Following the "turkish crisis" and the vertiginous fall of the Turkish lira (TRY) on Friday, there is an explosion of Turkish lira / bitcoin trade. The Turkish lira is overheating. The national currency, which has lost nearly half of its value against the dollar since the beginning of the year, recorded Friday, August 10, a vertiginous drop to historic lows, a decline of 13% on the day.

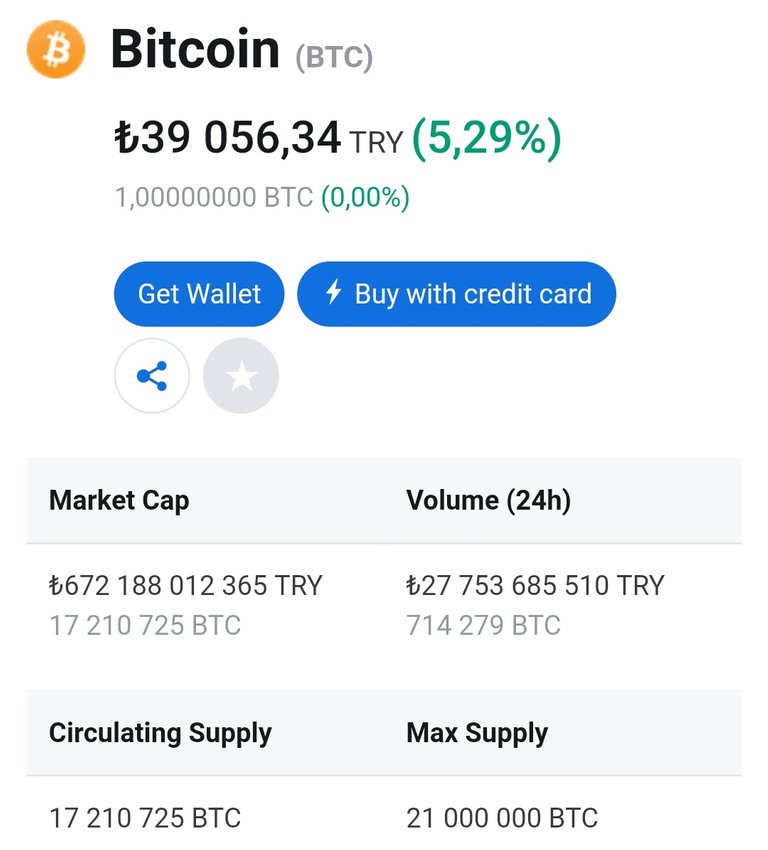

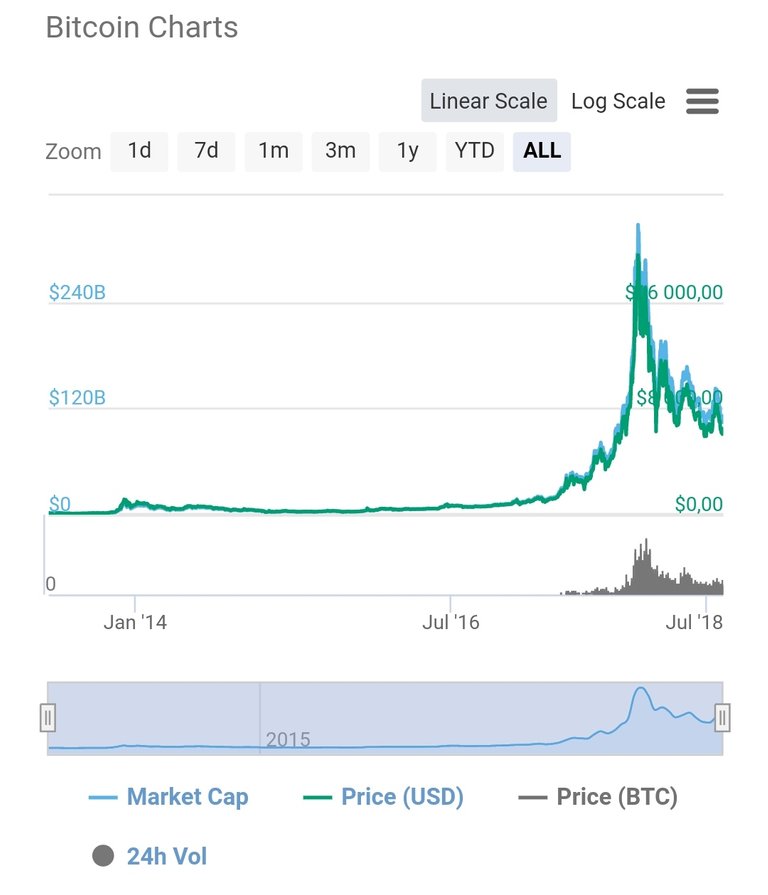

This turkish crisis against a backdrop of strong diplomatic tensions between Ankara and Washington, which came on Friday after the detention of an American pastor by the Turkish government, sent a wave of global shock. It has led in its wake the main European stock markets that have all closed in the red, particularly affecting the banking sector. On Monday, as the currency continues to fall, and worries about the financial markets remain, bitcoin.org has seen a 42% explosion of Turkish visitors. The pair BTC / TRY reached its highest since January 2018.

All these indicators suggest that many Turkish investors are interested in Bitcoin and cryptocurrencies. Turkey is facing a crisis of confidence in its currency, which is pushing more people to take an interest in bitcoin. Bitcoin transaction volumes are up sharply on Turkish trading platforms. Koinim, the country's most important cryptocurrency exchange platform, has seen BTC / TRY transaction volumes rise by more than 60%. On BTCTurk, volumes increased by more than a third and on Paribu, they increased by 100%. Venezuela and Nigeria have experienced similar situations. Political and economic events have led to a hyperinflation of the national currency: confidence in fiduciary money has again been questioned in each of these countries. This has caused many people to take an interest in and invest in bitcoin and cryptocurrency.

For example, today, many Venezuelan traders accept DASH as a means of payment. Some say it is not thanks to ETFs or various holding strategies that cryptocurrencies will be democratized, but thanks to this kind of events: by replacing fiduciary currencies, and by overcoming the current problems of the systems. around the world. That's the essence of Bitcoin.