This post will cover all the common questions related to ZeroBank, and will be updated regularly.

Question 1: What is the total supply of ZeroBank tokens, and is it increasing?

Answer: It’s fixed at 1,600,000,000 ZB tokens.

Question 2: What is the soft/ hard cap of ZeroBank?

Answer:

- The softcap is $ 6,000,000

- The hardcap is $ 48,000,000

Question 3: How is ZeroBank tokens distributed?

Answer: The tokens will be allocated as below:

15% : Team & Advisor

15%: Company Reserve

10%: Sales & Marketing

20%: Community Reserve

5%: Angel Investors

5%: Ambassadors

10%: Whitelist

10%: Pre-ICO

10%: ICO

Question 4: When do I receive my tokens?

Answer:

- Bounty participants, Pre-ICO and ICO contributors will receive their tokens within 02 weeks after the end of our ICO.

- Whitelist participants will receive their tokens 03 months after the end of our ICO.

- Ambassadors will receive their tokens 04 months after the end of our ICO.

- Angel Investors will receive their tokens 12 months after the end of our ICO.

- Team members will receive their tokens 24 months after the end of our ICO.

Question 5: When will ZB token be listed?

Answer: 2 weeks after the end of the ICO.

Question 6: What differentiate ZeroBank from other projects in the remittance industry?

Answer: ZeroBank is different from other projects in the remittance industry in the following aspects:

- We build a practical application that can be used immediately on what we are doing well. We do not create a platform and promise anything too distant.

- With 30 years experience in international remittance and IT solution for Banks, our team is a perfect match with IT knowhow, experience in blockchain, smart contract and customer database.

Question 7: Does ZeroBank have any plans to protect and improve the trust of the investors?

Answer: We commit to what we do. As a group of founders with high-paying jobs and profitable businesses, we gave that all up to start this project. With our specialties in the field, investors who understand our model would put their long term belief in us and the project.

Question 8: Beside fees, what advantages does ZB have over traditional MTO and banks?

Answer: ZeroBank benefits its users in terms of convenience as money transfer can be made anytime compare to only banks’ and MTOs’ working hours, especially considering the different time zone. ZeroBank also provides the community with values, such as better services, and income for many community groups.

Question 9: What is the minimum transaction amount through ZeroBank system?

Answer: The reasonable amount for one remittance transaction is 1,000 USD, and non-commercial transactions are no more than 7,000 USD. Any amount smaller than 1,000 USD bears higher relative commission fees.

Question 10: What do I need to become a ZeroBank agent?

Answer: You have to pass the KYC procedure, and have some fiat money or ZB tokens to start the work.

Question 11: How can I be an agent if I don’t have any Token/ money at first?

Answer: If you want to become an agent you have to pass the KYC procedure. Then, you either buy ZB tokens (from ZB local offices or on any exchanges that ZB token is listed ), or you can complete your first transaction as a sending agent and get ZB tokens. If you do not have ZB token nor fiat money, then you do not have any collateral to become a ZeroBank agents.

Question 12: Will ZeroBank users have to know how to use tokens?

Answer: ZeroBank users (senders and receivers of fiat money) will NOT need to know about blockchain, token, cryptocurrency, etc. Only ZeroBank agents have to use ZeroBank tokens as the collateral for their work.

Question 13: Is ZeroBank tokenized remittance model legal in many countries that are not yet open to cryptocurrencies?

Answer: Currently, many countries are against the use of digital currencies as a means of payment. However, ZeroBank’s business model only utilize ZeroBank tokens as a collateral and settlement instrument.

Question 14: With such a model that requires the processing large information and implementation of new technology, what does the dev team have to tackle difficulties?

Answer: Dr. Bao Ly Van, CTO of Zerobank will be responsible for the development of the system. He has extensive experience in banking system architecture as well as blockchain technology. All tasks from setting up ZeroBank’s architecture, system workflow, to test-net, smart contract development, etc. is under his management. Dr. Bao also works closely with his colleagues from the banking sector in constructing ZeroBank system, and has recruited a team of developers with at least 2 years of experience in the field according to Dr. Bao’s plan.

Question 15: How can I join ZeroBank Pre-ICO, ICO and what is the bonus?

Answer: For Pre-ICO, you can get 15% bonus. Please check it out here: https://ico.zerobank.cash/. The bonus will end on 30th July 2018.

Question 16: With such fluctuation similar to other cryptocurrencies, how can agents manage their ZB tokens?

Answer: There are two options in the ZeroBank system:

- For ZB tokens with price fluctuation, ZeroBank system provides a hedging options for our agents.

- ZBT tokens with stabilized pricing are to be hard-forked later on in the project for agents who only want to work for the service fees.

Question 17: How will ZB agents earn income?

Answer: ZeroBank agents earn from the service fees of their transactions, as well as the trading of the tokens.

Question 18: How can ZB help its agents and customers avoid risks when taking part in the system?

Answer: ZeroBank will provide its users and agents with educative program to help them understand more about the system and the way it works, as well as to comprehend the risks and skills needed and involved.

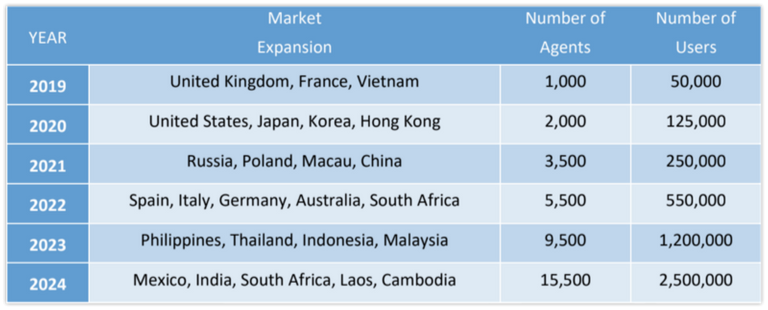

Question 19: At what markets will ZB be available at and when?

Answer: Please see the Global Expansion Roadmap section towards the end of our White Paper HERE

Question 20: What information will be needed to sign up to become users/ agents?

Answer: We will implement a KYC procedure that is the standard in the remittance industry.

Question 21: How should the commission fees be divided between the two agents?

Answer: In each market, ZeroBank’s local office determines a general commission fee level for all agents in the market. Each agent also has an option to provide their own commission fee in case users select them manually. Thus, all commission fees are determined before each transaction.

Question 22: To be a remittance company, what measure of security does ZeroBank have?

Answer: All users and agents in the ZeroBank system have to pass a KYC procedure that is standard in the remittance industry. ZeroBank’s credit scoring system will also increase the security measure in the system. Also, Anti-money-laundering (AML) procedure is implemented as a must in the industry to prevent money laundering and terrorists support. Our founders who are experts in the remittance industry are going to set up these security measures.

Question 23: I'm non-English speaker. Do you have any plans to translate your Whitepaper to another languages?

Answer: We know that a significant part of the ZeroBank community is composed of non-english speakers, particularly Vietnamese, Chinese, Korean and Russian individuals. In line with this, we would like to announce that we have just released a Vietnamese, Chinese, Russian and Korean translations of the whitepaper.

Here are the Whitepaper links:

- Chinese: https://bit.ly/2JG2Ept

- Korean: https://bit.ly/2uKyNqu

- Russian: https://bit.ly/2Lc1l7l

- Vietnamese: https://bit.ly/2L9fylF

- Stay updated on our channels:

Website: www.zerobank.cash - Email: [email protected]

- Telegram Community: https://t.me/zerobank_cash

- Telegram News: https://t.me/zerobank_news

- Chinese Community: https://t.me/zerobank_Chinesecommunity

- Twitter: https://twitter.com/zerobank_cash

- Facebook: https://www.facebook.com/zerobank.cash/