A quiet week in a down market adding to uranium holdings and gold mining.

Portfolio News

In a week where S&P 500 dropped 1.46% and Europe dropped 2.53%, my pension portfolio dropped only 0.18%. Heavy lifting done in ASX stocks with De Grey Mining (DEG.AX) up 7%, lithium stocks adding almost as much in value terms and all uranium stocks going up. Japan was positive with only 4 stocks out of 21 down. Canada weighed in with positive moves in cannabis, silver mining and some of the uranium holdings.

Big movers of the week were AXP Energy (AXP.AX) (100%), Aurora Cannabis (ACB.TO) (65.1%), TechGen Metals (TG1.AX) (60.7%), Aeris Resources (AIS.AX) (54.3%), Stroud Resources (SDR.V) (42.9%), Stuhini Exploration (STU.V) (35%), Lanthanein Resources (LNR.AX) (33.3%), Vulcan Energy Resources (VUL.AX) (32.9%), American Rare Earths (ARR.AX) (32.6%), Appen (APX.AX) (30.9%), Earths Energy (EE1.AX) (25%), St Barbara (SBM.AX) (22.9%), Global Oil & Gas (GLV.AX) (19.5%), Latin Resources (LRS.AX) (17.2%), Blue Star Helium (BNL.AX) (14.3%), Bayhorse Silver (BHS.V) (14.3%), Solis Minerals (SLM.AX) (14.3%), Aura Energy (AEE.AX) (13.4%), Direxion Daily Real Estate Bear 3X Shares (DRV) (11.1%), Elixir Energy (EXR.AX) (11.1%), Lithium Universe (LU7.AX) (10.5%), CoreNickelCo (CNCO.CN) (10%), Panther Metals (PNT.AX) (10%), Global Uranium and Enrichment (GUE.AX) (10%)

24 stocks in the big movers list and dominated by energy - oil (3 stocks), lithium (6 stocks), uranium (2 stocks). The themes from previous also showing are silver/gold mining (4 stocks) and cannabis, rare earths and alternate energy (geothermal and helium)

US markets had a torrid week with a higher than expected inflation number, rising oil prices on geopolitical tensions in Middle East and weak guidance from JP Morgan (JPM) overpowering strong results. Somehow in the middle of all of that Nasdaq did make another new high.

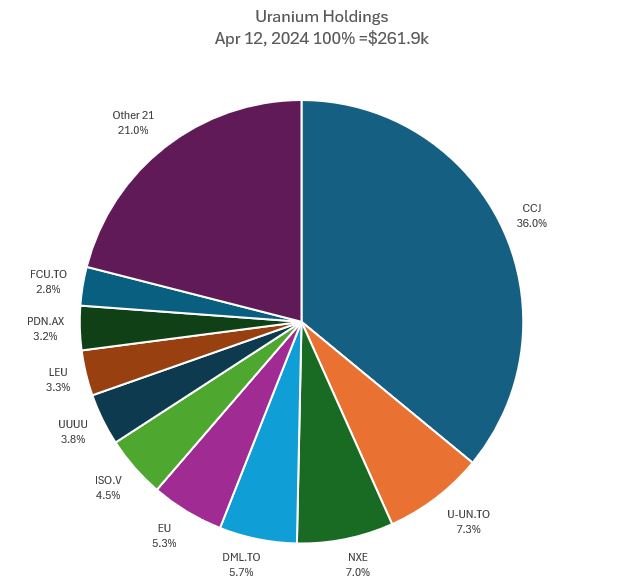

Uranium Holdings

Was a quiet week for my uranium investing but not for uranium investors. Cameco passed the November 2007 high but not quite enough to reach the all time high from Mid 2007 (10% to go). Did add a few new holdings in the Others category

Cannacord published a report pointing to supply challenges especially from the two major producers. Their take is the price of uranium has to rise and any producers that are close to prodeuction will be winners - think Paladin (PDN.AX), Boss Energy (BOE.AX) and Lotus Resoiurces (LOT.AX). As the supply deficit is so large, the two big greenfileds are key - NexGen in Athabasca (NXE) and Global Atomic in Niger (GLO.TO)

Overall holdings went up to 13.8% of holdings - partly from adding a few more holdings but more to do with the dual move of rising uranium valuations and falling portfolio valuation (note: managed portfolio went up in value). Change in places with Global Atomic (GLO.TO) dropping out of the Top 10 and replaced by Fission Uranium (FCU.TO - increase in holding and value

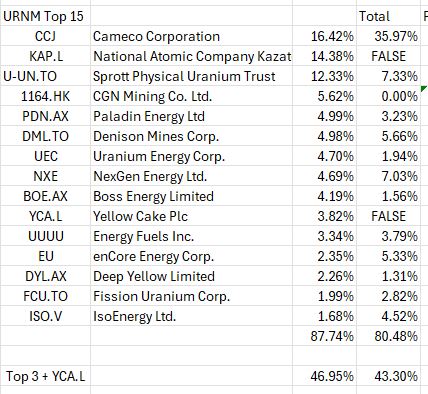

Comparison with Sprott Uranium Miners ETF (URNM) top 15 holdings is the closest match to the portfolios holdings. Have added share of YellowCake PLC (YCA.L) to the Top 3 (4) as it does the same thing as the Physical Uranium Trust run by Sprott. The portfolios are a little under-invested in stocks holding inventory or producing and also under-invested in the Top 15 (87% vs 80%).

Rebalancing will start if Cameco price stays around the $49.59 close (Apr 12) with some covered calls written at lower strikes (46 - 8 out of 10 contracts, 46.5 - 8 out of 8 contracts, 47 - 1 out of 1 contracts, 50 - 2 out of 10 contracts). Plan is to reduce the number of speculative holdings - maybe at 52 week highs and weight the holdings more in line with the Uranium Insiders Focus List.

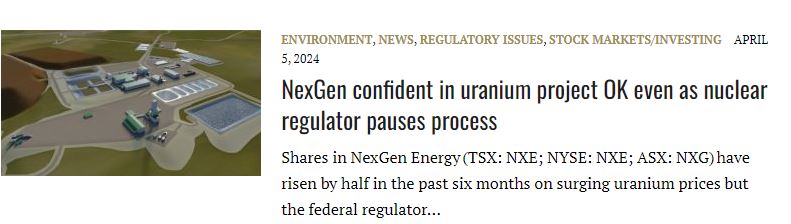

Hiccup of the week came from Canadian Nuclear Regulator - could be a delay for NexGen. NexGen commentary was - not a problem. We shall see.

Quick update on the options trades open. Two of the trades are in-the-money and 2 are in no mans land between the sold put and the bought call

The chart shows the 54/65/50 call spread risk reversal on Sprott Uranium Miners (URNM). Price is above the price trajectory taken from the last run up (the blue arrow) but is stubbornly hovering between the sold put (50) and the bought call (54). Will not be surprised to see price continue in the parallel channel between 48 and 56 till expiry.

Trade on Global X Uranium ETF (URA) is looking healthier with price on the price trajectory that will get it close to teh sold call level (33) and also running tidily above the sold put level (26). Tells me this was a better constructed trade.

Crypto Dumps

Headlines for Bitcoin point to nerves of a Middle east conflict playing into price - it came true this week

Bitcoin price drifted to start and then fell with US markets ending 4.8% lower for the week with a peak to trough range of 15.7%

Ethereum price pushed higher to start and then fell over teh same way ending 8% lower on the week with a peak to trough range of 23% - frightened money week.

Almost all the altcoins got hit. A sample - was looking at potential for reversal in EOS against ETH last week. 20 day EMA had crossed the 50 and was rising. price was making higher lows - then bang - a drop of 25% in 2 days

Maybe from drops like this comes opportunity. On the Fantom chart we see price drop as low as the last entries made - now to get a confirmed reversal - maybe inside bars.

One that went up - VeChain (VET) - and moving averages lined up 20 day above 50 day

Bought

Added quite a few more speculative uranium holdings to the portfolios in anticipation of being assgned on covered calls on Cameco (CCJ). The next step is to map out a trade maangement strategy to define exits and streamlining.

Aura Energy Limited (AEE.AX): Uranium. With news from NexGen pointing to a potential delay in permitting approvals looked at adding to holdings in other ASX listed uranium stocks. Rather than follow the leads from last week, chose to look for laggards. Aura Energy has a near-production resource in Tiris, Mauritania, West Africa (their words). EFS suggests production starting in 2026 and reaching full scale at 2 Mlbs in 2028. Financing is not yet fully finalised with first placement completed in March 2024. They just appointed a new CFO with solid mining experience especially in West Africa.

Chart shows price has dropped with Bollinger Bands widening.

Contrast the chart for Paladin (PDN.AX) with bands widening and price at the top side

Fission Uranium Corp (FCU.TO): Uranium. Scaled into position in managed portfolio in anticipation of being called away on Cameco (CCJ) and on drill program news

https://finance.yahoo.com/news/fission-announces-exploration-drill-programs-070000201.html

Anfield Energy Inc (AEC.V): Uranium. Anfield announces reopening of the Shootaring Canyon Mill in Utah. Added to pension and managed portfolios. Got the order size wrong in one - bought a C$100 parcel - meant to do 10 times that. Fixed next day at a higher price

Lifeist Wellness (LFST.V): Medicinal Marijuana. Stock has appeared on the big movers list a few times in recent weeks - not hard when share price is C$0.005. With holdings under $200 added to get holdings to around $1000 at $0.0075. Last quarter results showed a decline in revenues but a step up in gross margin to 42% - feels like a profit game opening up.

Starr Peak Mining Ltd (STE.V): Gold Mining. Doubled position size to average down entry price on the back of rising gold price.

VanEck Gold Miners ETF (GDX): Gold Mining. With price opening at $34.15 (Apr 8) put in place a May expiry 35/38/32 call sread risk reversal.

Bought a 35/38 bull call spread for a net premium of $0.78 offering maximum profit potential of 285% if price moves 11.3% from $34.15 opening price. Funded the net premium partly by selling a 32 strike put option - this lifts the maximum profit potential to 1900% with 6.3% price coverage.

Let's look at the chart which shows the bought call (35) as blue ray and the sold call (38) as a red ray and the sold put (32) as a dotted red ray with the expiry date the dotted green line on the right margin. If price follows the left hand price scenario to conclusion the trade will expire in-the-money but not at maximum profit - an extra month or two to expiry would be better. The sold put is just below the top of the last mini high which will form a support level.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Rolls-Royce Holdings plc (RR.L): Aerospace. Got a bit behind on adding back holdings after the last assignment.

Read a news item that the Australian Opposition leader, Peter Dutton was holding conversations with Rolls Royce about SMR nuclear reactors was the trigger to add back. Bought a parcel of stock and wrote a naked put offering 2% return with 7.3% price coverage. Wrote May expiry covered call for 1.1% premium with 11.9% price coverage.

Cronos Group Inc (CRON): Marijuana. Bought back stock likely to be assgined in personal portfolio - keen to stay in for the long haul

Elevate Uranium Ltd (EL8.AX): Uranium. Elevate announced increase in inferred resrouce for their Koppies tenements in Namibia. The value lies in the relatively low depths and access to 3rd party processing facilities.

South 32 (S32.AX): Base Metals. Last time the stock screens suggested South32 for the ASX portfolio (below), I added it the personal portfolio - same again this time.

Sold

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Assigned early on covered calls (two strikes). Have a very high average cost on the holdings but had set these trades up after buying in low after the recent split. Makes for a 21.4% blended proit since February/March 2024 and 19.4% profit since March 2024. Holdings go back to 2021. My accountant will be told to apply the massive loss for tax purposes. Covered call premium added another 33% to profits.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

South 32 (S32.AX): Base Metals. Dividend yield 2.50%. Have previously held South32 in this portfolio.

Chart shows price breaking the mini-downtrend with plenty of headroom to hit a 35% profit target

Scale Ins

A few stocks showing signs of life or on a hot trend - rising gold and oil prices

St Barbara Ltd (SBM.AX): Gold Mining. Dividend yield 4.35%

Santos Ltd (STO.AX): Oil/Gas. Dividend yield 4.80%

Whitehaven Coal Ltd (WHC.AX): Coal Mining. Dividend yield 6.20%. Bought as scale in but it popped up on the top up screens the following day.

Chart shows price cycling in an upward sloping parallel channel - this entry is somewhere in the middle of the channel and could well make a higher high for 2024

Top Ups

Qantas Airways Limited (QAN.AX): Airline.

Been stayng away from investing in Qantas. Now they have a new CEO, maybe time to get back in the air. Price popped on a revamp of their rewards program - it is a big driver of flight demand. Chart shows price now have a second attempt of holding the break in the downtrend

Insignia Financial Ltd (IFL.AX): Financial Services. Dividend yield 7.50%

Chart shows price making a 3rd one month high in the last 4 months - a good way to average down the high entry from November 2023. My wife met with some of her former colleagues there - business is actively working new projects and also trimming contractor costs by limiting contract terms

Iluka Resources Limited (ILU.AX): Mineral Sands. Dividend yield 1.00%

2nd one monht high - looks more like a scale in trade than a top up - price building up from a solid support level

Fixer Uppers

Went through the laggards in the portfolio with a view to averaging down on stocks that had charts showing signs of life.

Appen Ltd (APX.AX): IT Services. The challenge for Appen lies in the way AI machines are taking over the work they used to do. They had a million gig workers reading and summarising material online - the machines now do that. My plan - find an exit at intrinsic value of discounted cash flows (will be at a loss). Looks like this was a mistake.

Sold

Macmahon Holdings Ltd (MAH.AX): Mining Services. Sold at 52 week high for 48.9% blended profit since February/July/August 2023.

Chart shows the challenges of the strategy - first entry was close to a cycle high. The next two using the same signals were in the middle of the leg up. Approach is to put in a sell order when price is within 2% of a 52 week high and to not make any more buys. In this case this knocked out two more buying opportunities - maybe time to revisit the approach and make it a bit more of an investing process rather than a trading process - i.e., keep buying when there are buy signals

Universal Store Holdings Ltd (UNI.AX): Retail. Closed around 52 week high for 35.9% blended profit since January/February 2024.

When I wrote up the first purchase drew a chart with two Fibonacci retracements and doubted that price would reach the 0.5 retracement. Well it did more than that and raced past all the key levels. This is one that will go past the previous highs.

Cryptocurrency

No trades

Income Trades

Only 3 covered calls written across 3 portfolios (UK 1 US 2)

Naked Puts

A few naked puts written at strikes at or below levels covered calls could be assigned

Cameco Corporation (CCJ): Uranium. Return 1.04% Coverage 7.1%

Glencore plc (GLEN.L): Base Metals. Return 0.5% Coverage 3.5%

A few written at low strikes at which I would be comfortable buying stock.

Marathon Oil Corporation (MRO): US Oil. Return 1.19% Coverage 10.2%

NexGen Energy (NXE): Uranium. Return 2.71% Coverage 15.1%

Dollar Tree (DLTR): US Retail. Return 0.22% Coverage 6.7%

Barclays PLC (BARC.L): UK Bank. Return 0.29% Coverage 10%

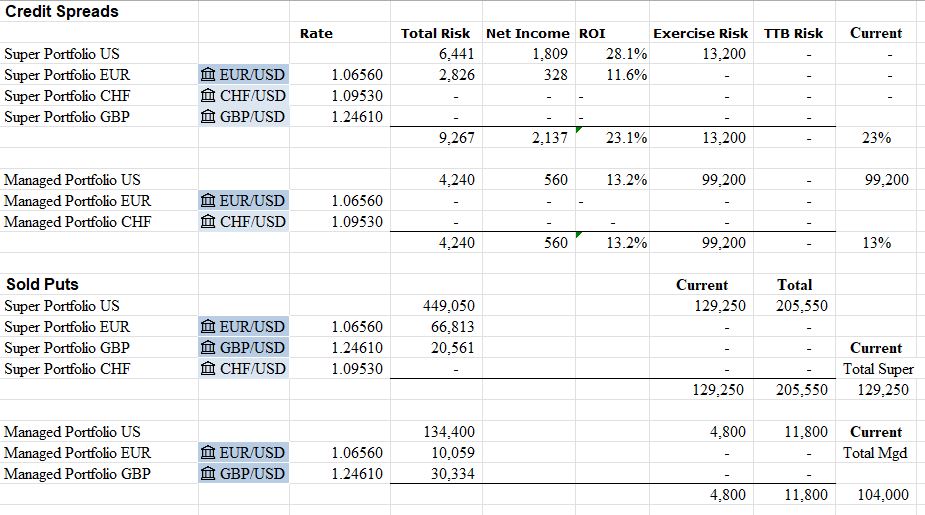

Credit Spreads

Morgan Stanley (MS): US Bank. ROI 10.8% Coverage 5.9%. Timing was a problem with JP Morgan (JPM) results smashing all bank stocks.

Big sell off on Friday (Apr 12) jumped the current exercise risk dramatically and in the pension portfolio will test cash margin available - will be kicking the can down the road in Monday trade. Credit spreads in US are pressuring margin in the managed portfolio - US banks responded badly to JP Morgan guidance at some cost.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 8-12, 2024