We are glad to see the excitement among Nexo’s clients about our instant crypto-backed loans. Nexo provides crypto owners with a great way to unlock the value of their holdings and get access to instant cash by borrowing against their assets instead of selling them.

Nexo Processes $300M+ in First 7 Months

As a profitable company, a top 50 most important Swiss Blockchain company, and a pioneer in the crypto lending space…

medium.com

Instantly Happy Nexo Clients

When Nexo embarked upon its journey just a few months ago, we had a clear vision to create the world’s first instant…

medium.com

Receiving a loan from Nexo is quick, easy and fully automated based on our 10+ years of expertise in online lending.

Create Your Free Nexo Account

Web: https://platform.nexo.io/new

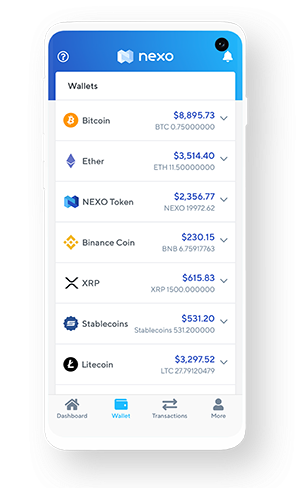

Also available on mobile:

The Nexo Wallet App Now Available on iOS & Android

We are beyond excited to announce that the Nexo Wallet is now also available as a mobile app for all iOS and Android…

medium.com

After you log in for the first time, you will need to verify your account. Verification is automated and usually takes less than a few minutes. This measure ensures compliance with the highest KYC/AML standards and protects your account from unauthorized access. Verifications are managed by Onfido, the world’s leading Know-Your-Customer enterprise

Basic Verification (for loans up to $10,000)

You will be asked to verify your account by entering your information and submitting it for review. You will not be required to upload any documents.

Advanced Verification (required for 30% dividends, the Nexo payments card, and for bank withdrawals up to $2,000,000)

To complete the process, take a photo with your mobile phone or upload an existing copy of your Passport, Driver’s License or ID card.

Deposit Crypto Assets to Your Secure Nexo Wallet

Presently, you can make a deposit, choosing from Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), NEXO Tokens and Binance Coin (BNB), with new collateral options being added regularly (you can vote here).

Crypto assets are held in multi-signature wallets and cold storage at Goldman Sachs-backed, SEC-approved custodian BitGo and SEC-approved custodian PrimeTrust.

Click “Deposit”, and enter the desired amount. You can increase your Loan Limit by placing more crypto into your Nexo Wallet at any time.

We have recently decreased the minimum loan amount to $500 and increased the maximum limit to $2,000,000.

Get started

Nexo

Getting Your Instant Nexo Loan in Three Easy Steps in 200+ jurisdictions and 45+ currencies

Nexo

Nexo

Aug 28, 2018 · 6 min read

We are glad to see the excitement among Nexo’s clients about our instant crypto-backed loans. Nexo provides crypto owners with a great way to unlock the value of their holdings and get access to instant cash by borrowing against their assets instead of selling them.

Nexo Processes $300M+ in First 7 Months

As a profitable company, a top 50 most important Swiss Blockchain company, and a pioneer in the crypto lending space…

medium.com

Instantly Happy Nexo Clients

When Nexo embarked upon its journey just a few months ago, we had a clear vision to create the world’s first instant…

medium.com

Receiving a loan from Nexo is quick, easy and fully automated based on our 10+ years of expertise in online lending.

Create Your Free Nexo Account

Web: https://platform.nexo.io/new

Also available on mobile:

The Nexo Wallet App Now Available on iOS & Android

We are beyond excited to announce that the Nexo Wallet is now also available as a mobile app for all iOS and Android…

medium.com

After you log in for the first time, you will need to verify your account. Verification is automated and usually takes less than a few minutes. This measure ensures compliance with the highest KYC/AML standards and protects your account from unauthorized access. Verifications are managed by Onfido, the world’s leading Know-Your-Customer enterprise.

Basic Verification (for loans up to $10,000)

You will be asked to verify your account by entering your information and submitting it for review. You will not be required to upload any documents.

Advanced Verification (required for 30% dividends, the Nexo payments card, and for bank withdrawals up to $2,000,000)

To complete the process, take a photo with your mobile phone or upload an existing copy of your Passport, Driver’s License or ID card.

Deposit Crypto Assets to Your Secure Nexo Wallet

Presently, you can make a deposit, choosing from Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), NEXO Tokens and Binance Coin (BNB), with new collateral options being added regularly (you can vote here).

Crypto assets are held in multi-signature wallets and cold storage at Goldman Sachs-backed, SEC-approved custodian BitGo and SEC-approved custodian PrimeTrust.

Nexo Teams up with SEC-approved BitGo to Ensure Security of Clients’ Crypto Assets

SEC-approved market leader and multi-signature technology pioneer BitGo henceforth holds clients’ crypto assets for…

medium.com

Click “Deposit”, and enter the desired amount. You can increase your Loan Limit by placing more crypto into your Nexo Wallet at any time.

We have recently decreased the minimum loan amount to $500 and increased the maximum limit to $2,000,000.

The Loan Limit is dynamically determined by the Nexo Oracle algorithms, depending on the current and historical volatility and market liquidity of the particular assets.

Depending on the type of assets you deposit, the loan-to-value (LTV) ratio ranges from 20% to 50%. Example: If you stake $10,000 worth of BTC, you will be able to withdraw an instant loan of approximately $5,000, i.e an LTV of ~50%. If you place a mix of assets, the LTV ratio will be determined proportionately.

It takes BTC deposits six network confirmations to appear in your Nexo Wallet. ETH and ERC20 deposits will appear after 50 network confirmations. You can track the status on the Transactions page.

Once your deposit is confirmed on the blockchain, you can instantly withdraw a loan. No credit check, no loan application to fill out, no waiting for approval, nor any other tedious procedures are needed.

Note: If you choose to use NEXO Tokens as collateral, you will receive a 50% interest rate discount. You are still going to receive dividends on your NEXO Tokens which you keep in your Nexo Wallet.

Instantly Withdraw Your Loan to Your Bank Account

Click on “Withdraw Loan” and a screen opens displaying your available loan limit. You will be asked to choose your desired withdrawal method and currency, along with your bank account details.

In addition to instant USD and EUR loans, Nexo customers can also borrow instantly using a stablecoin which they can then exchange for a preferred cryptocurrency and/or convert into fiat easily. In the weeks to come, we are rolling out more local currencies. Finally, you need to enter the two-step authentication security code and agree with the terms.

Payment Processing: You should receive the funds by local bank transfer within 1 business day (up to 2–5 business days if it is a USD withdrawal to a non-US bank account). Coming Soon: We aim to empower all Nexo clients to spend their cash instantly through the comfort of their free Nexo Credit Card.

Loan Terms

Interest: The annual percentage interest rate (APR) starts at 8%, still much lower than the average credit card rate. Interest is charged only on what you use and for the days you borrow. No minimum loan repayments are required, as interest is debited automatically from your available credit limit.

Maturity: up to 1 year (may be renewed on request without repayment). You can repay all or some of your loan early at any time and you could save interest.

Maturity: up to 1 year (may be renewed on request without repayment). You can repay all or some of your loan early at any time and you could save interest.

Loan Example

Let’s say you want to buy a $20,000 car and instead of selling your Bitcoin, you would like to use it for an instant crypto-backed loan from Nexo.

Loan Limit: $20,000 (available instantly, without credit checks)

Deposit Required: $40,000 (worth of BTC, which stays yours)

Interest: starts at 8% per year APR

Daily Interest: ~$4.44 (debited daily from your available credit limit)

No additional fees. No hidden charges. No installments.

Loan Repayment

You can repay all or part of your loan at any time by bank transfer or using crypto, including the assets deposited in your Nexo Wallet.

Congratulations on using Nexo’s instant crypto-backed loan for the first time! You have taken the very wise decision to gain access to instant cash and to HODL your crypto assets. To top even that, bear in mind that you have also improved your tax situation, as selling crypto assets at a profit triggers a tax event, while borrowing against them does not

Get started

Nexo

Getting Your Instant Nexo Loan in Three Easy Steps in 200+ jurisdictions and 45+ currencies

Nexo

Nexo

Aug 28, 2018 · 6 min read

We are glad to see the excitement among Nexo’s clients about our instant crypto-backed loans. Nexo provides crypto owners with a great way to unlock the value of their holdings and get access to instant cash by borrowing against their assets instead of selling them.

Nexo Processes $300M+ in First 7 Months

As a profitable company, a top 50 most important Swiss Blockchain company, and a pioneer in the crypto lending space…

medium.com

Instantly Happy Nexo Clients

When Nexo embarked upon its journey just a few months ago, we had a clear vision to create the world’s first instant…

medium.com

Receiving a loan from Nexo is quick, easy and fully automated based on our 10+ years of expertise in online lending.

