The Hive stabelcoin has been around for a long time, a total of six years when we include the previous version. Since the creation of the Hive chain, March 2020, it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can lose its dollar peg. Something that every HBD holder should have in mind and adjust their positions accordingly.

2023 is starting to see some small positive trends, so lets take a look how is HBD doing under these conditions.

Background generated with Midjurney

HBD is being created and burned in multiple ways. Like many things on Hive, it has its nuances. The main mechanics for expanding and contracting the supply are the conversions, but there are also the author rewards, proposal payouts, interest payouts etc.

For better visibility we will be grouping the HBD created/burned in the following categories:

- @hbdstabilizer

- Conversions

- DHF Payouts

- Author rewards

- Interest payouts

The HBD in the DHF is treated differently than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market, so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is 2016 – 2023, with a focus on the last year.

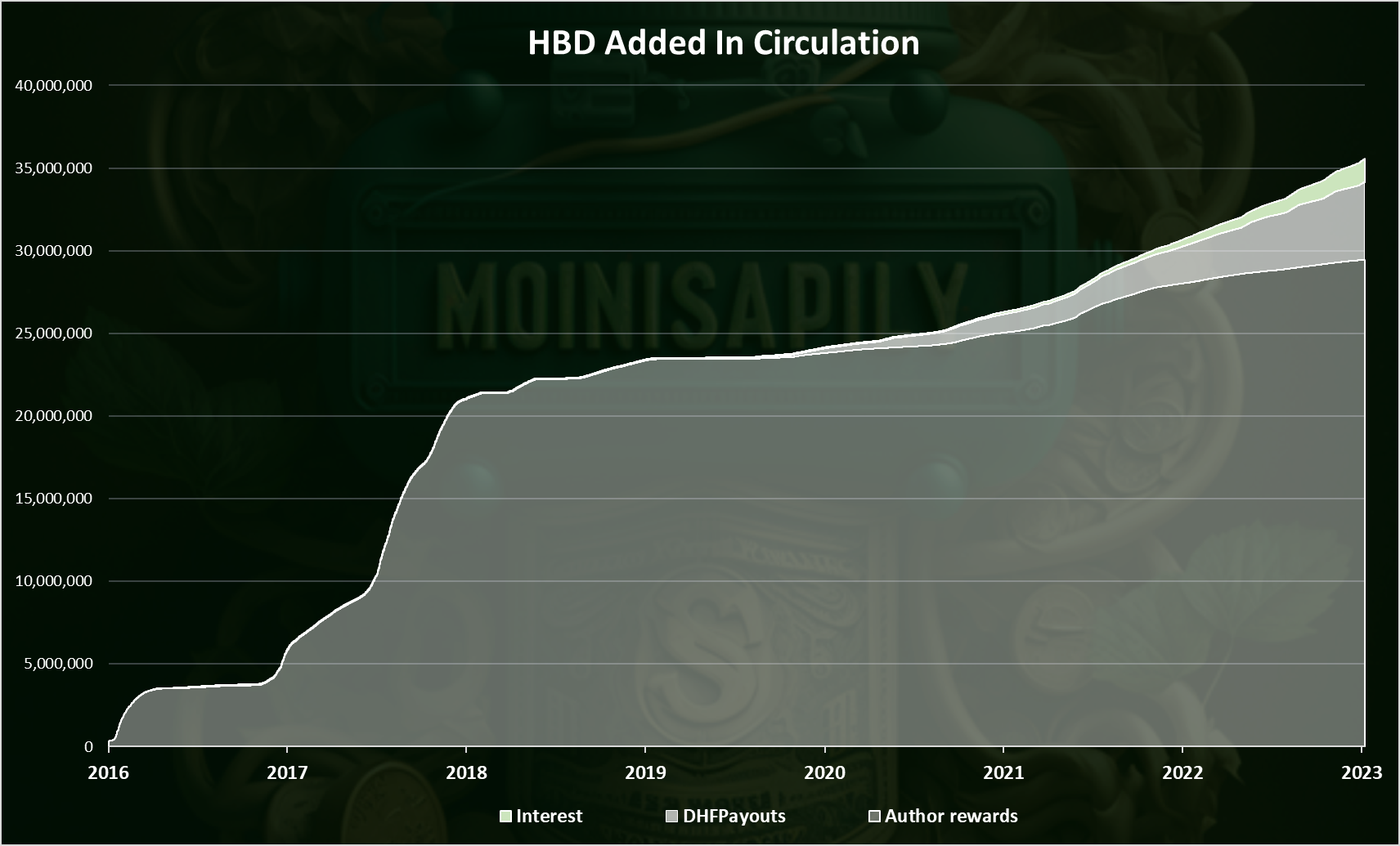

HBD Added in Circulation

HBD enters circulation via multiple ways, like author rewards, DHF payouts and interest to HBD held in savings. HBD is added in the DHF as a share of the inflation, but we will be looking at the HBD that only leaves the Decentralized Hive Fund, the DHF payouts.

Here is the chart.

The chart includes the following:

- Author rewards

- DHF Payouts

- Interest

As we can see the authors’ rewards are the number one source for HBD created.

HBD in theory can be created through conversions as well, but conversions can be both positive or negative depending on market conditions. Here we will be looking at the data for conversions under the HBD removed section.

Almost 30M HBD was created as author rewards since the very beginning, then 4.7M as payouts from the DHF, and 1.3M HBD as interest.

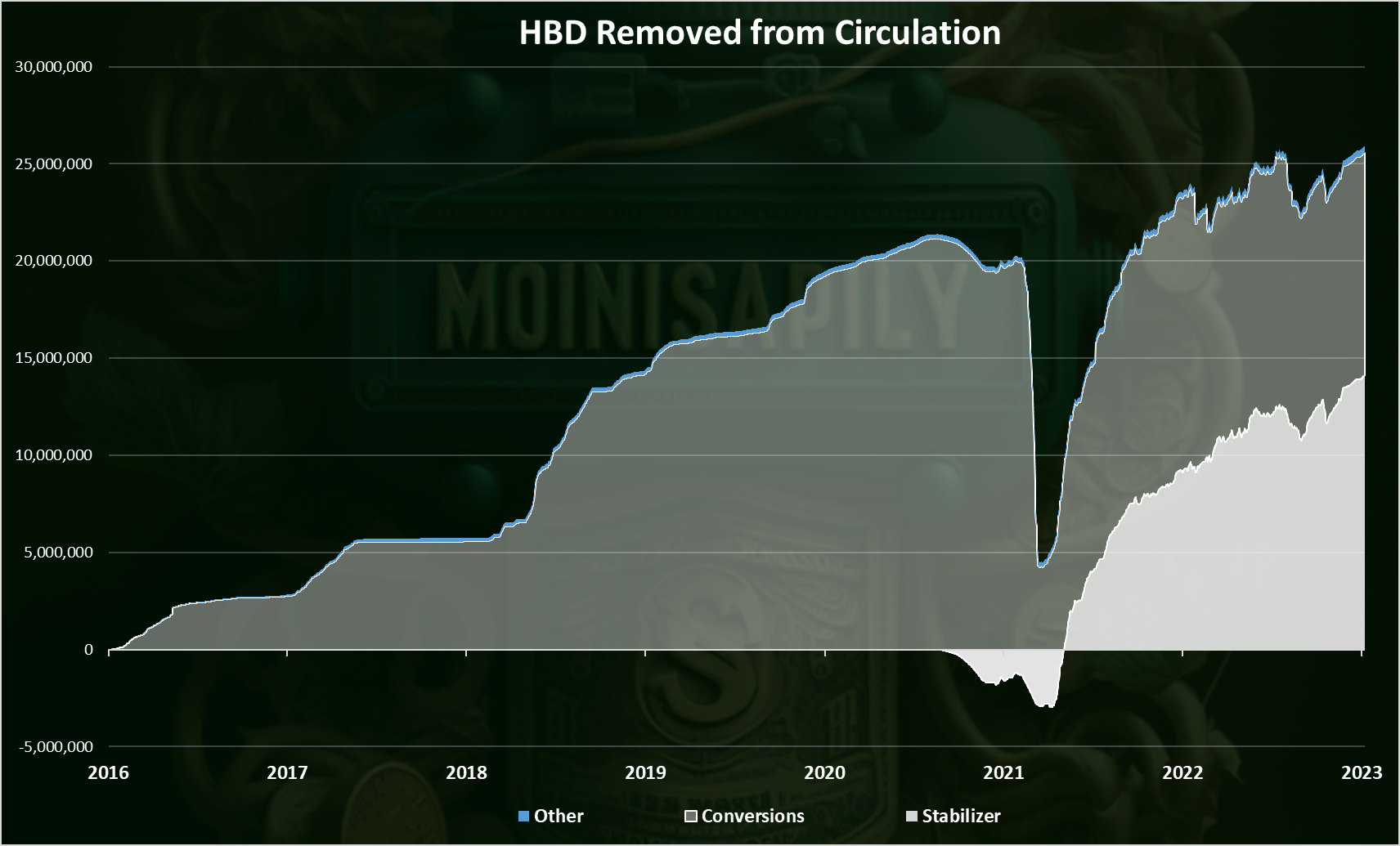

HBD Removed from Circulation

Now let’s take a look at HBD removed. Here is the chart.

We can see that up to the start of the stabilizer, the main way to destroy HBD was conversions to HIVE. Since the launch of the stabilizer, it has also played a major role in the decrease in the HBD supply. In the last year it has been the main method for removing HBD from circulation.

Cumulative, the stabilizer has removed 14M HBD from circulation, while 11M were removed trough conversions.

The stabilizer is providing support for the HBD price on the internal market, buying HBD with HIVE if the HBD price is below the dollar. Since recently the stabilizer has scaled down its operations and lowered the funds that is receiving from the DHF. Will see how things will evolve going forward.

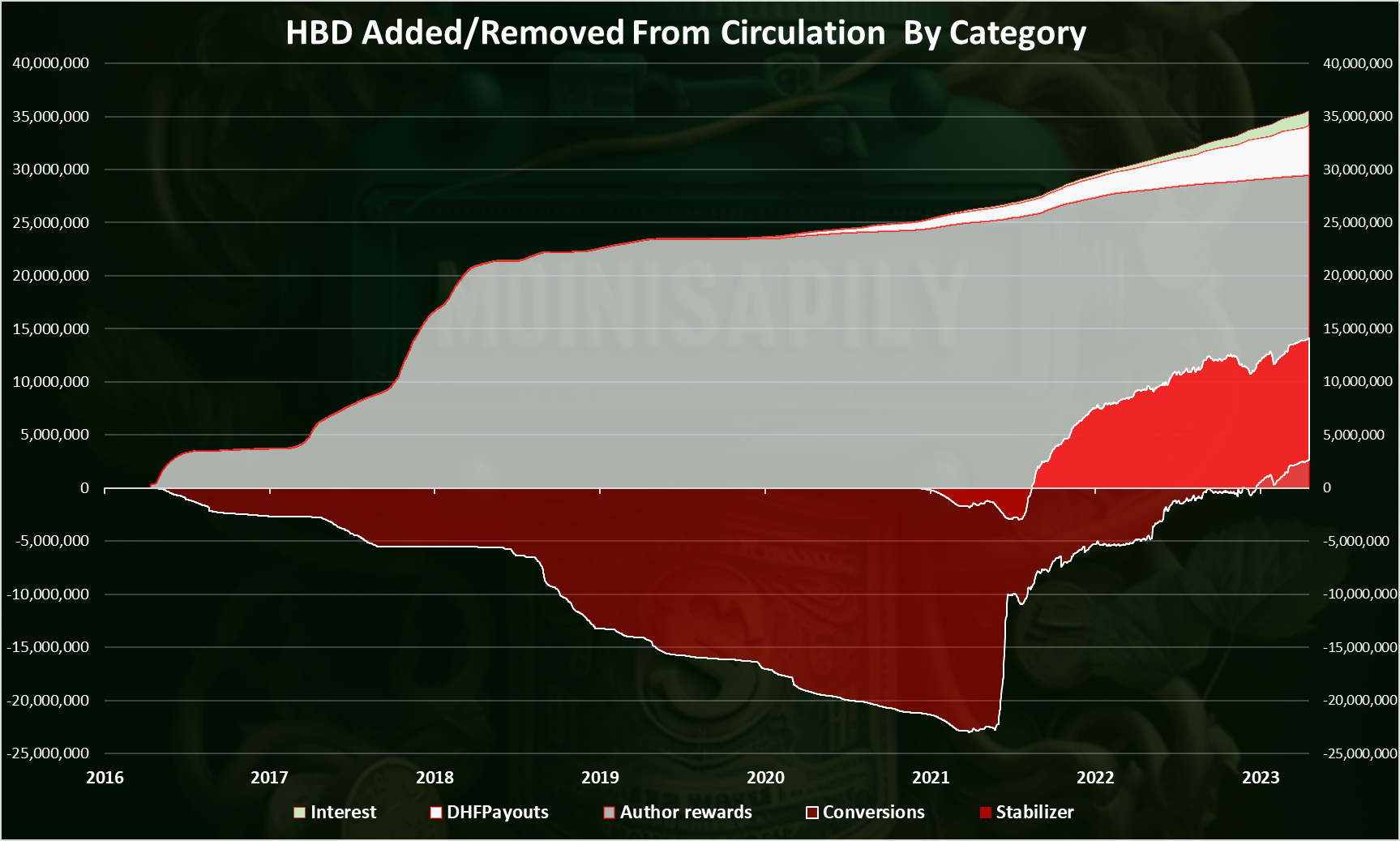

Cumulative HBD Added/Removed from Circulation

When we add the two charts above, we get this.

As mentioned already the author’s rewards are the main category in the positive, and the stabilizer is dominant in the negative.

What’s interesting is that after the introduction of the HIVE to HBD conversions, we are now seeing that the trend for the conversions has switched and now there is more HBD created from conversions then removed.

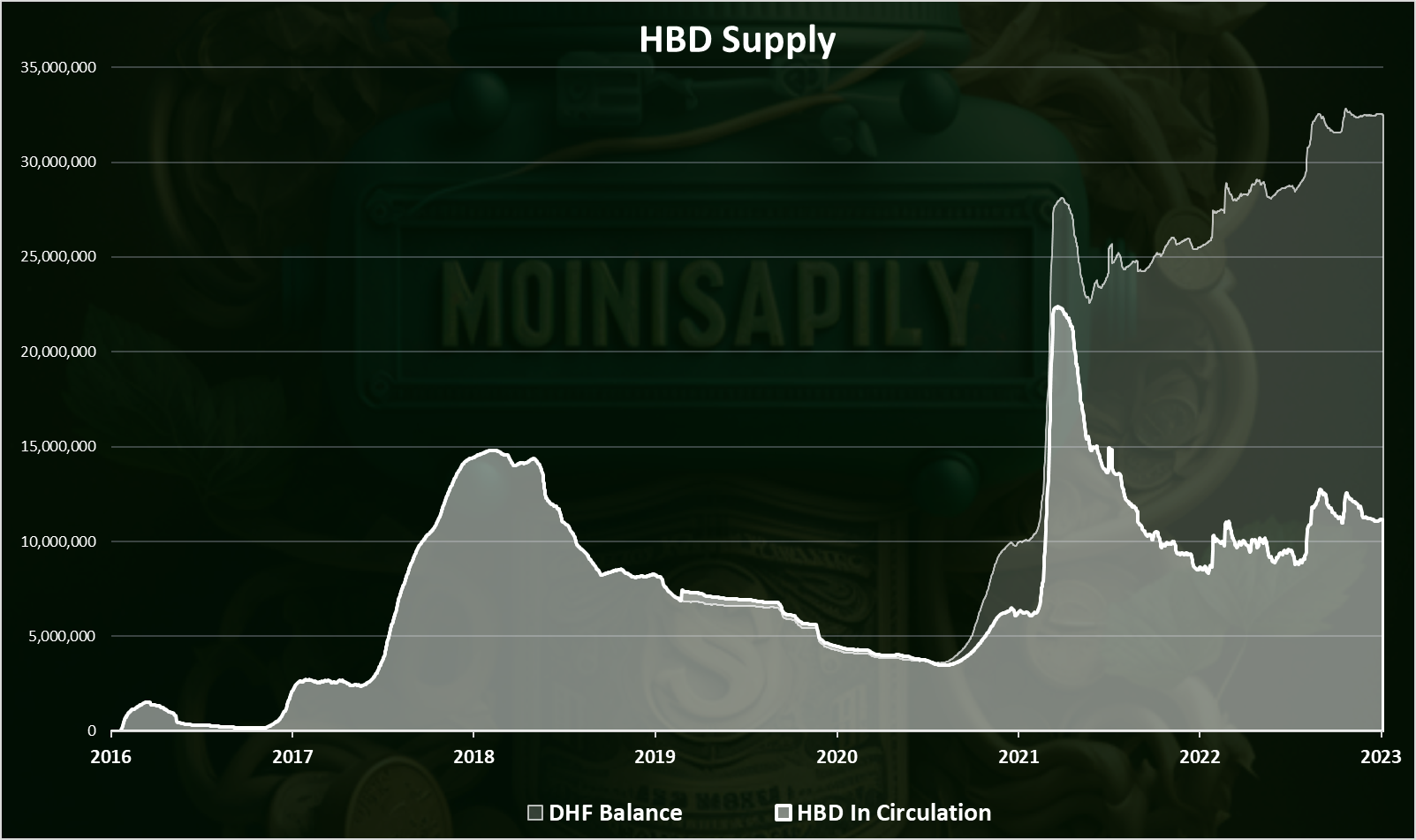

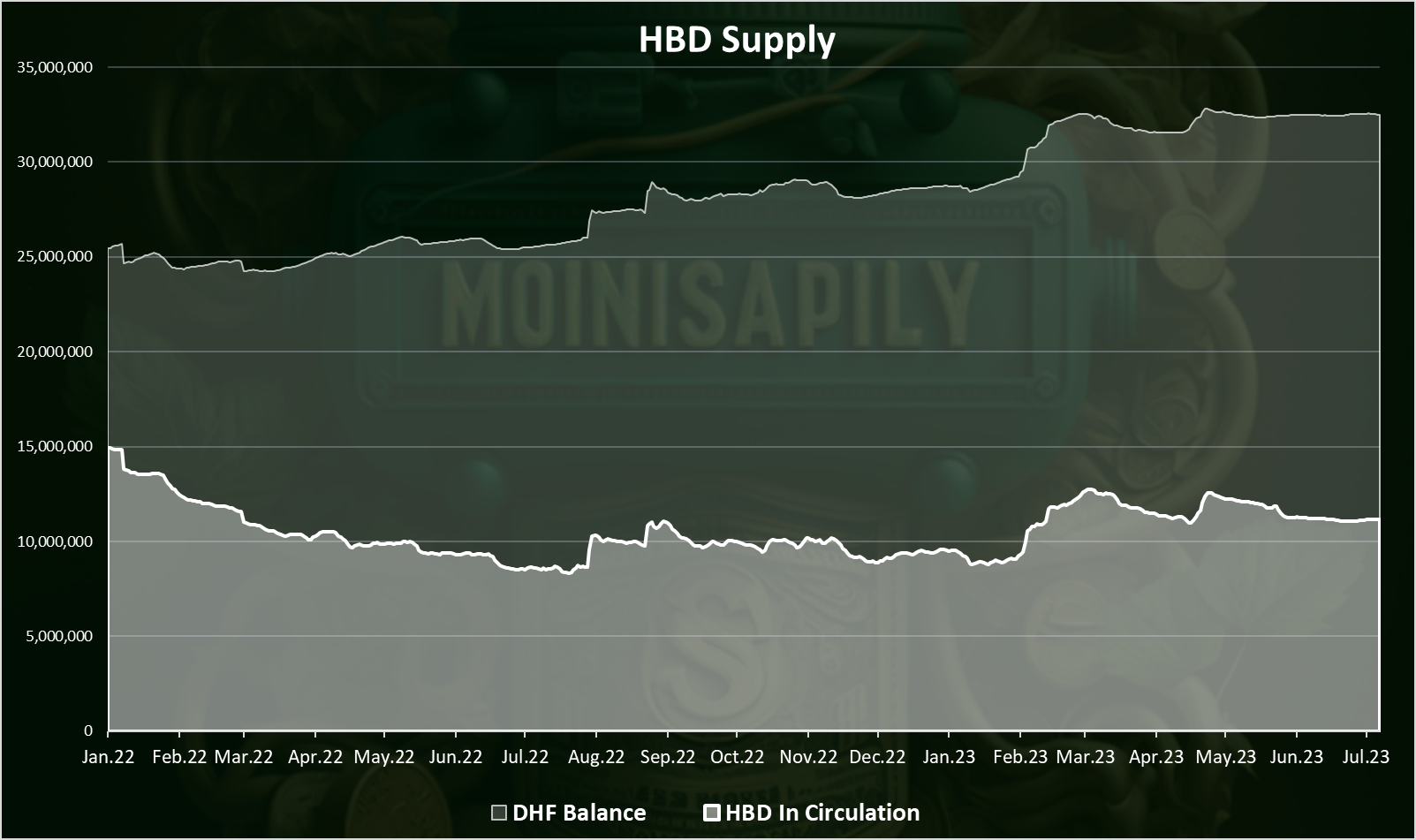

HBD Supply

Finally the HBD supply looks like this.

The HBD in the DHF is represented with the light white.

We are now at 11M HBD in circulation, while there is another 21M HBD in the DHF, accounting for a total of 32M.

In the last year the HBD in circulation has been around the 10M mark, going from 9M to 11M HBD.

When we zoom in 2022-2023 we get this:

Back in 2022, the freely circulating HBD supply started the year with 13.7M and ended the year with 9.2M HBD supply, or a 4.5M reduction in the supply. In the first half of 2023 we have a slight increase in the supply from 9M to 11M.

On the other side the HBD supply in the DHF has increased from 10M at the beginning of 2022, to 21M where it is now.

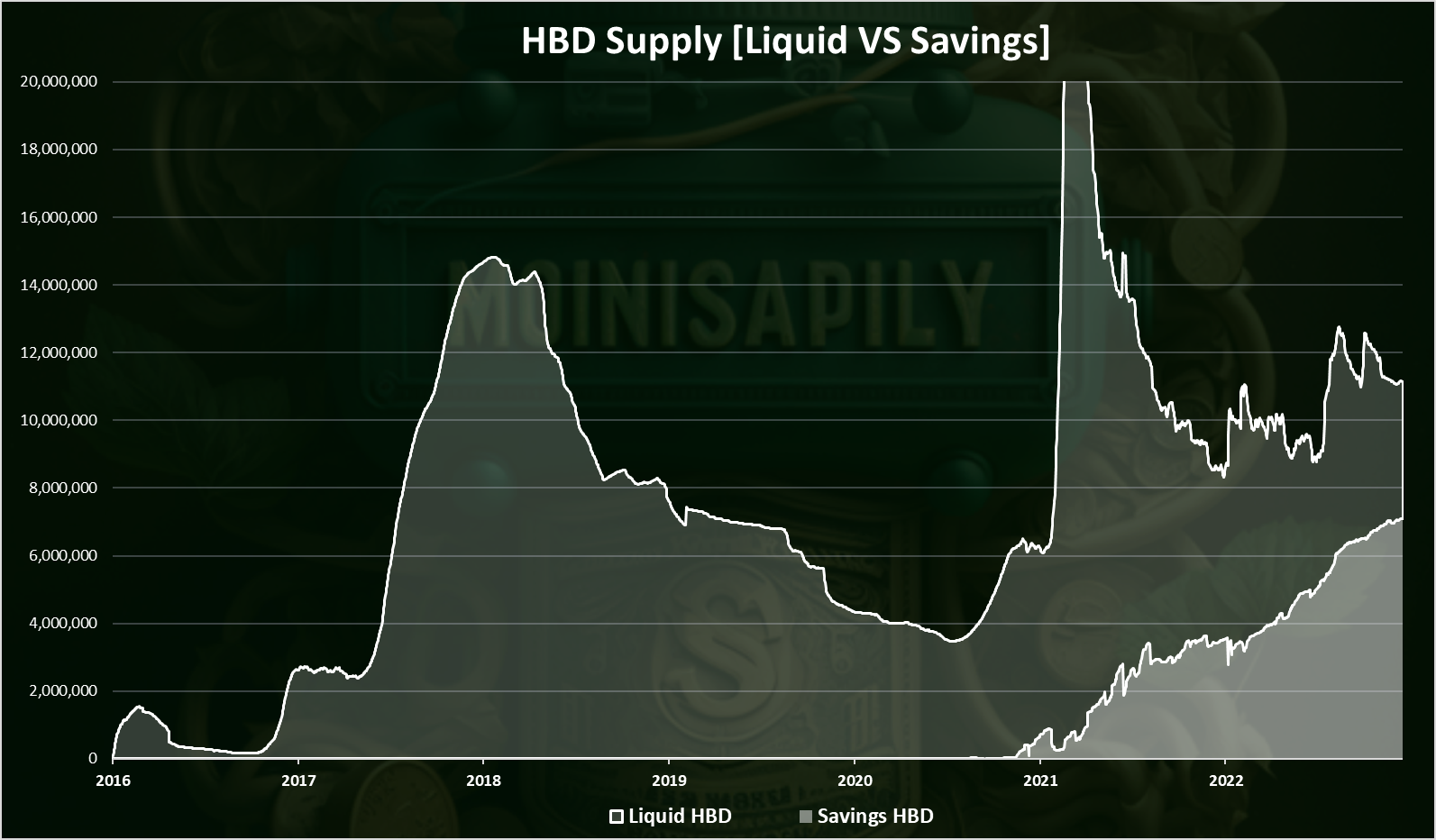

HBD Liquid VS Savings Balance

We can clearly see that since the introduction of the interest for HBD, back in 2021, there is a constant growth in the amount of HBD in savings, while the liquid HBD supply went down.

We are now at 7M HBD in savings from the totally 11M supply, leaving 4M liquid HBD.

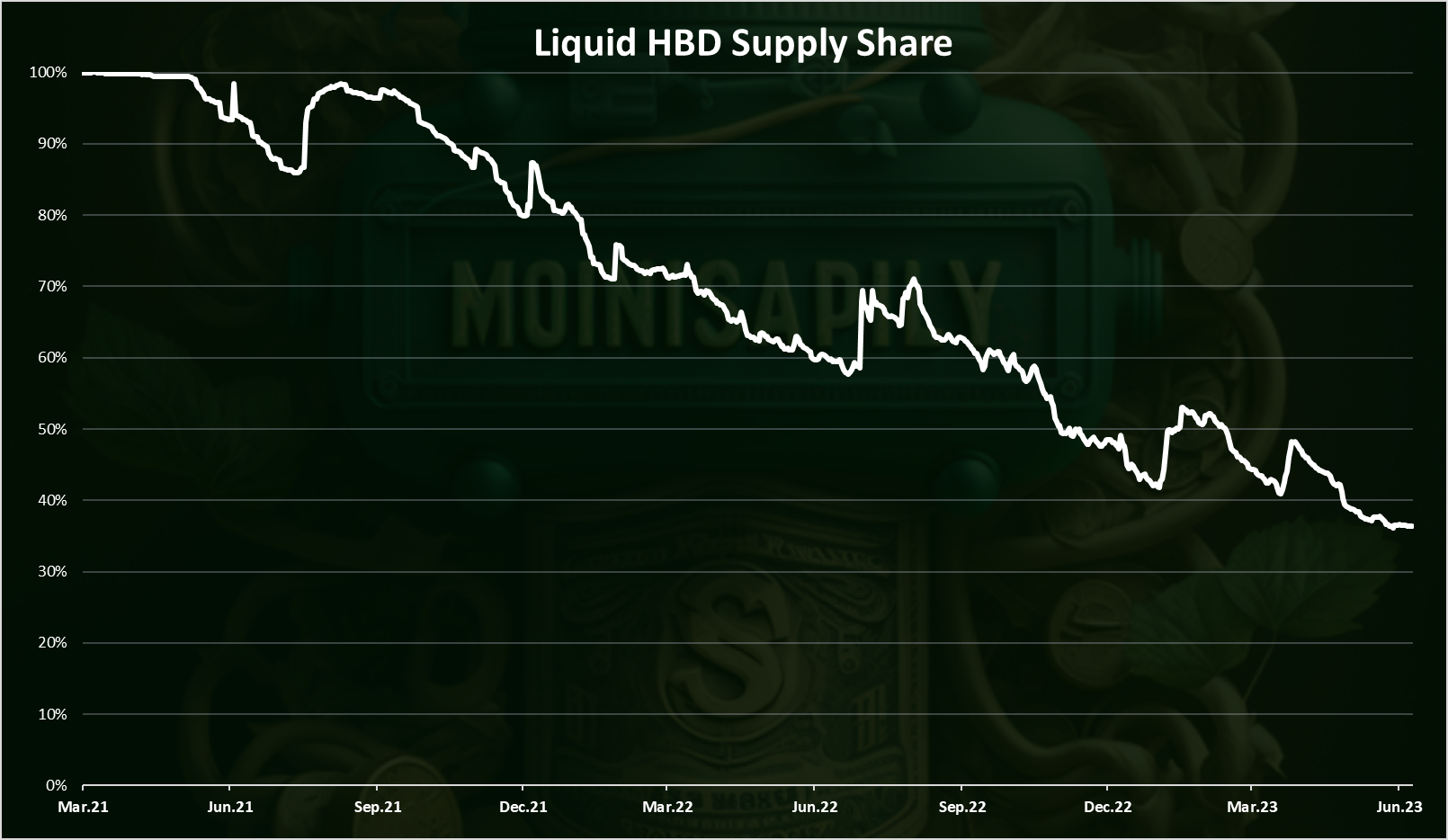

Liquid HBD Share [%]

The chart for the liquid HBD supply share in percent, excluding the HBD in DHF and in the savings looks like this.

We can see that the liquid HBD supply share keeps going down. In the last two years. We are now at a record low of 36% liquid HBD. A year ago, this number was around 70%.

As the liquid HBD supply drops, the demand for new HBD should trigger conversions from HIVE to HBD, driving demand for HIVE as well.

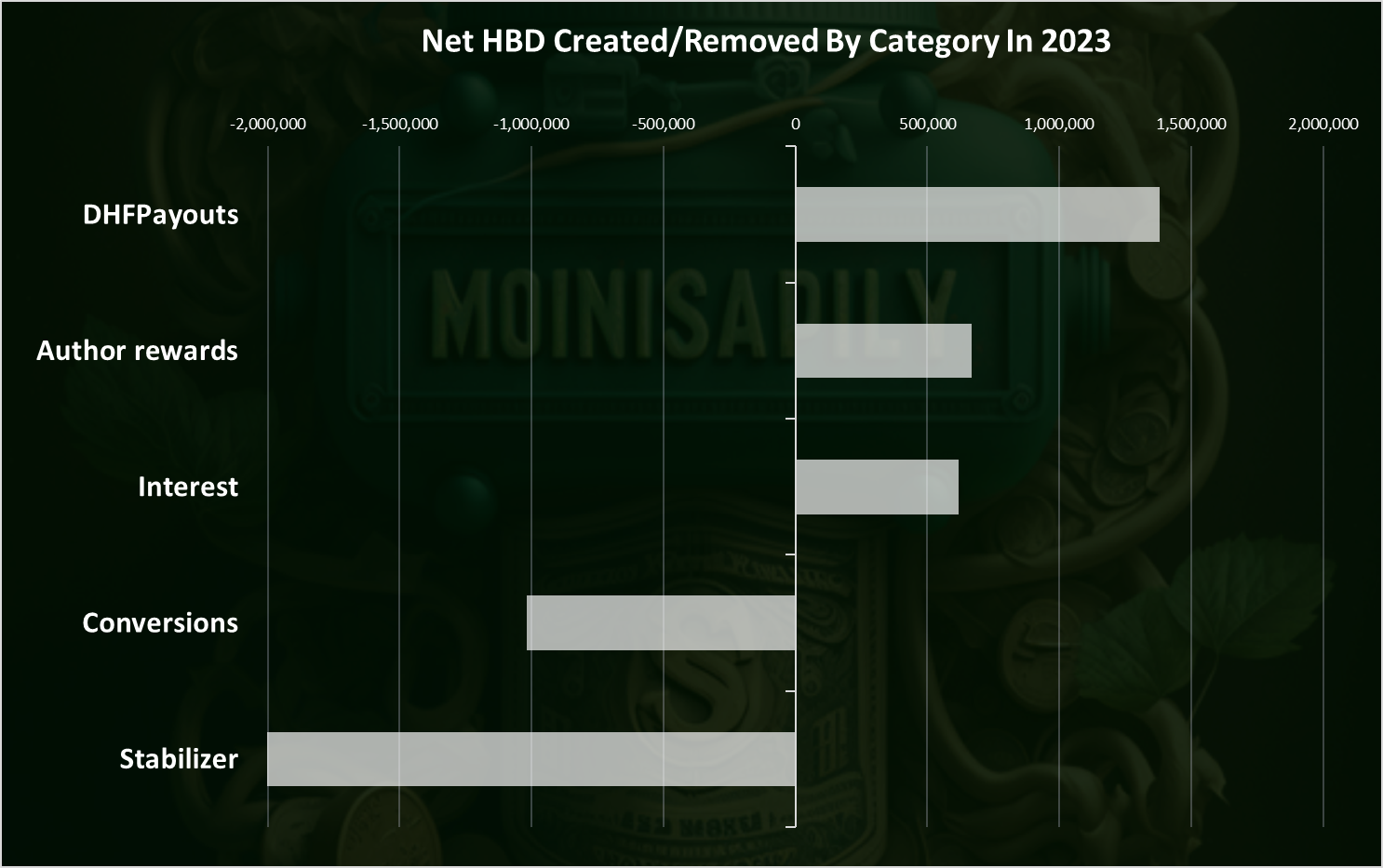

Summary for HBD Added and Removed by Category in 2023

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

In the first half of 2023, the DHF payouts are the number one way for HBD entering in circulation. Almost 1.5M HBD was put in circulation in this way. Next are the authors rewards, and then comes the interest payouts.

When it comes to removing HBD from circulation the stabilizer is on the number one spot now with 2M HBD removed, followed by the conversions with 1M.

We are seeing that there is now a shift in the way HBD enters circulation. In the past the majority of it was put in circulation from the authors rewards, and cumulative this is still the bigesst position. But in the last year the shift is more towards proposal payouts and interest, that is close to the author rewards. It should be noted that this is just half of the author rewards, the other half is paid in HIVE.

Summary

It’s been a wild ride for the HBD, if look far back since 2016. But we can conclude that it seems that HBD has entered a maturity phase with a more stable price and therefore supply. In the last three years, HBD has never lost its peg on the downside, and after the massive increase in the supply back in September 2021, the fluctuations since then are less volatile. The HBD in savings has kept growing, causing the liquid HBD supply to reach record lows of 36%. The DHF payouts have emerged as the main source of new HBD in 2023, while the stabilizer is the main reason for the contraction. The circulating supply (excluding the DHF), in the first half of 2023 has slightly increased from 9M to 11M HBD, after a period of contraction in 2022, when it dropped from 14M to 9M.

All the best

@dalz

Posted Using LeoFinance Alpha

All these terms are new for me as I am a new user. But really informative.

It will be good to invest in HBD in this time since you said the price is really becoming more stable than that of four to five years ago.

If I may ask, can I just invest in HBD at any day and get my 20% profit after thirty days or is there a particular date for investing in HBD

@dalz one question, what do you think about the scenarios at the end of 23 and beginning of 24, do you believe that the percentage will remain 20%, which will reduce or increase the accumulation via savings?

I cant really tell about the 20%, will it change or remains the same, since it is not a one person deccison, so everything can happen. In order to have any predictibilty for the interest rate, there needs to be rules in code, amd I'm not sure what those will be

i'm agree 100% with you, its imprevisible the % ,I'm also following the graph of active users, this indirectly impacts hbd as well, hive is going through a period of transformation, I hope this is the moment when we will be able to develop and populate the communities within it more, thanks for the answer

Long live HBD!! The stable coin of all stable coins.

I appreciate the information and thanks for the update.

Awesome analysis as always and thanks for sharing.

Tnx!

Muito interessante a analise.

Important information. I am still learning.

Another great and informative post.

Thank you for sharing this information with the community. 😃

!ALIVE

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @tuisada. (8/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

i like hive and hbd =^^=

What a great analysis! I wonder what is the main use of the HBD apart from speculation and savings?

is interesting the fact that the DHF payouts have emerged as the main source of new HBD in 2023, while the stabilizer is the main reason for the contraction. This suggests that the HBD is becoming more self-sufficient, and that it is no longer reliant on the influx of new HBD from author rewards to maintain its peg.

The supply of hbd seems to be increasing

I found it very informative, I was surprised to see how HBD supply has increased in July, after having contracted in the previous months. I have also been struck by the role of the HBD stabilizer, which has burned more HBD than it has created.

What are your thoughts on the future of HBD?

HBD es una gran moneda, y es nuestro mayor respaldo en la cadena de bloques, y tiene una excelente capitalización de mercado que sube día a día, yo creo que está en uno de sus mejores momentos.

Oh! I believe Lazy Panda must know very well where the most part of those HBD in "savings" are right?

But then, anything is possible in the Twilight Zone!

In a bull run? Yes