Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

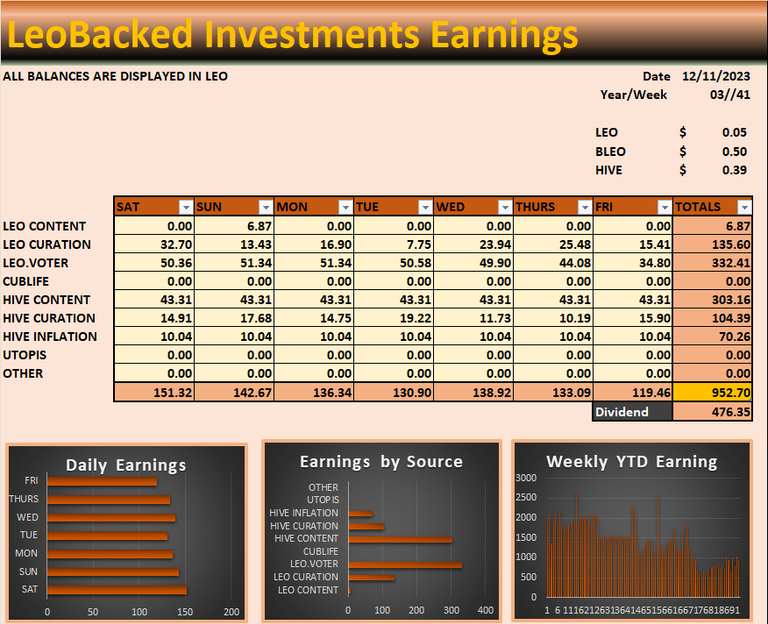

What a week it has been for LEO, earning this week were good, still over 900 LEO. leo.voter was are top earner with 332 LEO, next was HIVE content with 303 and 3rd was LEO curation with 135. Because alot of are income comes in the form of HP from content, we will notice dip in earning as the price of LEO of increases. We'd rather have weekly earning at 500 LEO per week and LEO being worth 20 cent over earning 1000 LEO per week with LEO at 4 cent. Earning less is earning more in a backwards way.

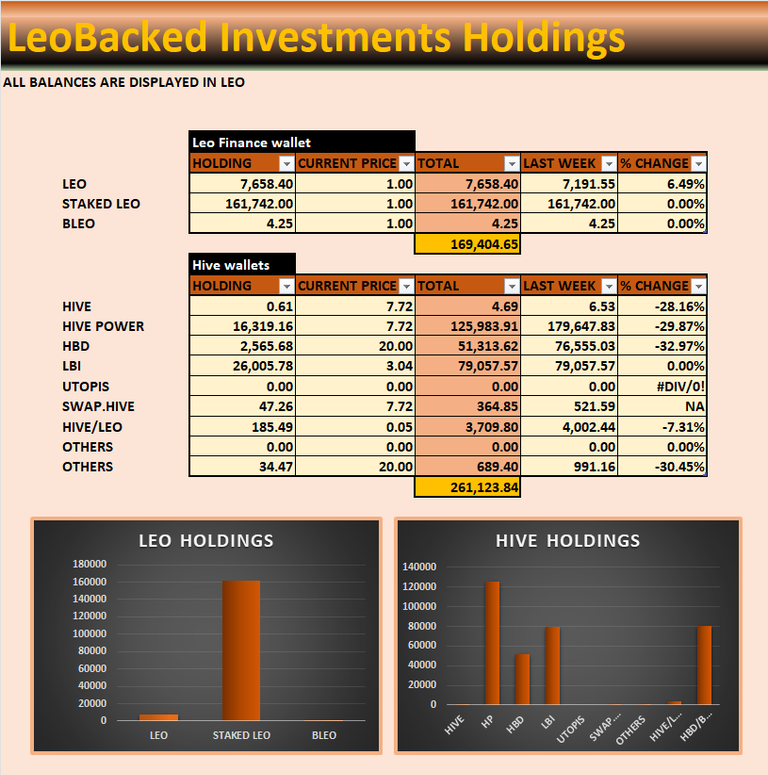

Everything in our HIVE wallet expect for LEO lost value this week. With LEO mooning 50%, it has outperformed everything. We seen last week that our HP valued in LEO was worth more but this week, the tables have turned again and staked LEO is once again our single biggest holding. We lost around 30% in LEO value this week against both HIVE and HBD.

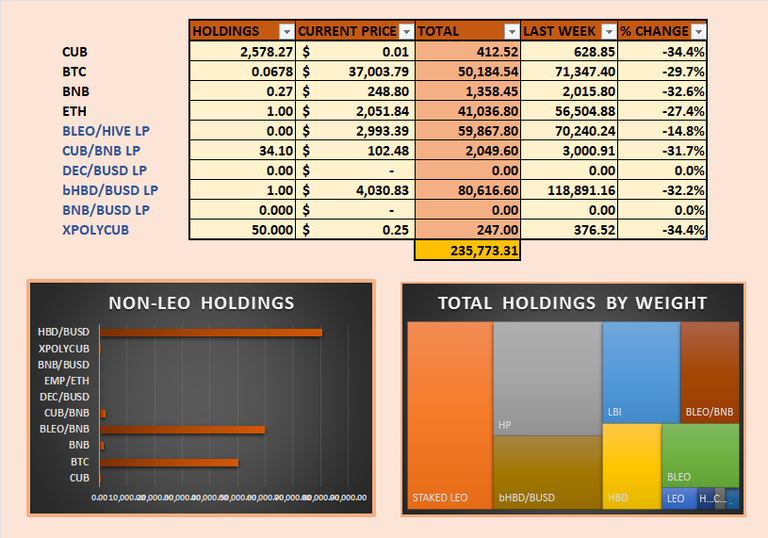

Non-HIVE wallets are the same, down 30% in LEO value across the board. Pretty much all-out crypto increased in $ value by 5-10% but because LEO increased 50%, it is still worth less LEO. Being worth less LEO value is not a bad thing because it mean that LEO is worth more.

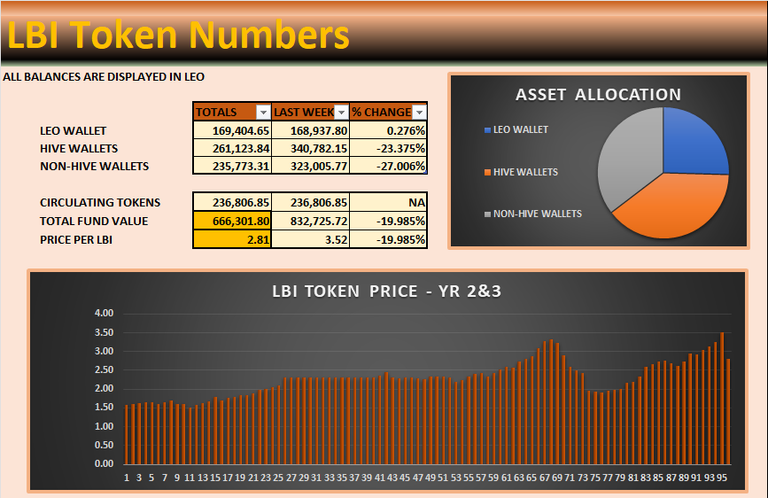

The LBI token price took a big dip this week and wiped out about 5 weeks of gains in 1 shot. And weirdly the fund value fell to 666k LEO this week. The LBI token price today sits at 2.81 LEO each which is still higher than its average over the past year. If the price of LEO is to further increase and outperform HIVE

and out non-HIVEholdings, we can expect to see a further decline in the LBI token price. This is not a bad thing because it means the fund is worth more dollars. I understand LEO growth is the target here but dollars are how things are valued still so I have to be aware of this price even if it's not reported. The fund grew by 15% in dollar value over the past week adding $4500 to the fund.

Its been a standard week for LBI apart from the price of LEO mooning which has been amazing, let's hope it can hold. Thank for taking the time to check out the report.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Congratulations @lbi-token! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: