In this post, I list and elaborate a few points that I have learnt (from my - and others' - mistakes and experiences) trading altcoins

Firstly, how does one reduce mistakes in our trades ? How to be mostly on the "green side" ?

It is important to note that to trade right requires your full focus. Trading is not for everyone. The following suggestions are easy to follow because they are intuitive. However, it may still be difficult to apply them to practical situations, like many things in life.

1. Have a reason before entering each trade: Start a trade only when you know why you’re starting and have a sound strategy for afterwards. Not all traders make gains from trading, yep, nothing in the universe is a free lunch, for everyone who benefits someone else loses on the other side (a zero sum game). The Altcoins market is driven by large whales. They are patiently waiting for noobs (or just dumb money in the market) to make mistakes. Even if you are committed and available to trade on a daily basis, sometimes it is just better to hodl on some days than to trade. From my experience, there are days when you keep your profits simply by not trading at all.

2. Target and stop when starting a trade: For each trade you must have a desired profit at which point you sell no matter what, Dollar cost averaging may significantly reduce your risks. Also, a stop-loss level for cutting losses. A Stop-loss is setting the level of loss where the trade will get closed. Some traders may fail when they have biases with a trade or the coin itself. They may be thinking, “Here it will turn around, and I will get out of this trade with a minimum loss, I’m sure”. They’re letting their emotions take charge and unlike the traditional stock exchange where extreme daily movements are considered 2-3% in value, trading alt coins can be a lot more risky: only in my short period as a trader I’ve seen massive (over 50%) pumps and dumps in few hours. If you were following the price movements, you would've noticed the ridiculous price swings bitcoin had last week, with FUD (fear-uncertainty-doubt) around news from china , JP Morgan CEO trash talking bitcoin and the normal market correction after BTC hit $5000 coming at once. Although it recovered $700 within 5-6 hours, I'd guess that many, many small traders lost a ton by panic selling, to the whales, manipulators and a few lucky ones who managed to pick up BTC at $2900 (I'm jealous) .

3. FOMO (fear of missing out). It really isn’t fun to see some situations from the outside – such as when a certain coin is being pumped up like crazy with double digit % gains in minutes.

That big green candle is telling you, “you are the only one not holding me”. Usually at this point you will notice shills and trolls flooding forums, subs and the exchanges’ Troll boxes to talk about this pump. Simply ignore them and go about your usual strategy.

True, it’s possible that many may have got on the boat ahead of the wave and it can continue rising, but keep in mind that the whales are just waiting for small buyers on the way up to sell them the coins they bought at cheaper prices. Prices are now high and the current holders may decide they are up by enough % . The next step is usually the bright big red candle selling through the whole order book.

If you happen to be holding something that's pumping rapidly, and if it's up by too much in a 24 hour span (usually 25-30% or more, for cryptos) you get out of it ASAP. Take your profits and get outside, do something else. Hodling for too long because you think it will pump higher (greed) due to some news or simply because you're biased, is one of the most common reasons the average trader loses out to someone with a bit more experience. It will almost always come back down if it balloons in a single day, there's no reason to keep holding at this point. If you love the coin, you can usually buy in more once the pump is done. Keep an eye on the retracement levels, some traders like to use fibonacci ratios to predict trend reversal points (this may sound kooky, but it has more probability of success than blind guessing), figure out the support lines and buy back more. This is usually a consolidation period after the big red candles show up.

4. Risk Management. Little pig eats a lot, big pig gets eaten. This statement tells you the story of profits from our perspective. To be a profitable trader, you never fall for the hype or try to hit a homerun with one trade. You look for the small profits that will compound as you reinvest them.

Even small profit like 1% daily (I get it, this is unreasonably high, but for crypto - 1% daily is very much achievable if your portfolio is diversified within the top few coins) can help you accumulate significant profits over months.

The math is simple :

Let's say you start with a $1000 and make 1% daily* for 90 days

1000*(101/100)^90 = 2448.63

That's a 2348% profit in just 90 days!

*note that I don't mean you have to be consistently making 1% daily, that is impossible, like I said, on some days you are better off just holding. But the next week when one of your coins get a 10-20% bump up, you'd have made up for the "boring" days.

Another important strategy is to use USD Tethers to hold some of your profits , as it is pegged to the USD and remains stable at all times. In cryptos, usually in a bear trend, everything in the market is going down including bitcoin, so having some tethers at this point can be really useful. You can buy up a lot of coins at cheap prices during these times. Withdrawing to fiat incurs significant losses in fees. Also, putting in fiat into the markets takes time and the high volatility means that prices are usually back up when you have some fiat ready to buy with.

Some people do not like the way Tether operates at all, and even call it a scam. While some of these may be legitimate concerns , it cannot hurt you unless you're perpetually holding tethers or holding too many (which is a bad idea anyways since it is not recommended to have large amounts with the exchanges.) While there's a SLIM possibility tether might turn out to be a scam and crash to zero (Mt. Gox 2.0) , it is highly improbable that that day will be when YOU are holding it, if you hold them in small amounts for short periods of time. Think of it as going out - accidents happen regularly , you have to be really unlucky to be in one .

Evaluate risk wisely across your portfolio. For example, it's never a great idea to invest significant percentage of your portfolio in a low volume (your funds can get locked up if you don't find buyers at the right time) or low marketcap coins (price manipulation is easier for low marketcap coins).

5. An important point to consider is the fact that most altcoins are bought and sold in terms of BTC, and not directly tied to fiat. So even if you made profit from a trade in terms of dollars, it may be a losing trade if you've lost value relative to BTC. Unless you are directly using USDT to trade, you have to monitor the altcoin's price in satoshis and not in dollars.

When Bitcoin is very volatile (like the last week), the conditions for trading are kind of foggy. So it may be better to have close targets for your trades or not trade at all.

6. Most Altcoins lose their value over time. They simply bleed out slowly (sometimes rapidly).

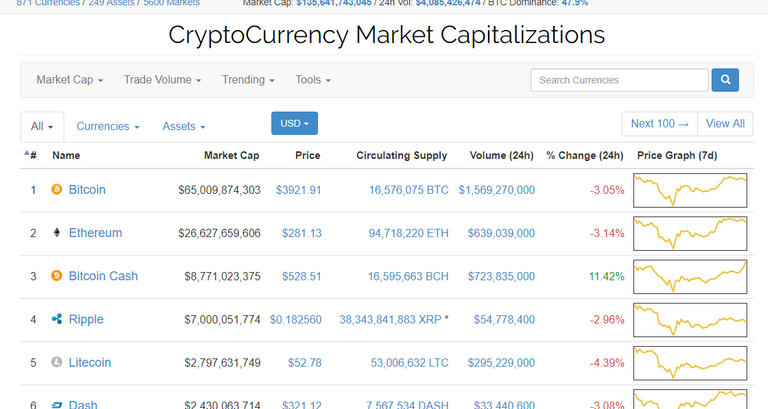

Take this into account when you have decided to hold alts for the medium to long term, do so only if you have done your research about the project and really have confidence in the Devs and the idea. The projects/coins that have a higher daily trading volume, which have an active community behind them, with continuous development, and satisfies a market need, are here to stay. If I had to guess, most of the ones in top 10 will be around for quite a while.

Some of my personal favourite alts are - Bitcoin Cash (I don't even consider it an alt since it is the REAL bitcoin, visit r/btc if you want to ask why), Ethereum, Monero, Litecoin and OmiseGo. These are the more established ones, you could look into the lesser market cap ones (100 - 250 million - high risk/high reward), there are definitely some decent ones in there but you'd really need to do your due diligence if you plan to invest a sizable amount.

You should follow the coin’s chart history and identify low and stable periods. Such periods are likely to be a consolidation period by the whales, and when the right time comes, accompanied by a good press release of the project, the pump will start and they will sell in profit.

7. A word about public ICOs (Initial Coin Offering - crypto version of crowd-sales): Many new projects choose to make a crowd-sale where they offer investors an early opportunity to buy a share of the project (tokens or coins) in what is meant to be a good price for the tokens.

The motivation for the investors to participate in the ICOs is that the token will be traded from day one on the exchanges and would yield a nice profit. The last year or so, there have been many successful ICOs, both the project itself and the ROI for investors. Augur’s and Populous's ICOs yielded investors around a ~10X on their investment.

There's a catch here though. Not all the projects benefit their investors. Many ICOs proved to be complete scams, not only were they not being traded at all but some projects disappeared with the money and we have not heard from them right up to this day. You also have to consider the fact that sometimes you'd have more profit simply by holding the Ethereum (ETH) instead of sending it to an ICO. If ETH is bullish, the ROI on the new coin/asset has to be phenomenal to outperform ETH.

Many scam ICOs are easy to detect, obnoxious advertising, style-over-substance websites, bogus white papers (or no white paper), any co-founder with a shady past, devs prevaricating or using buzzwords to explain things, should be red flags. Be sure to google a lot, view their bitcoin talk ANN thread, their subreddit, popular cryptocurrency subs, and other forums.

8. Buy the rumor, sell the news. When major news sites publish articles it is usually exactly the right time to actually get out of the trade.

Lastly, leave your ego aside. Do NOT indulge in revenge trading. The goal here is not to be right on your trades, but to make a profit. Do not waste resources (time and money) to try to prove something. Remember, there is no trader who never loses, at least sometimes. The equation is simple – get the total profits to be higher than the total losses.

i have 343 followers where muh niggas at SMH yall sleeping

344! I appreaciate it. I just can't upvote at the time. :( Thanks

Hi,

when you want to receive profitable trading ideas for free then follow the million dollar challenge:

https://steemit.com/trading/@niel96/million-dollar-trading-challenge-is-coming-soon

This post received a 20% vote by @minnowsupport courtesy of @r0nd0n from the Minnow Support Project ( @minnowsupport ). Join us in Discord.

Upvoting this comment will help support @minnowsupport.

You got a lot of views on this relative to the upvotes. Did you share this on fb or reddit or something?

yea i did actually lol

Lucky that i found this kind of article its a great opportunity for ppl that is new in crypto to know more about altcoins. I also found something that is also related with altcoins

thanks for posting this mate! Now i know how can i trade my iog now i can apply it in this IOG trading competition lol https://www.kucoin.com/#/rank/IOG