Week after options expiry sees some topping up for portfolios with margin space. Continued building uranium holdings.

Portfolio News

In a week where S&P 500 rose 2.65% and Europe rose 2.64%, my pension portfolio rose only 1.2%. Drags were Australia and Canadian uranium and silver mining and low exposure to Europe. Doing the lifting was Japan and a few stocks in US not in the big movers list, like Fiverr (FVRR) up 6% and AMD up 7%.

Big movers of the week were Lanthanein Resources (LNR.AX) (66.7%), Lithium Universe (LU7.AX) (43.5%), American Rare Earths (ARR.AX) (25.5%), NuScale Power Corporation (SMR) (24.9%), Earths Energy (EE1.AX) (23.1%), CoreNickelCo (CNCO.CN) (18.2%), Stem, Inc. (STEM) (18.1%), Coeur Mining (CDE) (17.9%), Delivra Health Brands (DHB.V) (16.7%), Maruka Furusato Corporation (7128.T) (15.6%), Seven West Media (SWM.AX) (15.4%), Blue Star Helium (BNL.AX) (14.3%), Marvell Technology (MRVL) (12.1%), JinkoSolar Holding (JKS) (12%), Beamtree Holdings (BMT.AX) (11.8%), Elixir Energy (EXR.AX) (11.5%), Canopy Growth Corporation (WEED.TO) (11.4%), ENCE Energía y Celulosa (ENC.MC) (10.8%), AdAlta (1AD.AX) (10.7%), GoGold Resources (GGD.TO) (10.4%), Loop Industries (LOOP) (10.1%), Aeris Resources (AIS.AX) (10%)

22 stocks in the big movers this week - quite a step up from the week before. Theme that stands out is alternate energy (lithium (2), nuclear power, geothermal energy, battery technology, helium, solar, recycling (2)). 2 gold miners and 2 cannabis stocks and 2 ASX listed biotech related stocks also make the list. Things are moving.

Turned into a topsy turvy week with the GDP and inflation numbers creating the stagflation fear selloff.

That was not enough to over-power the solid earnings from Alphabet (GOOG) and Microsoft (MSFT). Headlines from the last 3 days of the week tells the tale.

Yen Tumbles

Something that has slipped under the radar screen is the drop in the value of the Japanese Yen - down 11% so far this year.

Not often does one see a headline in the Japan Times like this - cleary they are getting worried. What is the driver? It is the differential in intereest rates between Japan and US. Talk that the Federal Reserve may not cut rates for a few months longer is stoking the fear.

https://www.japantimes.co.jp/business/2024/04/28/markets/yen-drops-past-158

My portfolios contain quite a few Japanese stocks going back to 2016. At the time, I chose to hedge the Yen risk by buying futures - eventually those rolled into a long USDJPY position.

That position is now 54% in profit - a whole more profit than the underlying positions have made (only 3.65% in profit).

Uranium Holdings

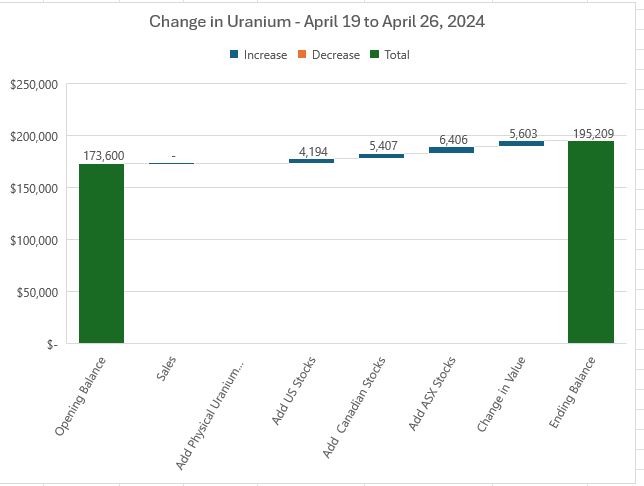

Rather than comment on the movements in uranium will focus on the state of the holdings across the portfolios. Like last week will start with the sources of change in portfolio values

Have now created a standard approach for reporting the sources of change. Overall portfolio value committed to uranium went up 12.4% and is now 9.35% of portfolio value. Target is 10%. Changes came from new investments across US, Canada and ASX listed stocks and from an increase in value (note: some of the value change could include currency changes)

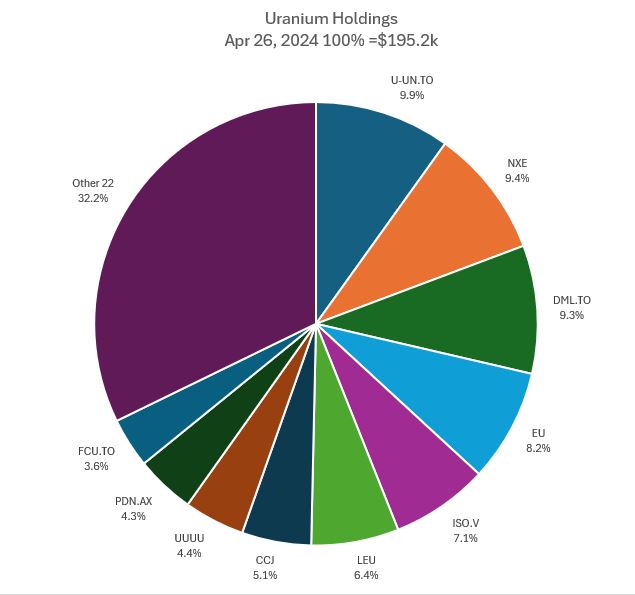

Mix of holdings shows just a few differences - the share of Sprott Physical Uranium (U-UN.TO) drops below 10% (it is the target). A few percentages went up with value increases (like Denison (DML.TO) and added investments (like IsoEnergy (ISO.V)). Centrus Energy (LEU) went up three positions. Two of the portfolios are still under-invested with the personal portfolio a bit too much invested. In the coming week, will hold the line for a while and see where the market wants to run. Cameco (CCJ) reports earnings this week.

Quick update on the status of the options trades - the worst performing is on Sprott Uranium Miners (URNM) with price sitting between the sold put and bought call levels. The shape of the charts looks sound enough and there is enough time to expiry. The call spread expires January 2026.

Crypto Drifts

Bitcoin price pushed higher a few days after halving and then fell over ending 3% lower on the week with a peak to trough range of 7%

Ethereum price went much the same way - higher and then dropping but recovered in the back end of the week to end 2.2% higher with a trough to peak range of 9.5%

A few altcoins followed the price momentum from the week after the Bitcoin selloff. Helium (HNTBTC) popped 75% and gave away only one third

Algorand (ALGOBTC) spiked 37% with price racing through the 50 day moving avarage but then gave two third away

Theta token (TFUELBTC) chart is a bit different as it is already in an uptrend - made a new high with a 43% surge and gave away one third only. The size of these pops is why I use a 50% profit target. Get a pop, bank he profit and buy back on the reversal.

Bought

With pension portfolio under cash constraints added a few additional holdings to managed and personal portfolios.

Silex Systems (SLX.AX): Uranium Enrichment. Open new position in managed portfolio - Uranium Insiders idea.

Lotus Resources Limited (LOT.AX): Uranium. Open new position in managed portfolio - Uranium Insiders idea. They are in the process of reopening Kyalakera mine in Malawi.

Added banks back to managed portfolio

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Replaced stock assigned in Febrary at 4.5% premium to assigned price - need to hold some European banks. Wrote covered call for 1.38% premium with 5.2% price coverage.

Chose these two banks as they are lagging other European banks that have been in the portfolios. Chart compares Amundi Europe Banks ETF (CB5.PA). ABN is 40 percentage points behind

Société Générale SA (GLE.PA): French Bank. SocGen is 16 percentage points behind.

Of note: Have no European Banks in pension portfolio. Might add some ABN Amro this week.

Glencore plc (GLEN.L): Base Metals. Landed up with an odd lot on assignment - rounded up at 4.5% premium to assigned price. Wrote covered call for 0.83% premium with 2.6% price coverage - a bit tight.

Rolls-Royce Holdings plc (RR.L): Aerospace. Scaling in for personal and managed portfolios. Investment idea is to leverages position in nuclear SMR's

Centrus Energy Corp (LEU): Uranium Enrichment. Added to personal portfolio. Next day with price opening at $41.62, added a July expiry 45/55/35 call spread risk reversal. With net premium of $1.61, the call spread offers maximum profit potential of 211% for a 20% move in price. The sold put fully funds the net premium and is at 15.9% price coverage. Breakeven should the sold put go to assignment is $34.71.

Did not set this trade up freshly but just bought more of an existing holding. Update of the chart shows price is working around where the purple price scenario arrow was placed the first time around. Price is happily staying above the sold put level (35) and there is enough time for the trade to run to the maximum.

Marathon Oil Corporation (MRO): US Oil. Added to personal and managed portfolios. Wrote covered call for 1.4% premium with 5.5% price coverage.

Price has pulled back to 50 day moving average (red line) and reversed. Fully expecting a pop in oil prices any time the Middle East winds up again. Price is 15% below the recent broker target which is above the recent highs.

POSCO Holdings Inc (PKX): Korean Steel. Opened a new holding in personal portfolio. Price showing some sign of life after US proposed tariffs on Chinese steel. Investment thesis for Posco is a long term view on their battery technology ambitions. Their Argentine lithium hydroxide plant is due to start production during 2024.

Sigma Lithium Corporation (SGML): Lithium. Added to holding in personal portolio to scale in

Chart shows price finding a bottom and compressing into a triangle - when these break, they break hard. Wall Street target is below the previous highs and would offer 100% profit. Sigma are already shipping lithium concentrate from Brazil.

IsoEnergy Ltd (ISO.V): Uranium. Ran the price comparison analysis for UI core list against Sprott Uranium Miners ETF (URNM) - the bars.

Picked the two laggards going back to the recent cycle low. Added to all portfolios other than small managed portfolio. Averages down entry prices. IsoEnergy has potential to reopen operations in US and is in advanced epxloration in Athabasca Basin.

enCore Energy Corp (EU): Uranium. Added to pension portfolio based on the laggard analysis above - more of a scaling in entry as price is not the lowest paid. enCore are ramping up the reopening of ISR operations in South Texas.

RTL Group S.A. (RRTL.DE): Broadcasting. Took the opportunity to average down entry with price breaking up above the support level. Was not paying attention to the upcoming dividend payments which smacked price down below the support by the amont of the dividend.

Chart shows the reversal off the short term trend line - the green number is Friday close (Apr 26) . Good news is did get the dividend.

Vallourec S.A. (VK.PA): Europe Steel. Replaced stock assigned in March 2024 in managed portfolio based on pullback toward 50 day moving average (red line).

Previous investment was breakeven but covered call and sold put income was solid. Time to run stock screens in Europe again rather than going on instinct off the charts Wrote covered call for 1.3% premium with 7.1% price coverage.

Centrica plc (CNA.L): UK Utility. Dividend yield 3.04%. Ex date May 30. Added back to managed portfolio

Qualcomm (QCOM): US Semiconductors. Prices recovered in early trade after the big Friday selloff - added a parcel to managed portfolio - also on instinct about the shape of the chart - but also to add some more tech exposure to the portfolios. Wrote covered call for 1.1% premium with 10.3% price coverage.

Airtel Africa Plc (AAF.L): Telecom. Ran stock screens across Europe markets. Added a small parcel to average down entry price in one portfolio - looking to exit at breakeven. Dividend yield 4.08%

Denison Mines Corp (DNN): Uranium. With sale of Qualcomm below a little less margin presssure allowed a topping up of uranium holdings in pension portfolio. UI idea.

The Trade Desk (TTD): Digital Advertising Software. TheStreePro idea - they added to their holdings on the back of the Meta Platform (META) results - chose to get a low ball bid in before Alphabet (GOOGL) results - that bid was taken up and a nice pop during the day and after results came out. Wrote covered call for 1.9% premium with 25% price coverage. That feels like free money

Decided late in the week to add more ASX listed uranium stocks to pension portfolio - keeps stuff in Australian Dollars. Doing this in small lots - $A1,000 at a time or scaling up to $2,000.

Alligator Energy Limited (AGE.AX): Uranium. New position. Explorer in Northern Territory, Australia

Boss Energy (BOE.AX): Uranium. Developer turning producer in South Australia. Nameplate production of 2.6 mlbs scheduled for 2026.

Elevate Uranium Ltd (EL8.AX): Uranium. New position. Explorer in Namibia - high grades at low depths.

None of these positions are on the Uranium Insider (UI) lists but they slot in the 10% speculative plays.

F3 Uranium Corp (FUU.V): Uranium. Explorer in Athabasca Basin - on UI list - they were buying at $0.40 - nibbled in at $0.38 after seeing tweet from JR Wollansky saying it was a no-brainer level

Anfield Energy Inc (AEC.V): Uranium. Two weeks ago Anfield announced the reopening plans for the Utah Shootaring Canyon mill. Bought a parcel then - then averaged down a week later - did the same again this week. Saw a tweet after the 3 big red bars asking if we could get a break (Apr 24).

A low test bar, followed by an inside bar and then train tracks off support suggested the support might hold. As my position sizes have been nibbles no problem averaging in above support. Production is slated to start in 2026

Reviewed all TheStreetPro portfolios - my portfolios are now strongly out of line. Time to add some back.

Amazon.com (AMZN): US Retail. A small nibble first as prices have moved ahead hard.

Marvell Technology Group (MRVL): US Semiconductors. Wrote covered call for 1.3% premium with 8.5% price coverage.

Chart shows price has been travelling sideways for most of 2024 with one surge above and below the channel. Sideways moves like this are ideal for writing covered calls and there is 25% upside to the last highs - there is earnings risk ahead (the E in the box below)

Global Atomic Corporation (GLO.TO): Uranium. Niger has been in the news - they have requested the US to withdraw its military (some 2,000 men). Global have yet to finalise their Dasa mine funding and are in detailed discusisons with a consortium of Western banks. There is talk of growing Russian presence - those two factors could scare off those banks. The government also issued a warning to Goviex Uranium (GXU.V) that they have to commence mining by July 2024 or lose their permits. All of this has pressured Niger uranium prices. I had written about staying away from Niger because of the sovereign risk. Well the price action was such that adding a small parcel to average down in the personal portfolio felt like a no brainer. A 5.1% pop in price on the purchase felt good. AND markets need to large Dasa volumes when they begin.

Sold

Qualcomm (QCOM): US Semiconductors. Sold the parcel assigned on naked put in pension portfolio - releases cash and books a 3.1% profit plus the % sold put premium.

ASX Portfolio

No trades in the week

Hedging Trades

Coeur Mining, Inc (CDE): Silver Mining. Pull back in prices in the last week sell off gives an opportunity to jump back in. The surge in silver prices makes this more of a pure investment idea than the normal hedging trade. Wrote covered call for 4.8% premium with 19.3% price coverage. Income from hedging - I like the idea.

Barrick Gold Corporation (GOLD): Gold Mining. Replaced stock assigned at 2.75% premium to assigned price - 2 months of covered calls will recover that. Wrote covered call for 1.03% premium with 9.5% price coverage.

iShares Silver Trust (SLV): Silver. Silver prices raced ahead and pulled back. Replaced stock assigned in March at 10% premium to assigned price - will be many months of covered calls to win that back or another surge in price.

Cryptocurrency

Followed the bounce from the big selloff and the upward momentum on the Bitcoin halving to add a few positions

Fantom (FTMBTC) Looking for the reversal gets an entry below the last partial exit but above the previous entries. Moving averages are crossing over in the wrong way (20 - blue line dropped below 50 - red line) - maybe a bit early into the trade. But 63% head room feels encouraging.

Fantom offers a high-performance smart contract platform

Holo (HOTETH) Price tested right down to support (the yellow line) and reversed with a few days buying. New entry is about the same level as prior entries which both hit targets in big spikes - 68% head room feels good

Holo (HOT) is the native digital asset on a distributed ledger called Holochain, which is a distributed application network that allows for payments to be sent around the world with practically no entry barriers for its users. Holo rewards people who support the network infrastructure with HOT tokens.

Uniswap (UNIBTC): Chart looks much the same - big sell over four days followed by a few smaller buyer days. Entry is well below the last entry and there is heaps of head room.

Uniswap is a leading decentralized crypto trading protocol with a growing netwrok of DeFi Apps.

Have put 50% targets on all 3 trades - waiting for a pump. Do have residual holdings to grab any o fthe moves above 50%.

Income Trades

58 covered calls written across 3 portfolios (UK 3 Europe 11 US 42 Canada 2) getting back to more normal writing levels as markets improve. Am still writing to cover verage cost rather than taking permium for stocks down more than 10% and using that to stop losses.

Naked Puts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Yields are pushing higher which is making the sold put at 97 strike look quite uncomfortable. Converted the sold put into a 97/87 credit spread by buying an 87 strike put option - protects the downside. Funded that premium by seling a 86 strike put below that using a ratio (6 to 4). This move restricts the loss on potential exercise but it leaves open the opportunity to buy back in lower.

Now this headline is the bother - if the economy is growing more slowly than expected and inflation is rising, yields will stay higher and the Federal Reserve will not cut rates - being long Treasuries will be an uncomfortable space.

Looking at the chart which shows the new trades as red rays with the pre-exisitng sold put in above. That trade has been rolled a few times and was started in December 2023 where yields were falling - expectation is they would continue (hence being happy to buy at $97). My instinct is the doomsayers are wrong and price could reverse at the bottom of the blue arrow.

Trade management will be key as the structure is now a little complicated. Kick the can down the road on the 97 strike sold put and then manage the 87/86 as the credit spread.

Elevance Health (ELV): US Healthcare. With price opening at $534.96 and trading higher closed out 500 strike sold put locking in 94.3% profit in 10 days. Normally I would let this run to expiry but was keen to reduce margin pressure in the pension portfolio. The income trades have recovered 3 times the loss made on the stock since first buying in January 2023. With the high $500 ticker price, sold puts is a good way to make profits. TheStreetPro still hold the stock.

Was a busy week writing naked puts in the managed portfolio which has a large cash margin after last week's assignments.

- Advanced Micro Devices (AMD) US Semiconductors. Return 0.86%. Price coverage 21.3%

- CVS Health Corporation (CVS): US Healthcare. Return 1.20%. Price coverage 12.3%

- Invesco Ltd. (IVZ): US Asset Management. Return 1.43%. Price coverage 4.6%

- Morgan Stanley (MS): US Bank. Return 0.49%. Price coverage 6.4%

- Coty Inc. (COTY): US Consumer Products. Return 2.45%. Price coverage 5.1%

- JinkoSolar Holding Co (JKS): Solar Power. Return 2.65%. Price coverage 15.3%

- Wynn Resorts (WYNN): Hotels/Gaming. Return 0.94%. Price coverage 9.4%

- Bank of America (BAC): US Bank. Return 1.08%. Price coverage 2.5%

- Universal Display Corporation (OLED): US Technology. Return 3.08%. Price coverage 4.5%

- Amazon.com (AMZN): US Retail. Return 1.32%. Price coverage 11.1%

- Cameco Corporation (CCJ): Uranium. Return 2.89%. Price coverage 7.3%

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 1.43%. Price coverage 16.7%

- iShares Silver Trust (SLV): Silver. Return 0.92%. Price coverage 5%

- UBS Group AG (UBSG.SW): Swiss Bank. Return 2.60% Price coverage 2.4%

Naked puts on stocks likely to go to assignment on covered calls

Safe Bulkers (SB): Shipping. Return 4% Coverage - same strike on half the holding

Credit Spreads

- NVIDIA Corporation (NVDA: US Semiconductors. ROI 28% Coverage 8.5%

- Morgan Stanley (MS): US Bank. 10.1% Coverage and ROI 14.3% Coverage - tighter spread

Exercise risk on spreads is within cash limits but some work needed to kick the can down the road in the pension portfolio - that $52k and $60k number is a bit tight.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 22-26, 2024

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: