Psychological Factors Affecting Cryptocurrency Adoption

If we are not here for the money, why do the views on cryptocurrency content go down with the price in bear markets? There is no doubt that crypto has become an integral part of the lives of many people who would still be here regardless of how much 1 Bitcoin is worth in dollars. And of course, there are those who have been here from the beginning when there was no sign of cryptocurrencies being profitable. But yes, most people are here for the money too. This explains why videos on technical analysis are popular in the space even though crypto assets have proven to be unpredictable when it comes to price. In this article, the psychological factors affecting cryptocurrency adoption are analyzed.

Let’s Face it, it’s Mostly about the Price

If it were up to just the sound technology behind Bitcoin and its use cases, the price of Bitcoin and other cryptocurrencies would most likely not perform as well as they have done over the years. With the exception of people living in countries experiencing galloping inflation and those who need to make transactions without going through traditional banks, most cryptocurrency users would generally be okay without their tokens. We have those who are in it for ideological reasons but I doubt they were buying up huge volumes of Bitcoin at $20,000 for ideological reasons.

The truth is, upward price movements can only be sustained for a long period if new buyers enter the market. For instance, people who bought their Bitcoins below $1,000 per coin are very unlikely to have bought more when the price went above $10,000. It is agreed that cryptocurrencies are a great invention with interesting technology and great potential to change the world in different ways. However, it is the promise of future gains that attracts newcomers to invest any substantial amount in cryptocurrencies. Basically, the price goes up, people tell their friends and family about their gains and get them to buy some coins too. The price continues to go up, more people join and make gains, and the euphoria reaches its peak and even more people with the fear of missing out get onboard the crypto train. It is usually after people get involved that they begin to learn more about the technology and know what it is they bought. This is the reality of cryptocurrency adoption at the moment.

Irrational Behavior at the Peak of the Frenzy

Every time the price approaches a new high in a bull run, the sentiments shared across the crypto community are often positive ones. With most people making gains in dollar terms, it begins to feel as if the price taking a downward turn for an extended period of time would be impossible. At this point, it is all success stories and people kick themselves for not buying more. Some take highly risky actions like selling their homes or taking loans to purchase cryptocurrencies.

Another interesting thing that occurs in such times is that we find people clamoring for cheap coins on social media with comments like, “I would like me some cheap coins” and “ I would scoop up as many coins as possible if it ever falls to $6,000”. Interestingly, such people are nowhere to be found when prices drop to the said amounts and the bulls run away. Sentiments change and price predictions are more modest and pessimistic.

In the midst of all this, there are also those who are less moved by the euphoria. They do not buy because of the fear of missing out or panic sell in bear markets. Even though different investors have different personal traits, it is those who have been around for longer periods that are less likely to make rash decisions based on emotions. This means that if one is able to stick around for a couple of bull and bear markets, one learns the trends, develops nerves of steel and is able to make more rational decisions.

Where we are now and Preparing for the Next Stage of the Cycle

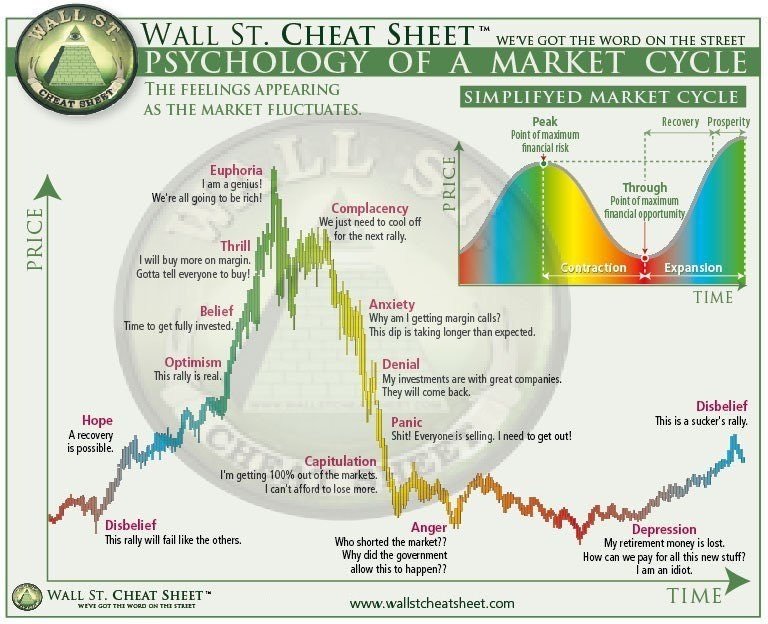

From the Wall Street cheat sheet above we see that at the lowest point of the bear market, we have capitulation, anger and depression. I agree with the assessment that we are probably currently at the stage of capitulation. Some might now be experiencing the panic and others might be angry already.

It is also true that these times are the best to gain more crypto knowledge and invest as well since it positions one for future gains when the next Bull Run shows up with the next wave of adopters.

Are you feeling any signs of capitulation? If so, let me know in the comments so I prepare to buy some more. It has to be said that this is not financial advice. Please do your own research before investing in any cryptocurrency.

Posted from my blog with SteemPress : https://cryptocoremedia.com/psychology-cryptocurrency-adoption/