A basic income (also called basic income guarantee, citizen's income, unconditional basic income, universal basic income (UBI), basic living stipend (BLS) or universal demogrant) is typically described as a new kind of welfare regime in which all citizens (or permanent residents) of a country receive a regular, liveable and unconditional sum of money, from the government. From that follows, among other things, that there is no state requirement to work or to look for work in such a society. The payment is also, in such a pure basic income, totally independent of any other income.[2][3][4] An unconditional income that is sufficient to meet a person's basic needs (at or above the poverty line), is called full basic income, while if it is less than that amount, it is called partial. Basic income can be implemented nationally, regionally or locally. Some welfare systems are related to basic income but have certain conditions. For example, Bolsa Família in Brasil is restricted to poor families and the children are obligated to attend school.[5] A related welfare system is negative income tax. Like basic income, it guarantees everyone (where everyone can mean, for example, all adult citizens of a country) a certain amount of regular income; but with negative income tax, the amount a citizen receives depends on his or her income from labor. That is not the case with a pure and flat basic income, where everyone (for example every adult citizen) gets the same amount.

The idea of a state-run basic income dates back to the late 18th century when English radical Thomas Spence and American revolutionary Thomas Paine both declared their support for a welfare system in which all citizens were guaranteed a certain income. In the 19th century and until the 1960s the debate on basic income was limited, but in the 1960s and 1970s the United States and Canada conducted several experiments with negative income taxation, a related welfare system. From the 1980s and onwards the debate in Europe took off more broadly and since then it has expanded to many countries around the world. A few countries have implemented large-scale welfare systems that are related to basic income, such as the Permanent Fund in Alaska and Bolsa Família in Brasil. From 2008 and onwards there has also been several experiments with basic income and related systems. Especially in countries with an existing welfare state a part of the funding assumably comes from replacing the current welfare arrangements, or a part of it, such as different grants for unemployed people. Apart from that there are several ideas and proposals regarding the rest of the financing, as well as different ideas about the level and other aspects.

The idea of an unconditional basic income, given to all citizens in a state (or all adult citizens), was first presented near the middle of the 19th century. But long before that there were ideas of a so-called minimum income, the idea of a one-off grant and the idea of a social insurance (which still is a key feature of all modern welfare states, with insurances for and against unemployment, sickness, parenthood, accidents, old age and so forth).

The minimum income, the idea to eradicate poverty by targeting the poor, is in contradiction with basic income given "to all", but nevertheless share some underlying ideas about the state's or the city's welfare responsibilities towards its citizens. Johannes Ludovicus Vives (1492–1540), for example, proposed that the municipal government should be responsible for securing a subsistence minimum to all its residents, "not on grounds of justice but for the sake of a more effective exercise of morally required charity". However, to be entitled poor relief the person’s poverty must not, he argued, be undeserved, but he or she must "deserve the help he gets by proving his willingness to work

The first to develop the idea of a social insurance was Marquis de Condorcet (1743–1794). After playing a prominent role in the French Revolution, he was imprisoned and sentenced to death. While in prison, he wrote the Esquisse d’un tableau historique des progrès de l’esprit humain (published posthumously by his widow in 1795), whose last chapter described his vision of a social insurance and how it could reduce inequality, insecurity and poverty. Condorcet mentioned, very briefly, the idea of a benefit to all children old enough to start working by themselves and to start up a family of their own. He is not known to have said or written anything else on this proposal, but his close friend and fellow member of the Convention Thomas Paine (1737–1809) developed the idea much further, a couple of years after Condorcet’s death.

The first social movement for basic income developed around 1920 in the United Kingdom. Its proponents included Bertrand Russell, Dennis Milner (with wife) and Clifford H. Douglas.

Bertrand Russell (1872–1970) argued for a new social model that combined the advantages of socialism and anarchism, and that basic income should be a vital component in that new society.

Dennis Milner, a Quaker and a Labour Party member, published jointly with his wife Mabel, a short pamphlet entitled “Scheme for a State Bonus” (1918). There they argued for the "introduction of an income paid unconditionally on a weekly basis to all citizens of the United Kingdom". They considered it a moral right for everyone to have the means to subsistence, and thus it should not be conditional on work or willingness to work.

Clifford H. Douglas was an engineer who became concerned that most British citizens could not afford to buy the goods that were produced, despite the rising productivity in British industry. His solution to this paradox was a new social system called "social credit", a combination of monetary reform and basic income.

In 1944 and 1945, the Beveridge Committee, led by the British economist William Beveridge, developed a proposal for a comprehensive new welfare system of social insurance and selective grants. Committee member Lady Rhys-Williams argued for basic income. She was also the first to develop the negative income tax model.

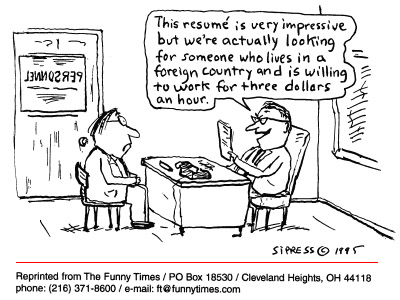

In the 1960s and 1970s, there were a welfare debates in United States and Canada which included basic income. Six pilot projects were also conducted with negative income tax. Then US president Richard Nixon once even proposed a negative income tax in a bill to the US Congress. But the Congress eventually only approved a guaranteed income for the elderly and the disabled, not for all citizens.

In the late 1970s and the 1980s, basic income was more or less forgotten in the United States, but on the other hand it started to gain some attraction in Europe. Basic Income European Network, later renamed to Basic Income Earth Network, was founded in 1986 and started to arrange international conferences every two years. From the 1980s, some people outside party politics and universities took interest. In West Germany, groups of unemployed people took a stance for the reform.[

From 2005–2010 and onwards, basic income again became a hot topic in many countries. Basic income is nowaday discussed from a variety of perspectives. But not least in the context of ongoing automation and robotisation, often with the argument that these trends will mean less paid work in the future, which in turn would create a need for a new welfare model. Several countries are planning for local or regional experiments with basic income and/or related welfare systems. The experiments in India, Finland and Canada, for example, have received international media attention. There has also been several polls about basic income, investigating the public support for the idea in different countries, and in 2016 a basic income proposal was rejected in Switzerland by 73% of the voters in a national referendum.

You obviously put some effort into this post, but I'm puzzled about the assumptions behind these proposals. What kind of limits to you recognize for how much of the GDP could go into government spending...especially if the program fails? What is the rational basis for using the criteria that you (or other progressives) would use for answering that question?

Ha! OK, how about letting me know which issue is most important to you? Do you feel like your paycheck is OK, is your primary concern to look out for poor people, was there another issue that motivated you to look for solutions?