Uranium takes a breather making time to average down - did that in a few other places too. New foray in microcaps.

Portfolio News

In a week where S&P 500 rose 1.39% and Europe rose 0.24%, my pension portfolio dropped 0.17%.

The drags were across the board - like last week - not enough technology stock exposure. Specific drags were De Grey Mining (DEG.AX) down 4%, European banks, 2/3rds of Japan holdings, NuScale Power (SMR) down 14% and Paypal (PYPL) down 5.6% and lastly uranium stocks.

Big movers of the week were Sarytogan Graphite (SGA.AX) (37.9%), Panther Metals (PNT.AX), Premier American Uranium (PUR.V) (21.2%), American Rare Earths (ARR.AX) (18.5%), Articore Group (ATG.AX) (14%), DGL Group (DGL.AX) (14%), Stem, Inc. (STEM) (11.7%), Northern Minerals (NTU.AX) (11.5%), 88 Energy (88E.AX) (11.1%), Mitsui E&S (7003.T) (10.6%), Mizuho Medy Co (4595.T) (10.4%), Sunrun (RUN) (10.3%), Seven West Media (SWM.AX (10.2%), Latin Resources (LRS.AX) (10%)

14 stocks in the big movers list. Hard to say there are any consistent themes with one stock per big theme the portfolios are invested in apart from 2 in rare earths. 2 of the ASX stocks will be off the back of earnings. 2 Japanese stocks in the list is unusual especially on a down week for Japan.

Notable mover is American Rare Earths (ARR.AX) after increasing Total Rare Earth Oxides (TREO) resource estimates by 64%. Monday open - up another 37%

Markets wanted to sag early in the week but were buoyed by solid earnings from a few big technology names - the headlines reflect the last 3 days with record highs made.

Uranium

Cameco (CCJ) announced results in the week with revenue and profits up. The headlines tell there is a problem

The problem is they will not meet production forecasts and will have to buy spot uranium to make up the shortfall. Cameco also announced plans to extend life of Cigar Lake and expand capacity at McArthur River/Key Lake - these are major expansions. Added to Kazatamprom (KAP.IL) shortfalls announced the week before, market got very uncomfortable and almost all uranium stocks pulled back.

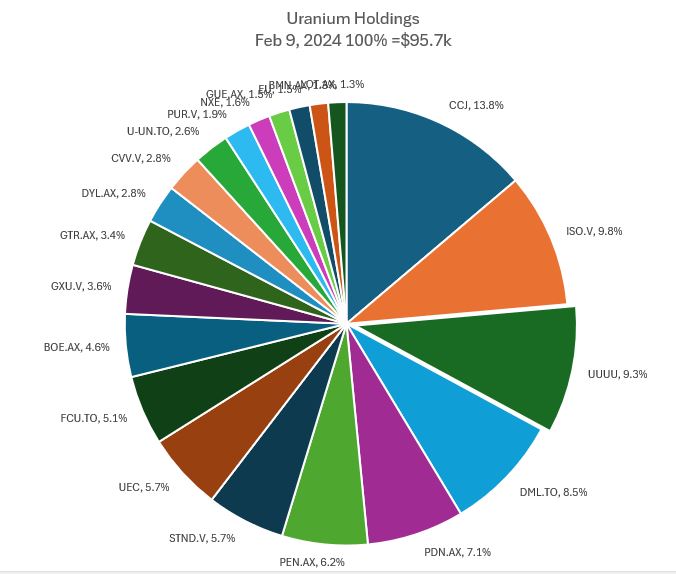

Someone asked in the week how to set out a new uranium portfolio - my thought is to invest 50% in a producer (Cameco); 25% in producers that can reopen production in next 2 years (Paladin (PDN.AX), IsoEnergy (ISO.V), UEC), 15 or 20% for production coming on stream in 3 years after than (Bannerman (BMN.AX) and the rest in wildcat explorers. I might navigate my portfolio toward that rather than hold 23 stocks

Update on holdings across the 4 portfolios - added two new stocks - total portfolio came down just under 4%.

Crypto booms

Bitcoin price pushed higher all week ending 13% higher with a trough to peak range of 14.7% - maybe the market is setting eyes on the upcoming halving - just 60 or so days away

Ethereum chart looks much the same with a 9% rise on the week and a 11.2% trough to peak range

COTI caught a pump and dump with an 80% spike - need two more of those to recover my last entry (time to average down perhaps)

Chainlink (LINK) continued the advance from last week with another 17% rise

Solana (SOL) found buyers after drifting the week before with a rise of 19.6%

Bought

Added small holdings in personal portfolio filling out holdings on ASX listed uranium stocks at the front of the week. Reference chart compares 3 ASX stocks against Cameco - the bars.

Why these two? Potential to deliver uranium in 2025 or 2026.

With the Cameco induced sell off - averaged down both holdings at the end of the week.

Bannerman Energy Ltd (BMN.AX): Uranium. Developing Etango mine in Namibia - fully permitted in December 2023. 3.5 million lbs annual production from late 2026 - potential to double capacity by late 2028.

Lotus Resources Limited (LOT.AX). Uranium. Owns 85% interest in the Kayelekera Uranium Project in Malawi and Letlhakane resource in Botswana. Kayelekera is on care and maintenance with a 15 month recommissioning once the go ahead is agreed (and financing raised). As of Feb 2024, that gives an end 2025 possible date. Capacity was 1 million lbs annually between 2009 and 2014

88 Energy Limited (88E.AX): Oil Exploration. Newsletter from Next Investors highlighting upcoming drill flow test results for oil well being drilled in Alaska. Price has been smashed to all time lows and there is enough captal to drill at least two wells - took an options type punt in personal portfolio. Have been holding this in pension portfolio in its previous lives for some time.

TechGen Metals Ltd (TG1.AX): Base Metals. Averaged down entry price. Something of a wildcat explorer with two main projects - one in lithium in Western Australia and one in gold in New South Wales. Other projects are in copper

Earths Energy was Cradle Resources Ltd (EE1.AX): Alternate Energy. Cradle Resources was developing a niobium deposit in Tanzania. That deposit was transferred to Panda Hill Mining and share distributed (not see mine). Business acquired Volt Geothermal which has two projects running in South Australia and Queensland. Have just completed a capital raising and relisted - added to my holding to earn something back. More like an options trade.

EML Payments Limited (EML.AX): Payments Services. Stock has appeared on the big movers list a few times recently - added to holding to average down entry price. Will exit at breakeven.

Microequities Asset Management Group Limited (MAM.AX): Asset Management. In TIB692, mentioned that Intelligent Investor runs a 3 for 3 contest among its analysts - pick 3 stocks to hold for 3 years. This asset manager was selected by the analyst that won the previous contest - added a small parcel as an options type trade. Dividend yield 4.76%. The business focuses on microcaps in Australia and globally.

Centrica plc (CNA.L): UK Utility. Assigned early on sold put. Dividend yield 2.50%

Evolution Energy Minerals Limited (EV1.AX): Graphite. Added to holding to average down entry price and scale in. Next Investors went to the big mining Indaba conference in South Africa. All the motor compnaies were there sourcing battery materials - graphite was a big topic.

Sold

No sales

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Earnings seasons is ahead - often a time for surprises. Chose to add two holdings ahead of that to run with price momentum - for the rest have chosen to stay away from any stock with earnigns coming up.

Sims Ltd (SGM.AX): Steel. Price has made a higher low and just looks like it could well make a higher high provided there are no surprises in earnings. Dividend yield 2.00%

Chart feels like it could make a leg higher with plenty of scope to make 30% profit

MyState Limited (MYS.AX): Financial Services. Chart shows price reversing off the 2023 lows and making a steady rise into 2024 - plenty of head room to the 2023 highs - and no rate rises expected from the RBA. Dividend yield 6.50%

Metcash Limited (MTS.AX): Food Distribution. Dividend yield 5.70%

Entry averages down entry price. Chart shows price has traded down to a support level several times and tried a few breaks upwards from mid 2023. Price has now made two higher highs following the end of an investor placement. A few notable levels on the chart - latest broker target is right at the 2022 highs (green ray). Share placement was made below the support level - I would have thought they could have found buyers at that level - not at $3.35 (the yellow ray)

Auto Invest

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Dividend yield 1.6%

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Dividend yield 6.6%

Sold

Summerset Group Holdings Limited (SNZ): Aged Healthcare. Sold at profit target around 52 week high for 21% bleneed profit since August/November 2022/January/June/October 2023.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. Sticking with short bias for Pfizer in the event of major vaccine injury claims expected. In pension portfolio, started the process buying a March expiry 26 strike put option - just out-the-money. As this portfolio is short February expiry puts am looking to kick those down the road to convert that trade to a credit spread (currently a diagonal put spread). That did not work that way as sold put was assigned early - am now long Pfizer stock at $29 - the bought put now becomes the stop loss. Wrote covered call at assigned price for 0.65% premium with 5.5% coverage to $27.50 close (Feb 6). Of note is there is no shortage of analyst suppport for Pfizer - starting with 6.24% yield

On an apples-to-apples basis, which excludes the company's COVID-19 treatments, Pfizer's remaining portfolio of dozens of approved therapies grew by 7% in 2023, with double-digit growth from its Specialty Care segment. Pfizer's portfolio, sans COVID-19 treatments, is expected to grow by another 3% to 5% in 2024.

https://finance.yahoo.com/news/3-magnificent-ultra-high-yield-100600679.html

Hedging Trades

Coeur Mining (CDE): Silver Mining. Assigned early on 3.5 strike sold put. Breakeven for the trade is $2.62 - 2.2% in-the-money compared with $2.68 open (Feb 6)

Pan American Silver Corp (PAAS): Silver Mining. Assigned early on 15 strike sold put.

Income Trades

Income trade activity focused on kicking sold puts down the road and only one covered call written (US)

Naked Puts

enCore Energy Corp (EU) Uranium. Return 3.75% Coverage 15.3%

Rolled out a few sold puts to reduce exercise risk this month (same strike)

DHL Group (DPWA.DU): Europe Logisitics 9.6% profit. 34% cash positive.

Société Générale SA (GLE.PA): French Bank 8% profit. 10.7% cash positive.

Fiverr International (FVRR): Internet Services. 11.9% profit. 24.7% cash positive.

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 118% loss 12% cash positive

Invesco Solar ETF (TAN): Solar Power: 43% loss 8.5% cash positive

Rolled out and down (lower strike)

iShares Russell 2000 ETF (IWM): US Small Caps Index. 38.9% profit. 45% cash positive.

CHPT: Electric Vehicles. 26% loss 17% cash positive. Did make a mistake on this trade and covered more than I was holding. Depending a little on how price moves will define the extent of the error - could be a profitable outcome as the error has resulted in an in-the-money bought put.

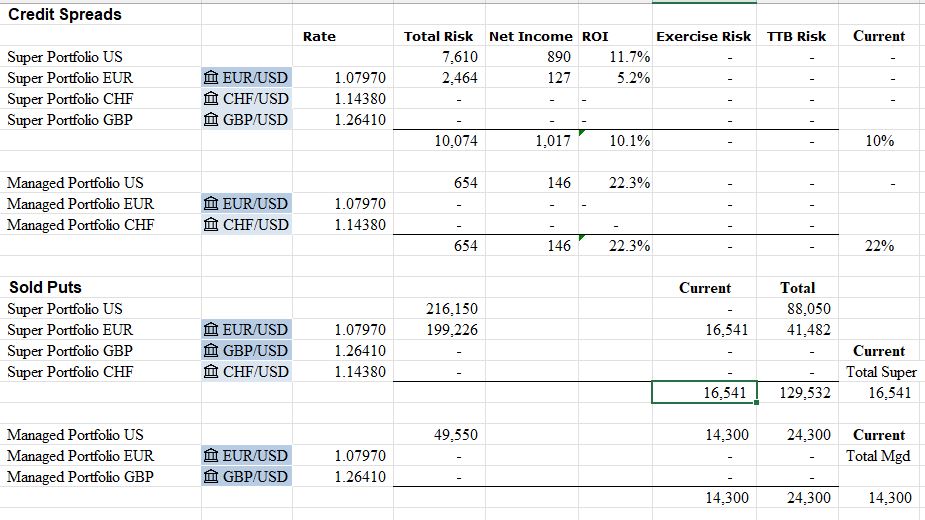

Credit Spreads

Exercise risk on the pension portfolio pulled back well inside the cash margins. Total exercise risk is a bit of a challenge if there are more early exercises on March expiries. There will be a few covered calls assigned this week - and scope to take some capital off the table after call expiry.

Note: spreadsheet goes back to prior week format - exercise risk columns are for holdings that are in-the-money and differentiated by current (this expiry) and total (all cycles). Total risk column was on the sheets anyway (left hand column)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 5-9, 2023

Covering all assets with reasoning in investment always appreciated, have invited @cryptoandcoffee to visit.