It seems as if every time the general public starts getting interested in cryptocurrencies, another exchange is hacked or another entry in the cryptocurrency sweepstakes blows up, sending the sector back into the "untrustworthy" abyss.

But this minefield shouldn't blind us to the possibility of a path to $10,000 bitcoin.

Skepticism is always prudent in any financial matter, especially a speculative one, so put on your skeptical thinking cap and follow along.

The problem is everything is now speculative.

Do you really think the $100 trillion private-sector bond market (i.e. the bet that debtors will pay back what they borrowed with interest) is "safe," as in guaranteed, bullet-proof, no serious loss of capital is possible, etc.?

How about the $60 trillion sovereign (government) bond market?The problem with sovereign bonds is governments with central banks can create "money" out of thin air to pay interest and redeem maturing bonds, but this devalues the currency. So getting back 100% of your nominal investment doesn't mean you're whole; if the currency the bond is denominated in fell 50%, bondholders suffer a 50% loss in the purchasing power of their initial capital. Ouch. How is that not speculative?

How about the $70 trillion in global stocks?

Yes, we all "know" that stocks will never go down ever again because central banks can keep inflating new credit bubbles indefinitely--but let's not kid ourselves: history tells us that stocks remain a speculative gamble.How about the $62 trillion in unsecuritized debt instruments? How much of this debt is collateralized by fast-dying malls, bubble-priced real estate, or Unicorn-type valuations in other assets?

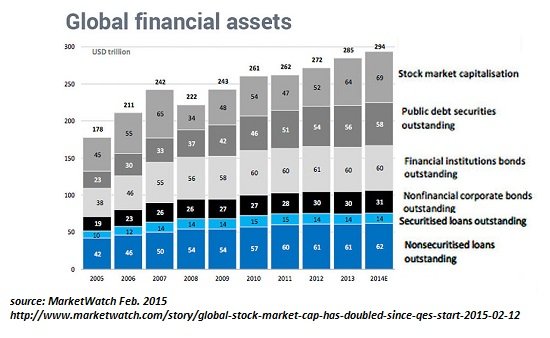

Take a gander at this chart of financial assets, roughly $300 trillion, and note that this doesn't include real estate, housing, etc.

Global real estate is estimated at $217 trillion roughly two-thirds of financial wealth. Together, these assets add up to over $500 trillion.

Once again, the larger context here is: all these assets are speculative. Yes, even real estate.

Then there's the currency market.

Care to argue that currencies are non-speculative investments? Is that why Chinese wealth is gushing out of the yuan, because it's so guaranteed to never lose purchasing power? Is that why the euro fell from 1.40 to 1.05, because it's a guaranteed safe investment?

Venezuelans learned the hard way that fiat currencies when mismanaged by the issuing nation/central bank can destroy wealth on an unimaginable scale.

So now let's turn to bitcoin, with a market cap of about $18 billion

Now compare that to $500 trillion. If we take 1 measly little trillion, bitcoin's entire market cap is 1/70th of that.

So let's imagine a scenario in which tens of trillions of at-risk wealth suddenly seek an alternative--any alternative to staying in an asset class that's circling the drain.

We're accustomed to "rotation," the nice little game where bonds can be sold and the capital invested in real estate or stocks, or vice versa. We're less accustomed to all the conventional asset classes toppling like dominoes. Where do the fleeing trillions go when stocks, bonds and real estate are all going down in a chaotic sell-off?

Gold and silver are time-honored safe havens, but it's not too difficult to foresee the potential for limits or bans on gold, or supply constraints. Some percentage of investors will consider alternatives.In such an environment of a crowd rushing for increasingly narrowing exits, what thin slice of institutional and individual investors will take a chance that bitcoin might hold or even increase its value as a major currency melts down, or some other global financial crisis unfolds?

Shall we guess 1/10th of 1% of the panicky fleeing wealth will take the chance that bitcoin will be a safer haven than the conventional assets that are cratering?So 1% of the $300 trillion in financial assets (setting aside the $200 trillion in real estate for the moment) is $3 trillion, and a tenth of that is $300 billion.

So what happens to bitcoin's price if $300 billion rushes through the wormhole? On the face of it, market cap would go up 20-fold from current levels. Since the number of bitcoin is limited to around 18 or 19 million (subtracting those bitcoin lost forever to hard drive crashes, etc., and those yet to be mined), price would also have to rise 20-fold.

OK, so 1/20th of 1% of global financial wealth flowing into bitcoin strains credulity.

Let's make it 1/20th of 1%, or $150 billion. That still pushes bitcoin's market cap and price up 10-fold.That's the pathway to $10,000 bitcoin. Unlikely, you say? Perhaps.

But if you're of the mind that $500 trillion in current assets might be revalued considerably lower in a global crisis, then a tiny sliver of that fast-evaporating wealth finding a home in bitcoin (or other cryptocurrencies) doesn't seem all that farfetched.

You want farfetched, how about $3 trillion in panicky fleeing capital flooding into bitcoin? Yes, a whole, gigantic, enormous 1% of speculative financial "wealth" and "money" seeking a home in cryptocurrencies.(It's worth doing the same exercise with gold, only substitute $6.4 trillion in market cap (i.e. all the non-central owned bank gold) for bitcoin's $14 billion market cap.)

Cryptocurrencies are intrinsically volatile and speculative.

Anyone pondering them must keep this firmly in mind at all times. There is no "guaranteed" safety or guaranteed anything. Everything that appears solid can melt into thin air (to borrow Marx's phrase) without advance notice.

![]()

Lastly, do your own research before taking market action. Don't take what anybody says for face value. Not even me.

Invest in your own education, that's the best investment you will ever make.

I would add the major companies now supporting it (example Fidelity investments CEO discussion this week)

this is a lock to happen! even in the next 3 months. But something on a global scale is brewing. all this terrorist activity has me suspicious

Nothing is for certain my friend. But the odds does seem to be in our favor indeed!

From my sources Western Countries are looking at the prospect of possible, multiple false-flag attacks meant to disrupt financial awareness and further increase military spending once again pushing our government and putting pressure on it to enter oil rich nations to prop up the PetroDollar and intimidste those who are bucking the system. But as a whole I agree sith one small caveat. The internet for the most part can be regulated or at the very least monitored and manipulated which can severely disrupt the transaction rate of BTC trades which we can see is making them very slow. Crypto's as a whole have this one sole area of weakness but this does not change the dynamic of limited versus unlimited money supplies. The post is correct that central banks and the declining retail sector have weakened the USD and Euro and any asset which is limited, scarce or rare will always fair better especially in times of hyperinflation. $10,000 is not unreasonable but I think people sould be far better off not taking the risk of buying high and instead buying something that IS scarce and rare and has monetary value like Silver. Yes I am a silver guy. I think BTC will go up, absolutely, but so will other cryptocurrencies and one should not limit themselves to BTC because there are major forces that can control the flow and therefore the value and I think diversifying into STEEM and even Litecoin can make a better day-to-day alternative means of currency. But long-term always pick tangible assets to intangibles especially when you are talking about $1,200+-$10,000BTC versus $17-$20 1oz Silver rounds. Long term, Silver and Precious Metals, short term, whatever is not based on nothing but the ever increasing population and need for a medium of exchange like the USD and other central bank derived currencies. Think of it this way, if BTC goes to $10m it will have gone up 8X as will Gold which many say will do the same thing. At only $400 per ounce of Physical Silver you will have 20X the return. JP Morgan has purchased a LOT of silver using the manipulation of the COMEX and when looking at financials do what the rich and what the banks do. Stay away from the stock market as retsil sales are going down the tubes due to price:income ratios and alllll the uncolateralized debt on the market which innately affects bond markets. Credit, forget it.

Do you guys realize how few bitcoins there are compared to humans on this planet?

There will be a time in the future, when people will say: "Remember when people used to have an ENTIRE bitcoin in their wallet?"

Like that would be crazy rich :)

also cryptocurrency is also a form of fiat after all, real wealth is land gold and silver

Yet, how do you price gold and silver? That's right in currency. You need some other form of means to pay than slapping around bars of gold. I agree that gold and silver is way, way, WAYYY, undervalued. But using it in practice as money is just silly. I could imagine a gold and silver backed currency but that's about it. My 2 cents.

You cant print it into oblivion.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://lfb.org/fiat-craps-bed-10000-bitcoin-gold-500-silver/

Congratulations @sjovmaiin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Congratulations @sjovmaiin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!