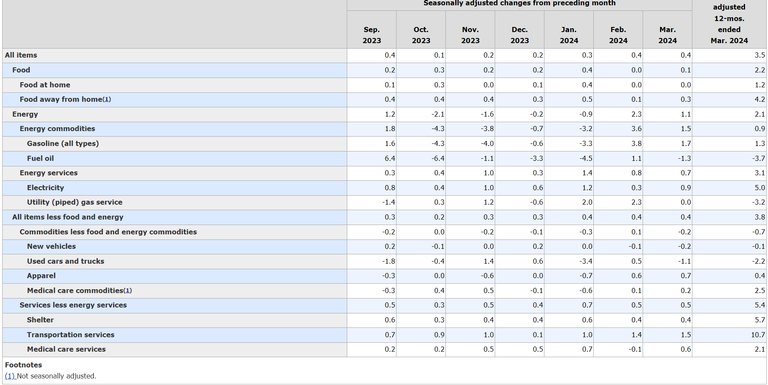

Some hours ago, the CPI data was released, and once again, the figures exceeded expectations, showing a year-on-year inflation rate of 3.8%. This trend is becoming commonplace, whether you reside in the USA or Europe, with prices escalating rapidly. One of the sectors witnessing a significant surge is housing prices. Let's delve into how this has evolved.

source

Owning real estate has long been perceived as a secure investment, given the consistent rise in prices and rents. However, from the perspective of renters and prospective homeowners, the narrative is starkly different.

Housing Crisis and Homeownership:

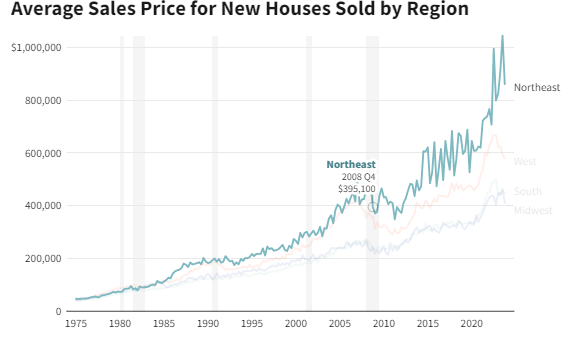

The housing market collapsed in 2008, with most properties losing considerable value. At its peak in 2008, a new home could be purchased for $511,000. Following the burst of the housing bubble, we hit a low in 2011, with prices plummeting to $348,700 per new house. Though prices vary across regions, the average decline was 32%. Since then, house prices have steadily climbed, with minor setbacks in 2020 due to the COVID-19 pandemic and in 2022 following the cessation of quantitative easing and the Federal Reserve's initiation of rate hikes. The housing market reached its zenith in 2023, with new homes selling for $1,044,000—double the price of those just before the housing crisis in 2008. Presently, we are experiencing a downturn, but indications suggest that prices will once again soar, likely reaching new all-time highs. However, such a trend is unsustainable, and I anticipate another housing crisis in the near future.

source

Renting:

Rental prices continue to soar, sometimes even surpassing the surge in buying prices. During the pandemic era, rent hikes were particularly pronounced: from 2019 to 2020, rents increased by 18%; from 2020 to 2021, the average increase was 14.07%; and from 2021 to 2022, rents rose by 12.2%. Although the rate of increase slowed to 8.1% from 2022 to 2023, the trend remains concerning.

While the past decade may have been exceedingly profitable for homeowners, necessitating the sale of property at times to realize gains, I find such exorbitant prices and rent hikes unsustainable in the long run. As costs across various sectors—food, energy, and housing—continue to escalate, alongside mounting debt, it's only a matter of time before things spiral out of control."

Posted Using InLeo Alpha

Posted Using InLeo Alpha

Prices can only sore if there are buyers. There aren't any.

Where this inflation in house prices has come out of is lowering interest rates, and a bigger percentage of people's incomes used for housing expense.

Currently, people's income is going down. (layoffs and necessities inflation)

and interest rates are going up.

This means house prices and rents HAVE TO go down.

That anyone looking at the tent cities can say, there is another price surge coming is trying to sell their house(s) before it falls too much. (there may be a surge as blackrock buys up properties in certain areas)

We have entered a depression. Rents need to drop. And they will. So, landlords had better work out their budgets to do so.

I believe this will happen soon and the housing market will crush down

Well, inflation numbers came back a bit high, so the Fed may raise rates, and that would make the crash faster.

What is soon to you? A month? A year?

Already here in Canada. Our mad Prime Minister promised to throw more printed cash at the problem but still wants to import more immigrants into a severe housing and looming construction labor shortage.

Printing is not a good idea at this point!

sometimes with this huge figures attached to the prices of the basic necessities of life one just wonder how survival is going to be eventually..

Yes it is coming to a point that many people are cutting unnecessary expenses in order to manage to pay for the necessary.

I think prices will rise again soon if more people need housing

Yes but can they afford it?

I don't know for sure but many people have the money to buy it

Congratulations @steemychicken1! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

If housing prices don't come down, we're going to have a civil war. Or at least massive social unrest. when you have two generations of young Americans that have zero hope of ever being homeowners, at some point they are going to do something drastic.

I hope something like this won't happen

You and me both!