It´s been a while. I hope you are all doing well. I have been doing some thinking on a lot of things in the past months. One of those things I have been thinking about is money, to be more exact how I and others view it and perceive it. What I have arrived at is we might be looking at money all wrong. Let me explain what I mean.

How we are taught money works

In school, the news, and most other places we are taught that there is inflation and deflation. Inflation makes the price of things go up and deflation makes the price of things go down. Most countries have a very similar year-to-year goal of what they would like these numbers to be. For the US this target number is an annual inflation rate of 2%. This all seems fairly straightforward. If the inflation goes up it means everyone's money will be worth less... But is this really the case?

On a side note, why is the goal to have inflation? Should the goal not be 0, neither inflation nor deflation? I mean countries can set any goal they want, right? Also last time the US had negative inflation was in 1954, -0.7%.

How money really works

It is very easy to look at inflation and assume that money now is worth less and that it would hold true for everyone. The reality tho is that it is not the case. I will give you some examples. If you are renting an apartment, the landlord will simply raise the rent. If you say anything about it they will simply shrug and say "inflation" like it is a magic spell. And that's that. This means that the landlord will not earn less money due to inflation. This holds true for virtually everyone who is producing and selling things. As well as people who own assets.

Suppose you are dependent on a salary for your income. Surely you should be able to walk into your boss's office and demand a raise simply by uttering the same magic spell "inflation". Most likely you will get a "these are tough times for everyone... bla bla." response and a no. What does this mean then, some people seem to be inflation-proof while others are not. But let us continue this dive into how money really works. Let's say that you have a great boss, one that has fallen under your spell and actually given you that raise. Surly now you are inflation-proof as well, right?

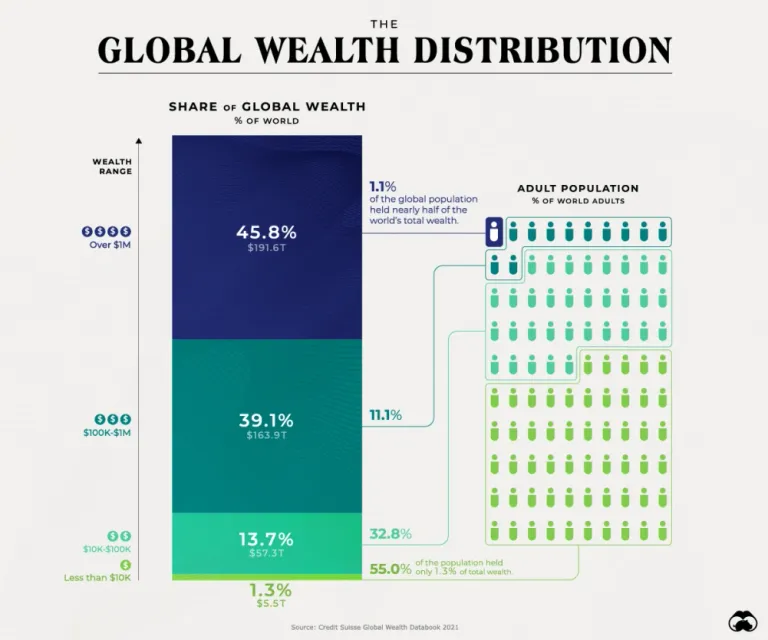

The answer is yes*. Ah, you noticed the * on the yes, how astute of you. The truth is inflation is not the only mechanism or factor to take into consideration regarding money. There are other factors that affect your money's worth. Let us take a look at the wealth distribution in the world.

According to the data from 2021, 12.2% of the population controls 84.9% of the world's total wealth. Much of this is in assets, and as we saw before these tend to be inflation-proof. This is of course on top of the annual gains they can accrue by simply going up in value. Not only are these inflation-proof, but as I just said they most likely tend to go up in value as well.

If we take a look at the S&P 500, the stock markets index that is tracking the top 500 companies in the US. This has shown an annual average growth rate of 9.9% from 1928 to 2023. Adjusted for inflation it is "only" 6.37%. I would argue that this means that it is extremely likely that at least 8% of the world's total wealth has an annual growth rate of 6.37%, adjusted for inflation of course.

This means that if you are living of a salary, and you managed to get a wage increase to cover the inflation. You are still having your money lose 6.37% of its value manually. How so you ask. Well simply by others getting more than you, this means you can buy less stuff with your money proportionally than these people. This I would argue is the true fact of how money works. And unless you are able to "join the club" as they say, or insight a rebellion, the truth of the matter is your money is losing value at a far greater pace than you probably have realized. And probably at an even greater rate than the 6.37% average annual growth of the S&P 500, as stock simply is one of many assets.

I would argue that we would need to look at these types of numbers in order for us to have a true inflation number. At least a true number that is of use to the vast majority of people.

How can you even the playing field?

But there are some things that we can do. I am going to ignore the obvious things like buying a lottery ticket, betting the house on black, and all other high-risk high-reward options. What we need is something that is unknown and in its infancy. Meaning it still should have a large potential for growth. And while this is fairly obvious for most of my readers. I am talking about my new NFT project... No? Well ok then, the real one this time. Cryptocurrencies.

How so you might ask? Well the the idea is if you are part of something only a few are doing, and it is profitable. This means that you have managed to grow your money compared to the others. The only way to get ahead of the curve is to have a relatively higher yield or return on your investment than the average. Let us take a look at Bitcoin.

With the current financial system, the only way to not "lose" money is to outpace everyone else

In Bitcoin's 12-13 year span of existence, it has been able to produce some very exceptional results. The historical data give us a mean annual return of 560.8%. If we take a look at the last 10 and 5 years the average is dropping some; 10 years mean annual return 156.4% and 5 years' mean annual return 104.6%. And while it is very likely that it will continue to drop some over the coming years as well. I think the odds of it going to 0 as many crypto skeptics argue is virtually 0. While Bitcoin has had three years of negative growth, with Father Time on your side it is looking very positive. Also given the historical cyclical nature of cryptocurrencies, the bad years should also be fairly "easy" to adapt to, if you want. If cryptocurrencies continue to keep that pattern.

But if Bitcoin is the best choice for you, or perhaps some other cryptocurrency. I will leave that for you to decide. If you do want to start earning some sats here and there, that does stack up with time. Then I can recommend taking a look at one of my older posts that will show you how you can find it here. If you have any questions about it just ask in the comment section here or in that post.

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead.

https://medium.com/@bo.daniel.jensen

See you on the interwebs!

Picture provided by: https://pixabay.com/

Resources

The thing that is best about Bitcoin is the fixed supply imo which makes it a great store of value. But let's see how things pan out in the next years. Good to see you again.

Thank you =) <3 and yea the fixed supply along with the decentralized nature of it is what makes it great.

I added your posting here:

https://peakd.com/ccc/blkchn/investment-watchlist-wikifolio

Thank you, I appreciate it =)