From all the defi apps we have seen in the previous bull market, Uniswap has kept its dominance and continued to develop and grow. It was the first defi app to bring in users thanks to its simplicity and incentives. Following the FTX collapse and the multiple other collapses centralized entities in 2022, its importance grew even more. In the last period Uniswap seems to be growing and spreading on other ETH L2 chains like Arbitrum.

Let’s take a look how is the protocol performing under the current market conditions.

Here we will be looking at:

- Total value locked

- Trading volume

- Top exchanges

- Number of users

- Top Pairs

- Price

The period that we will be looking at is 2020 - 2024.

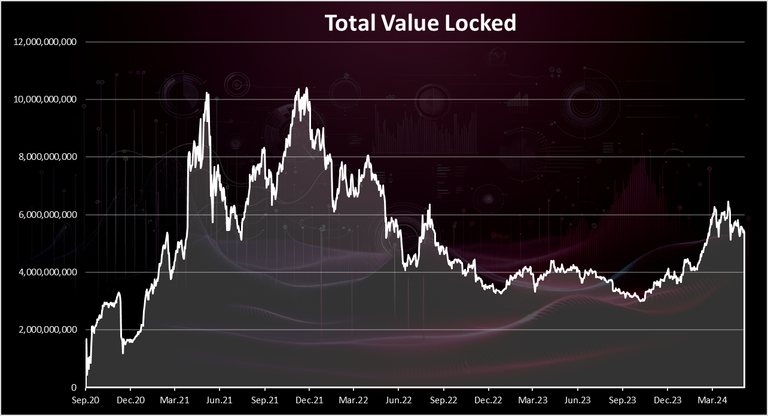

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

Uniswap launched its token back in September 2020, and the liquidity grew fast then. A record high of 10B was reached in April 2021, and again in November 2021. Since then, it has been a downtrend and dropped to 3.5B at the end of 2023.

In the last months the TVL has started growing again for the first time in years and it has reached a recent peak of 6B.

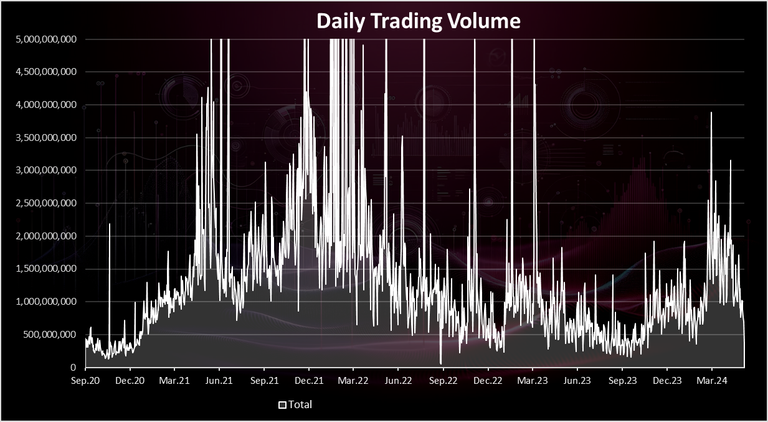

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

This is a chart for the daily trading volume. It’s quite volatile.

The daily trading volume has been more constant in the last year, similar to the TVL, with occasional spikes whenever there is some volatility in the market. At times there was more than 5B in daily volume, all legit and recorded on chain with fees paid.

We can see the increase again in the volume in the last months. It has been growing above 1B and reached 2B and 3B on a short period of time.

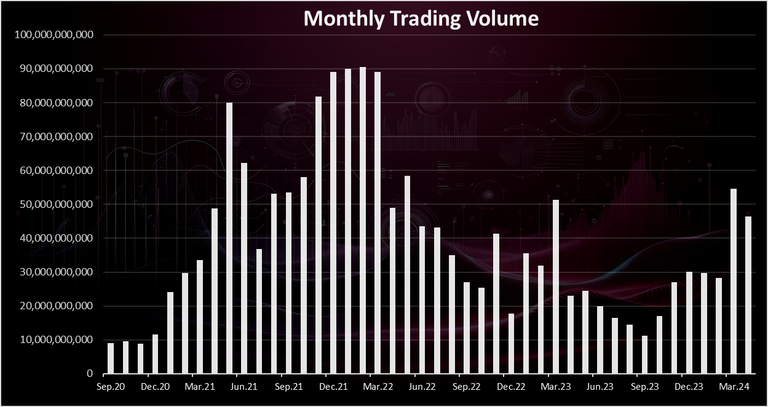

The monthly trading volume looks like this:

A clearer picture here than the daily volume.

We can see the monthly trading volume reached an ATH at the end of 2021 and the beginning of 2022, when it was around 90B for a few months.

In the last months the trading volume has increased again and it has reached 50B in March 2024.

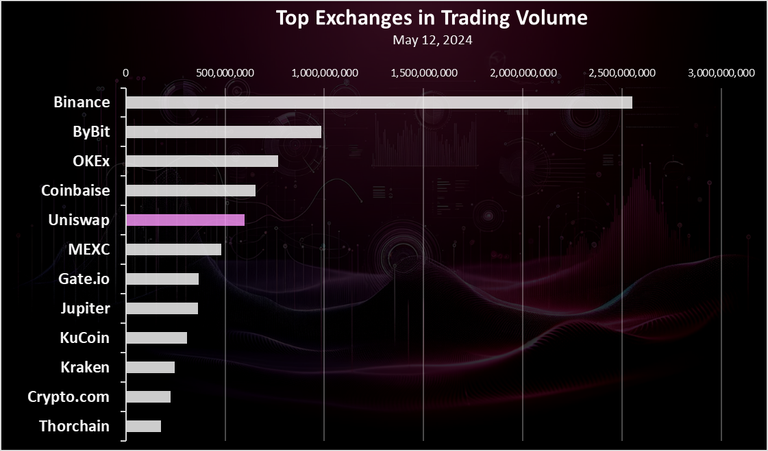

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

Uniswap ranks in the upper top, although in the last year it was in the top three on occasions, just after Binance and Coinbase, even surpassing Coinbase a few times.

Obviously, the volume on CEXs has increased in the last period and they are ranking better now. The fear from CEXs collapsing has probably been reduced now, more than a year after FTX went down.

There are few more DEXs that are in the top exchanges like Jupiter on Solana and Thorchain.

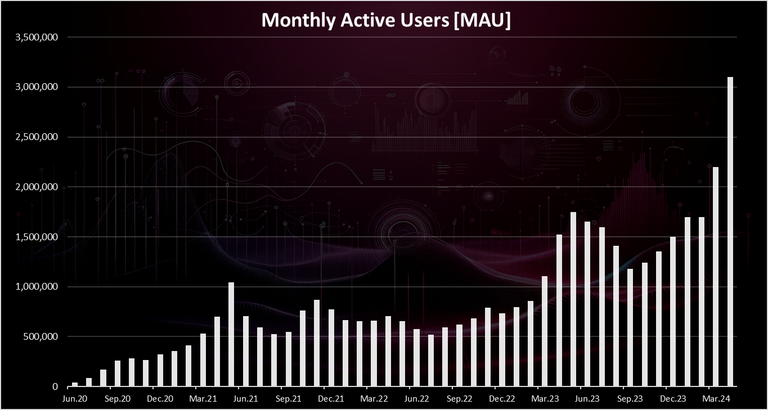

Active Users

How many users does Uniswap have? Here is the chart.

This is a chart on a monthly basis.

We can see a massive growth in the last period with April 2024 reaching an absolute ATH for MAUs with more than 3M users. Previously Uniswap had somewhere between 500k to 1M MAUs for a long time. The growth in the number of users is mostly because of the L2 expansion on Unsiwap on chains like Arbitrum, Base making the transactions cheap and affordable for the masses.

In terms of DAUs the numbers have increased from around 100k to more than 300k DAUs.

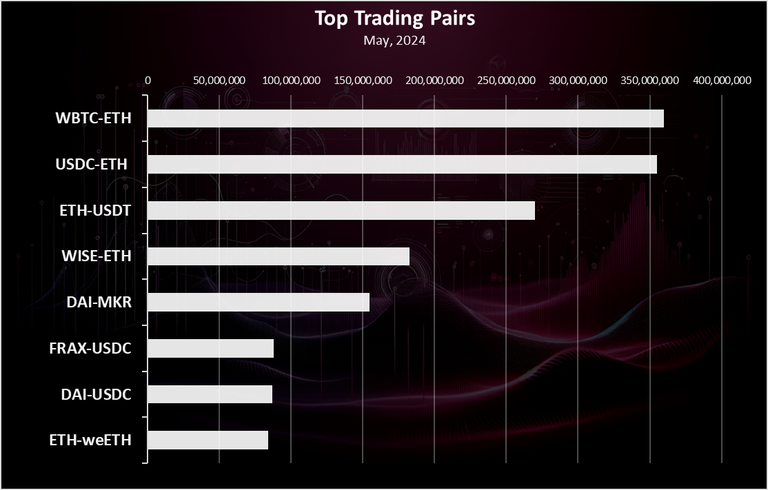

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

The WBTC-ETH pair is on the top with more than 350M, followed by closely by the ETH-USDC. In the past the stablecoin to stablecoin pairs were on the top in liquidity like USDC-USDT but obviously these have now moved elsewhere. FRAX-USDC and DAI-USDC is still in the top 10 with close to 100M in liquidity.

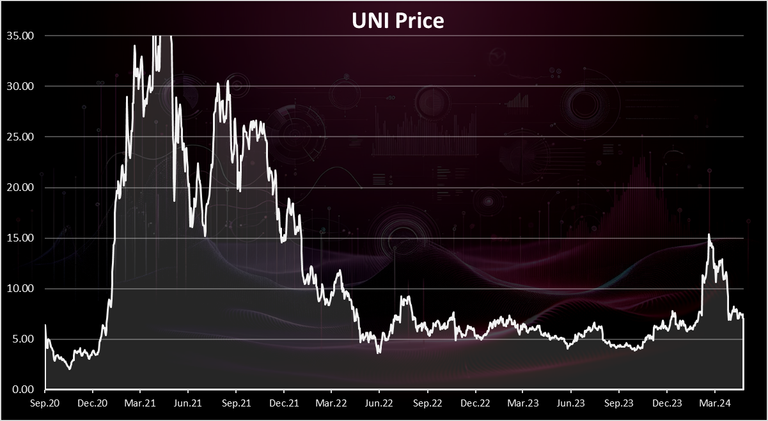

Price

The chart for the UNI price looks like this.

The UNI token has been on a wild ride, reaching $40 at some point in 2021. Since then, it has dropped and has been hovering around the $5 mark for a long time. In the last months there has been an increase in the UNI price reaching $15 for a short period of time and dropping to around $7 where it is now.

All the best

@dalz

I tend to agree with the assessment that Uniswap has maintained its dominance and continued to evolve and grow in the DeFi landscape. As the first DeFi app to attract users with its simplicity and incentives, Uniswap paved the way for decentralized exchanges to become a significant force in the cryptocurrency space.

The recent expansion of Uniswap onto other Ethereum Layer 2 chains, such as Arbitrum, demonstrates its adaptability and willingness to embrace new technologies to better serve its users. This move has undoubtedly contributed to the growth in Total Value Locked (TVL) and trading volume on the platform, as evidenced by the recent increase in both metrics.

The increase in trading volume and the number of active users on Uniswap further underscore its importance in the decentralized finance ecosystem. The surge in monthly active users (MAUs), especially with April 2024 reaching an all-time high of over 3 million users, highlights the platform's growing popularity and accessibility.

Additionally, the performance of top trading pairs on Uniswap, ranked by liquidity, reflects the platform's ability to facilitate a wide range of trading options for users. Despite fluctuations in the price of the UNI token, its recent increase and sustained trading activity bode well for the platform's overall health and growth trajectory.

Overall, Uniswap's resilience, innovation, and commitment to decentralization position it as a leading player in the DeFi space, with the potential to continue driving positive impact and growth in the years to come.

Uniswap has been solid, in 2021 many felt it'll die off due to that massive airdrop to it's users back then. The MAU is currently still good, might reach some higher numbers in 2025

Wow Uniswap seems to be hitting an all time high success... I wonder how it would go by the end of 2024

Uniswap is a great dex. I have used it a few times. The fees are quite competitive !

I gotta register on Uniswap too

Thanks for sharing

Long live Decentralised

I am so sure that Uniswap is a great dex to really look out for in the coming yeaes

Wow, I didn't know Uniswap is that popular. Seeing their users increase even more is encouraging to the future of crypto.

It actually looks like the users on uni swap keeps dropping and dropping

!ALIVE

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ tuisada. (9/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.