Chapter 3.2. MiCA and crypto-asset innovation

-21. When speaking about “digital transformation”, which is the second highest priority of the current Commission, the discussion quickly reaches the “FANGAM” (sometimes also “GAFAM”, leaving aside Netflix), the big internet platforms. It is hard to contest that the digital transformation was brought about by companies such as Facebook (now “Meta”, founded in 2004), Apple (founded in 1976), Netflix (founded in 1997), Amazon (founded in 1994) and Microsoft (founded in 1975), along with others. In contrast, few observers associate the digital transformation with long established IT giants such as IBM (founded 1911) or SAP (founded 1972). Since 1975, very few notable digital companies were founded in Europe and when that happened, they were either quickly acquired by American companies or they migrated to the US voluntarily. It was the case for Skype, DeepMind, Spotify or UIPath, among those best known.

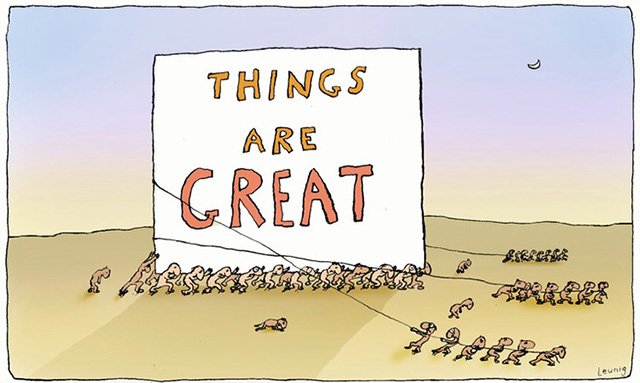

-22. In Part 2, par. 36, I was quoting Patrick Hansen observing that “In view of the outcomes of recent policies (e.g., GDPR) and the current status of European tech companies, it is safe to say that whatever the current “third way” model is, this strategy is failing. Instead of catching up economically, Europe is falling more and more behind.” The same case is made in a recent opinion piece published in the Financial Times, where G. Rachman begins by stating the facts: “In 2008, the EU and the US economies were roughly the same size. But since the global financial crisis, their economic fortunes have dramatically diverged. […] The aggregate figures are shocking. Underpinning them is a picture of a Europe that has fallen behind — sector by sector. […] The European technology landscape is dominated by US firms such as Amazon, Microsoft and Apple. The seven largest tech firms in the world, by market capitalisation, are all American.”

-23. By comparing the US and European economic trajectories, one would be led to conclude, on the back of empirical evidence, that Europe should encourage the emergence, and local development of disruptive new firms.

-24. Yet, as I have analysed in detail in Part 2, MiCA “stays the course” established by prior European legislation and** erects significant legal, regulatory and financial barriers in front of would-be European entrepreneurs** in the field of crypto-assets and blockchain technologies.

-25. It is thus unlikely that many European start-ups will manage to clear the legal and financial hurdles raised by MiCA, let alone succeed in growing to a significant size. Hence the main hope of accomplishing the objectives of the Treaties (see Introduction, par. 7-9), of the Commission “Digital finance strategy” (see Part 2, par. 18), and of the MiCA regulation itself (see Part 2, par. 114) come perhaps from “intrapreneurship” – new, crypto-asset focused business lines sparking off inside traditional financial institutions.

3.2.1. Credit institutions and investment firms as potential ART and EMT issuers

-26. In Part 2 I have mentioned that the requirements in terms of own funds, redemption obligations, reserve asset management, marketing and communication, reporting, and liability in relationship to ARTs and EMTs make it unlikely that new firms could find a profitable business model inside the EU.

-27. On the other hand MiCA repeatedly carves out exemptions and doles out waivers for the incumbents, the established “credit institutions” and “investment firms”, as defined in Art.3.1 (28) and (29). The latter are mentioned specifically 34 times in the regulations’ final version, the former no less than 67 times. Credit institutions figure prominently for instance in MiCA’s Title III, dedicated to asset-referenced tokens (ARTs), which runs to more than 100 pages (not counting the recitals dedicated to ARTs), or about 20% of the final version. Art. 17 for instance sets out separate requirements for their issuing ARTs.

-28. Because they aim to stabilize their value, ARTs can be functionally compared with money market funds (MMFs) – ARTs can be said to be “MMFs which can be transferred using DLT”. Money market funds are regulated in the EU through Regulation 2017/1131. This Regulation explains in its Recital (2) that “On the demand side, MMFs are short-term cash management tools that provide a high degree of liquidity, diversification and stability of value of the principal invested, combined with a market-based yield. MMFs are mainly used by corporations seeking to invest their excess cash for a short time frame. MMFs, therefore, represent a crucial link bringing together demands and offers of short-term cash.”

-29. In contrast, MiCA speculates in its Recital (5) that ARTs “could in the future be widely adopted by retail holders”, presumably because they bring benefits, on which MiCA remains silent, but instead stresses completely hypothetical risks. Furthermore, Recital (40) notes that ARTs “could be widely adopted by holders to transfer value or as a means of exchange […]”. It should be reminded in this respect that while the initial Commission Proposal was explicitly exempting algorithmic stablecoins from the ART definition (Recital (26)), the final version does the opposite, by explicitly including them, in Recital (41).

-30. However, Recital (58) of MiCA’s final version prohibits the yield which the MMF Regulation quotes as the source of demand for MMFs: “To reduce the risk that asset-referenced tokens are used as a store of value, issuers of asset-referenced tokens and crypto-asset service providers, when providing crypto-asset services related to asset-referenced tokens, should not grant interest to holders of asset-referenced tokens related to the length of time during which such holders are holding those asset-referenced tokens.”

-31. In a political choice of MiCA’s objective 4 (“financial stability”) at the expense of objective 2 (“supporting innovation”) this interdiction completely discounts the potential benefits in order to avoid “choice in currency” (see Part 1, par. 87). It is not immediately clear what is the rationale for the Union legislation trying to prevent European citizens from choosing ARTs (or other tokens) as a store of value, a strikingly arbitrary restriction of their freedom. As far as I’m aware, EU citizens are not restricted from storing value in dollars, other currencies, or indeed MMFs, nor in gold or other commodities. Neither are financial service providers prohibited from offering interest on foreign currencies or commodities. I will quote again L.H. White: “Ordinary citizens are harmed by the restriction of monetary competition. […] If we care about the welfare of ordinary citizens in their role as money users, then the law should allow the market for monies should be openly competitive. It should not make money production a privileged monopoly.” These views are held by other economists too, beginning with Nobel prize laureate F. Hayek who writes: “I hope it will not be too long before complete freedom to deal in any money one likes will be regarded as the essential mark of a free country.”

-32. By prohibiting interest for ARTs (and EMTs) MiCA removes the incentive for what could have constituted a useful financial innovation in the MMF domain, potentially adding transparency and decreasing overhead costs, and also contradicts not only the principle of “technology neutrality” but also the spirit of its own Recital (16), updated in the final version with the words “Any legislative act adopted in the field of crypto-assets should be […] founded on an incentive-based approach.”

-33. It appears therefore likely that, with the main source of demand destroyed, credit institutions will see little or no incentive to issue ARTs, despite the considerable waivers consented to them, as MiCA does its outmost to effectively ban “blockchain-based MMFs”.

-34. Credit institutions and electronic money institutions authorized under the “E-Money Directive” (Directive 2009/110/EC) similarly benefit from waivers not consented to new firms for issuing and managing EMTs, to which Title IV of MiCA is dedicated. Title IV is considerably shorter than Title III (only 22 pages in the final version, without the Recitals dedicated to EMTs). As noted above (see Part 2, par. 51), its provisions are expected to “effectively suppress Euro-denominated stablecoins even before the emergence of this market.” Among these, perhaps the most relevant is Art. 50 “Prohibition of granting interest” which has three paragraphs, unlike the much shorter equivalent Art. 12 of the E-Money Directive (one paragraph only). Art. 50(3) thus details: “For the purposes of paragraphs 1 and 2, any remuneration or any other benefit related to the length of time during which a holder of an e-money token holds such e-money token shall be treated as interest. That includes net compensation or discounts, with an effect equivalent to that of interest received by the holder of the e-money token, directly from the issuer or from third parties, and directly associated to the e-money token or from the remuneration or pricing of other products.”

-35. It becomes difficult to imagine why, despite the considerable waivers granted to them, a credit institution or an e-Money institutions would issue an EMT rather than e-Money. It also becomes difficult to imagine why would there be a demand for EMTs regulated under MiCA, rather than e-Money, vouchers, or USD-denominated stablecoins (not falling under MiCA).

-35. To sum up, if traditional financial firms are to innovate in the field of crypto-assets and blockchain, it is hard to imagine that they’ll take advantage of Titles III and IV by issuing ARTs or EMTs.

[189] “A Europe fit for the digital age”, Commission Priorities 2019-2024, accessible at https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age_en

[190] G. Rachman, “Europe has fallen behind America and the gap is growing”, Financial Times, 2023

[191] See for instance Recital (44) of the final version of MiCA

[192] REGULATION (EU) 2017/1131 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 14 June 2017 on money market funds

[193] F. Hayek, “Choice in Currency”, op. cit., p.22

It's unfortunate to know that Europe is falling more and more behind, instead of catching up with the current digital trend. Europe should encourage the development of digital firms to prevent the drain to America or other digital friendly countries.

What is Mica?

Is it a form of organizational or what?

It's the name of a new law. Will apply in the EU from 30.12.2024

!LOL

!ALIVE

@sorin.cristescu! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ cryptoyzzy. (6/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

lolztoken.com

But CAT scan.

Credit: marshmellowman

@sorin.cristescu, I sent you an $LOLZ on behalf of cryptoyzzy

(4/8)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

Credit institution seems to be the one that might be suffering it soon with the way it is looking