In this guide I am going to make comparisons between the money we use today and cryptocurrencies. Traditionally we have only had one system for buying and selling called “money”. However over the last 10 years “cryptocurrencies” like Bitcoin have been used as an alternative form of payment. Lets dive deeper and see just how well cryptocurrencies stack up to money in some key areas...

What is Money?

Money as we know it is controlled and managed by “Trusted Third Parties” called banks. 92% of all money is digital in format and for centuries has been an accepted method of payment.

People are reliant on banks to validate and process all transactions that its customers make. The role of banks is to store customer’s money in named accounts, validate transactions and also log them using a process popularly known as “book keeping”. This “centralised” and closed ledger of transactions can only be seen by the bank and cannot be verified by the public at large.

What are Cryptocurrencies?

Cryptocurrencies like Bitcoin are also digital and accepted as a means of payment for goods or services. They are built on a public and decentralised “trustless” technology called a “Blockchain”, a software which holds the ledger of all transactions distributed across a network of internet connected computers called “nodes”. The blockchain ledger system is transparent and publically available for all to see.

There is no central controlling authority for cryptocurrencies and payments can be made directly between the buyer and seller. Everyone can immediately send and receive currency using a free software program called a “wallet” which can be installed on a computer or smartphone. Paying for things is similar to how Paypal works.

To find out more about cryptocurrencies read my introductory guide “Demystifying Cryptocurrencies”

Security

Whilst you may have your own bank account, your money is controlled by the bank. You have to trust that the bank can manage your account for you. Fraud is possible using money and with so many transactions being made online, thieves and hackers are frequently able to access bank accounts and credit card information from consumers. Fraudsters can also use obtained names and addresses to apply for fraudulent accounts, credit cards, and loans. Embezzlement can also occurs when a bank worker steals funds from customers or from the bank itself. This means the security behind bank accounts has to be comprehensive and each bank needs to independently implement their own systems to secure your account. To protect individuals if a bank were to go out of business, many country’s governments have schemes in place to protect accounts like the the UK’s Financial Services Compensation scheme.

Cryptocurrencies are not controlled by any one person or company. Bitcoin has over 8000 computer nodes running the bitcoin ledger and all have to agree and come to consensus for the blockchain to work. If a someone where to falsify a transaction all the other nodes on the network would have to agree for it to be a valid transaction. The nature of the blockchain technology that cryptocurrencies are based on means that all transactions are intrinsically linked to each other. Every part of the blockchain knows about the other parts. Therefore to falsify a single transaction also means having to change all the other millions of transactions in the blockchain - an impossible feat.

Read my guide which explains the security behind cryptocurrencies.

With Cryptocurrencies you are the bank and 100% responsible for your wallet and the security surrounding it. If you forget or lose your wallet password there is no central authority to call.

Tangibility

It is a common misconception that if all a bank’s Customers lined up to withdraw their money in cash that bank would not be able to pay them. For centuries banks have operated a system called fractional reserve banking. This typically means that they only actually hold approximately 3% of their holdings in cash. The remaining 97% of their “assets” are created out of nothing in the form of loans, credit and interest payable on this debt. There is no effort required to increase the money supply apart from typing zeros on a computer screen.

In the Cryptoworld it is impossible to create cryptocurrencies without a node on the blockchain. An immense amount of computing power and electricity is required to produce cryptocurrencies in a process called mining. I will talk in more detail later on when I compare the supply of money and cryptocurrencies. Once cryptocurrencies are mined they can be viewed on the blockchain so everyone knows how many are in existence.

Privacy

Your bank knows everything about you, what you spent, where you spent it, what you spent it on, your name, address and credit score. Every time you use your bank card all this personal information is attached and can be used to track your location and activities. Banks have also been known to sell this data to third parties without your knowledge or consent like when Mastercard sold client data to Google in 2018.

Using cryptocurrencies your wallet has a public key which identifies the wallet, nothing more and you can make and receive payments anonymously. The only checks that are made by the blockchain are whether the wallet has sufficient funds to pay the seller. All transactions are totally transparent and may be viewed publicly on the blockchain.

Using Bitcoin as an example, below is the transactional history for a Bitcoin public key and the transactions associated with it.

Bitcoin Public Key: 1HS2spBcmRg84JWG7GwZtrL8oEeSy9zjZ3

Click here to view transactions publicly on the blockchain

Barriers to Entry

To open a new bank account there is a lead time whereby the applicant is verified, identification checked, credit score reviewed, account setup and bank cards printed. To get started with cryptocurrencies all you need to do is download and install a wallet.

Not everyone has access to a bank account especially in areas like South America, Africa and Asia. However these groups of people have smartphones and internet which is all that is required to use cryptocurrencies.

Speed

When you make a payment to a retailer using your bank card, you will see money deducted from your bank account the same day, however it may take days for your bank to reconcile with the seller’s bank account.

Similarly cryptocurrency payments are instant but there is no need to wait, both the seller and the buyer get immediate confirmation and this can be publicly viewed on the blockchain.

Costs

If you use a bank card to purchase goods, the retailer gets charged anywhere between 3% and 5% to accept Visa or Mastercard which gets passed on to you the buyer. Some banks will charge a monthly fee to use the account and most banks will charge you to use your card abroad (recently in Argentina all the banks charged me £7 everytime I withdrew cash!). Also if you go overdrawn there will be a penalty to pay as well.

As mentioned previously the computer nodes on the blockchain follow the Cryptocurrency’s software rules to automatically to validate transactions. When validating transactions the node receives a small amount of cryptocurrency as a reward for the work it has done. This reward is only a fraction of a percentage. Cryptocurrencies are borderless so there are no fees to pay in another country. It is also impossible to have a negative balance and be overdrawn, you either have cryptocurrency or you don't.

Restrictions

With money it is the bank that controls your account and they can stop and freeze it without informing you. Often this is useful if it detects “unusual” activity on the account like a large payment. However more frustratingly a bank may prevent you from buying from a particular supplier. Recently Lloyds bank in the UK prevented its customers from buying Cryptocurrencies and most banks will happily allow you to spend with gambling sites and charge you for going overdrawn.

There may be times when you can't access your bank account due to their website being down or the physical bank being closed. Recently while travelling abroad using my debit card there were some countries that would not accept it because it used Mastercard. In these situations I was forced to use my Visa credit card which incurred even more charges!

Using cryptocurrencies there are no restrictions on what you buy, how much you spend or who you buy from in any part of the world. You can buy and sell using cryptocurrencies 24/7 and 365 days a year. The only restriction is that you must have balance of cryptocurrency to pay for the good or service and an internet connection. With cryptocurrencies you are the bank and you get to decide when you spend them.

Resources required

Each banks requires a lot of infrastructure, offices, power, transport and people to keep accounts running. The system behind cryptocurrencies is fully automated and only needs the computer nodes to run the software and follow its rules.

Reliability

The funds inside your bank account exist on computer databases physically at your bank where they will have back up locations, however this is insignificant compared to the number of computers maintaining the Bitcoin blockchain for example. As of May 2018 there were over 8000 Bitcoin computers securing it. If a hundred computers were to go down this would not affect the performance of the network in anyway.

Banks are reliant on the financial networks of Visa and Mastercard to process your bank card transactions, so when they fail as they have done in recent years it is impossible to make payments. The only way a cryptocurrency blockchain could be disrupted is if the whole of the internet globally where to go offline.

Illegal activity

Often criticism is targeted at cryptocurrencies because they are anonymous and therefore can be used for buying illegal drugs and arms trading. For decades that is exactly what cash has been used for and still is.

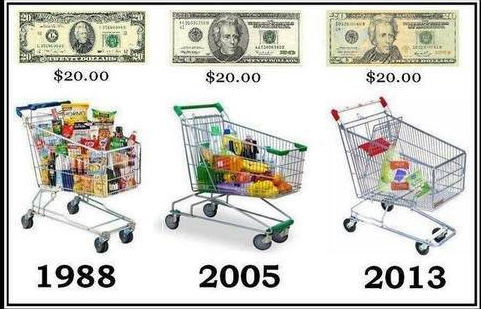

Supply

The privilege of controlling money is given exclusively to private banks. Traditionally money was backed by a weight in gold which gave it an intrinsic value and helped regulate the market because there was a limited supply of gold. These days nothing backs money which allows banks to create an unlimited supply. They create money in the form of credit cards, loans, mortgages, overdrafts and the interest payable on this debt. This has an inflationary effect on the economy which historically has raised prices and devalued money.

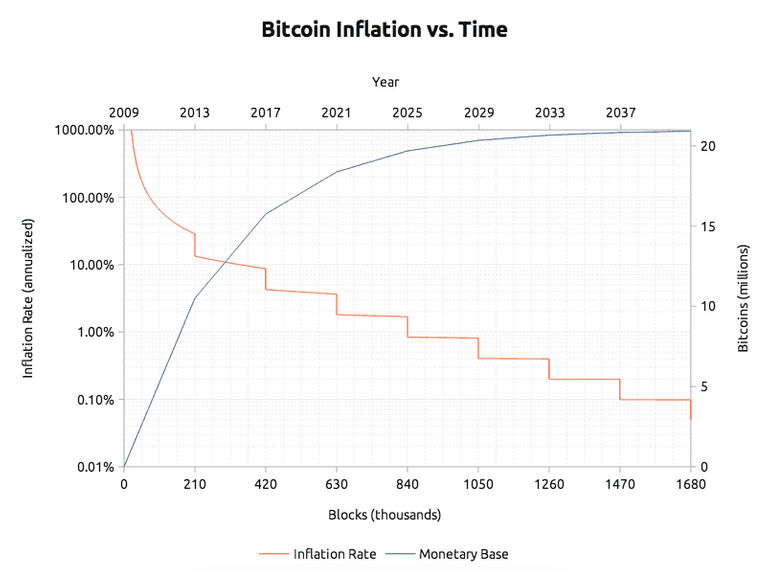

As well as validating transactions, the nodes on a cryptocurrency blockchain like Bitcoin follow the software’s rules automatically to mine and create new currency. This is the only way to bring cryptocurrency into existence. Built into Bitcoin are anti inflationary rules that make creating it more difficult over time. Also the more nodes there are competing on the network, the harder it becomes.

I have written a supporting guide “Demystifying Bitcoin Mining” which explains how Bitcoin is mined.

Value

The continual expansion of the money supply means that a dollar yesterday is worth more than it is today. Cryptocurrencies like Bitcoin are anti inflationary in nature and as such maintain their value - a Bitcoin yesterday is worth a Bitcoin today and tomorrow.

Want to learn more about Cryptocurrencies?

I hope you have found my comparisons to money useful. If you would like to learn more about the topics I have covered in this guide I have written a few more introductory guides:

Why Businesses should accept Cryptocurrencies

How I can help you?

My background is in technology and training and for over 10 years I have provided IT Support to home and small business users through my IT company ithound.co.uk. In recent years I have added cryptocurrencies to my product offering with cryptohound.me.

Whether you are a business wanting to accept cryptocurrencies or an individual interested in investing in them, I will help you get started and provide training and support to give you confidence using them.

I regularly write blogs both on my website and the Steemit platform so be sure to connect with me there. If you would like to support my work please check out my affiliate links below which help finance my work:

- Mine Bitcoin and earn passive income with the Elevate Group

- Earn $10 worth of free Bitcoin on your first trade with Coinbase

- Buy Bitcoin and Cryptocurrencies using the Binance Exchange

- Protect your Cryptocurrencies with a Ledger Hardware wallet

Carl Hughes, The Crypto Hound

Signal Messenger: +447919 562 418

Telegram: @ flowingman

cryptohound.me | @Steemit | @Minds | @Twitter | @LinkedIn | @Trybe | @Gab

Posted from my blog with SteemPress : https://www.cryptohound.me/comparing-cryptocurrencies-to-money/

Disregard fiat, acquire crypto. :D

Posted using Partiko Android

Very good post!