Last week Bitcoin forked into two competing blockchains, which for the purpose of this article I will call Bitcoin Cash and Bitcoin SegWit. There is one previously unforeseen black swan event could possibly bring the Bitcoin SegWit chain to a grinding halt in the coming weeks.

After four years of arguing about how to scale Bitcoin, some members of the “bigger blocks” faction hard forked on August 1st to form “Bitcoin Cash” following Satoshi’s original vision of simply increasing the block size.

The remaining “SegWit” faction expect to activate their new protocol “segregated witness” on their blockchain in two weeks. SegWit has kept the block size capped at 1 megabyte for the past four years, even though this has led to transaction processing delays and skyrocketing transaction fees.

Even though Bitcoin Cash is now separated from the SegWit blockchain, the two are still economically connected by the scarcity of mining hash power because they use the same proof of work algorithm.

Bitcoin transactions are processed by “miners” who run specialized hardware to solve the math problem called proof of work. This algorithm is solved by custom made processors called “ASICs”.

There are a limited number of ASIC computers in the world, and nearly all of them are currently employed in mining Bitcoin. This means the supply of Bitcoin mining hashpower is inelastic over the short term, but fairly elastic over longer periods that allow for manufacture and delivery of new ASIC machines.

Bitcoin’s difficulty automatically adjusts every 2016 blocks to keep the network producing new transaction blocks every ten minutes. It normally takes two weeks to mine 2016 new blocks.

When Bitcoin Cash forked away, the initial difficulty of the new chain was the same as the SegWit chain. Since only a small percentage of miners initially supported Bitcoin Cash, it took over six hours to mine the first Bitcoin Cash block. This would normally take ten minutes, so Bitcoin Cash was taking 36 times longer than Bitcoin SegWit to process the same transactions.

The slow initial block production was loudly jeered in social media by the supporters of SegWit, and the price of Bitcoin Cash dropped accordingly for the first five days, bottoming around $200 on Saturday.

However, the creators of the Bitcoin Cash fork anticipated that they would initially have very little miner support. So they added a second difficulty adjustment rule to reduce difficulty every 12 hours if enough blocks have not been mined. The SegWit blockchain does not have this emergency difficulty reduction rule and cannot add it without a hard fork of their own. This small feature addition by Bitcoin Cash may have unintentionally exposed an asymmetric vulnerability on the SegWit chain.

Bitcoin miners tend to choose where to apply their mining power based purely on profitability. The two Bitcoin forks are now competing for a limited pool of mining hash power.

The profitability of mining Bitcoin depends on three factors - the price of Bitcoin, the price of electricity, and the mining difficulty. More efficient miners are able to solve more blocks at a lower cost of electricity. For this reason the majority of Bitcoin mining is done in countries with low electricity costs, primarily China and Iceland.

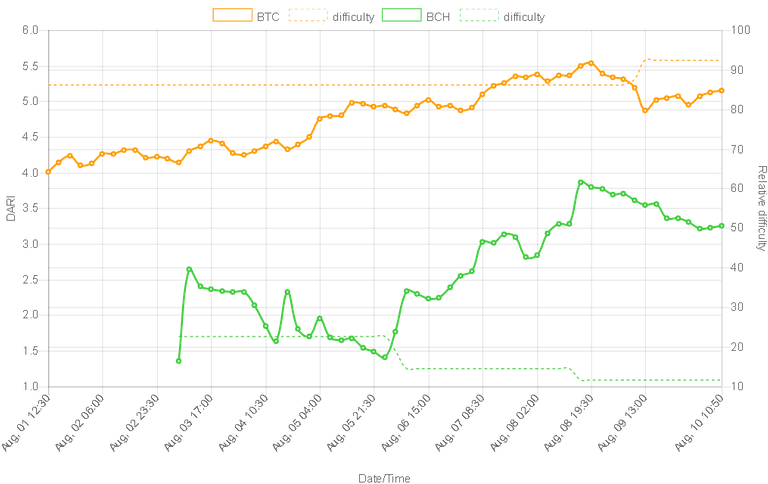

This chart shows the profitability of mining the two chains over the past 24 hours. http://ztnark.com/bitcoin-fork

At the current prices, if the price of Bitcoin Cash remains stable and the difficulty continues to fall, when the difficulty reaches 10% of the SegWit chain, it will become more profitable to mine Bitcoin Cash than to mine SegWit. The green and gold lines on the chart above will cross.

SegWit is coming up on its two week difficulty adjustment, and based on the hashpower, the difficulty is expected to increase by 7%. That will push Bitcoin Cash even closer to profitability.

The Runaway Scenario

By the end of the first week, the difficulty of Bitcoin Cash had fallen to 17% of that of the SegWit chain.

It is expected that if the profitability of the Bitcoin Cash chain surpasses that of SegWit, some miners will make the rational decision from self-interest, and start redirecting their machines to mine the Bitcoin Cash chain instead of SegWit. However, this could cause a runaway scenario.

If the SegWit blockchain loses a significant amount of hashpower from miners jumping to the other chain, it will have major slowdowns and delays in transaction processing. Because SegWit has no built-in mechanism to reduce difficulty, it would take two weeks before the difficulty would be reduced, and even then, the current difficulty algorithm limits reductions to 75% in one period, which may not be enough.

Thus a migration of 25% of mining hashpower to the Bitcoin Cash chain could result in the main Bitcoin SegWit blockchain slowing substantially. This in turn could cause a panic crash of the Bitcoin SegWit price on exchanges, pushing the profitability of mining SegWit even further underwater.

If the panic and ensuing price crash were large enough, the hashpower for the SegWit blockchain might fall so much that it takes more than two weeks to reach the end of the 2016 block period when the next difficulty adjustment is made.

Consider that if hashpower fell by 50%, it would take 4 weeks instead of two. If hashpower fell by 75% it would take 8 weeks. If it falls by 90%, it will take 20 weeks to reach the next difficulty adjustment.

This scenario assumes that the miners make decisions purely pragmatically on the basis of profitability. Undoubtedly some miners are ideologically motivated and might continue mining the SegWit chain even if the profitability went negative. But that costs them money in the form of electricity, and there is a limit to how long any organization can afford to operate at a loss.

Miners also have to consider the damage that would be done to Bitcoin as a whole if the SegWit chain suddenly died. Even if Bitcoin Cash survives, this black swan event might significantly reduce the market value of Bitcoin for a long time, cutting into profits.

On the other hand, it will only takes a few miners jumping chain to start the process. Once that process begins, a race to the bottom may ensue.

This scenario seems improbable, unless Core is successful in blocking Segwit2X from activating on November 1st. At that point the miners will have to decide whether to fork bitcoin again, as Segwit2X, or simply move their hashpower over to the Bitcoin Cash chain.

Bitcoin Cash was designed by the mining faction of the Bitcoin scaling debate to keep mining Bitcoin profitable. The SegWit faction has long viewed miners in a negative light and proposed the SegWit changes to reduce the power of miners over the Bitcoin network. In the economic nature of competition, this may lead to Bitcoin SegWit losing the support of its miners if Bitcoin Cash is seen as a viable alternative.

In such a scenario the only way the Bitcoin SegWit could recover would be to do an emergency hard fork on very short notice to reduce the difficulty. It is unclear whether that is even possible.

Some people in the SegWit forums are now discussing the vulnerability.

More information about the runaway miner scenario:

https://medium.com/@shludvigsen/traders-guide-to-bitcoin-cash-bitcoin-segwit-819933694b34

https://medium.com/@malimujo/bitcoin-cash-bombshell-incoming-soon-44eee7d1fca6

Segwit totally changes the way the blocks are arranged. It may work for now, for next few years. Or a vulnerability nobody thought possible could occur - but much later on. Both chains will go fine, tomorrow, next year.

★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★

https://freebitco.in/?r=8869745

WIN BITCOIN

Roll to win up to $200 BITCOIN

You can enter to win every hour

There is also a weekly jackpot drawing of $500

The more you roll the more entries you get for the weekly lotto

The best thing is it's completely FREE!!!!!

★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★

This is a page from the carbohydrate/sugar - that could be in bitcoin too.

https://steemit.com/sugar/@tuventure/bitcoin-and-ancel-keys

Do. Not like Black swans

Interesting .. what are the chances of this scenario playing out the way you've explained above ?

I don't think it is likely to happen prior to Nov 1, when the 2X part of the NYA kicks in. Core just released new version that disconnects 2x nodes. I believe that if the NYA fails, there is a strong chance that a lot of miners will jump chains at that point. Then this scenario could possibly play out.

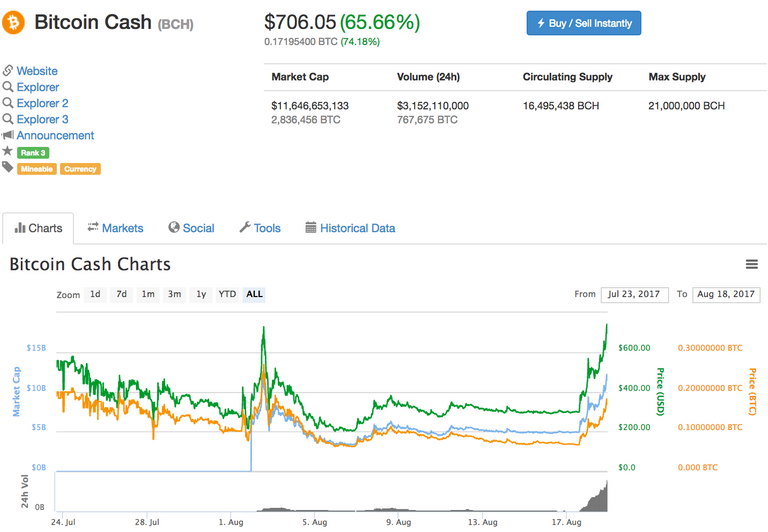

Wow thanks so much for posting. 11 days after your post here it is August 18th and the price of BCH has skyrocketed almost as if the tide is turning toward this scenario actually occurring. Look at this.

I think this scenario is going to happen. I feel it in my gut. And BCH will go up and beyond the current value of BTC (~$4100) in a jiffy.

Lol, what Jiffy? There is space for both coins but Bitcoin will be number one for quite a while longer.

Updated profitability of mining graph http://fork.lol/#/dari/7

.... and I am betting on it .... bought more Bitcoin Cash .....

When designing Zcash 1.0 (“Sapling”) we were concerned about this possibility hitting Zcash: https://github.com/zcash/zcash/issues/95 What we decided to do about it for Zcash 1.0 Sapling was just recalculate the difficulty factor more frequently (https://github.com/zcash/zcash/issues/147), similarly to how Bitcoin Cash has apparently done.

Interesting post, thanks for your thoughts

Interestingly highlighted points. I have always been a proponent for a total overhaul (BCH) instead of a "windowdressing" (SEGWIT) approach to bitcoin scaling issues. For anyone who still hasn't understood what bitcoin scaling,SEWIT and the birth of BCH really is, you can head to my blog, I have a recent article that explains in simple terms what this is. This can help us understand what the future really should be like for bitcoin.

This is fantastic news here. I will share this with my people :) BCH could very well spike if we see this and we are long overdue for a downward retracement in Bitcoin price.

BCH broke through resistance this morning. It's up 50% in 24 hours.

This is a very well written blog that's answered many of the questions I've been thinking about, I didn't sell my BCC for short-term profits, I'm holding as insurance in case they flip. Upvoted and resteemed.

As a miner, this is a scenario I have talked about and brought up to people before...

Some miners care about the profitable coin, others care about its culture and ecosystem...

You see it all the time, miners jumping pools/changing algorithms to mine the most profitable, while I have other friends who mine coins and go negative because they believe in the coins future.

Great post, upvoted and resteemed.

Seems that BCH could become the more profitable to mine AND maybe more in line with the original vision/culture/ecosystem. I'm sure there will be die hard bitcoin enthusiasts who will never switch simply because bitcoin was first. You can never take that away from bitcoin. But, at the end of the day, I want to see the coin succeed that really fights centralization and oppression and corporate influences, and time will tell if that is BTC, BCH or something else entirely. Like, wink wink, ZenCash. Been following that project for awhile and am super excited about the secure node feature.

I completely agree which is why I only mine ZenCash right now... gotta support the ecosystem you believe in, and they are what I think crypto-currencies originally aimed to be.

Really glad to hear that from a miner. I'm just a layman, but I'm super into what they're striving for and think they have a great team.

They have in my opinion, the best currency structure for an anonymously and decentralized currency and the team behind the tech is awesome!

I really see them picking up more steem in the coming years.

You are also missing the fact that miners can also just devote a tiny bit of hashpower to bitcoin cash to make sure the 12 hour rule doesn't kick in. There is some evidence of this taking place such as the lovely message left on the bitcoin cash blockchain by suprnova.

you are making a lot of assumptions. First of all there is an agreement and any big miner that wants to breach the NY agreement will not be trustworthy to its clients and the ecosystem and will cause its downfall. Second, mining something that does not have the best developers is a risky proposition unless you think all bitcoin software is ready to go. Bcash has as a developer who? Third, you need to convince all users and shops to change software to support bcash payments. And that all sounds very logical to you.

First, the NYA agreement says nothing about dedicated hashpower. So any signatory can mine both chains, or neither, without being in violation.

Second, Core has already trumped the New York Agreement by releasing 0.15 which automatically blocks 2X nodes, even before November 1st. If the SegWit chain does not upgrade to 2X on Nov 1, the NYA is dead, and the miners will be completely free to migrate.

Third, your argument is somewhat nonsensical. "any big miner that wants to breach the NYA will not be trustworthy to its clients". What clients? Miners mine for bitcoins. Oh you mean wallets? The vast majority of Bitcoin users have no idea which miner full node their wallet connects to, much less how to change it.

"Third, you need to convince all users and shops to change software to support bcash payments." My article does not predict the victory of Bitcoin Cash. It predicts the possible collapse of the processing power of Bitcoin SegWit. If SegWit tranasction delays get longer and longer, while fees go higher and higher, nobody will have to convince anyone to use Bitcoin Cash. It will be the only alternative that works, which can be adopted at the least cost to businesses, because the protocol is effectively the same as original Bitcoin.

Man! You are good!

Followed you 👍

@belerphon

Mate, you just explained the whole picture in a very short post. I appreciate your explanation. Cheers buddy!

Please who has seen satoshi?

Found your post very amusing. However, it is of course all complete nonsense. The amount of mining activity in a network really does not determine the value of the currency being mined. First, we have to remember that Bitcoin has really become a digital store of value (like gold) rather than a daily transactional currency. There are other blockchain currencies that are better, faster, and cheaper than Bitcoin in every way that will be used for day to day spending. The reality is, if the Bitcoin network were to become temporarily extremely slow and sending would be very expensive that would not undermine the value of bitcoin (a case can be made that it might actually go up in value). If you purchase a gold coin or a bar of gold, it might not arrive that fast. Regarding Bitcoin Cash, unfortunately it has no reason to exist because there are other cryptocurrencies that already provide the very same function, like Litecoin or Dash. It is extremely unlikely that Bitcoin Cash will become "Bitcoin" due to a powerful network effect. So the only thing that your article was able to demonstrate is that hashing power may drift to Bitcoin Cash and make the "original" Bitcoin slow and expensive to send (I only say original because its the one with ticker symbol BTC and BTC will always have the network effect). Ok, who cares? That will not harm its price. There is no question that BTC will continue making massive gains over time and I hope to see about $500k per Bitcoin in 3 years. The same thing can't be said about Bitcoin Cash because it is a much more speculative investment.

I appreciate how conservative everyone has been, in regards to the hardfork, and while still a bit reactionary, the cooler heads prevailed and the bitcoin price stabilized nicely. I'm worried still that it may be a double peak scenario, and could still have significant pull back in the weeks to come, though not likely.

I really enjoyed our post, even though its somewhat aged. Well done.

It can only be a black swan event if no one has thought it possible.

Bitcoin has never been the most profitable to mine. It's always been a flaw. For that reason, I think that this logic is flawed. In reality, we will see miners leave, but are we going to see troves and troves of them leaping to BCH? Doubtful, because all of the value-driven miners would be mining Zcash and ETH and the numerous other coins that are much more profitable already. Of course, this is looking strictly from an electricity to value ratio, not taking into account the speculation of appreciation. This is likely why Bitcoin still has many many miners because people believe in its appreciation since it is the forefather of blockchains.

Slowly it comes...

I actually am amazed at the way things shift in the market

I thought I was the only one who saw this.

SegWit has problems!

informative post :)

This post received a 2.3% upvote from @randowhale thanks to @belerophon! For more information, click here!

I see, this could turn pretty much into a clusterfuck if bitcoin cash becomes more profitable to mine. Bitcoin cash could definitely go higher when it's profitable to mine but probably that would make the markets crash pretty fast.

really great info, thanks for sharing

This post has received a 3.57 % upvote from @buildawhale thanks to: @buildawhale.

This would be a disaster for cryoto but I think you hit the nail in the head. It's all about profit at the end of the day.

I don't think it would be a disaster for crypto. Now don't get me wrong, I love Bitcoin and am so grateful for the birth of the blockchain, but there is a certain arrogance that comes with being top dog and I don't know if that will be tolerated by the people.

The disaster would be if there were a huge crypto to fiat dump. But if a Bitcoin dump just goes to other alt-coins, including BCH, then that will just be a big market adjustment.

And for sure, mining profitability will play a large role.

This is all so captivating, very happy to be on this ride with everyone and thanks for sharing such good knowledge.

Yea when you put it that way it doesn't seem so bad. I just think it will slow adoption. For crypto to be taken serious it needs to it a total of 1 trillion market cap. Right now crypto just breached 100 billion. I'm keeping me eye in Tezo's and ByteBall.

The Future of Bitcoin is in : https://platincoin.com/en/registration

If the New York Agreement is not broken, Bitcoin has 80% hash rate guaranteed. With current transaction activity, a 20% reduction in transaction capacity will not be dangerous.

You need to read the NYA closer. It does not bind the signatories to devoting 100% of their hashpower to the SegWit 2X chain.

Very interesting post, thanks for sharing!

Interesting article and helped settle nerves when I went back into Bitcoin Cash

Very good read. Very much to think about. Will share this :)

This post has been ranked within the top 25 most undervalued posts in the first half of Aug 08. We estimate that this post is undervalued by $17.05 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Aug 08 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Well that's a dark cloud .

There is an error in reasoning in this calculation:

Point #1, yes, but the difficulty of Bitcoin Cash can only increase after 2016 blocks. So it is not immediate. The difficulty can downgrade in 12 hours, but the difficulty cannot upgrade in less than 2 weeks.

Point #3, Bitcoin SegWit difficulty cannot reduce until the end of 2016 blocks is reached. If substantial mining power leaves, the end of 2016 blocks is greatly delayed. The more it is delayed, the more possibility of miners leaving. It would only take the top four miners leaving in the first few days of a difficulty period to take away 50% of the hashpower, doubling the adjustment period. None of the top four miners presently have any ideological commitment or interest in SegWit.

Good piece. Am following this closely myself and also think Bitcoin cash has brighter days ahead.

Satoshi himself couldn't say it better.

I'm pro-Satoshi, therefore I'm pro-BITCOIN CASH and that makes me ANTI-BITCOIN SEGWIT.

Well put @belerophon 👍

This post has received a 11.54 % upvote from @booster thanks to: @belerophon.

Looks like you updated the mining profitability chart, but the link you provided doesn't work to see even more current info. Can you provide that? And, am I correct that when the two lines cross, that is when it's more profitable to mine BCH?

Just read through all your comments. You are on the tip and really seem to know your NYA stuff. Thanks for your work.

Good articel thank you.

What are your thoughts to the spike in the BCC prices as well as the seemingly exponential BCC mining difficulty decreases in the last day(s)? It looks like the profitability is accelerating quite drastically https://cash.coin.dance/blocks.

The more I learn the more I like Bitcoin CASH!!!!

great

Whether we’re ready for it or not, it’s going to happen the second time in three months!!! It seems like the next time the technical team that proposed Segwit2x will do the hard fork. What if they forking Bitcoin every day? A good way to make value from nothing!

Lol, too funny, real vulnerabilities lie in 8 meg blocks offering double spend issues. Segwit is working very well.

It is not over! BitcoinCash will take over, that Bitcoin has it`s black swan

freebitco.in/?r=8869745

Hey, wanted to let you know where to get some free Bitcoin.

It's a Bitcoin lottery and you can win up to $200 every hour, there's also jackpot drawing of $500 every week!

You can also mine BTC and they have a gambling section if that's your kind of thing.

Hope this can help you get a little extra in your wallet.

Good luck!