Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

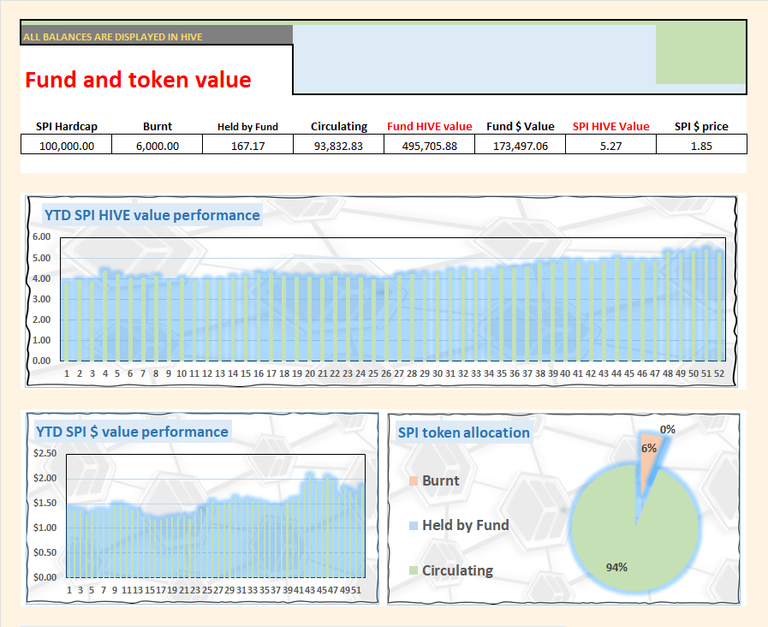

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

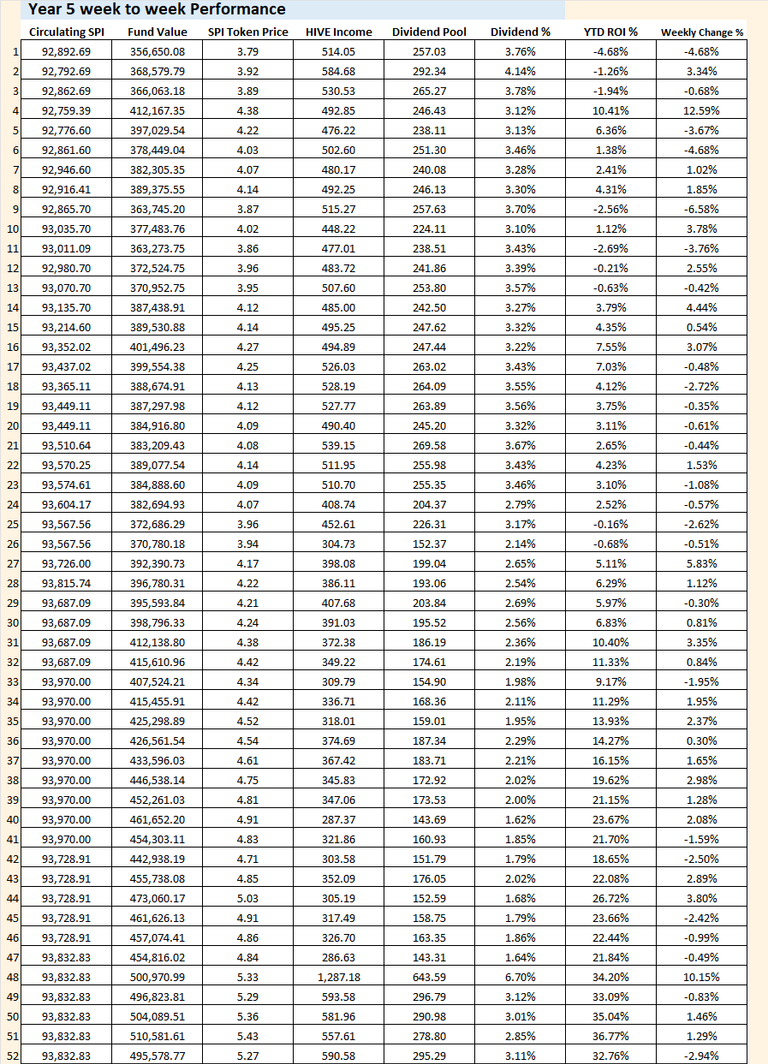

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

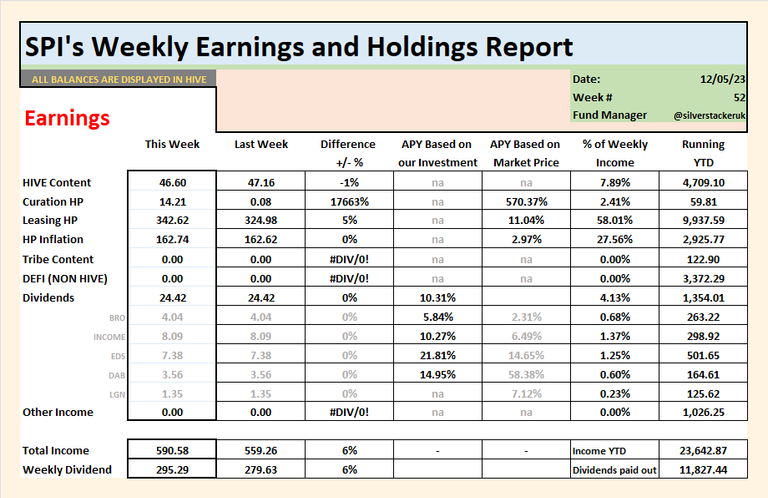

We finish the year with a nice HIVE income of 590 HIVE. You see can we earned a total of 23,642 HIVE this year and paid out 11,827 HIVE as dividends. Our top 3 earners for the year have been...

Leasing HP = 9937 HIVE

HP Content rewards = 4709 HIVE

DEFI Rewards = 3372

Our HIVE POWER balance is the main driving force behind our HIVE income. When we couple leasing/delegations rewards with HP inflation, we get a total of over 12,000 which makes up 50% of our total HIVE earnings. HIVE content rewards have always been an important part of SPI's HIVE income and growth in the early days but as the fund matures and grows, these rewards become more insignificant as each year passes. DEFI incomes have come to a halt the past 2 months as @jk6276 switched from cashing out to full-on compounding to prepare for the coming bull.

Going into year 6, our HIVE income should remain at this current level between 550-600 HIVE per week for the first 9-10 months and we'll finish the year with lower incomes due to a planned power down of @spi-store in Feb/Mar 2025.

I'd say we've had a good year and this coming year will be better.

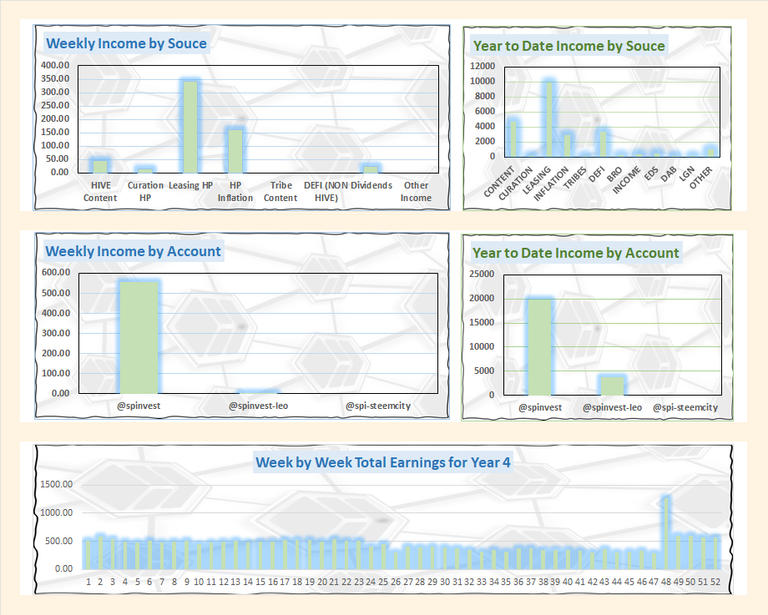

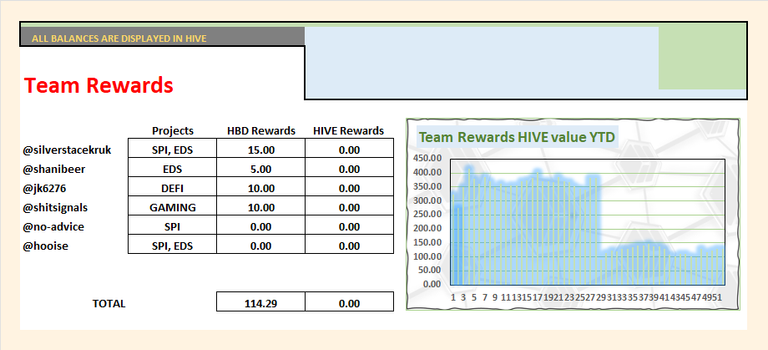

Team rewards swapped halfway through the year from SPI tokens to HBD and content rewards split's. You can see when this happened in the above chart, the team took a big hit but they will be rewarded in some shape are form when things are crazy next year.

Total team rewards were valued at roughly 12,200 HIVE. Currently, the HBD interest we earn each month covers this cost (mostly)

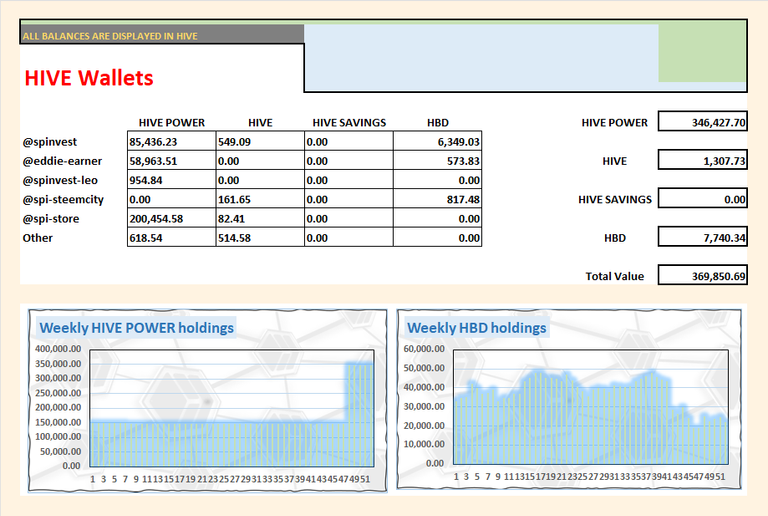

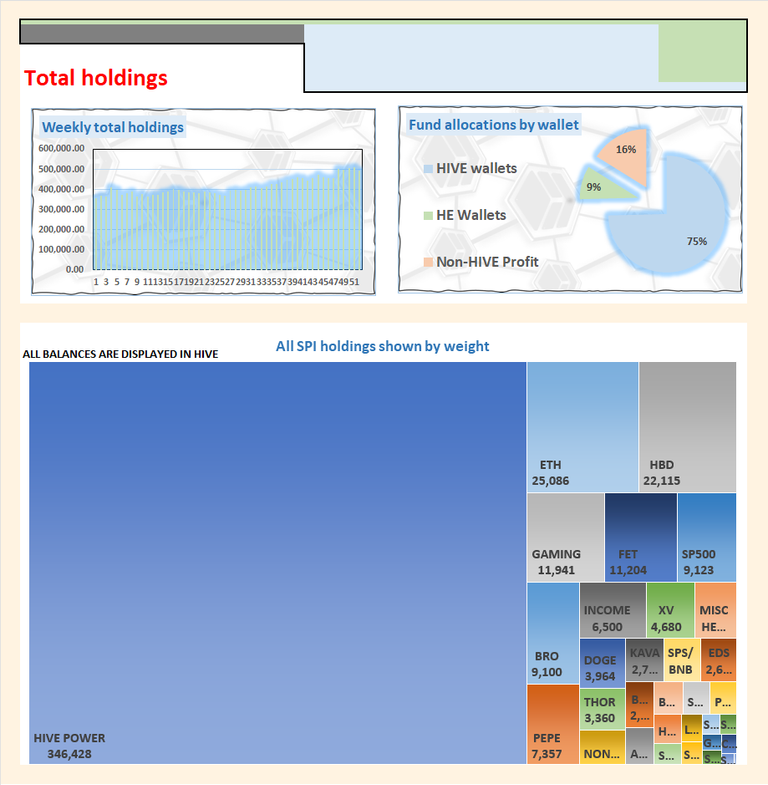

Compared to 1 year ago, we hold alot more HIVE today. We started on week 1 with 148,000 HIVE and finished with 346,000. For these unaware, we converted 1 BTC into 204,000 HIVE and powered 200,000 of that up. Today 1 BTC will get 170,000 HIVE so.... you're welcome! saved us 30k HIVE there, 0.31 HIVE per SPI token.

You might be thinking, if we start with 148,000 and power up 200,000, how do we finish with 346,000? The simple answer is EDS has cost us 6750 HIVE this year because it mints more EDS than it produces income and they all need to be backed. This cost is declining, on week 1 EDS cost SPI 180 HIVE and this week, the cost was just 60 HIVE. In a few years, this will switch from a cost each year to a gain each year.

We finish the year with a smaller HBD than we started with, around half. I pulled funds to make some last-chance investments for us but this 6000 HBD we have now we stay where it is for the foreseeable future. I dont expect much change in our HBD balance during year 6 as the next of our gains will come in year 7 toward the end of 2025.

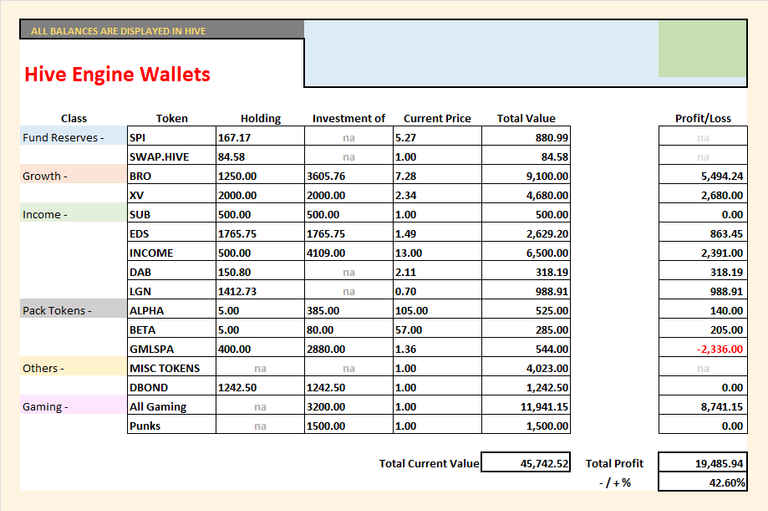

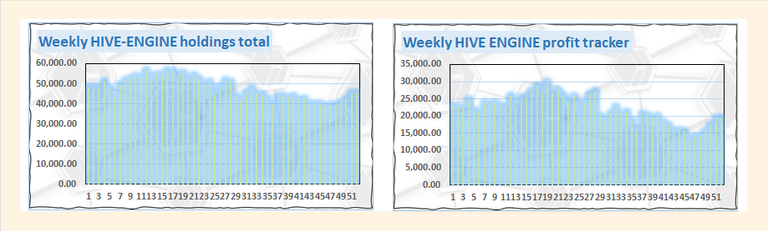

Over the past year, not been much change in our HE wallet. We sold some BRO, bought some INCOME and SUB, and then sat on the rest. To be honest, of our 3 main investing wallets (HIVE, HE & NON-HIVE), HE gets the least attention because there's not much released to it and most that is, is just crap so better to spend my time elsewhere researching proper projects.

We're earning 70-80 EDS and a few DAB each each week. We let these balances build and maybe they can turn into some nice HIVE incomes for us. Apart from this, i have no plans to make investments into HE tokens in year 6.

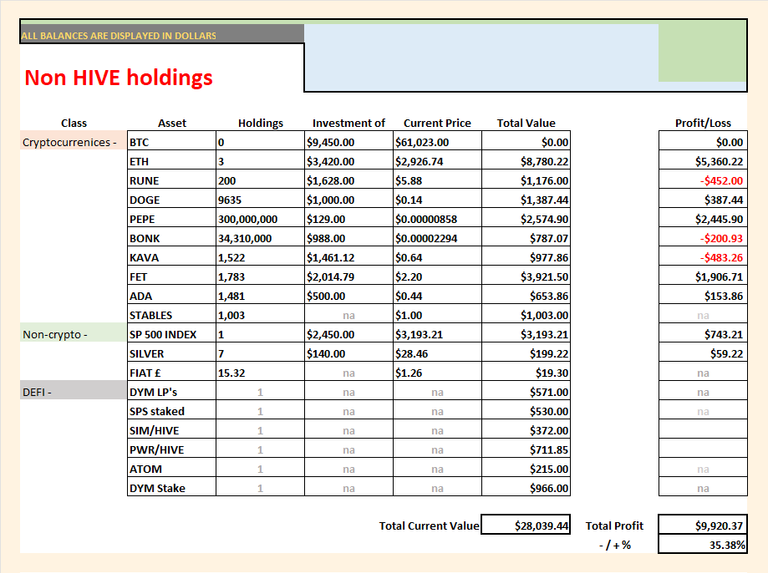

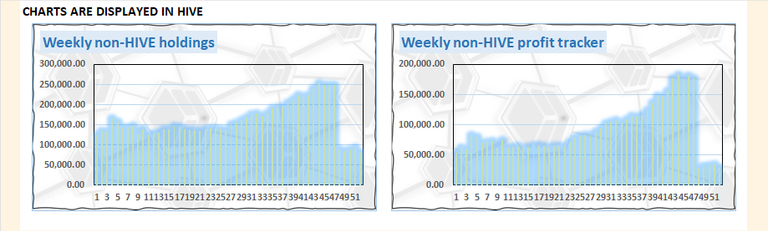

For the first time ever, we finish the year holding 0 BTC. We cashed it out, booked a profit of over $50k and converted it into HIVE exactly when BTC was at its strongest against HIVE since March 2021. Long term, we'll get our BTC back but for now, ETH is are top non-HIVE asset.

This year we added a bunch of stuff. We bought PEPE, BONK, KAVE, FET and more DOGE tokens. Most of these are performing well, 2-3 not so well but we are sitting on a nice overall profit.

This last week is bitter/sweet because we lost 3% of the fund value but we see the price of HIVE jumping 15%. If we could finish every year with an increase of 32.76%, we'd have a million HIVE fund in no time.

SPI continues to be an underground project known to a few on HIVE and undervalued by many that do and im good with that. In 5 years, we've 7x people's HIVE investment and I would not be surprised to 5x today's price over the next 5 years easily. Based only on the things I have learned over the past 5 years, we can 5x and have a 25 HIVE SPI token price.

To round up year 5. We have got prepared for the 2025 bullrun. We've spent what stables and HBD we were looking to spend to make new 1st cycle investments and we did our BTC to HIVE swap. These are the 2 most important things we did this year. Increasing the HIVE income, building out EDS, starting DAB and the rest is background stuff. They are important but SPI asset management/growth is #1.

For year 6, the most important thing we need to do is start the powerdown of @spi-store during Q1 of 2025. We will do other things of course but this is the most important thing, like if I could only do 1 HIVE transaction for the whole of year 6, this would be the one.

I will release a post during the week to include tons of charts and stats for year 5. Thank you as always for all your support and let keep doing what we are doing.

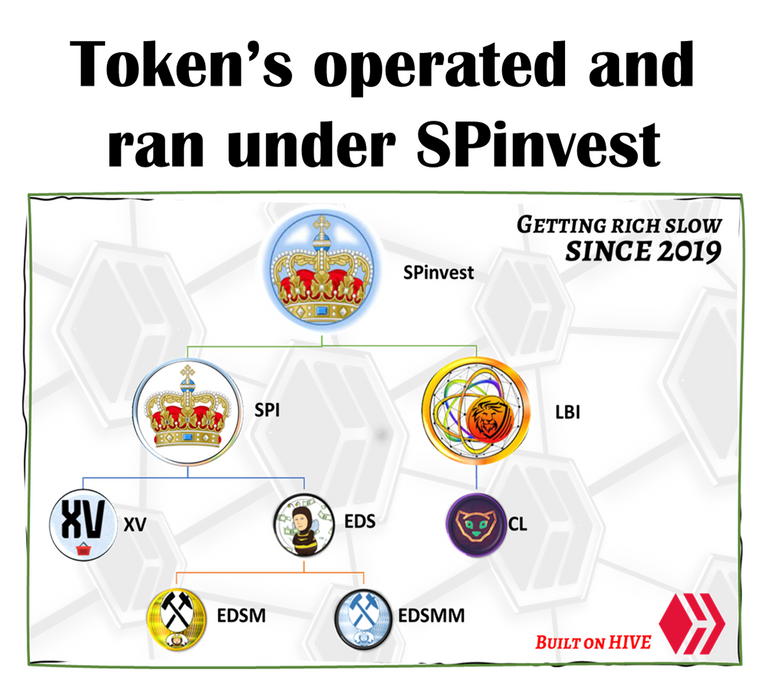

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

Great report, supernice to be able to follow the progress in-depth.

I’d like to subscribe to these report, thank you.

!PIZZA

Thank you for checking it and leaving some nice feedback. I have added tagged you to future reports

Thank you!

$PIZZA slices delivered:

@relict(1/15) tipped @spinvest

Pops and I thank you for all the hard work and dedication you have and continue to put in to make SPinvest an attractive investment. Great moves this year, just as previous years. We remain excited to see what the road ahead for SPinvest might look like. Cheers my guy

Thanks Bro. We'll keep on grinding and hopefully keep getting good results. Thanks for the continued support for 5 years now, you and your father. I very excited for the next 2 years, if we do them right, we'll put SPI into a new level.

Here's to another 5 years my man 🎉