20 Reasons Why Bitcoin Could Skyrocket To $50k

By Adam Boudjemaa Linkedin

This article is not financial advice and I am not a financial advisor. What follows is my personal opinion, subjective and biased.

Bitcoin, created by the mysterious Satoshi Nakamoto, is the most well-known cryptocurrency and enjoys the largest market cap. Over the past few years, interest in Bitcoin has surged, and the cryptocurrency is increasingly being accepted and adopted by major organizations as a digital asset and investment vehicle. Herein is a comprehensive overview of some of the reasons why you should buy Bitcoin.

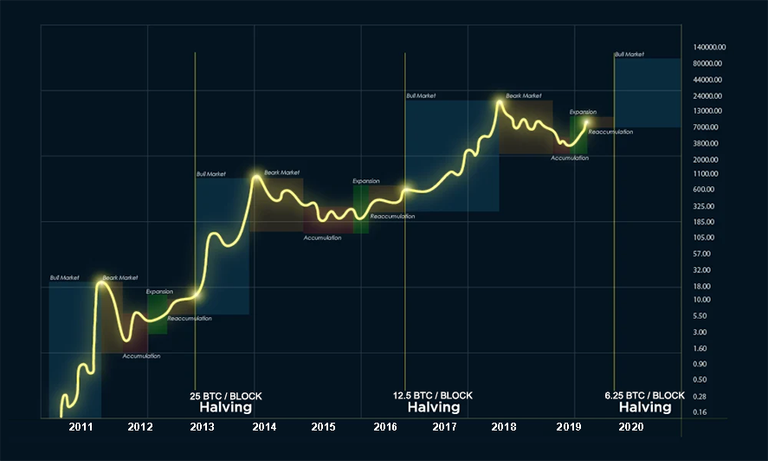

1. Bitcoin Halving

Bitcoin halving, a reduction of the mining reward by 50%, is set to take place in May 2020. Currently, miners receive 12.5 BTC for a successfully mined block. The figure will be 6.25 BTC by the end of May 2020.

Halving was Satoshi Nakamoto’s way of combating inflation by controlling supply. As such, halving is effective at maintaining the value of Bitcoin. Historically, every halving event is followed by a major price spike in anticipation of a disruption in supply and demand balance.

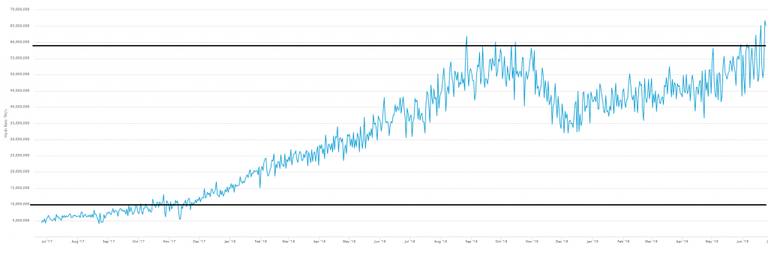

2. Improving Network Fundamentals

Bitcoin’s hash rate, the computing power that secures the network, is currently at unprecedented levels. It has been gradually rising, which may be signs of a bullish market. It hit an all-time high of more than 65 million Tera Hashes per second.

This is a sign that the network is as secure as ever. Growing confidence from miners signals an improvement of the cryptocurrency’s fundamentals, which may lead to price surges.

3. The Bigger Macroeconomic Picture

The supply of fiat currencies continues growing at an accelerated pace leading to gradually devaluation. Since Bitcoin has deterministic supply, it is increasingly been seen as a viable alternative to fiat currencies.

Bitcoin is already a macroeconomic variable is many jurisdictions, including the U.S, China, and the European Union. With the volatility of Bitcoin steadily decreasing, it is outperforming some fiat currencies and looks to be a functioning alternative in the future.

4. It Is Inflation Proof

Among the reasons for Bitcoin’s exponential growth is the overwhelming consensus regarding its programmatically fixed supply. This means that it is not inflatable.

It is a trait that is unique to Bitcoin. Satoshi Nakamoto further incorporated halving to ensure Bitcoin does not experience inflation as it is distributed. All other assets face an inflation risk if their values increase enough to warrant new efforts to increase supply.

