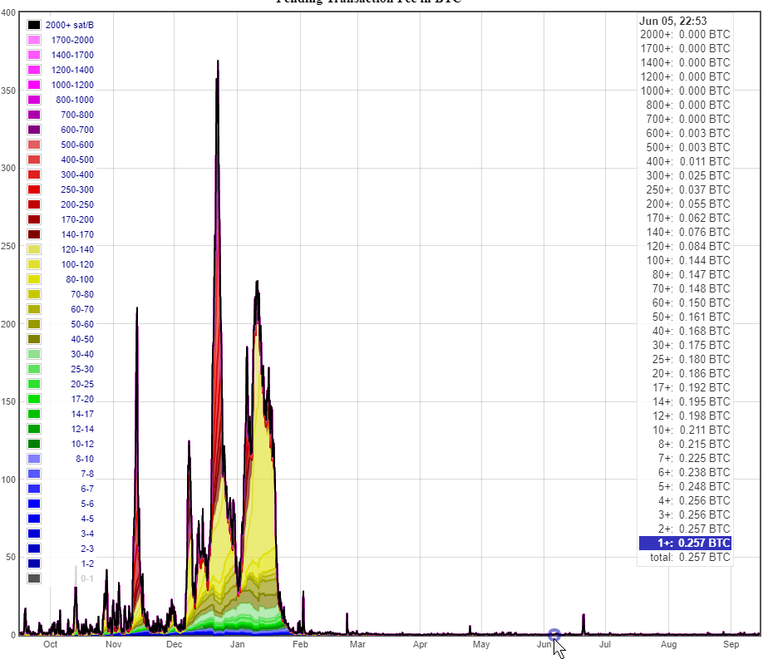

BTC fees are better than they've been in a long time and still not competitive on their own.

Do you have any idea of what is competitive? I don't think so.

3sat/bytes = 4 cents per transasctions.

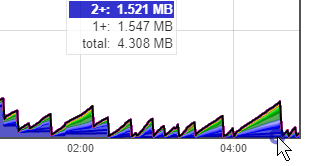

Since spam attack has stopped on BTC 9 months ago the fee has been on average 3 sat/bytes.

The current most efficient way of transfering large value are expensive wire transfers. 50$ vs 0.05$. Bitcoin is currently about 1000 times cheaper than wire transfers.

93% mean bitcoin cash is worth 7% of a Bitcoin so if you're a BCH purist and want to ignore BTC you're lost 93% of your purchasing power.

When setting fee arbitrarily you're letting each MINERS and only miners play with many variable one at a time. Computer resources, CPU, bandwidth, storage space. It's obvious the tendency will tend toward larger and larger resource usage invariably reducing full node count.

Patience mean no sacrificing Bitcoin most important property because of a 2 month long obvious politically motivated spam attack. (see screenshot above)

Segwit is easy to use and if wallets don't support it yet it's because there is little demand for it as 3-10 cents per tx is ridiculously low for most people.

Free-market? Impersonation and miss-representation have been globally recognized as unethical practice.

I've got no problem with competing projects but according to Roger modus operandi. BCH main value proposition is Roger's money and media influence's usurping the brand and openly misleading and confusing people into buying fake Bitcoins.

By Reckless I mean that Roger wants to make a 1m$ bet that in 10 year BCH will overtake Bitcoin market cap.

This is frankly a lot of fluff. Transisto I've been patient. With you. This isn't our first time discussing this so I would have expected a little more nuanced argument at this point.

Low prices are more competitive as compared to high prices and the BCH network (as the Bitcoin design) is itself more internally competitive due to a commitment to large blocks. That's all I'm saying in that regard.

Fewer nodes is fine. It's been the expectation ever since Satoshi first announced Bitcoin. It's a good, depending on how we use the terms network and client nodes. Miners have the incentive to run any and all of the necessary infrastructure if that should become necessary. Bitcoin is a fully competitive system. While I can understand how this seems like a worrying trend, you are free to try out something else. Just as we are here with Steem.

The problems with SegWit I'm pretty sure you and I have already been over and it's not to do with "ease of use". It's also so much more than just SegWit.

Same with Roger and various personalities. They are not Bitcoin Cash, just like they never were Bitcoin. -Yes, Rogers $1M bet is reckless but then again what is it to you.

The issues had been going on for far longer than 2 months and they are still there. Just because you think they are now small enough again, doesn't mean they actually are.

I've tired of all these senseless arguments with both supposedly pro and anti BCH crowds. What remains to see now is if Bitcoin Cash remains recognizeable by hashpower or if it turns into a UASF drama of further and further splits to no end. Other than that I'm not really interested anymore.

I'll look back in a few years and see what happened.

You're not factoring in the security difference when comparing tx fees.

Fewer nodes is not fine. Full validation isn't for everyone buy we should aim at not increasing the cost of it.

What's the problem with SegWit? What's much more than SegWit???

It wasn't so much about the bet but that he thinks it might take up to 10 years for BCH to recover.

What do you mean by " doesn't mean they actually are.".

You're right that high fee lasted more than two months, more like 4 months.

There is no way to know for sure if this fee surge was organic or politically motivated at the time. In hindsight it appear that it was.

I suggest you check more often than every few year if you're invested in BCH.

-Just a quick acknowledgement on my part before I resume my break from this BCH/BTC mess. These questions (in whatever limited way) deserve answers, but I think I have already given them elsewhere and I want to leave these arguments to others for a while. Preferably to be solved in free market competition between actual technological implementations, but we shall see what the future holds in store.