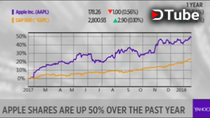

In case you haven’t noticed, Apple’s (AAPL) stock is up a mind-blowing 50% over the past 12 months.

That’s a gain of some $300 billion in market value for shareholders, an incredible run for a company so large (never mind 2X the overall market’s gain.). Apple’s market capitalization is now $911 billion, the biggest of any publicly-traded company and, of course, the biggest ever. (Amazon, btw, is worth a mere $631 billion.)

I don’t know if Apple will become the first company worth $1 trillion, but I do know that the performance of the stock has everything to do with not only the company’s products, but also with Apple CEO Tim Cook’s management of what has become an increasingly key element of succeeding as a CEO in America. That being a Trump strategy.

Yes, Cook brought the iPhone X to market with generally good reviews and sales, apparently signaling another upcycle for Apple’s most important product, the iPhone. But just as important, he has figured out what President Trump and — to my mind by extension — the markets want to hear.

Before I get into to that, a quick look back at Cook’s tenure. Since he took the helm in August of 2011 (two months before Steve Job’s death)—the stock has soared 228% (i.e. more than tripled.) That’s versus 125% for the S&P 500. On the one hand, yes, Cook was teed up for success by a genius, once-in-lifetime CEO. On the other hand, Cook had huge shoes to fill, and more to the point, has not rolled out any revolutionary new products a la Steve. Naysayers said that unless he did that Apple’s stock would falter. To the contrary, it has thrived. Why? In large part because the iPhone’s growth has mitigated that need.

▶️ DTube

▶️ IPFS

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/tim-cooks-trump-strategy-made-apple-killer-stock-181341634.html