The bitcoin run is far from over. Here’s why.

PlanB’s stock to flow ratio

Worldwide central bank money printing

Institutional investors flowing into bitcoin

Growing access for the average person to invest

Stock to flow of an asset takes into account the total inventory (stock) of an asset and the amount of newly added assets (flow).

Think of gold. There are bars of gold in vaults, golden coins in people’s safes, even gold in people’s teeth. That is part of the total above ground stock. Every year gold is mined out of the ground, different amounts every year but a relatively stable amount. This is the flow. The total above ground stock of gold is an unknowable number that has wide ranging estimates. The newly mined gold every year is more easily tracked but still unable to get an exact number of new ounces brought out of the ground.

Not the case with bitcoin. We know exactly how many bitcoin have been created. We also know how many bitcoin are created every hour. We know that in about 4 years that amount will be cut in half from its current rate. That will continue to about 2140 when the last bitcoin is mined and the 21 million bitcoin that will ever be in existence will be circulating.

PlanB, an anonymous character who at the minimum is known to be a Dutch fund manager has released multiple stock to flow models that have tracked the the preceding price very well.

The latest S2FX model put forward by PlanB incorporates the stock to flow of similar assets to bitcoin in silver and gold. You can see in the following chart how the bitcoin price is triggered upward by each halving of the bitcoin supply. The latest halving happened on May 11, 2020 at 3PM.

There is a wavelike growth of the price of bitcoin that lines up to proceed each halving. According to the S2FX model we are in the growing swell of the next wave. The modeled price between the years of 2020 and 2024 is $288,000.

Bitcoin’s mechanism of halving the new flow of bitcoins into the market makes it naturally deflationary. Increasing scarcity as time goes on. This unique trait of bitcoin is completely inverse to how most of the world denominates their wealth, in central bank issued currency.

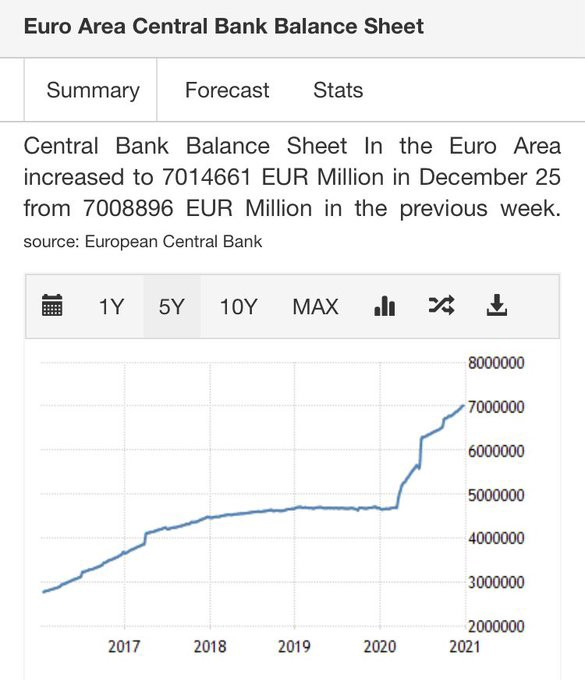

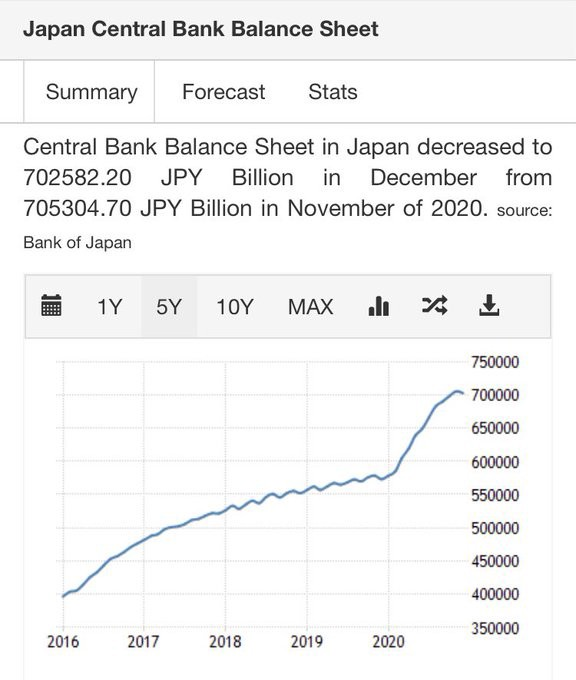

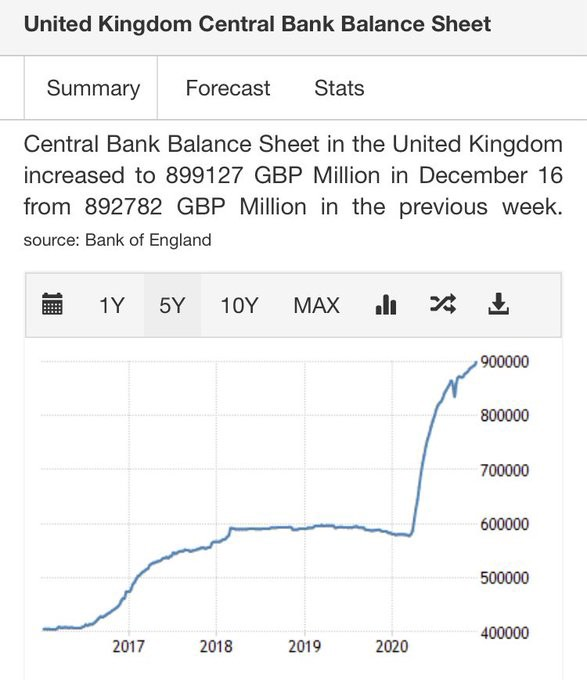

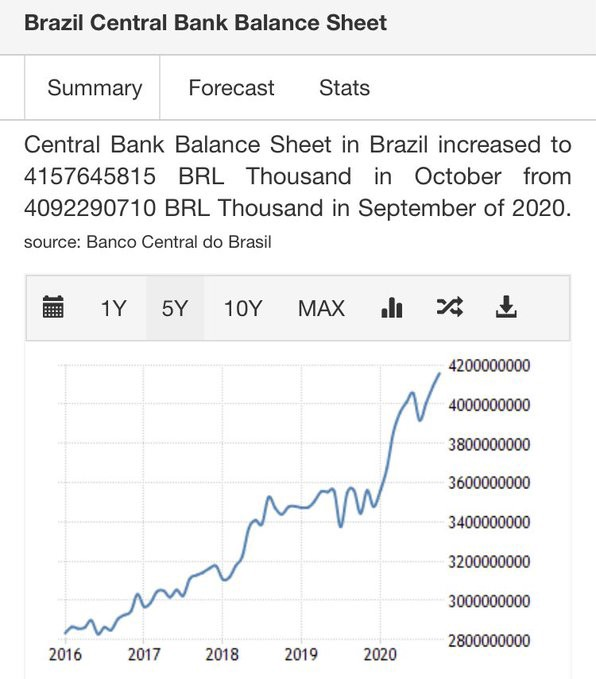

Lets take a trip around the globe to see how much the central banks are printing and adding to their balance sheet.

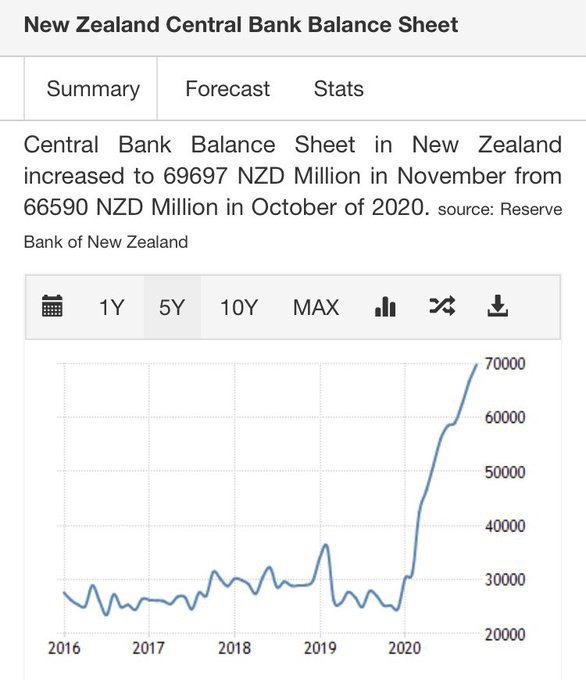

New Zealand, ~+133% in annual balance sheet growth

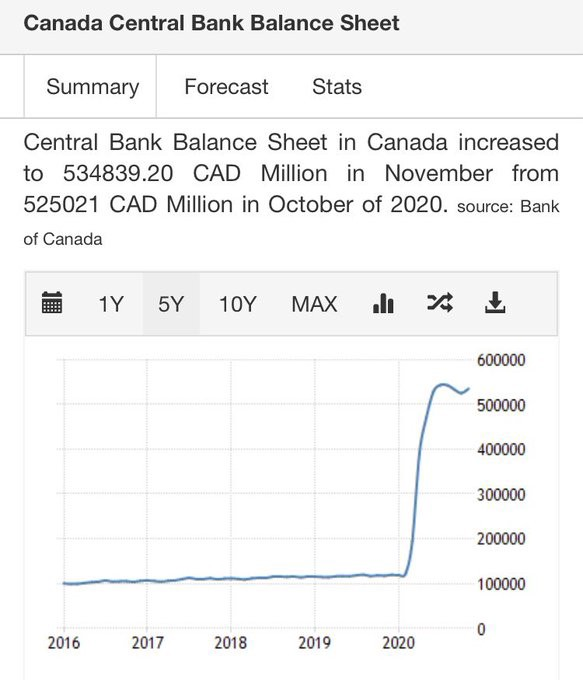

Canada ~+472% in annual balance sheet growth

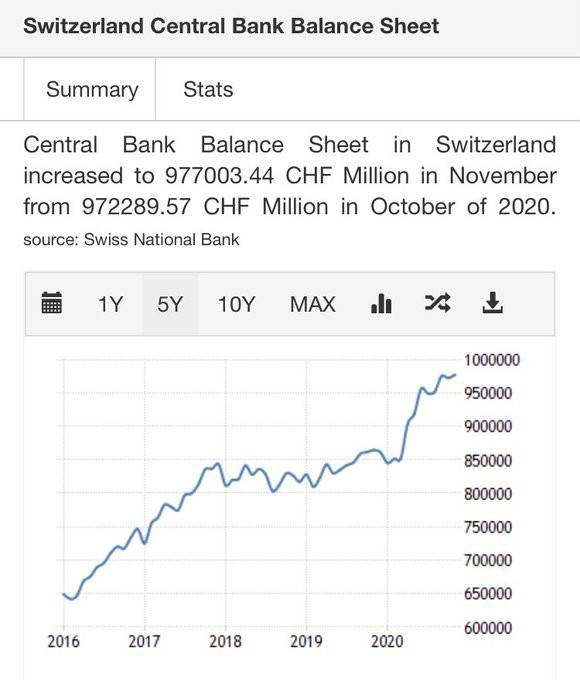

Switzerland ~+15% in annual balance sheet growth

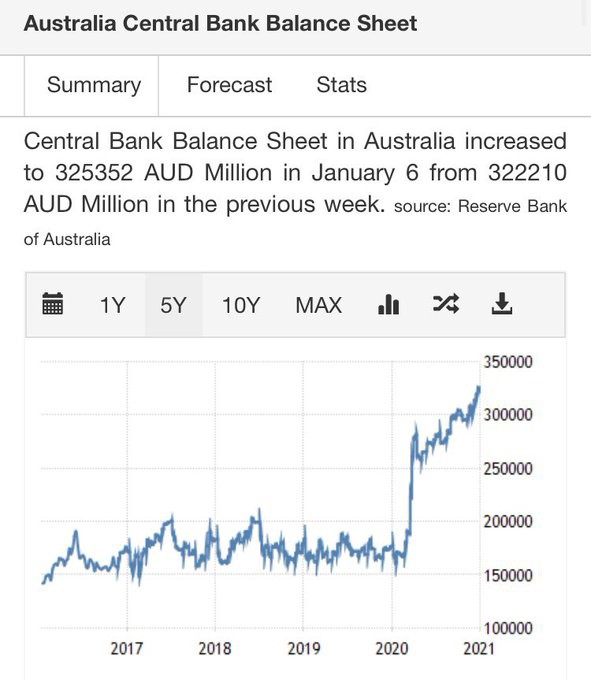

Australia ~+85% in annual balance sheet growth

Europe ~+49% in annual balance sheet growth

Japan ~+23% in annual balance sheet growth

United Kingdom ~+55% in annual balance sheet growth

Brazil ~+19.1% in annual balance sheet growth

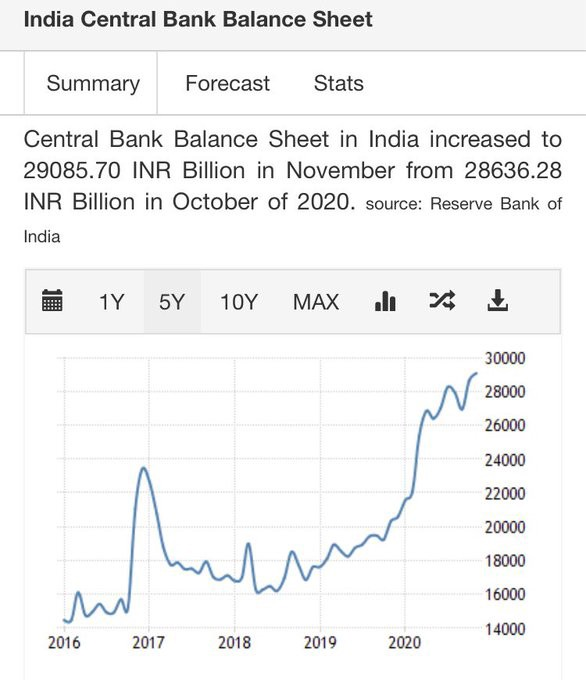

India ~+33% in annual balance sheet growth

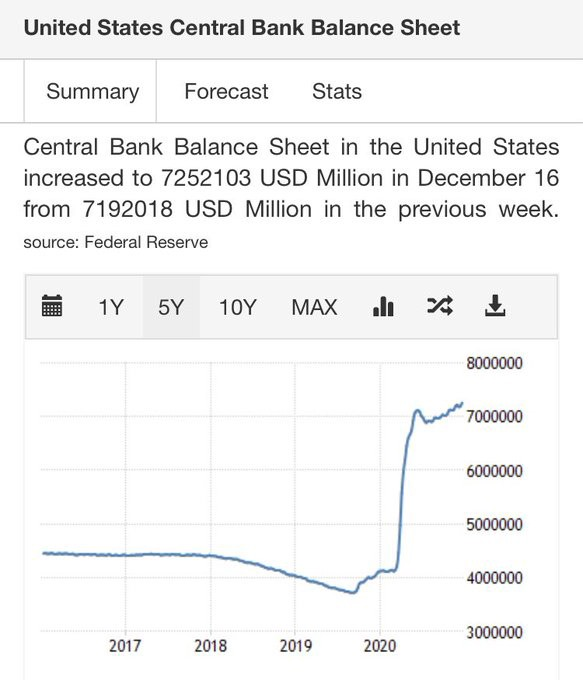

And finally, America. ~+78% in annual balance sheet growth

There are plenty of currencies around the world that are being printed at an unprecedented pace. Each country is printing their own individual currency. But bitcoin isn’t stopped by borders.

Microstrategy, a business intelligence software company, headed by Michael Saylor, has converted the cash reserves into bitcoin, citing the macro environment and effectiveness of bitcoin as a superior asset.

Guggenheim Parters, a hedge fund based out of New York City has signaled that they plan to allocate up to 10% of their $5.3 billion Macro Oppurtunities Fund. Scott Minerd, Guggenheim’s Chief Investment Officer has stated that bitcoin’s current value is $400,000 based on scarcity and it’s relative valuation to other assets.

MassMutual Insurance company has allocated $100 million to be held on their balance sheet.

Jack Dorsey, CEO of Twitter has allocated $50 million of another company of his, Square to hold bitcoin on their balance sheet.

Another project of Dorsey’s, CashApp now allows users to hold their balance in bitcoin.

This was followed by PayPal who has given users the ability to transact in bitcoin.

Although users are unable to move their bitcoin off of PayPal, the supply of bitcoin held by PayPal must be bought off the market, making it even more scarce.

All the factors are pointing in favor of bitcoin’s price rise to continue.

Stock to flow timeline, global money printing, institutional buying, growing access to investment.

Long bitcoin, short the bankers.

Congratulations @bchainbastards! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP