Liquidity is more than just a buzzword, it's the lifeblood of the market. But what exactly is liquidity, and why does the crypto market often find itself grappling with insufficient liquidity levels?

Understanding Liquidity in Crypto

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly impacting its price. In simpler terms, it's about how quickly and seamlessly you can convert an asset into cash or another asset. In traditional financial markets, high liquidity ensures that there are enough buyers and sellers to facilitate trades efficiently.

source

Why Crypto Faces Liquidity Challenges

Despite the growing popularity of cryptocurrencies, the crypto market often struggles with liquidity issues. Several factors contribute to this:

Market Fragmentation: Unlike traditional markets, the crypto market is highly fragmented, with thousands of different tokens traded across numerous exchanges. This fragmentation disperses liquidity and makes it harder to match buyers with sellers.

Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, leading to uncertainty among market participants. Regulatory crackdowns or ambiguous regulations can deter traders and investors, reducing liquidity.

Volatility: Cryptocurrencies are notorious for their price volatility, which can deter institutional investors and traditional market participants from entering the market. High volatility can also lead to wider bid-ask spreads and lower trading volumes, further impacting liquidity.

The Dangers of Low Liquidity

Increased Volatility: When liquidity is low, even small trades can have a significant impact on asset prices, leading to higher volatility. This volatility can scare away investors and traders, further exacerbating liquidity issues.

Market Manipulation: Low liquidity makes it easier for market manipulators to influence prices through large buy or sell orders. This manipulation can distort market prices.

Inefficient Pricing: Without sufficient liquidity, assets may be priced inefficiently, leading to wider bid-ask spreads and reduced price transparency. This can deter traders and investors from participating in the market.

The Looming Liquidity Crisis

Many experts warn of an impending liquidity crisis in the crypto market, fueled by factors such as increased demand, regulatory scrutiny, and market fragmentation.

Liquidity Shortages: As demand for cryptocurrencies continues to rise, exchanges may struggle to keep up with liquidity demands, leading to shortages and liquidity dry-ups.

Price Dislocations: Insufficient liquidity can cause significant price dislocations, where assets trade at prices that deviate significantly from their intrinsic value. This can create arbitrage opportunities but also increase market instability.

Market Instability: A liquidity crisis could trigger widespread panic selling, resulting in a sharp decline in asset prices and market instability. This, in turn, could deter new investors and stall the growth of the crypto market.

Virtual AMMs, A Solution to Liquidity Problems

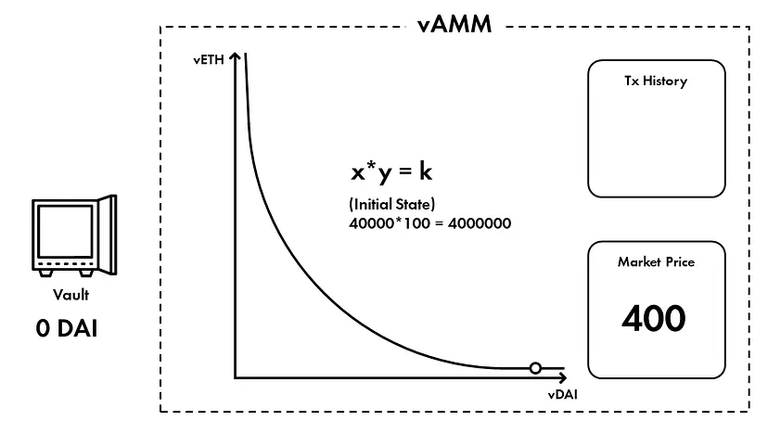

Virtual Automated Market Makers (vAMMs) offer a promising solution to the liquidity challenges faced by the crypto market. Unlike traditional order book-based exchanges, vAMMs utilize an automated smart contract platform to facilitate trades and determine asset prices.

Here's how vAMMs differ from traditional exchanges

Direct Liquidity Provision: In vAMMs, liquidity is provided directly from a smart contract vault, eliminating the need for liquidity providers. This ensures consistent liquidity availability and mitigates the risk of liquidity shortages.

Flexible Pricing Mechanisms: vAMMs employ innovative pricing mechanisms, such as the constant product formula, to determine asset prices. These mechanisms enable efficient price discovery and reduce the risk of price manipulation.

Leveraged Trading: vAMMs enable leveraged trading without the need for margin traders or liquidation mechanisms. This allows traders to access additional capital and increases market liquidity without the risk of liquidation cascades.

By addressing the root causes of liquidity challenges and offering a more efficient trading environment, vAMMs have the potential to revolutionize the crypto market and mitigate the risks associated with low liquidity.

The emergence of Virtual AMMs presents a promising solution to these liquidity woes, offering direct liquidity provision, flexible pricing mechanisms, and leveraged trading capabilities.

Posted Using InLeo Alpha

@tipu curate

Upvoted 👌 (Mana: 3/53) Liquid rewards.