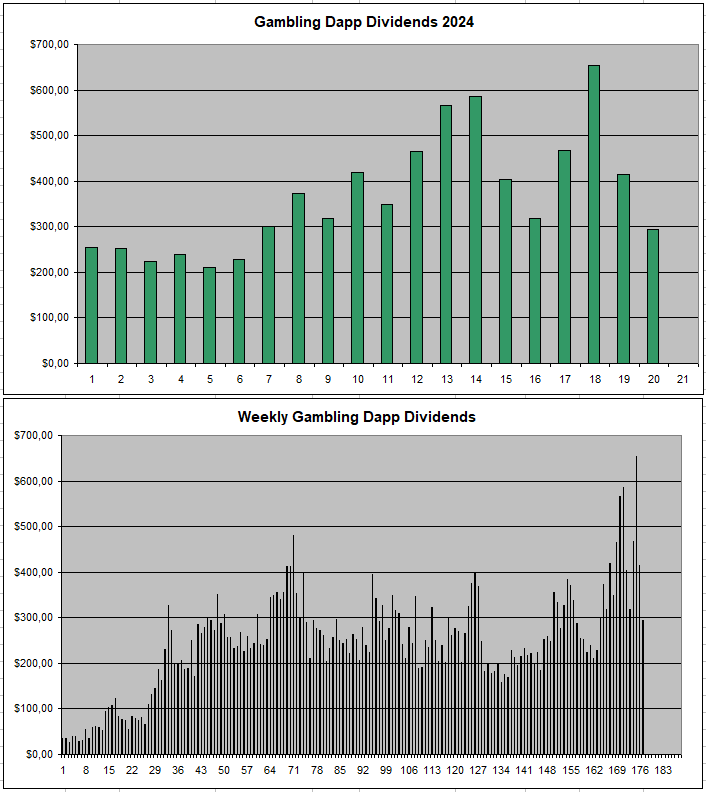

Dividends continue to flow in week after week from the different GambleFi Projects while prices of the coins are underperforming since they are directly linked to the returns which still are catching up.

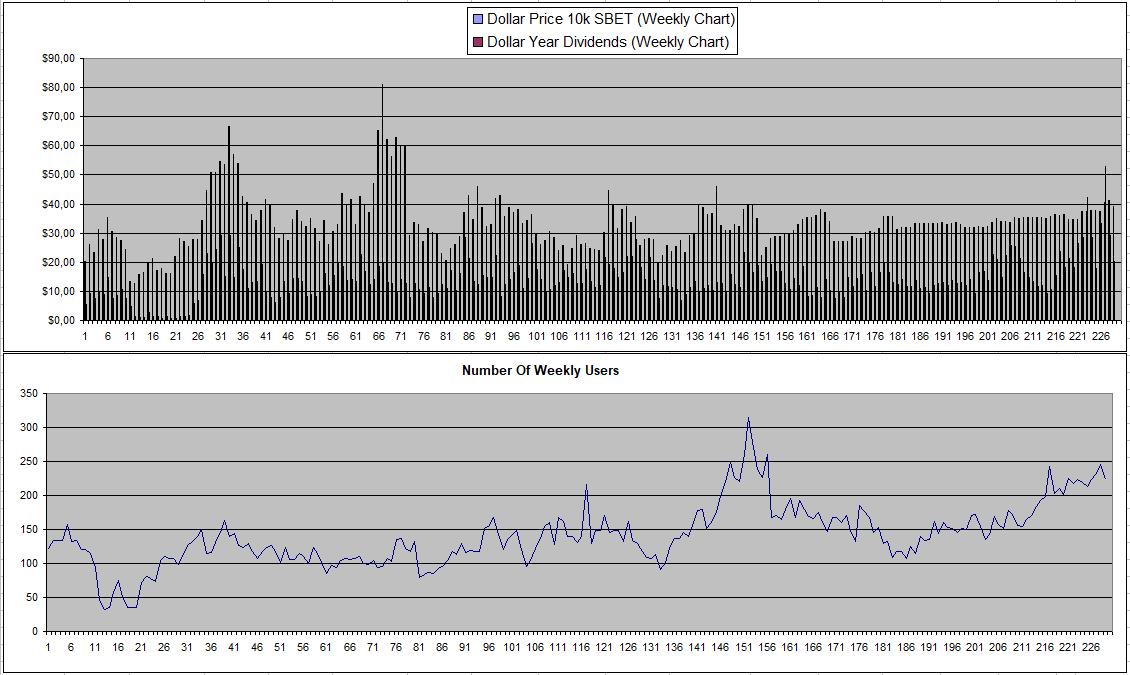

Sportbet.one (SBET)

There was a god dividend candle 2 weeks ago but since then, them have come down again. All this while the platform still offers +50% APY which is really solid and pays week after week. The next hope is for there to be an increase in users and activity during the European Football Cup. The previous spike was during the World Cup so it is certainly possible to at some point in the coming months reach a new all-time high weekly users above 300.

So pretty much all continues to work properly on Sportbet

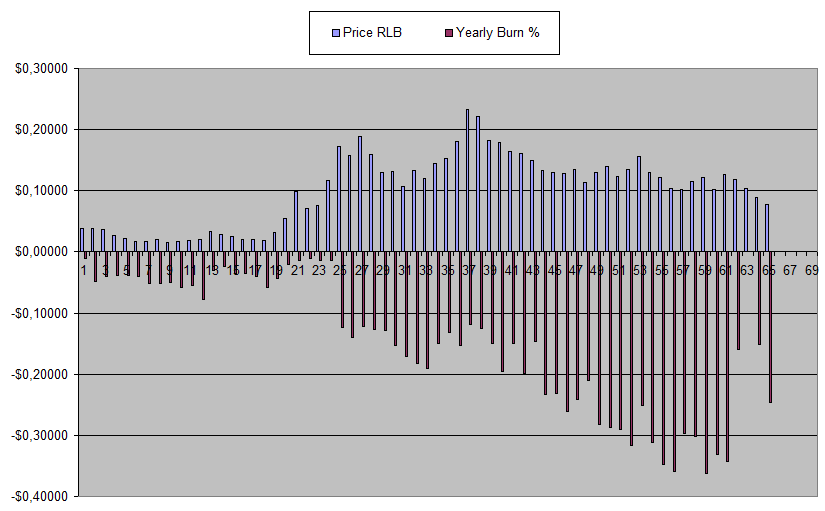

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Rollbit and RLB seems to be on a way back down now with overall volume and earnings that have decreased quite a bit lowering the burn rate the past month. Last week saw a spike again though. I was quite fortunate to having to force sell my Sportsbot which at that time gave a 148$ in revenue share with me getting to sell the bot for ~1250$. Looking at the revenue share of the bot right now, it has crashed down to 34.17$. This mainly is a result of the big StakeStinks whale (who increased the earnings like crazy) leaving. Since the dividend pool is made from the last 30 days of revenue, this can make it go up or down in value like crazy.

So Rollbit is a bit in a wait and see mode. I'm glad I sold all my RLB Holdings to buy memecoins a while back as the price came down quite a bit due to the decreased revenue & burn. Right now, I'm back in accumulation mode holding or re-investing what I earn on the site.

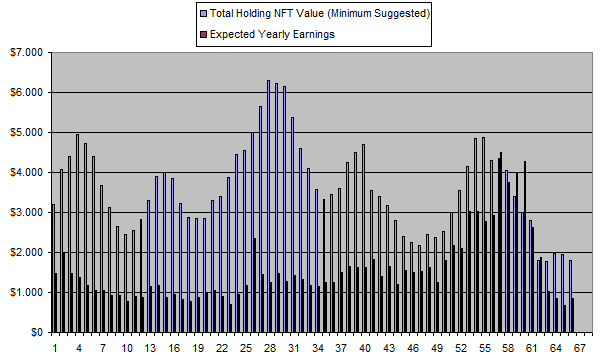

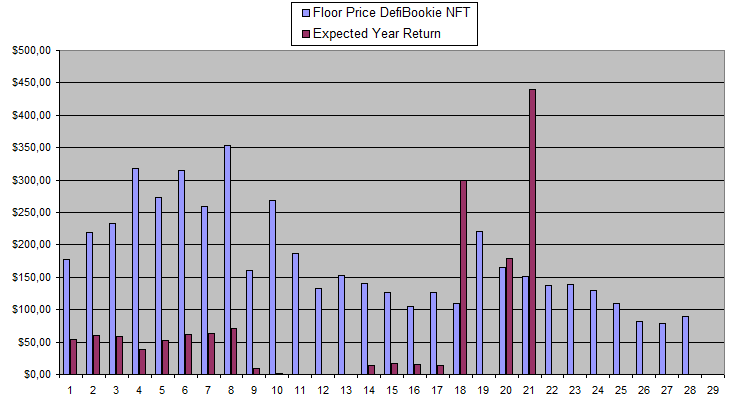

Defibookie (NFTs)

Not much is happening now with Defibookie and I'm taking the opportunity to increase my holding a bit during this time of uncertainty. I added 2 more NFT's staking them which each cost me ~85$. Anything around this price range feels like a good risk-reward price to me and I do plan to add 2 more getting them at an even 20.

At this point it's a game of patience hoping there either will be another airdrop of for the earnings to actually get to a point where there is a revenue share. And off course for the project not to get rugged one way or another which I don't believe will happen. If there is ever a new hype cycle with prices of NFTs increasing, I do plan to force myself to sell a couple to get in a zone where I fully recovered the initial investment.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.88$ | 21.6% | +615$ |

| Week 25 | 1822$ | 139$ | 2114$ | 0.000$ | 369.88$ | 20.3% | +661$ |

| Week 26 | 1822$ | 129$ | 1968$ | 0.000$ | 369.88$ | 20.3% | +515$ |

| Week 26 | 1822$ | 110$ | 1673$ | 0.000$ | 369.88$ | 20.3% | +221$ |

| Week 27 | 1822$ | 81$ | 1242$ | 0.000$ | 369.88$ | 20.3% | -211$ |

| Week 28 | 1993$ | 78$ | 1338$ | 0.000$ | 369.88$ | 18.56% | -285$ |

| Week 29 | 1993$ | 90$ | 1537$ | 0.000$ | 369.88$ | 18.56% | -285$ |

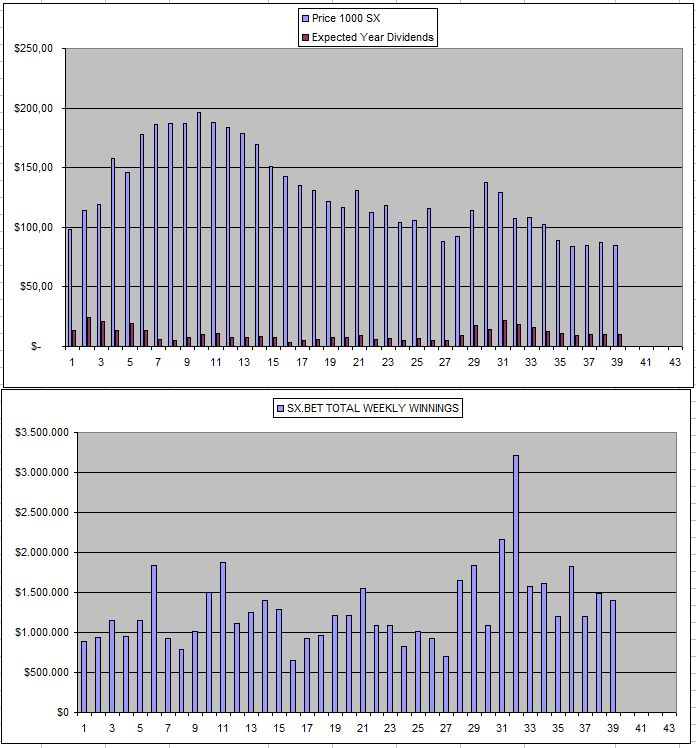

Sx.Bet (SX)

So far it is quite clear that the strategy of cutting the fees down to 0% isn't really working as the platform needs users to attract more users as offering good odds getting the 0% fee benefit doesn't really have anyone on there to take them systematically. In the meantime, inflation continued to increase as 'earning' are paid out in more coins as there is no real revenue due to the 0% fees. So the process of getting more users is a really had one as in all crypto projects.

So while they have everything in place to succeed as a platform, there is no real guarantee that it will happen.

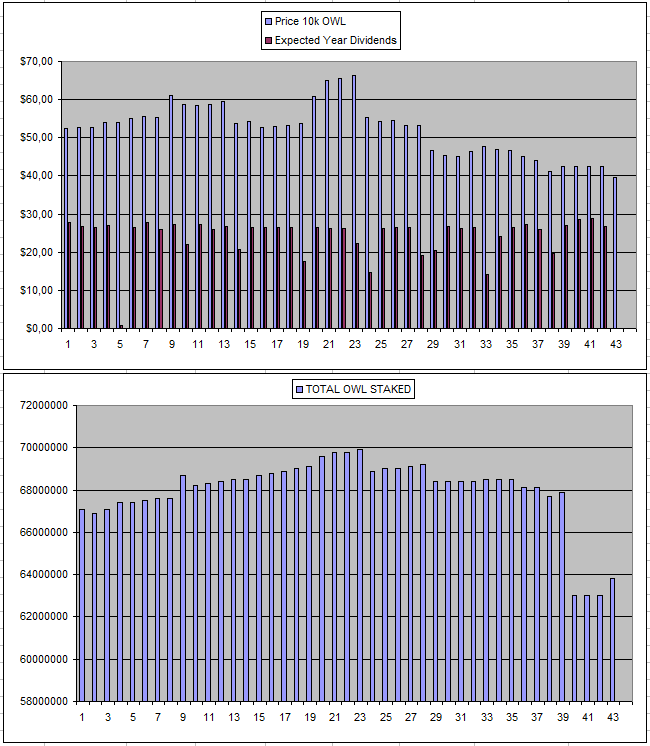

Owl.Games (OWL)

Owl continues with the same disappointment as there was a full week without dividends now as the reward pool needed to be replenished which is always done with a delay cutting into the earnings. The team behind this project needs to do a lot more to show that they actually can be trusted.

After 26 weeks in this project, I earned back 33.71% of my initial investment but I'm down -4$ overall due to the high fees that it takes to buy/ stake / unstake / sell combined with the decline in price.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

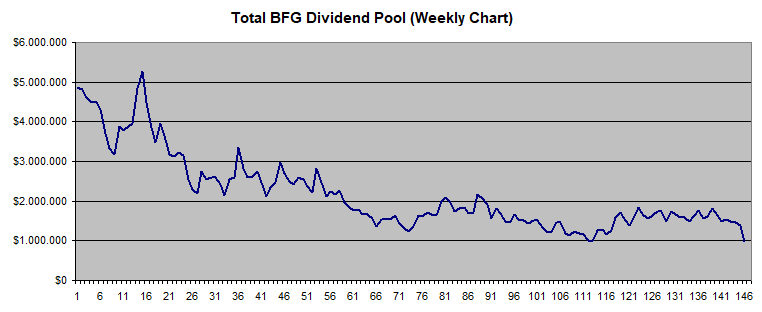

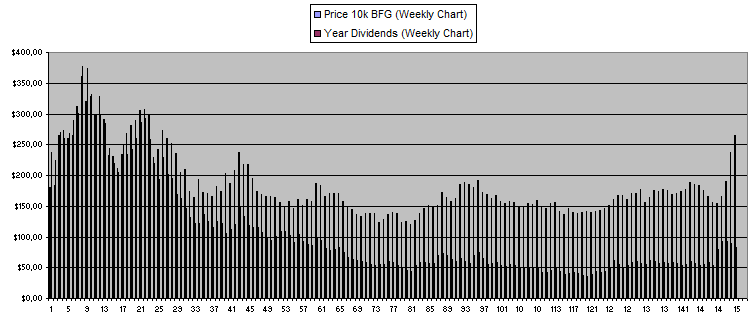

Betfury.io (BFG)

The price of BFG continues to go up while the dividend pool and earnings seem to be going down. So for anyone who managed to buy while the price was below 0.2$ or has been holding for a long time getting a lot of dividends while being even on the investment, it might be a good time now to sell and just take the profit before the token price goes down again. This feels inevitable at the current dividend pool and returns.

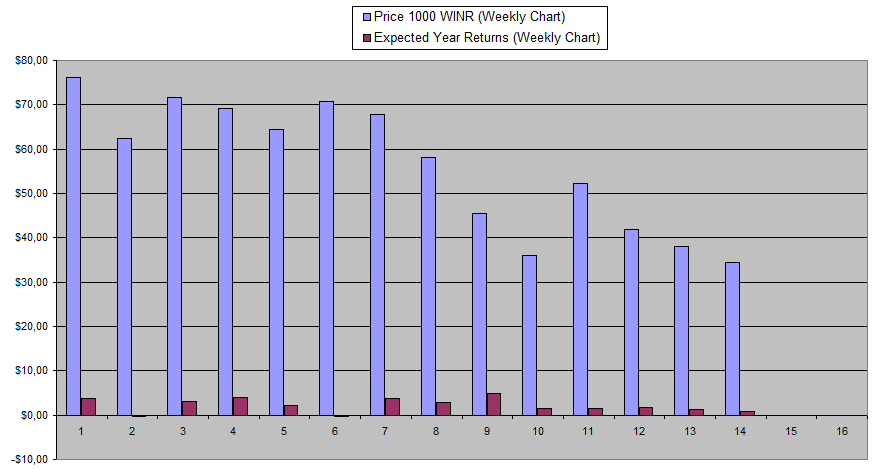

There is something about the WINR Protocol that continues to intrigue me despite the fact that the actual return right now are just 2.15% APY and the gambling sites themselves not being something I would use while the entire tokenomics are ridiculously complicated. In that regard, I'm tempted to add a bit to my bag now that the price is down again a lot. So far, I haben't done this just yet.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +51% APY |

| Betfury.io (BFG) | +31% APY |

| Rollbit.com (NFTs) | +46% APY* |

| Owl.Games (OWL) | +0% APY |

| Sx.Bet (SX) | +11% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +2% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

I'm no holding holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 18 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Thanks @costanza - I didn't notice that BFG had doubled in price. Sold out most of my BFG position.

Nice timing, you should be able to buy back more soon