The RWA narrative is the best performing narrative in the past year and it is the one that I like the most even more than the AI because they can provide something now and can leverage Blockchain to give real world value. Right now at the top of the narrative stands a project called Ondo Finance.

What is Ondo Finance?

Ondo Finance is a decentralized finance platform that focuses on tokenizing real-world assets (RWAs), such as US Treasuries and bank deposits, to offer stable, yield-bearing financial products on the blockchain. By doing this, Ondo aims to provide the benefits of traditional finance—stability, regulatory compliance, and high-quality returns—within the DeFi ecosystem.

How Does Ondo Finance Work?

Ondo Finance operates through two primary arms: asset management and technology.

Asset Management Arm: This part of Ondo is responsible for creating and managing tokenized financial products. For example, Ondo’s USDY token is backed by short-term US Treasuries and bank deposits, offering a stable and high-quality yield.

Technology Arm: This arm focuses on developing the decentralized protocols that power Ondo’s financial products. These protocols are designed to be autonomous and are governed by decentralized autonomous organizations (DAOs) to ensure transparency and security.

Ondo's products are built on blockchain technology, which allows for enhanced accessibility and efficiency. Users can buy these tokenized products and enjoy yields typically seen in traditional finance but with the added benefits of blockchain's speed and security.

Key Products

USDY (US Dollar Yield Token): This token is backed by US Treasuries and bank deposits, offering a stable yield and designed for non-US investors seeking dollar-denominated returns.

OUSG (Ondo Short-Term US Government Bond Fund): This tokenized wrapper of a BlackRock-managed ETF provides a stable investment backed by US government bonds.

OMMF (Ondo Money Market Fund): A tokenized BlackRock money market fund that offers liquidity and capital preservation.

Flux Finance: A decentralized lending protocol that supports both permissionless tokens (like USDC) and permissioned tokens (like OUSG).

Recent Collaborations and Integrations

Injective: Ondo has partnered with Injective to integrate USDY into the Injective ecosystem, allowing users to access yields backed by US Treasuries across various decentralized applications (dApps).

Pendle Finance: This collaboration enhances Ondo's tokenized products' utility by integrating them into Pendle’s yield-trading platform, providing users with more ways to optimize their yield strategies.

Goals and Challenges

Ondo Finance aims to

Bridge Traditional and Decentralized Finance: By tokenizing real-world assets, Ondo wants to make traditional financial products accessible on the blockchain, thereby attracting a broader audience to DeFi.

Enhance Transparency and Compliance: Ondo strives to meet or exceed the transparency and regulatory standards of traditional finance, ensuring investor protection and trust.

Improve Accessibility and Efficiency: By leveraging blockchain, Ondo aims to offer faster, more efficient financial products that are accessible to a global audience.

However, Ondo faces challenges such as regulatory hurdles and the need to continually adapt to the rapidly changing DeFi landscape. Their conservative approach to compliance and risk management is designed to address these challenges.

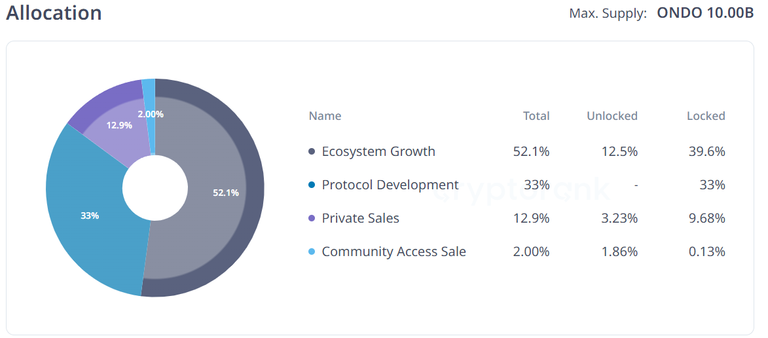

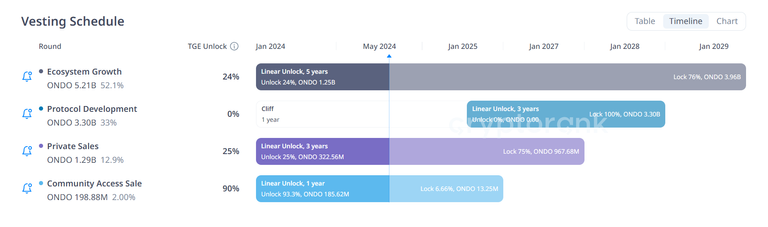

Tokenomics

Ondo Finance’s tokens are designed to offer stable yields backed by high-quality assets. The tokenomics of products like USDY involve:

High-Quality Collateral: Backed by US Treasuries and bank deposits.

Daily Liquidity: Ensuring investors can access their funds when needed.

Regulatory Compliance: Adhering to stringent KYC/AML requirements to ensure security and legality.

For potential investors, the stability and yield offered by Ondo's products make them an attractive option compared to more volatile cryptocurrencies. Moreover, the integration of these products into various DeFi platforms increases their utility and potential returns.

At the same time have on your mind that products like that are mainly design and launched in Bull markets but if they can withstand a bear market then they are something that you must have in your portfolio.

Ondo Finance is at the forefront of merging traditional finance with decentralized finance, offering innovative products that provide stability, yield, and accessibility. Ondo Finance is well-positioned to transform the financial landscape.

Links

https://ondo.finance/

https://twitter.com/OndoFinance

Posted Using InLeo Alpha

Ondo is the name of the city I grew up in and that makes me have a soft spot for this project.

@tipu curate

Upvoted 👌 (Mana: 29/49) Liquid rewards.

looks to me the token itself is a bit useless?

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP