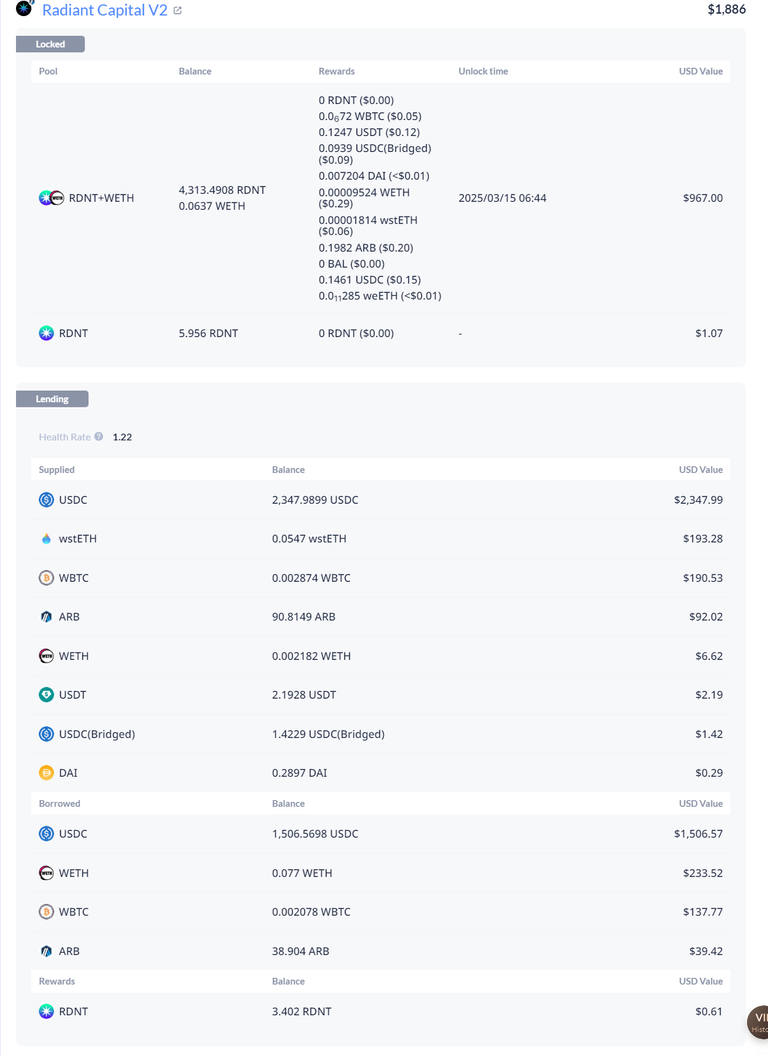

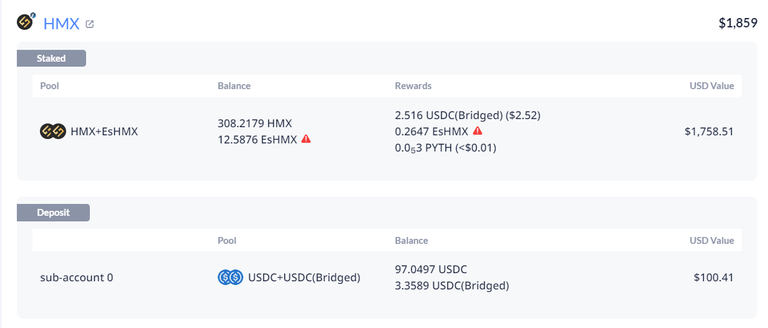

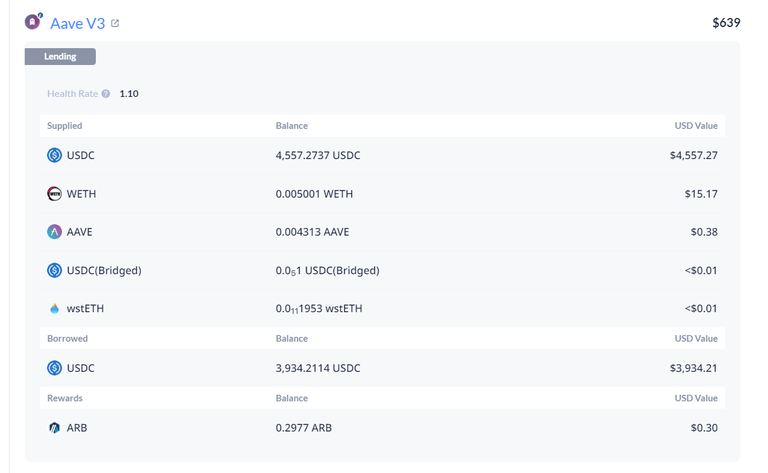

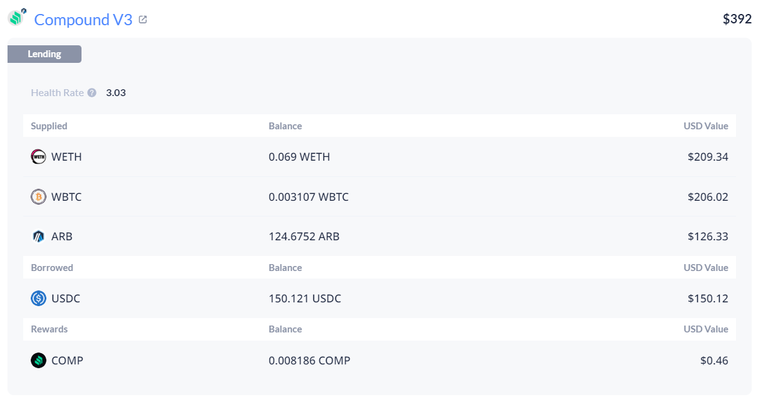

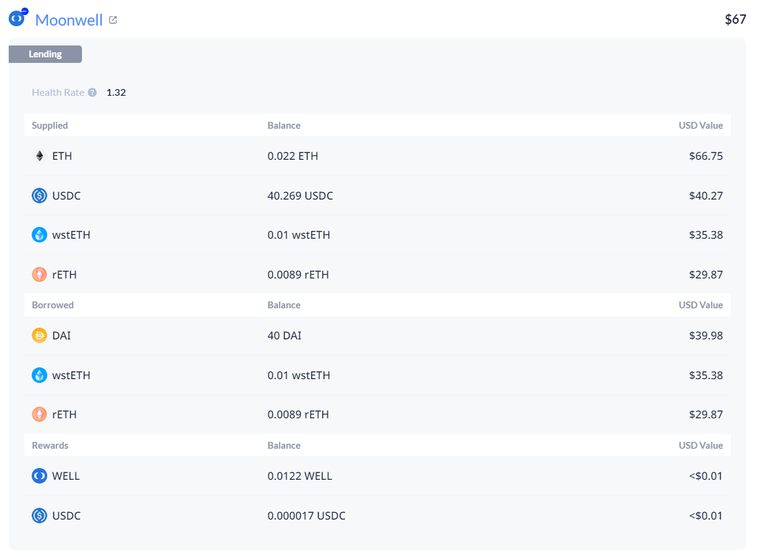

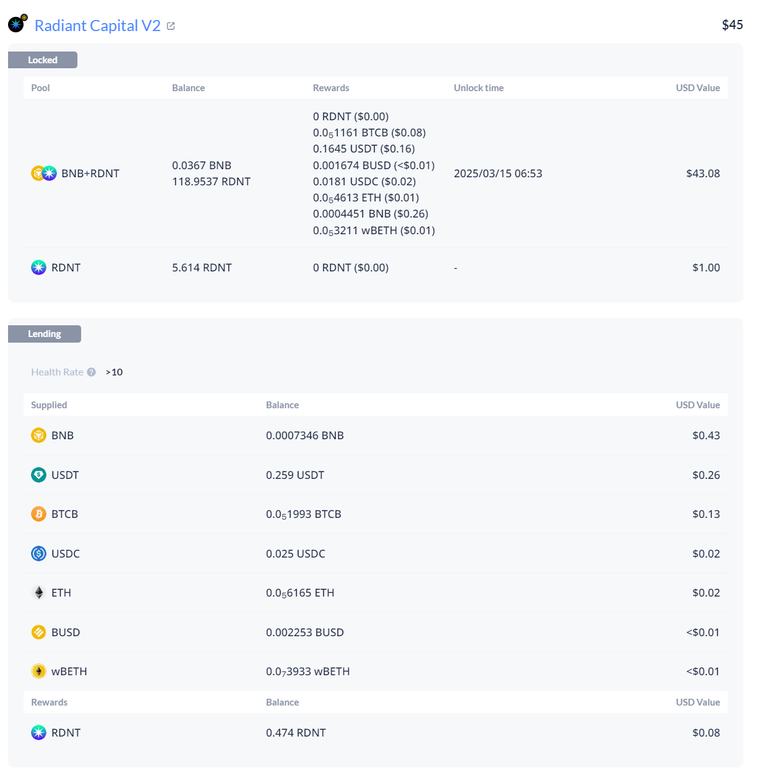

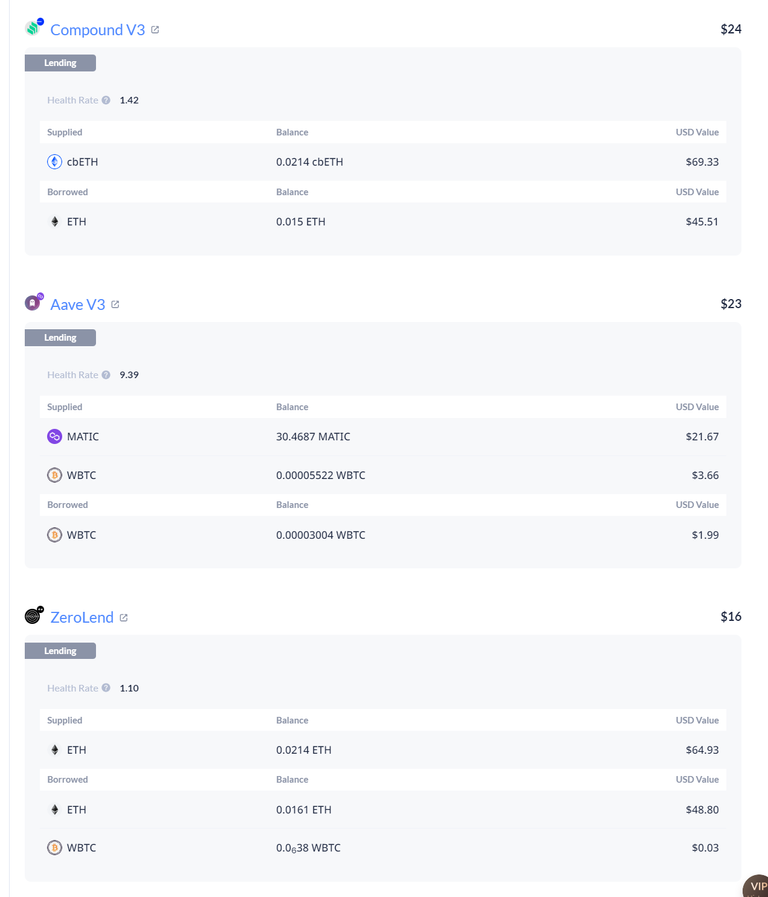

Just updated my allocations in my test portfolio to take advantage of some airdrops and farming via various lending, perp market making and airdrops on AAVE (ARB Airdrop on USDC), Radient (RDNT & ARB interest and airdrop), Moonwell (WELL airdrop), Zero Lend (ZERO Airdrop), HMX (BLAST Points and PYTH, Dragon Points & esHMX, Compound (COMP interest), DERI (DERI rewards).

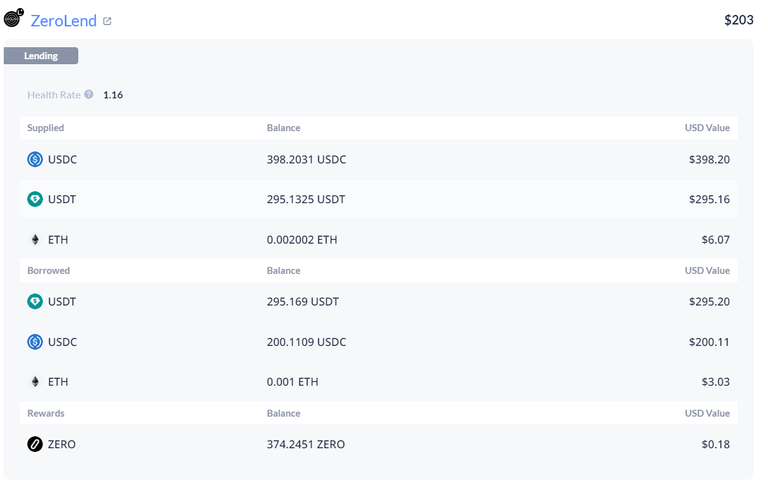

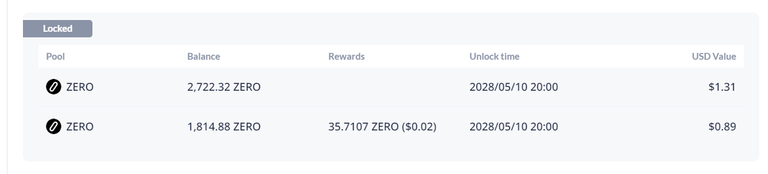

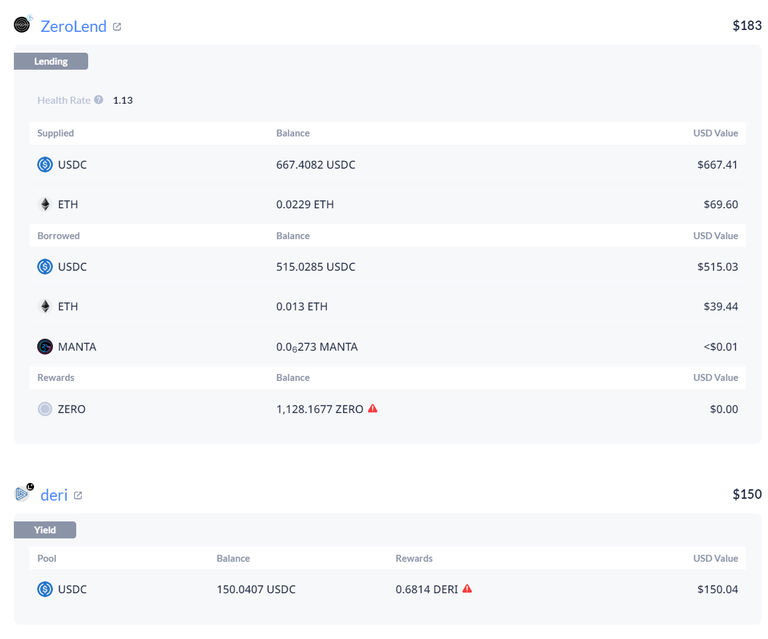

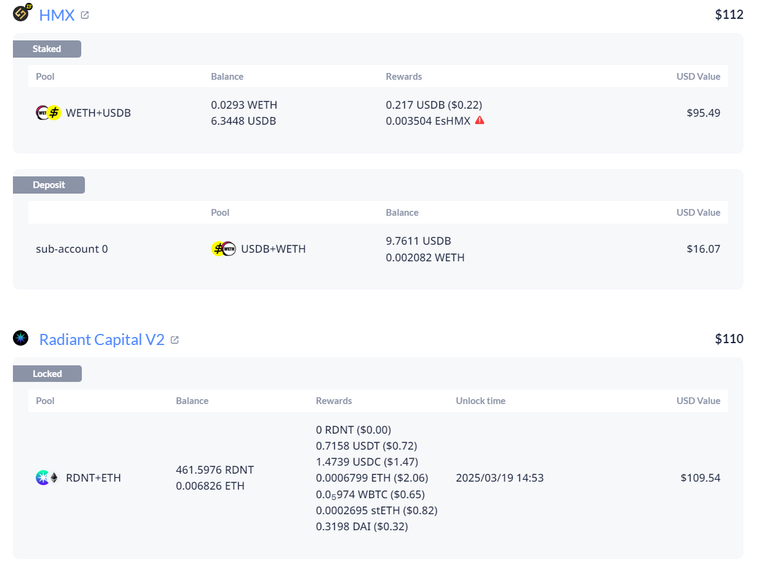

I think zero lend on manta has some of the best deposit and borrow airdrops for ZERO currently as the supply and borrow aprs are very close and the ZERO APR on top of the deposit and borrow more than 20X the borrow rate so the return in ZERO is very good on Manta right now. Already accumulated another 1128 ZERO in in less than a day I beleive since I opened the postion and will be staking that weekly on Linea which is where all ZERO earned is staked at about 130% right now and I want to maximize this as much as possible before the PYTH airdrop and get as much ZERO as possible staked and locked up for 4 years so it gets the 130% APR. Lower locking periods offer much worse terms like less than a year is like 12% or something so might as well lock it up as the return will give you the ZERO locked back in less than a year with a APR of 130% and if you account for the PYTH airdrop it will be less and what ever other airdrops are coming as indicated on the site. Also HMX trading incentives airdrop PYTH and esHMX and to take advantage of that I have been using high leverage on pairs that offset each other in gains so I am risking like 100 dollars and using anywhere from 10-400X leverage on forex pairs trading to collect a funding rate and also close out the positions when they have a gain or are break even to get the trading volume with little to no losses and claim more of the airdrops for trading volume. I am doing this on BLAST and ARB as well. Also using the airdrops to buy and stake more HMX to earn additional shares of the protocol trading fees to increase my share of the pie. I have am increasing my deposits and lending on Radient as well as they have a nice airdrop of ARB on USDC deposits as well as RDNT interest in excess of the cost on the borrows so they can be looped and the RDNT will be used to zap into DLP to earn additional fees in 8 different tokens such as BTC, ETH etc. I am still adding more to the positions and adding new airdrops and plan to add additional protocols that hedge a different aspect of the portfolio so that there are high returns and low volatility. I have been looking at various options protocols and am currently using Hegic to stake and get exposure to the option writing side as well as looking at a options market maker protocol to earn fees from that asset class. Having additional income not correlated with SPL assets will be good to take advantage of dips in SPS and DEC as well as assets when they seem to be miss priced so my BP wont be impacted as much by the recent fluctuations in SPL assets and tokens as they have been more volatile lately and have less liquid asset markets than in the past as well as less rental demand for cards so APRs are down and that means you need to get cards cheaper on the bids to get a good APR in a lower demand environment. Also need to be selective with buys as cards have taken a beating and some of the cards I bought have halved or more since a week ago but I think demand will start to pick up over the next 6 months as these prices are getting pretty low for some of the assets. Land had especially taken a beating from when i purchased most of mine so my ROI on land currently with SPS in the all time lows has gone to almost single digits but all it takes is a little inc in SPS price for it to get back in the 20-40% range on my cost basis and since the land market is very illiquid right now holding and collecting SPS and selling off some of it when prices are up for the day or week and using it to get some of the cost out so there is less risk in the game when markets are not at the best. I am also keeping some in the game to add to my stake when needed or make strategic purchases of assets that I believe are undervalued.

ing pret

Congratulations @hive-178951! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 30 posts.

Your next target is to reach 500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: