In the last 24 hours the attention within the cryptocurrency market has been focused on the positive behavior that the ETH price action developed upwards, although there is uncertainty about the certain possibility that they will approve the spot ETF for Ethereum and today's behavior was just a product of rumor.

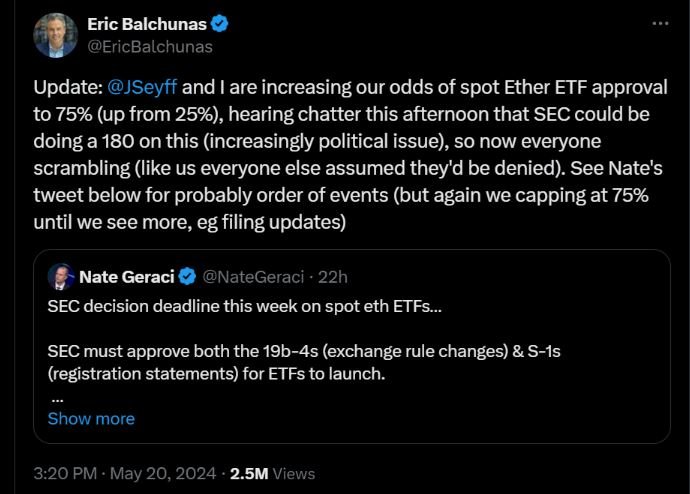

According to information disclosed by Marcel Pechman, "On May 20, the price of ETH rose more than 18% after Eric Balchunas, a senior analyst at Bloomberg, raised the odds of approval for the Ethereum exchange-traded fund (ETF) from 25% to 75%."

Refers the aforementioned article that Balchunas, "further mentioned that the SEC is reportedly asking exchanges such as the NYSE and Nasdaq to update their filings, although there has been no official confirmation from the regulator. However, Nate Geraci, co-founder of the ETF Institute and president of ETF Store, said that a final decision is still pending regarding the registration requirement for individual funds."

An important fact to note is that, "The impending Ethereum spot ETF decision has significantly increased interest in weekly and monthly ETH options expiration. On Deribit, the leading derivatives exchange, open interest in Ether options for May 24 is recorded at USD 867 million, while by May 31 it reaches an impressive USD 3.22 billion."

Meanwhile, call option holders of up to USD 3,600 will exercise their right, locking in the price difference. This scenario results in a substantial open interest of USD 397 million in favor of call options if ETH remains above USD 3,600 at weekly expiration.

SOURCES CONSULTED

Cointelegraph. Ethereum price soars on spot ETF rumor — How are ETH options markets positioned?. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph