SOURCE

For decades, the precious metals market, particularly silver and gold, has been under the shadow of price manipulation. Western central banks, with a notable focus on the United States since it abandoned the gold standard in 1971, have been accused of artificially suppressing the prices of these monetary metals. The manipulation, predominantly bearish, has aimed to keep prices artificially low through various strategies, with significant repercussions for investors and the market at large.

One of the primary tactics used by these central banks involved short-selling massive quantities of gold and silver futures contracts. These futures contracts are paper assets, representing large quantities of precious metals without any real connection to the actual physical gold or silver held in vaults such as those at COMEX. Traded on margin, these contracts allowed manipulators to exert tremendous selling pressure with relatively small cash deposits, sometimes only 10% of the total contract value. This leverage enabled them to sell quantities far exceeding the actual physical supply, driving prices down significantly.

In contrast, if trading were confined to the physical bullion market, the manipulators could only sell the amount of gold or silver they physically possessed, limiting their ability to influence prices. The reliance on paper assets allowed for almost unlimited selling pressure, distorting market realities.

Another manipulation technique known as “spoofing” involved placing large sell orders without the intention of executing them. These fake orders would create an illusion of overwhelming selling pressure, prompting genuine traders to sell off their positions, thus driving prices down. For example, a bank might place sell-stop orders for gold just below the current market price. The mere presence of these orders would create a bearish market perception, unbalancing the market and facilitating the intended price suppression.

Recent developments, particularly in the last week of April and the first week of May 2024, have provided compelling evidence that the influence of Western central banks on precious metals prices is waning. Despite their continued efforts to suppress prices, they are no longer able to achieve the significant and sustained downward price movements they once could. This shift is largely due to the growing influence of China in the precious metals market.

China has emerged as a dominant force, wielding substantial financial power and becoming a key player in determining market prices. As the largest consumer and importer of gold, China's market activities have created a robust demand that Western central banks can no longer counteract effectively. When China is active in the market, it counterbalances any bearish attempts by Western entities, leading to more stable or even rising prices.

SOURCE

The past two decades have seen a significant shift in the global dynamics of gold and silver demand. Nations like China and Russia have been strategically increasing their gold reserves, driven by a desire to reduce reliance on the US dollar and to bolster their financial stability. This has dramatically altered the supply and demand equation, creating a level of demand that the traditional sellers find increasingly difficult to suppress.

This heightened demand is now strong enough to resist and even overpower the artificial selling pressures previously exerted by Western central banks. The substantial rallies in gold and silver prices witnessed in the first quarter of 2024 are a testament to this new balance of power in the precious metals market.

SOURCE

For years, investors in gold and silver faced frustration as price manipulation stifled market growth. Any emerging uptrend was quickly quashed by sudden, massive sell-offs, preventing sustained price increases. However, the market landscape has transformed. The once-omnipotent influence of Western central banks is diminishing, making way for a more balanced and potentially bullish market environment driven by genuine demand.

As China and other nations continue to fortify their gold reserves and as global economic conditions evolve, the ability of any single entity or group to manipulate precious metals prices will likely diminish further. This change heralds a new era for gold and silver investors, one where prices can more accurately reflect true market conditions without the heavy hand of manipulation.

The silver and gold markets are experiencing a profound transformation. The era of Western central banks' dominance in price suppression is coming to an end, ushering in a period where market forces are more likely to be dictated by genuine supply and demand dynamics. Investors can look forward to a market where the true value of these precious metals is realized, free from the shadows of manipulation.

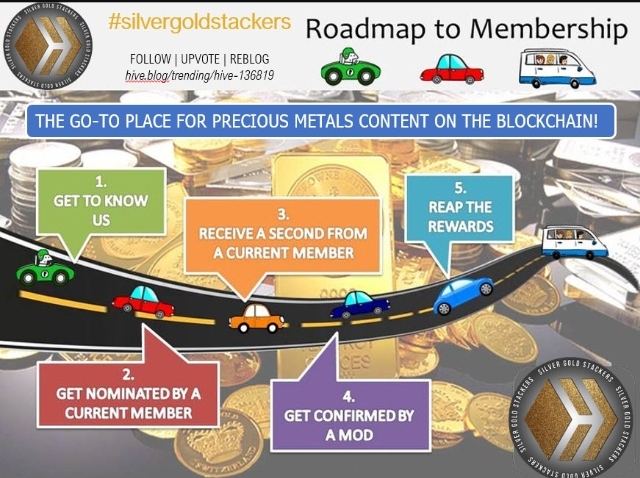

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

Hi @welshstacker,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I could use a little manipulation I like to buy my metals did the lows 🤣 !BBH

@welshstacker! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @bitcoinman. (19/50)