A mixed week of clearing the decks of under-performers to release margin and adding more uranium and topping up Europe Banks.

Portfolio News

In a week where S&P 500 rose 0.6% and Europe rose 0.6%, my pension portfolio rose more than double at 1.33%. No suprise when you read the big movers list below to see the heavy lifiting coming from uranium, lithium and solar power. The surprises came from ChargePoint (CHPT) and Pfizer (PFE). CharegPoint move is on the back of Tesla (TSLA) announcing big cuts in is charging network staffing (opens up the door for other suppliers). Pfizer move is earnings based - good chance the covered calls will be assigned early as holders grab the upcoming dividend. Current pricing is economic to buy back and collect the dividend.

Big movers of the week were Genmin (GEN.AX) (36.8%), 88 Energy (88E.AX) (33.3%), ChargePoint Holdings (CHPT) (30.7%), Global Uranium and Enrichment (GUE.AX) (27.8%), Silex Systems (SLX.AX) (24.6%), Bannerman Energy (BMN.AX) (22.8%), Boss Energy (BOE.AX) (21.2%), Arcadium Lithium (ALTM) (20.6%), Azincourt Energy Corp. (AAZ.V) (20%), GTI Energy (GTR.AX) (20%), Deep Yellow (DYL.AX) (18.5%), Tilray Brands (TLRY) (18%), Paladin Energy (PDN.AX) (17.8%), SunPower Corporation (SPWR) (17.6%), Lotus Resources (LOT.AX) (16.5%), Sunrun (RUN) (15.6%), Alligator Energy (AGE.AX) (14.8%), Canopy Growth Corporation (WEED.TO) (14.7%), Bayhorse Silver (BHS.V) (14.3%), Delivra Health Brands (DHB.V) (14.3%), Elevate Uranium (EL8.AX) (12%), Latin Resources (LRS.AX) (11.9%), Sigma Lithium Corporation (SGML) (11.5%), Pilbara Minerals (PLS.AX) (10%)

24 stocks in the big movers list dominated by long term themes - uranium (11 stocks), lithium (4 stocks), solar power (2 stocks), cannabis (3 stocks). The surprise is the stock on the top of the list - developing iron ore mine in West Africa. Market clearly liked the quarterly activities progress (and relisting).

Markets flip flopped between fear of the Federal Reserve words and earnings wins and losses and a looming jobs report. The week's scorecard all lined up - earnings better than expected, the jobs number worse than expected and Jerome Powell in market calming mood.

Uranium Holdings

The key news item for my portfolios was US Senate approving the ban on Russian uranium.

This has been talked about for a while and it seems the market did not have it fully priced in. This is the concept

provide assurance to industry, allies, and partners that the U.S. has made a clear decision to establish a secure fuel supply chain, independent of adversarial influence, for decades to come

Commentary was a little mixed as can be seen in these headlines. My read is what the ban does it accelerates the need to develop uranium capacity outside of Russia and Kazakhstan for supply to the West. This should also flow through to higher uranium prices especially in the medium term - and sooner if Russia imposes its own ban. The swing factor is the export waivers that are in place.

In my portfolios it is clear that markets had not priced in the possibility of a uranium ban fully especially outside US and Canadian listed uranium stocks - of the 11 uranium stocks in the big movers list, 10 are listed on ASX and only one in Canada.

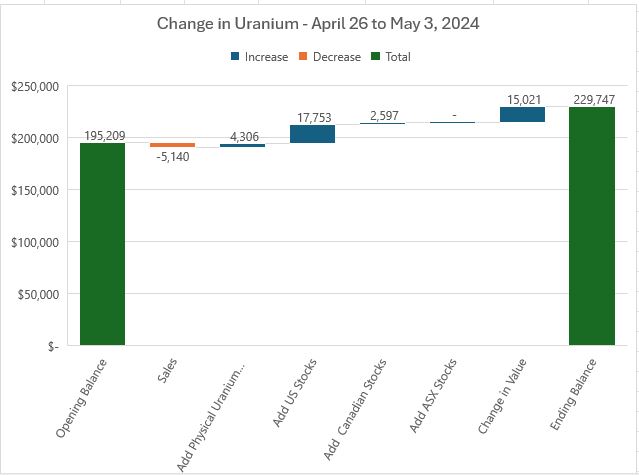

Start with a chart of the sources of change in uranium holdings - one sale (Peninsula Energy (PEN)) and purchases in physical uranium and ASX and Canadian listings. The key part is the value change of 7.7% in core holdings (does not account for changes in options values - might tackle that next week)

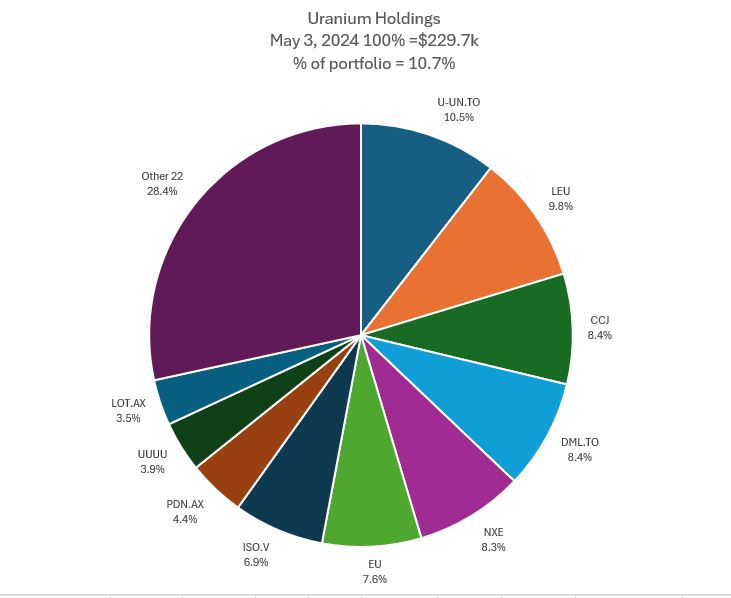

The mix of holdings moved around as a result of purchases and also some big value moves especially in ASX listed stocks. Sprott Physicall Trust (U-UN.TO) is back over the 10% target. Centrus Energy (LEU) moves up 4 places. Cameco (CCJ) moves up 4 places too. NexGen (NXE) drops 3 places. Fission Uranium (FCU.TO) drops out the top 10 and is replaced by Lotus Resources (LOT.AX). The Others percentage drops under 30% - more planned.

Did promise the Twitter community an update on the options trades - starting with Sprott Junior Uranium Miners (URNJ).

Price is having a 3rd go at passing the sold call level with a month still to go to expiry. Becomes a trade management question - bank the profits on the call spread and let the sold put run to expiry and set up another call spread. There is a previous high to run for at $30 - maybe put in another trade - or just exercise and close out the sold call and hold the stock. Read next week t find out the moves.

The Global X Uranium ETF (URA) trade has not quite reached the sold call level - what I do know that when price breaks above the current range it will jump.

One more is a trade on one of the individual miners set up when first starting the options trades - Uranium Energy Corp (UEC) price has stayed in a parallel channel since the trade was set up and has dropped below the sold put level (7) a few times. The price scenario arrows are borrowed from the time before this chart - have cloned this across to where price is now. This suggests that the trade will not reach the maximum. The step back view also suggests the sold put (7) was too tight - 6 would have been better with a narrower spread on the call spread

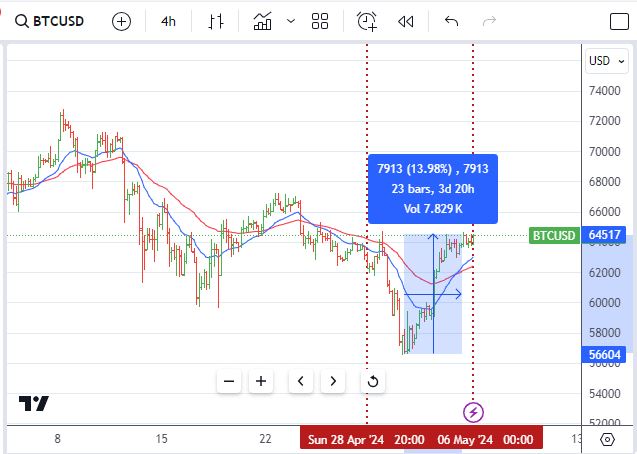

Crypto Bumbles

Bitcoin price dropped lower for the front half of the week and then bounced back to end 3.5% higher with a trough to peak range of 14%.

Ethereum chart looks similar - did try to push higher, but the drop and bounce and ending the week 1% lower with a peak to trough range of 15.3%.

Most of the altcoins did the same thing - dropped and then bounced - a few exceptions - Cosmos (ATOMBTC) popped 27% from the lows giving away only half

Polkadot (DOTYBTC) has the same shape but at half the scale up 15%

The Graph (GRTETH) found buyers all week and moved up 16% - the 20 day moving average (blue line) has curved upwards and my well pass through the 50 (red line)

Did join the Trading View Paper Trading compeition - this chart shows the entry on NEARBTC. Price has tested the previous consolidaiton zone and starting 2nd cycle higher with 20 day above 50 day.

Biggest move in my portfolios was Arweave (ARBTC) rising 40% on the week and still going. Those moving averages are stacked teh right way too.

Bought

Centrus Energy Corp (LEU): Uranium Enrichment. Scaled in holding in pension portfolio. Wrote covered call for 1.4% premium with 18% price coverage. Wrote covered call for 1.24% premium with 19.3% price coverage - feels like easy money on stock owned

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Averaged down holding in managed portfolio to drive covered call income. Price has popped - now time to claw back

Cronos Group Inc (CRON): Marijuana. Averaged down holding in managed portfolio

F3 Uranium Corp (FUU.V): Uranium. Added to managed portfolio to get size up to UI target (5%)

GoviEx Uranium Inc (GXU.V): Uranium. Used down day to reduce average price - parcel size was small as got the 10 and 100s mixed up. Time to stay away was the implicit message. This is a speculative dabble at small bucks depending on Niger Government to see the dollars

iShares Global Clean Energy ETF (ICLN): Alternate Energy. With solar power moving, averaged down entry price. Wrote covered call for 1.5% premium with 4.2% price coverage

GE Vernova Inc (GEV): Alternate Energy. GE Vernova is spin-off of General Electric's energy investments. Rather than buy stock, took a punt in the options market setting up a December 2024 expiry 155/170/135 call spread risk reversal. With a net premium of $7, this offers maximum profit potential of 114% for a 10.7% move from $153.58 opening price (Apr 29). The call spread was fully funded (by 30%) selling the 135 strike put option which has 12.1% price coverage.

No chart as there is no price history. This is a free trade and if there is an entry at $135, doing better than the IPO people.

They are investing approximately $1 billion annually in research and development to commercialize breakthrough technologies such as energy storage, hydrogen, carbon capture, small modular nuclear reactors, advanced wind turbines, and electrification software. My interest lies in this segment - A world-leading provider of advanced reactors, fuel, and nuclear services. GE Hitachi Nuclear Energy provides the technical solutions required to effectively enhance reactor performance, power, and safety. Detail digging shows nuclear is a tiny 5.7% of revenues and revenues are dominated by gas power - the good news is the tarde was cash positive and the downside is likely samll if the sold put goes to assignement.

IsoEnergy Ltd: Uranium. Nibbling away to get holding up to target 10% holding. UI idea - this is oversold based on nerves about Athabasca Basin - the short term value is in Utah

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Added a holding to personal portfolio to replace the holding assigned in Cameco (CCJ) and to realign with Uranium Insiders list. This portfolio is over-invested in uranium with a heap of speculative holdings - will trim these down with some profit target setting

Sprott Uranium Miners ETF (URNM): Uranium. Last week, of the existing options trades on Uranium, this ETF was the worst - decided to add a new trade. Rather than just copy an existing trade set up a new one with a shorter time to expiry for the call spread and a diagonal for the sold put. Set up a January 2025 expiry 54/60 bull call spread. With a net premium of $2.10 this offers 186% maximum profit potential for a 15.8% move in price from $51.82 open (Apr 29). Funded this net premium fully (by 26%) by selling an October expiry 45 strike put option.

Let's look at the chart which shows the bought call (54), as a light blue ray and the sold call (65) as a yellow ray and the sold put (45) as a dotted red ray with the expiry date the dotted green lines on the right margins. The other rays are from the other trade in the managed portfolio. The blue arrow comes from the previous run from the lows of April 2020 which seems to be a good enough pattern for this run. If price keeps moving like that, this trade might not go fuly in the money by January 2025 by a month or so. That suggests to me the sold call level is about right. What is better is the sold put (45) is below recent price action. Using a bit more time gave that little more leeway.

Options chain shows this trade was the volume for the day - and the broker paid me commission. I am making the market. Added the trade to managed portfolio next day by which time open interest was close to 100 contracts. Max profit was down to 164%

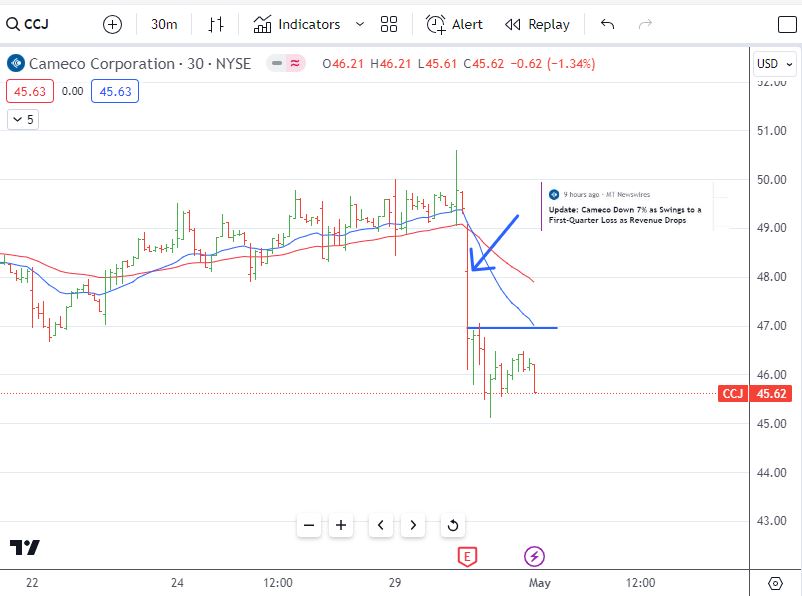

Cameco Corporation (CCJ): Uranium. Watched market open (Apr30) - market reaction to Cameco profits miss was quite muted at a 4% drop in the first 15 minutes (when I was watching).

Put in buy order and was filled at 1% premium to level stock was assigned the week before. Order was filled at the price somewhere near the bottom of the first bar after market open - price dropped another 3% afterwards. The details of the profit miss are a mismatch between term contracts and bought in production costs. Am expecting this to work through in time and am keen to see if Cameco will hit the acquisition trail in the Athabasca Basin. Wrote covered call for 1.4% premium with 6.5% price coverage. The truth is the big EYTFs have to keep buying Cameco to stay in balance.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Added small holding to pension portfolio to have at least one European Bank. Picked ABN as it is lagging the other European banks. Wrote June covered call for 1.13% premium with 10.2% price coverage - went longer and wider to keep the holding running a while.

Lightbridge Corporation (LTBR): Nuclear Technology. One of the #utwits keeps talking about $ltbr - came across it also when doing the research on GE Venova.

The chart is challenging. Price has been dropping since the August 2023 highs with only two attempts at breaking the downtrend - both failed. Price has now plumbed down to a support level (the top green line - from a weekly going back to November 2020) and tested it a few times. If the pundits are right about the growth of nuclear powerr, the suppliers of core technologies will see better days. There is risk in the chart - Earnings is on May 8 and there is another support level lower down (the other green line from April 2020)

Canopy Growth Corporation (WEED.TO): Marijuana. With US moves to change the scheduling of cannabis from Schedule I to Schedule III, prices have soared. In the week, added a covered call on the entire holding which would trigger massive capital losses on the early holdings. Added a parcel to mitigate those losses.

Corbion N.V. (CRBN.AS): Specialty Chemicals. Ran stock screens across Europe - liked the shape of the chart. Profile says speciality chemicals - the specialty is lactic acid - more to do with food than chemicals. Dividend yield 2.90% - ex date May 17

Chart shows price breaking the downtrend and making a series of higher lows

CVS Health Corporation (CVS): US Healthcare. Assigned early on naked put in personal portfolio. Market did not like CVS earnings - EPS miss.

In 2023, CVS pushed hard to build its Medicare business - that worked to get customers but also pushed up costs. The remediation program will take up to 3 or 4 years = ouch. Dividend yield 4.82%

Free link

AdAlta Limited (1AD.AX): Biotechnology. Received a letter advising upcoming options expiry data. AdAlta is in Phase 1 clinical trials for a protein theraputics delivery platfom - trials seem to be progresssing well enough. Not well enough to make options exercise at $0.03 a no-brainer. Put in a pending order for the amount of shares exercisable at $0.028 a share and am ahead of exercisie price after covering trading costs. If price pops before expiry, can still exercise.

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Assigned early (by two weeks) on 97 strike naked put. That caught me by surprise as the plan was to kick the can down the road once the Fed announcements were done. I am happy to be long yield now that it is clear the Federal Reserve is not going to raise rates - maybe just defer the first cut some more. This position is protected by a bought put at a lower strike which is funded by a sold put further down. The challenge is trade management on those. As the spread is fully funded there is no capital loss closing out - just the risk of a rise in yields bigger than we have seen. Yield 3.62% Breakeven after all income trades is $91.76 - will write covered calls at 92 strike and hold.

Sold

Peninsula Energy Limited (PEN.AX): Uranium. A few weeks ago Peninsula announced a $20 million overrun in it capex budgets for the Lance Uranium Project in Wyoming. Pending sell order placed at the time was taken up for 38% blended profit since September/November 2023/February 2024. Why hit the exits? When they ran the share purchase plan raising in February, they should have known what the numbers were going to be like - 2 months later - a surprise.

Timing is everything - order hits the pending price in he market session after US Senate approves the ban on Russian uranium. Peninsula stands to benefit provided their term book has space in for new deals. I doubt it has.

Gannett Co (GCI): US Media. Sold in small managed portfolio for 6.7% blended loss since February 2023/January 2024. Averaging down helped. Initial idea was stock screen idea. Too bad that Gannett got caught out by the way digital media crunched their print media business. Income trades (all calls) proffered a net capital profit - not quite $20. The plan is to deploy the proceeds in uranium.

Too bad there are calls open at a strike lower than market close (May 2). Bought back at 3.7% lower price and then sold again within 19 minutes at 4% profit. Last sale is a mistake - still exposed to the covered call.

Forced sale of a bunch of shares to cover looming margin problems triggered by early assignment of iShares Treasuries ETF above. Chose to pick my own targets rather than have the broker make the choices.

iShares MSCI Poland ETF (EUR) (IBCJ.DE): Poland Index. Partial fill on sell order to raise margin. Percentage profit was 34% since December 2020 but half that after trading costs - surprised to get taken for 1 share only. Balance sold next day for 14.8% blended profit since August 2018/December 2020 - not the best return for holding 6 and 4 years. Ukraine War did not help.

iShares MSCI Philippines (EPHE): Philippines Index. Knocked off an odd lot number of shares - choice is 35% loss since June 2016 or 1% loss since December 2023. My accountant will choose the bigger loss. Averaging down helped.

iShares MSCI Malaysia (EWM): Malaysia Index. Knocked off 100 shares - choice is 32% loss since June 2016 or 6.3% profit since December 2023. My accountant will choose the bigger loss. Averaging down helps. The South East Asia holdings were predicated on strong GDP and population growth - Covid-19 crunched that.

Airtel Africa Plc (AAF.L): Africa Telecom. Plan when topping up when stock appeared on screens last week was to exit at breakeven. Did just that with 0.9% blended profit since June/July 2023/April 2024. Small loss after trading costs.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

29Metals Ltd (29M.AX): Base Metals.

A chart with a few lessons. This is the 2nd time 29Metals has landed on the stock screens list. The chart shows the first entry (left blue ray) and a stop loss exit (red ray) and the new entry (right blue ray). The new entry is the smarter place to enter - after price has broken the downtrend and made a higher low after the reversal. The first entry shows a more challenging spot - 3rd cycle higher with the previous cycle length not enough to get price to the 35% target.

Top Ups

Pilbara Minerals Ltd (PLS.AX): Lithium.

Chart shows another chance to average down entry price. Not the ideal setup as price has just made a lower high though it is respecting a short term support level.

Income Trades

18 covered calls written across 3 portfolios (Australia 1 Canada 2 US 15)

Naked Puts

Coty Inc (COTY): US Consumer Products. Rolled out weekly option expiring for another two weeks. Locks in 71.7% profit on buy back and was 194% cash positive. With price opening above the sold strike, would normally let this run to expiry but wanted to preserve margin in this portfolio.

Other rollouts to preserve margin

Sunrun Inc (RUN): Solar Power. 4.2% loss on buyback. 31.3% cash positive - rolled out to June.

Invesco Solar ETF (TAN): Solar Power. 32.9% loss on buyback. 0.5% cash positive - rolled out to June - a tight call to buy time.

New sold puts

NexGen Energy (NXE): Uranium. Return 4.38% Coverage 1.6%

Apple (AAPL): US Technology. Return 0.39% Coverage 8.4%

Credit Spreads

Only one credit spread at risk of exercise is Global X Uranium ETF (URA) July expiry 33/28. Expiry si a few months away and quite frnakly this could well land out-the-money before then.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 29 - May 3, 2024