I recently stumbled upon the Pensions and Lifetime Saving Association's research on Retirement Living Standards here in the UK...

They have used the Joseph Rowntree Foundation's work on Minimum Income Standards as well as their own focus groups to establish three levels of retirement income to give people a better idea about what they can expect in retirement!

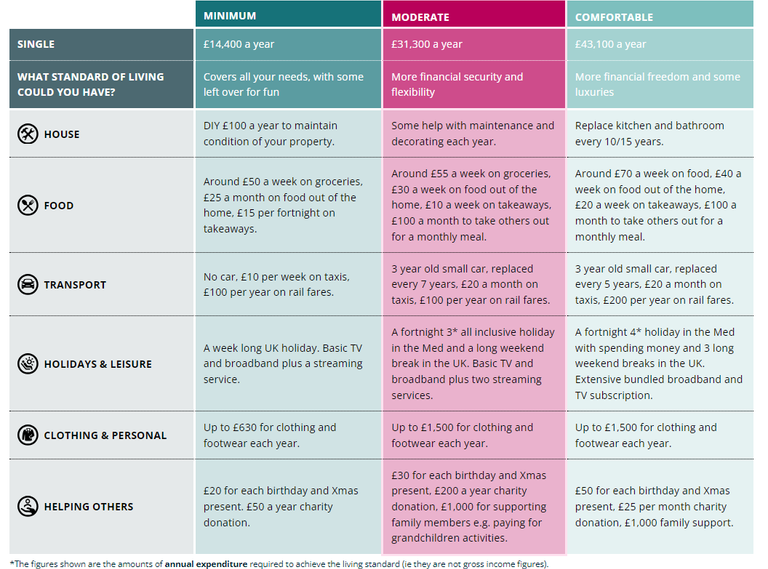

Three Levels of retirement income...

In 2024 the PLSA says a single person needs...

- £14,400 a year as a minimum.

- For a moderate lifestyle they need £31,300

- £43,100 is needed to be comfortable.

The minimum amount above is based on focus groups agreeing on what they think is a minimum standard, which is enough to meet your needs and have a little left over for some fun.

So this means all of your food, bills, clothes and coms needs are met first of all.

They go into some detail.....

I like this, it gives you an idea about the kind of lifestyle you can lead across various aspects of social life.

Assumptions made...

The above minimum model assumes you have no housing costs other than maintenance, and assumes you have no health or social care needs.

I guess for transport anyone on the minimum is looking at that free bus pass option! Not the most comfortable way to travel for sure, but it's something I guess!

Now to my mind, £14K a year, or around £1200 a month is a pretty reasonable amount of money to live off, it's in fact roughly what I've got in mind for my early retirement! It's manageable.

But this is speaking as someone who doesn't really have any expensive hobbies!

The problem with the above is that this amount isn't going to be anywhere near enough for people who haven't paid their mortgages off, and the real elephant in the rooms is health and social care costs, these later costs, if required, can be financially crippling.

It's something to be aware of!

The State Pension Isn't enough...

The State Pension only gives you around £11 500 a year. This is enough to keep you in radical poverty, survival mode, only 75% of what the public thinks you need. So you'd need a small private pension to get up to that £14 400 figure, and note that you start getting taxed at £12 500, something I still can't get my head around!

Final Thoughts...

Get saving, folks!

Posted Using InLeo Alpha

14400 Looks very small amount indeed, I don't think is a reasonable figure if you live in a big city...

I know what you mean, it's a case of meaningless averages!

.... and I'm assuming that the above numbers are for someone who has paid down their mortgage and is not renting. I think the bottom of that scale is a populous place

Yes housing costs are assumed at zero, I think that £14K figure will be A LOT of people you're right!

Very serious man.... I wonder how I'll end up retiring... Pension or Businesses... I think I'll pick business 😂😂😂