Introduction to bZx protocol

bZx was founded on Ethereum and synchronized with the Ox protocol. It was the first total decentralized, peer-to-peer margin funding and trading protocol.

Note that bZx is not a cryptocurrency exchange platform but can be incorporated into the technical framework of the present exchanges.

Why integrate bZx protocol?

With the emergence of Ox revolution, new sets of decentralized exchanges (DEXs) are gaining grounds. These new decentralized exchanges was said to proffer a solution to some of the issues plaguing existing exchanges but still devoid of a lot of potentials present in the leading centralized exchanges. Investors in need of a margin lending or a margin trading are left with no other choice than to invest their funds in centralized token and coin exchanges, which exposes them to risks from the third partyknown as counterparty risks.

In centralized exchanges, counterparty risks is very common whereby a third party defaults and jeopardizes the assets of an investor. In that case, margin lending makes the lender susceptible to risk from a third party (exchanges and borrower).

Decentralized exchanges have some shortcomings as well. Especially in their technical framework, there is still some difficulties experienced in the design of an Oracle that can meet up with the settlement security of centralized exchanges.

With the introduction of bZx protocol the issues present in current and existing exchanges will be resolved.

Some significant components of bZx protocol

The Library

The bZx library is a promised based asynchronous JavaScript library that contains all the tools required to connect with the bZx smart contracts on-chain. The software developers can utilize the library to facilitate easy integration and growth of the bZx system. Relays and exchanges will use the library yo create an interface for margin lending and trading on bZx platform. That will provide a value added services to their clients. Besides, these relays are allowed to implement a funding tab, common to various centralized exchanges. bZx will create for funding in the same way that Ox enabled relays to build a frontend for the exchanges.

The bZx Portal

According to the white paper, the bZx portal is a web based decentralized application that serves as a frontend to the bZx protocol, uses the bZx library and function as an outlet for people who need a platform to interact with the system for margin lending and trading purposes.

Guess what?

There is no condition to meet before utilizing the bZx portal for lending or trading on bZx. However, it offers an hassle-free access points for users thatare not acquainted with exchange or relay.

The first introduction of bZx portal will be divided into 4 segments.

The first segment is for lender and traders to execute their transactions.

The second segment is for traders to take care of the loan after the funds are authorized, including the opening and closing of trades as well as ending a loan early.

The third segment is for lenders to manage the loan after the funds are released including a review on how the funds are used and a request for interest payout.

The fourth segment is for bounty hunters to oversee open trades for margin liquidation and liquidate if necessary.

Token Information

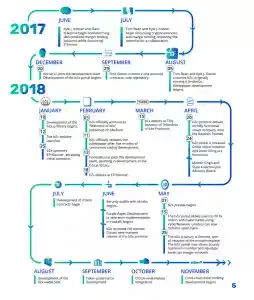

Road Map

For more info visit :

Website : https://bzx.network

Whitepaper : https://bzx.network/pdfs/bZx_white_paper.pdf

Lightpaper: https://bzx.network/pdfs/bZx_lite_paper.pdf

Telegram group : https://t.me/b0xNet

Twitter : https://twitter.com/b0xNet

Facebook : https://www.facebook.com/b0xNetwork/

Medium : https://medium.com/@b0xNet

Reddit : https://reddit.com/user/b0xTeam

Github : https://github.com/b0xNetwork

Authors’s Bounty0x Username : raymondavid

The lending system embedded in the BZX protocol makes it stable and safer to lend digital assets. This is a project to watch out for.

BZX acts as a bridge between the centralized and the decentralized liquidity pools that use the tokenized margin loans.

The traders dealing with centralized exchanges do pay higher interest rates so that the lenders can be compensated for the possibility of the exchange being attacked by hackers. The decentralized margin lending makes it more affordable to trade.