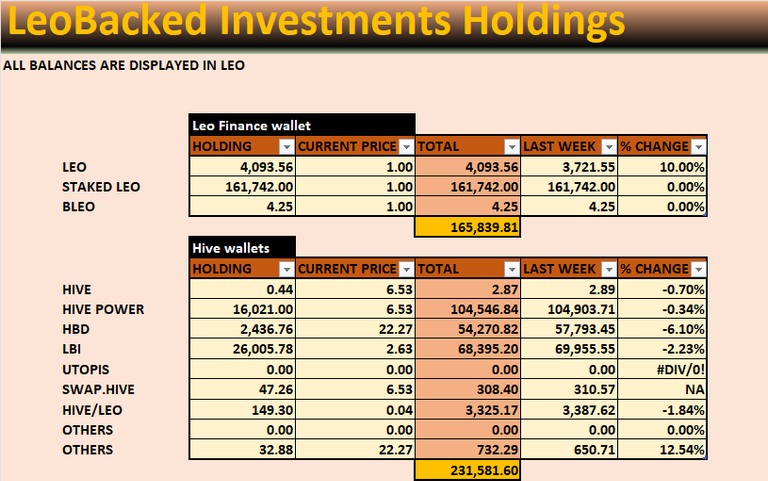

Our liquid LEO balance increased by roughly 400 LEO this week, our HP balance grew by around 70 and we added 10ish HBD into the saving wallet which we'll convert into HIVE and power up someday and up our leo.voter rewards.

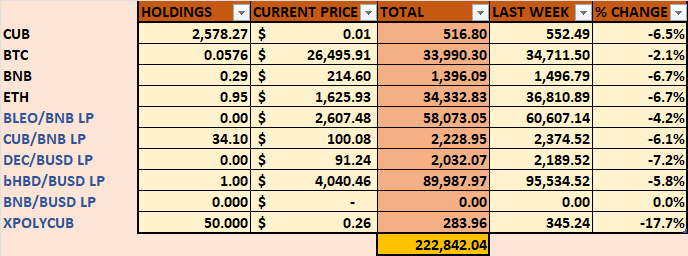

Most of our nonHIVE holdings dropped this week by 6% against LEO. CUB harvest was converted into BTC as always. I saw new farms on CUBfinance but when I "approve contract", they dont update. Shame because the APYs range between 7k to 250k APY, lmao. We have $3000 sitting in BTC and ETH and I got a boner when I saw the new farm but they are not working. I honestly think paying out these APY would destroy the price CUB and it could drop another 90% from selling pressure. Anyways, maybe it is a bug are someone made a mistake and made some live that should not be live, are not life yet 🤔

The price of LEO increased a few percent this week and outperformed HIVE and our non-HIVE holding. This results in the fund being worth less LEO but worth more dollars if that makes sense. If we ever see the price of LBI tokens dropping to 0.98 LEO per token, we're millionaires.

CUBlife update

There are still 6300 CUBlife token waiting to be sold back. If you are holding CL tokens, the project has been wrapped and we're buying back all tokens to burn them out of circulation. You can sell your CL token back to here for 0.65 HIVE each.

People holding or staking over 100 CL tokens are currently @themightyvolcano @daveks @moretea @flauwy @yieldgrower @myvest @beststart @preparedwombat @metzli @hykss @hhayweaver @eirik

All in all, not a bad week. Thank you for taking the time to stay up to date with LBI.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

I think those APYs are offered only for the first few to put funds into ine if the pools. I guess they would have to change the whole cub Token contract to keep APY this high for more than a few minutes.

Hi I do not see any weekly LEO dividends from LBI.

I admit I haven't had time to watch LBI and I'm surprised.

I will CL sell after unstake. Thank you for notofocattion.