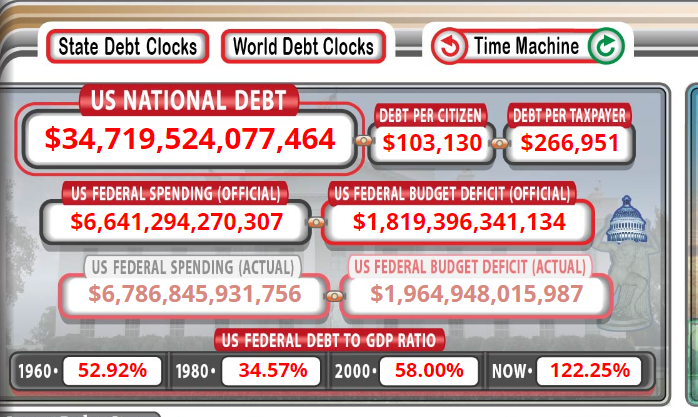

One of the most dangerous things in finance and in the world, in general, is the US debt, which at this point is sitting at the number $34,719,460,900 and it keeps on rising by the second. I also found a clock that I will include in this post; it's like a slot machine.😅

source

Understanding Debt

So, what's this whole fuss about government debt? Simply put, it's like taking out a loan to cover your expenses. When the U.S. government spends more money than it takes in through taxes and other revenues, it borrows funds by issuing Treasury securities. These securities are essentially IOUs, promising to repay the borrowed money with interest at a later date.

Why the U.S. Debt Is Needed

You might wonder, why does Uncle Sam keep piling up debt? Well, let's break it down. Imagine you've got bills to pay - from running the government machinery to funding critical projects like infrastructure, education, and healthcare. Sometimes, there's just not enough cash in the piggy bank to foot the bill. That's when borrowing comes into play, ensuring the government can keep the wheels turning without grinding to a halt. At this point in time the US never has enough money to keep the Nation running that is why we constantly that the debt ceiling needs to rise.

source

Where Does the Money Go?

Alright, so the U.S. borrows money, but where does it all go? The government needs to build new highways, invest in defense, and support social safety nets like Social Security and Medicare. It's like a giant financial juggling act, with borrowed funds allocated to various sectors to keep the nation humming along smoothly. Of course all this is happening because they have to keep the economy growing and because they want to spend that money in order to get re-elected.

Debt Spiral

At this point, in my opinion, the US is in a debt spiral. Each year, the government needs more and more money to pay off its debt and to keep the nation running. The only way to avoid borrowing more money is to either achieve astronomical growth, which is probably impossible for a mature economy like the US, or to cut expenses in order to reduce the amount of money needed. However, no politician wants to cut expenses, reduce salaries, or cut jobs because this would likely result in losing their position and being remembered in history as the individual who destroyed lives and the economy, even if the economy was fundamentally flawed.

source

Default

What happens if the U.S. can't pay back its debts? Well, it's not pretty. A default could shake the financial system to its core, spooking investors and sending shockwaves through global markets. Interest rates could skyrocket, making it costlier for everyone from homeowners to businesses to borrow money. A lot of people will be left with nothing because the US is the system and if they default then everyone will default.

Pyramid Scheme

Now, stop for a second and consider what a pyramid scheme is. Simplified, it's when someone makes an initial investment or purchase with the promise of getting their money back, plus a profit, over time. However, to fulfill this promise, a constant influx of new investors is required to pay off the older ones. This cycle continues because the old investments are exhausted, and only the new ones remain. If a large number of investors want their money back at once, they may not receive it. While it's not precisely the same, it certainly bears similarities.

Now, in my personal opinion, all of this is true. However, at the same time, I recognize that the whole world is running on debt. Debt is a tool, and like any tool, it can be very useful if used correctly. I also understand that the US is unlikely to default anytime soon. I probably won't be alive to witness something like that because it would take many years for it to occur, and a significant amount of preparation would need to be put in place. Those with the money and power would have to secure themselves and minimize their own losses.

Posted Using InLeo Alpha