5. Bitcoin Is Censorship Resistant

Among the greatest features of a decentralized blockchain is censorship resistance. Bitcoin has a very important history of helping circumvent censorship.

You can send BTC to any address of your choice without the fear of interference from any authorities or regulatory bodies. No corporation or government can silence or remove whatever goes into the blockchain. These safeguards make Bitcoin’s network immutable and censorship-resistant.

6. Bitcoin Cannot Be Shut Down

While governments can discourage the use or hamper the ease of use of Bitcoin, no government can shutdown Bitcoin. You cannot kill distributed cryptocurrencies unless you shut down the whole Internet.

Even officials from the US government admitted this. The underlying transaction records are copied all over the web. This means that, as a digital asset, Bitcoin is here to stay.

7. Higher Adoption Of Blockchain Technology And Bitcoin Globally

While blockchain technology is relatively new, it is currently experiencing adoption worldwide as its application potential becomes more apparent. Many countries, organizations, and businesses are gradually warming up to Bitcoin and other cryptocurrencies. Facebook is among the major organizations looking to leverage blockchain technology as it recently unveiled Libra, a new global coin that aims to bring cryptocurrencies into the mainstream.

8. The Spectrum ICO project

The Spectrum Project is the first dedicated protocol for issuing tokens through Bitcoin’s lightning network. It is an open-source ICO project that includes contributions from startups such as Chainside and investors at Poseidon Group and Fulgur.

It also has support from Bitfinex. The Spectrum Project will enhance the efforts to allow cross-currency swaps in Bitcoin’s lightning network and will serve as a DIY Bitcoin toolkit thus propelling the cryptocurrency’s popularity.

9. The CoinJoin Project

CoinJoin refers to a trustless way of combining several Bitcoin payments from several spenders into one transaction to make it difficult for outside actors to discern which spenders paid which recipients. It is a privacy solution that does not require a modification of the bitcoin protocol.

CoinJoin makes it harder to track funds on the blockchain, thus improving user privacy, which is a hot button issue today. It will help promote Bitcoin as an anonymous means of transaction and thus drive its adoption.

10. Bitcoin Lightning

One of the main issues with the Bitcoin blockchain is horizontal scalability. It was difficult to scale Bitcoin since it is programmed to handle about 3–7 transactions/second (TPS).

This resulted in a slow verification process as Bitcoin acquires mainstream acceptance.

The Lightning Network is the solution to this problem with its potential to scale ~3.5 millions of TPS and increase transaction speed. It is set to make the network more efficient and therefore, more appealing.

11. Fidelity Investment Trades BTC

Fidelity Investment recently announced that it is rolling out BTC trading for institutional customers. The investment firm conducted a survey that revealed that its target market had a consistent appetite for Bitcoin.

Fidelity Investment is one of the largest asset managers in the world, overseeing more than $2.4 trillion in assets. The fact that sophisticated investors are taking an interest in Bitcoin means that it is a valuable asset worth investing in.

12. The Bakkt Platform

The bakkt platform will launch in July and has been designed to allow institutions and consumers to buy, sell, store, and spend virtual assets. The platform’s purpose is to avail trust and efficiency to digital assets such as Bitcoin.

It looks to develop technology to connect merchant/market infrastructure to the blockchain. Backed by large brands including Microsoft, Starbucks, and Intercontinental Exchange, Bakkt is a moonshot bet that may herald a new future for cryptocurrencies where they are feasible and respected means of payment.

13. Bitcoin Exchange Traded Funds (ETFs)

An ETF refers to an investment mechanism, which tracks a particular asset’s performance. A Bitcoin ETF mirrors its price allowing investors to buy into it without trading bitcoin itself. Bitcoin’s unregulated nature has impeded the launch of Bitcoin ETFs.

Regulatory bodies such as the U.S. SEC are hesitant to approve Bitcoin ETF. However, investors and commenters are largely optimistic that a Bitcoin ETF will be approved in the near future. This will open the doors for large financial institutions to invest in Bitcoin.

14. Nasdaq Added BTC And Ethereum Indicators

Nasdaq, the second largest stock exchange, added Bitcoin and Ethereum indices earlier this year. The Bitcoin index on Nasdaq is a likely precursor to cryptocurrency investments.

Analysts claim that these inclusions may lead to the approval of a range of investment vehicles based on cryptocurrencies. Regulatory approval of cryptocurrency-based derivatives in the market could soon follow meaning more interest from institutional and retail traders.

15. Rising Institutional Interest

Fidelity Investments commissioned a research survey that was conducted by Greenwich Associates. According to the survey, approximately 70 % of the participants held positive sentiments about cryptocurrencies, and about half of institutional investors viewed digital assets as worth investing in.

There has been an upswing in the number of institutional investors involved in Bitcoin in recent years. This rising interest will most likely drive Bitcoin’s price up.

16. Bitcoin Is The Gateway Cryptocurrency

Purchasing and trading Bitcoin can be a great gateway to trading in traditional assets, including stocks, bonds, and commodities. Many Bitcoin investors go on to put their funds in other cryptocurrencies and traditional assets.

Bitcoin has demystified the investing landscape significantly and facilitated accessibility to digital assets. This is more evident in the younger generations who trust Bitcoin exchanges over stock exchanges.

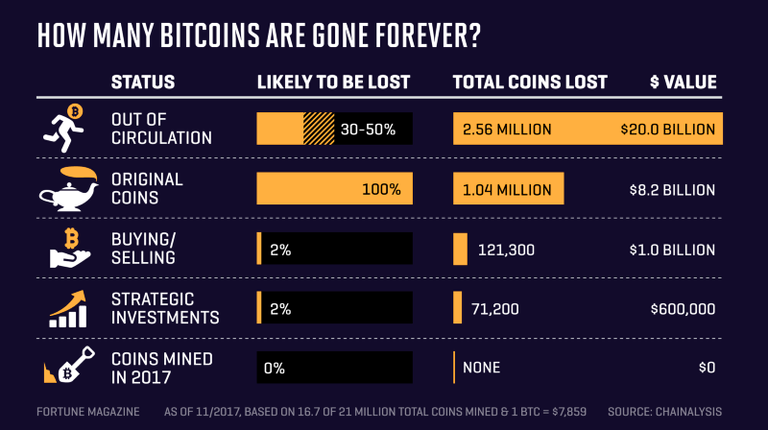

17. Bitcoin Is Scarce

Bitcoin has a fixed supply of 21 million coins. This deterministic supply was designed to produce scarcity artificially. It will get even scarcer as Square Cash app, and GBTC absorbs 10 % and 21 % of the daily Bitcoin supply respectively.

As of 11/2017

As of 11/2017

Bitcoin’s scarcity, much like gold, is what makes it valuable as a digital asset. This means that the cryptocurrency will increasingly be viewed as a great means of storing, processing, and enhancing value.

18. Bitcoin Is Recession Proof

The world is currently experiencing signs of an unstable economy with the prospect of a 2020 recession and crisis in play. The US trade wars with China is at the forefront of the risk factors.

Bitcoin is a fairly non-correlative asset and is recession-proof. Diversifying some funds into Bitcoin is a smart idea at this time. In this scenario, Bitcoin will likely play a significant role alongside traditional safe havens like physical gold.

19. Bitcoin Looks To Have A Bullish Future

This year, Bitcoin has undergone impressive price surges without exhibiting any significant selling pressure. As such, the overall market sentiment is more bullish, and technical analysts expect further gains in the near future. Prominent analysts are pointing out similarities with the 2017 parabolic run that saw a massive bull run. BTC prices may skyrocket if a similar bull run ensues this year.

20. Bitcoin Offers Market Flexibility

You can invest in and trade Bitcoin at any time and on any day. This offers you the flexibility to operate with your investments with no barriers.

Unlike stocks, you do not have to wait for markets to open in order to handle trades, thus you have more freedom with your money. Ultimately, this aspect of Bitcoin drives the price up as it attracts sophisticated investors.

Overall, Bitcoin has numerous qualities that make it a great digital asset. Investing in Bitcoin offers the possibility of large profit margins, security, privacy, control, 24/7 trading, and fast transactions. As more organizations adopt it as a viable store-of-value asset, its market outlook remains very optimistic.