Introduction

The crypto market is full of opportunities to gain financially. Lots of new projects are waiting for investors to buy into. These new projects often promise value and try to make users believe that buying and holding the crypto in the longer run would yield returns when the price appreciates. Of course, there are some projects that continued to do well after their token hit the market. Unfortunately however, many new cryptos loose value post-launch.

It is probably often a kind of gamble to buy a coin immediately after its launch in an exchange market. In this article, we will analyze stats on newly launched coins on a top crypto exchange to see how they fared some months after listing . Then, it might inform one's decision to either wait a bit or just rush and purchase a crypto once it hits the market.

This article presents a review of stats from a crypto analyst called Flow in X. He makes a case study of Binance, the largest crypto exchange platform and examines how cryptos launched on this exchange platform few months ago are performing now.

Binance tokens drain significantly in value post Launch.

Binance is a top crypto exchange and every new project would like to list their crypto there. Its interesting that this review is based on Binance which given its popularity and trading volume would make it easy to see the scope of this issue.

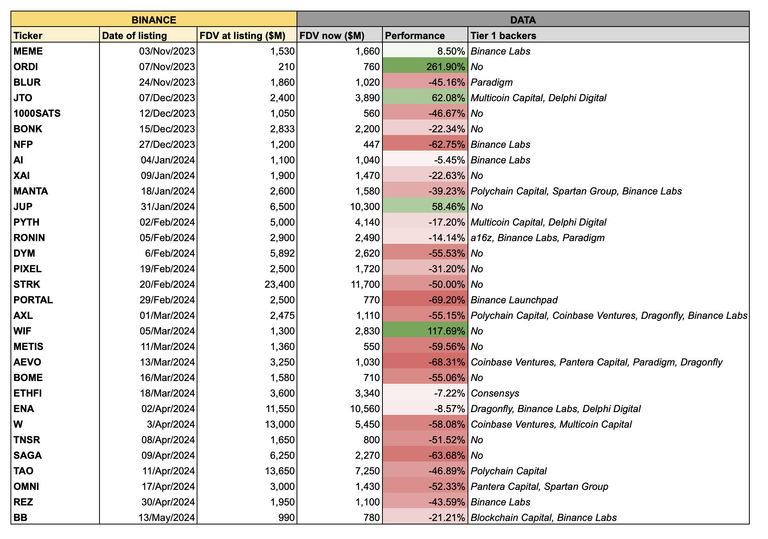

Binance launchpad is certainly the biggest launching platform and in the last few months, a lot of new cryptos have been listed through it. They include XAI, JTO, PYTH, PIXEL and most recently NOT coin. So what was the listing price of these cryptos and how are they doing today? Lets take a look at the table below prepared by flow on X. The table shows binance listings 6 months ago till date.

Now consider the Fully diluted value (FDV) of the cryptos above. Remember that FDV is used to measure the entire worth of a crypto project, taking into account all tokens that will ever exist for that project. Notice that majority of the tokens sampled above have lost significantly from the time of listing till date. Lets pick out a few.

Bonk listed at an FDV of $2,833m, but currently it is at $2,200m. That represents more than 20% devaluation. PORTAL had its listing FDV at $2,500. Now, it has lost close to 70% as it is currently valued at $770m. MANTA listed at an FDV of $2,600m. Its now valued at $1,580m, a loss of nearly 40% of its listing worth.

Very few of these tokens have appreciated in value since the day they were listed on Binance. Interestingly, most of these ones were not backed by any corporate investors like Binance. An example is WIF which had a value of $1,300m at listing time. Currently, it is worth $2,830m which is a growth rate of 117%.

Flow is trying to piece together the reason why up to 80% of these tokens listed on Binance which is a centralized exchange platform loose value significantly after they were listed. Below is what he thinks is the problem.

Collusion between VCs and CEXs?

Most of the new coin listings on Binance are backed by big crypto companies called Venture capitals. While they appear to foster investor confidence by supporting a new listing, there could be more to it. These VC's often hold a very large volume of the new crypto ahead of listing date. Flow believes that this is where the main problem lies.

Having a large allocation of the new token means that what these VCs do after launching could be of great significance to the direction of price movement. If these backers immediately dump their large holding in the market after launch, then the new crypto would struggle in value and over time, will continue to devalue significantly. But for the large corporate holders to gain from this setup, something else needs to happen.

The analyst believes that these new tokens are deliberately listed at astronomical prices. These huge listing prices is not usually backed by any value or utility attached to the project. When these new coins list at top value and the backers simply dump them after listing, it will definitely be a one-way price movement from top to bottom.

The real victims

If the opinions expressed by Flow in the above analysis are to be true, then newly launched tokens often have large backers that benefit and there must be loosers too. Its very similar to insider trading where a large investor benefits from having previliged information about a new token. There are victims here.

The victims are local traders that try to spiculate at the prices of crypto. These ones would quickly buy a coin after its launch, holding it over some time and believing that the prices would go up. To their horror, they watch and see the price of these new assets tank and their investment significantly drain in value.

So going back to the Binance example above, assuming an innocent investor or user purchased all the tokens listed on Binance and held them for 6 months, what would be their fate by now?

If you held a portfolio where you would invest an equal amount at each new Binance listing, you would be down over 18% in the past 6 months. source

Final words

The crypto market is risky business. Always do your own research before getting into any investment moves. As for buying and holding newly launched tokens on any centralized exchanges, always proceed with caution. It is best to invest only what you could afford to loose. From the above analysis, there is a lot to take away. This is not financial advice anyway.

Image credits

Thumbnail from pixabay. Image2 of crypto tokens from X.

Posted Using InLeo Alpha

There was a time when I used to feel safe about any coin listed on Binance because I was sure that they must have made their findings properly but not anymore

Man has to be careful about investing…

Thanks for the information

Yes always do your own research. Its best not to enter immediately the coin lists. Its price might swing in any direction and if there is a massive sell off by a VC, everything heads south.

I love putting assets into launchpools, but I sell the tokens as soon as I get them. The table you show above, shows I am right with this. I may miss opportunities like WIF, but more often than that I am saving lots o $, which are better reinvested in stables.

Yes I do launchpools too. Before I saw this analysis, from experience I discovered that many dump the tokens post launch which makes them struggle afterwards. So its best to sell off immediately when the price is still a little safe.

Sure stables are important to every crypto investor.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @bhattg suggested sagarkothari88 to upvote your post ❤️

🙏 Don't forget to Support Back 🙏