Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

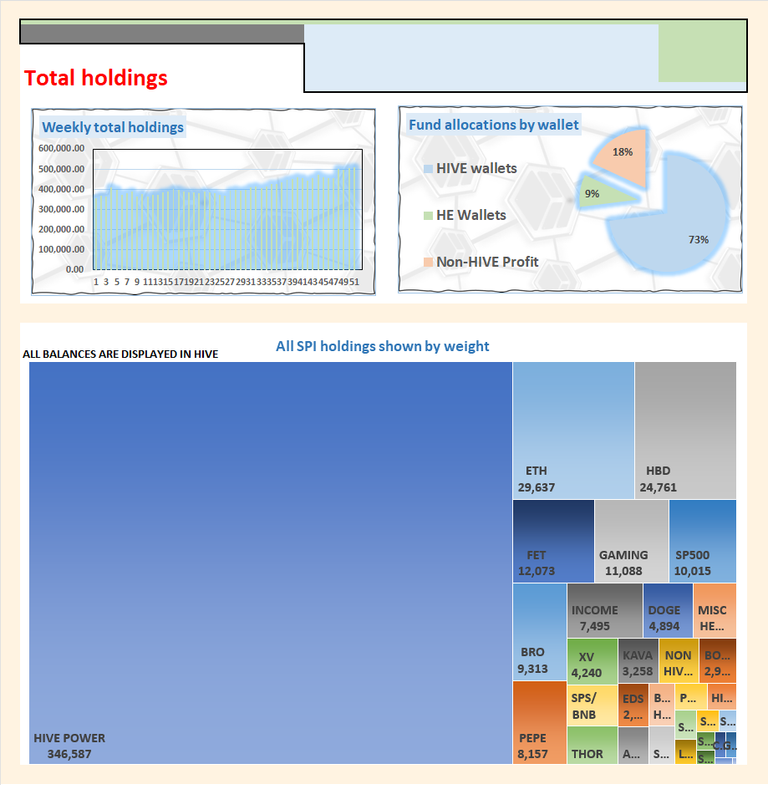

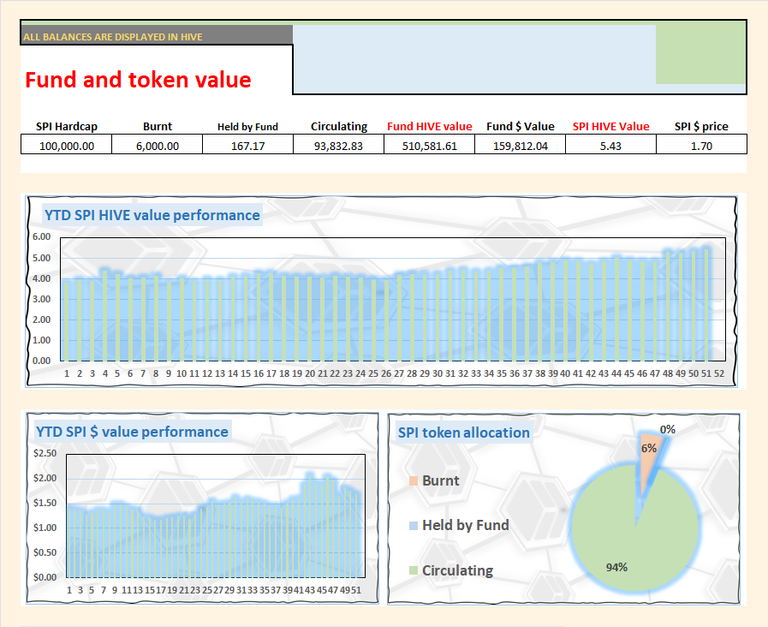

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

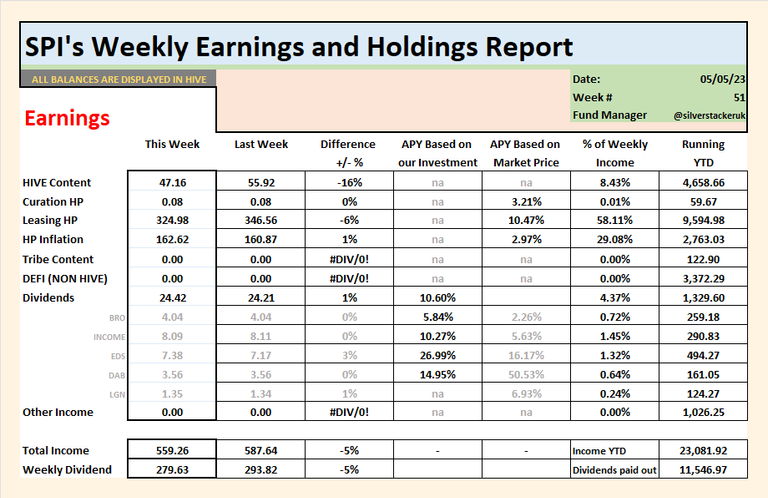

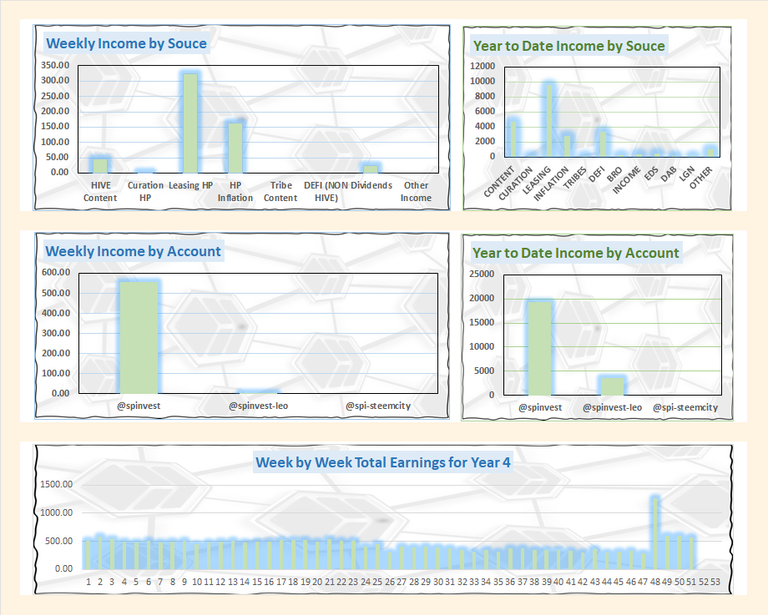

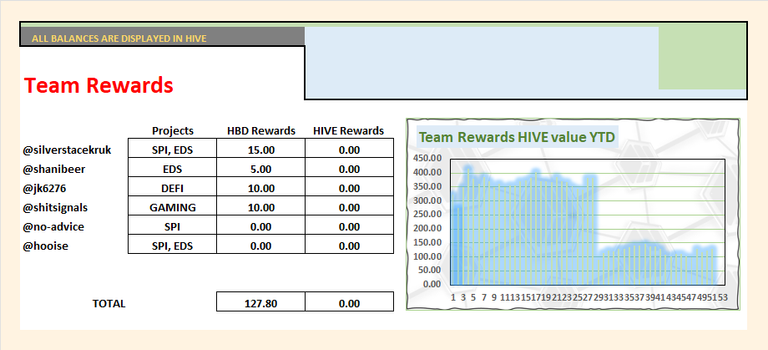

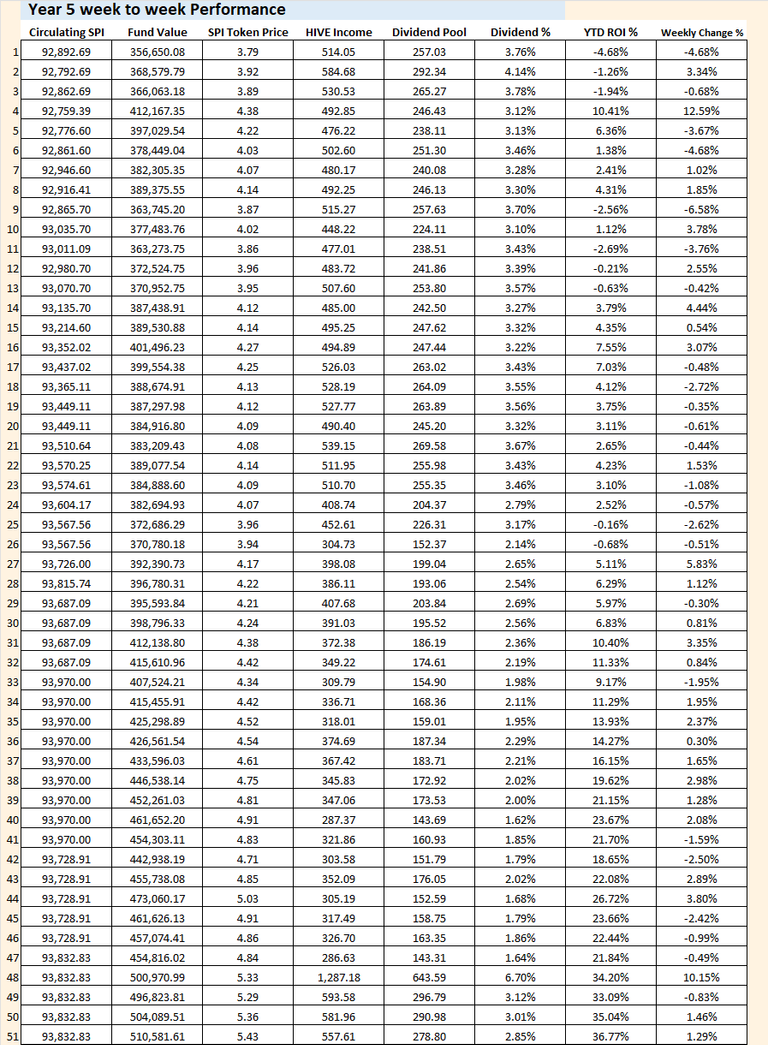

HIVE income this weeks is decent. Content rewards take a small dip as 6 posts went out last week instead of 7, next week will be the same as my post went out on Friday this week. Our leasing rewards took a small dip because i've pulled a private lease and it's been on cooldown the past 5 days but next week we'll be back to normal for these earnings.

Its not included as income but the amount of EDS we are receiving each week has increased to almost 90 per week and this is noticeable in the amount of HIVE it pays each week. Other than that, everything else is consistent.

Ps, its still strange for me to see "HP inflation" being our 2nd biggest earner. Its weird to see us earning over 160 HIVE a week from HP inflation full stop, haha. At 168 per week, we'll be earning 1 HIVE per hour from inflation 🚀

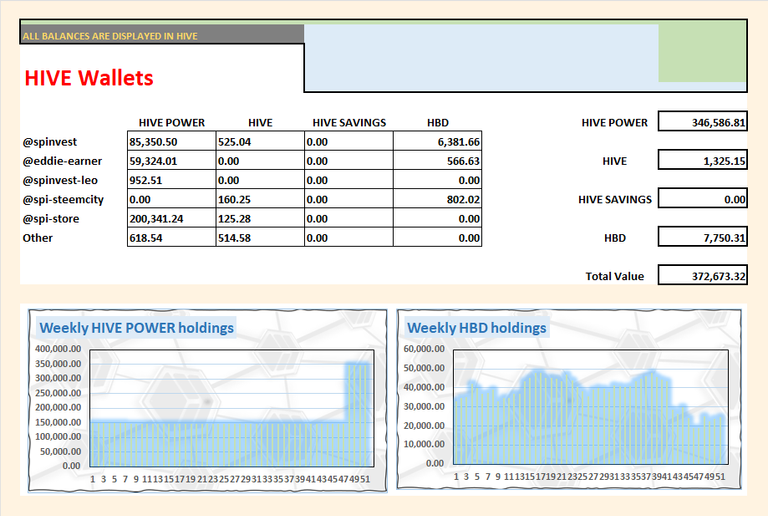

Our HP balance is once again going sideways. It was increasing there for a few weeks but then @eds-vote doubled in size and now it's minting twice as many EDS that need to be backed with HIVE. This means EDS is minting an extra 120 EDS a week but its not powering up an extra 120 HIVE per week to match it because it takes 13 week to powerdown the rewards. Long story short, EDS is going to cost SPI about 100-150 HIVE per week for the next 10ish weeks. In around 11 weeks, @eds-vote's powerdown to @eddie-earner will increase from 200 to at least 400 HIVE per week.

HBD balances are doing their thing, earning us interest to pay team rewards and monthly bot maintenance fees. Im tempted to withdraw them and buy a bunch of DOGE are more ETH cause prices are very low right now but i always come back to it's better to hold the HBD because in 3,6,9 months, maybe we could use the funds better. I'd guess we'll see tons of new cryptos and projects released in Q1&2 2025 so having a few grand handy could be good.

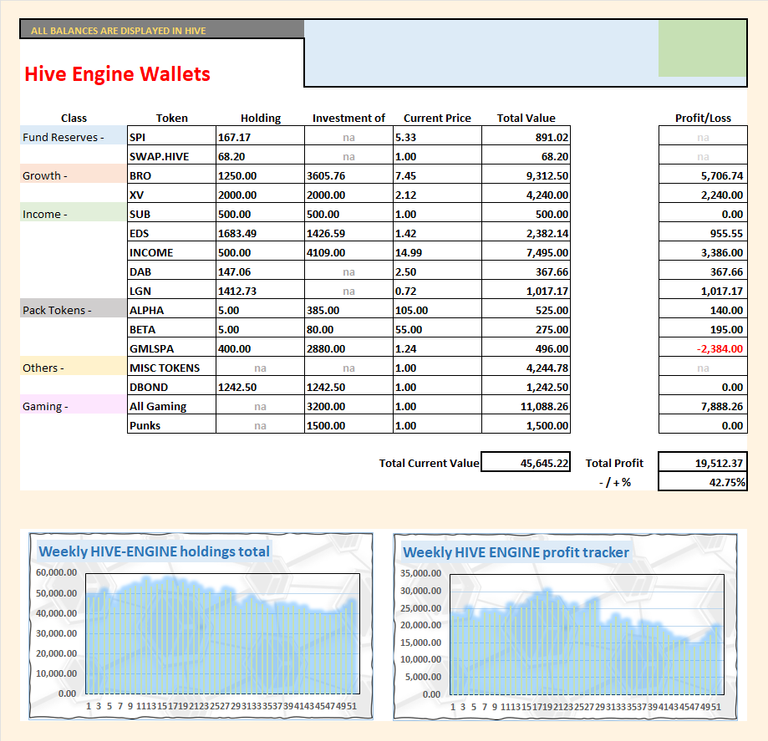

Not to much action with our HE wallet this week. With HIVE itself taking a small dip we see the value increase overall but not be much. Gaming pulled back a few thousand HIVE which was nice, this is the first week its been over 10k HIVE in maybe 3 months. As mentioned above we added close around 90 EDS tokens.

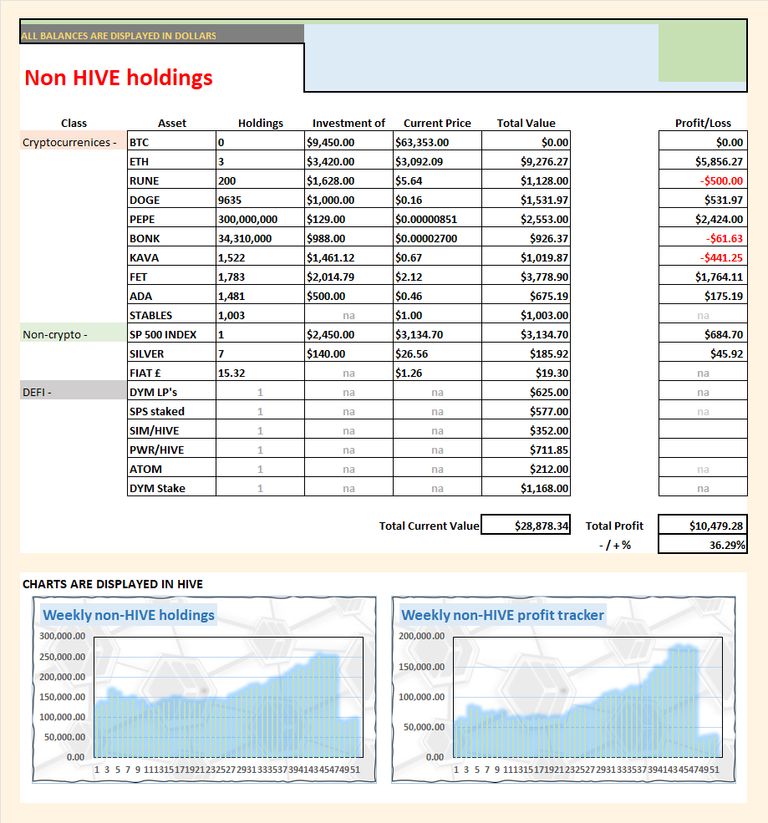

Up and down, up and down for the past month. This week, our strongest performer was PEPE, everything else went sideways to down. I am so happy we were able to dump half our RUNE when it was $11, we got lucky hitting its top.

We also got very lucky with our BTC to HIVE trade. You can see below when we traded.

It's nice to execute a plan but to hit the bottom while doing it is the cherry on top. It's only been 3 weeks and in 6 months 1 BTC could be worth 250k but we take these wins when we can, lol.

Lastly, we are still holding all our FET and I've not sold any yet as planned. I feel it will still outperform anything I replace it with so its a hold for the foreseeable future.

We finish the week well with the fund value up 1.3% bringing us to +36.77% YTD with only 1 week remaining in the year. The SPI token price itself has increased again for the 4th week running and im super happy 🙌

Next week will be end of year so you can expect a big post with tons and tons of charts. I think this is the first week I have a complete year's worth of stats. Any year up till now, I've either missed a week here are there due to holidays or my PC's fried an HDD from a power cut.

I think for next year, we will keep the structure of these reports the same. I might change a few words here and there in this template but I will not be upgrading the SPI tracking sheets. If there are any stats you think should be included, please share in the comments below and we'll about getting them added in.

Dividends will go out this evening and I look forward to next week and finishing the year off 35%+.

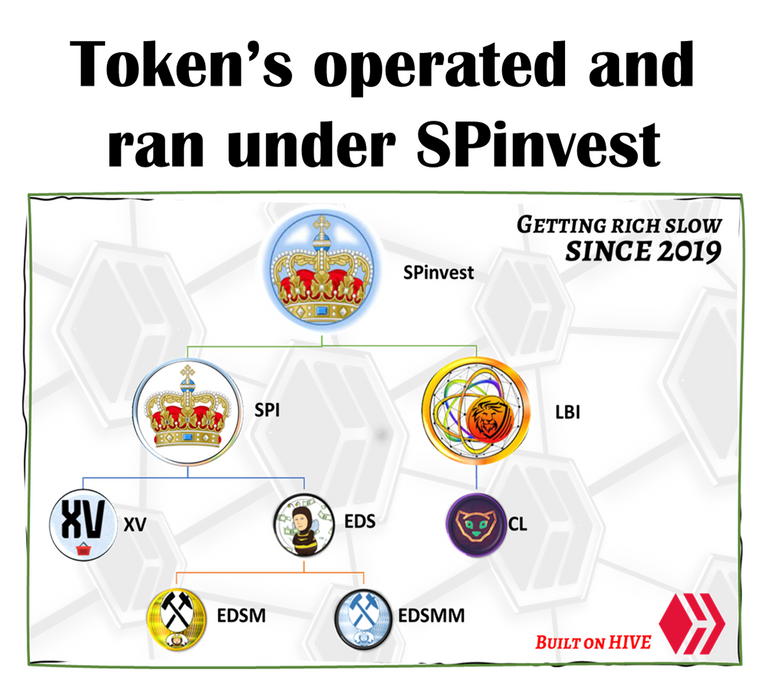

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

See that you hab sum $PEPE on Ethereum. Love to see it. Thought about creating a PEPE pool on Hive. Originally mentioned almost a year ago at this point. But a big cost may not full justifiable. Wonder if @spinvest may have interest in $PEPE (ETH) being listed on Hive. If so maybe we could figure out the best way of going about such for everyone as we consider pools and what not. Keep up the great job. !BBH

@spinvest! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @pepetoken. (10/50)

Never thought of it, I would not consider holding a HE wrap of any crypto because liquidity and pricing are not good. No idea how much this would cost, if i understand correctly, you'd want to be able to unwrapped $pepe from HIVE to ETH which would require a bridge.

On paper, it sounds like a great idea but in reality, HIVE is a blockchain made of mostly broke people who understand little about crypto outside HIVE. We cant even support a HIVE meme token for ourselves because people expect yield from everything.

Maybe someday my friend

Thank you fer your response. Unfortunately I agree with you. Maybe sum day! !BBH

@spinvest! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @pepetoken. (5/50)