Create Your Free Nexo Account

Web: https://platform.nexo.io/new

Also available on mobile:

The Nexo Wallet App Now Available on iOS & Android

We are beyond excited to announce that the Nexo Wallet is now also available as a mobile app for all iOS and Android…

medium.com

After you log in for the first time, you will need to verify your account. Verification is automated and usually takes less than a few minutes. This measure ensures compliance with the highest KYC/AML standards and protects your account from unauthorized access. Verifications are managed by Onfido, the world’s leading Know-Your-Customer enterprise.

Basic Verification (for loans up to $10,000)

You will be asked to verify your account by entering your information and submitting it for review. You will not be required to upload any documents.

Advanced Verification (required for 30% dividends, the Nexo payments card, and for bank withdrawals up to $2,000,000)

To complete the process, take a photo with your mobile phone or upload an existing copy of your Passport, Driver’s License or ID card.

Deposit Crypto Assets to Your Secure Nexo Wallet

Presently, you can make a deposit, choosing from Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), NEXO Tokens and Binance Coin (BNB), with new collateral options being added regularly (you can vote here).

Crypto assets are held in multi-signature wallets and cold storage at Goldman Sachs-backed, SEC-approved custodian BitGo and SEC-approved custodian PrimeTrust.

Nexo Teams up with SEC-approved BitGo to Ensure Security of Clients’ Crypto Assets

SEC-approved market leader and multi-signature technology pioneer BitGo henceforth holds clients’ crypto assets for…

medium.com

Click “Deposit”, and enter the desired amount. You can increase your Loan Limit by placing more crypto into your Nexo Wallet at any time.

We have recently decreased the minimum loan amount to $500 and increased the maximum limit to $2,000,000.

The Loan Limit is dynamically determined by the Nexo Oracle algorithms, depending on the current and historical volatility and market liquidity of the particular assets.

Depending on the type of assets you deposit, the loan-to-value (LTV) ratio ranges from 20% to 50%. Example: If you stake $10,000 worth of BTC, you will be able to withdraw an instant loan of approximately $5,000, i.e an LTV of ~50%. If you place a mix of assets, the LTV ratio will be determined proportionately.

It takes BTC deposits six network confirmations to appear in your Nexo Wallet. ETH and ERC20 deposits will appear after 50 network confirmations. You can track the status on the Transactions page.

Once your deposit is confirmed on the blockchain, you can instantly withdraw a loan. No credit check, no loan application to fill out, no waiting for approval, nor any other tedious procedures are needed.

Note: If you choose to use NEXO Tokens as collateral, you will receive a 50% interest rate discount. You are still going to receive dividends on your NEXO Tokens which you keep in your Nexo Wallet.

Instantly Withdraw Your Loan to Your Bank Account

Click on “Withdraw Loan” and a screen opens displaying your available loan limit. You will be asked to choose your desired withdrawal method and currency, along with your bank account details.

In addition to instant USD and EUR loans, Nexo customers can also borrow instantly using a stablecoin which they can then exchange for a preferred cryptocurrency and/or convert into fiat easily. In the weeks to come, we are rolling out more local currencies. Finally, you need to enter the two-step authentication security code and agree with the terms.

Payment Processing: You should receive the funds by local bank transfer within 1 business day (up to 2–5 business days if it is a USD withdrawal to a non-US bank account). Coming Soon: We aim to empower all Nexo clients to spend their cash instantly through the comfort of their free Nexo Credit Card.

Loan Terms

Interest: The annual percentage interest rate (APR) starts at 8%, still much lower than the average credit card rate. Interest is charged only on what you use and for the days you borrow. No minimum loan repayments are required, as interest is debited automatically from your available credit limit.

Maturity: up to 1 year (may be renewed on request without repayment). You can repay all or some of your loan early at any time and you could save interest.

Loan Example

Let’s say you want to buy a $20,000 car and instead of selling your Bitcoin, you would like to use it for an instant crypto-backed loan from Nexo.

Loan Limit: $20,000 (available instantly, without credit checks)

Deposit Required: $40,000 (worth of BTC, which stays yours)

Interest: starts at 8% per year APR

Daily Interest: ~$4.44 (debited daily from your available credit limit)

No additional fees. No hidden charges. No installments.

Loan Repayment

You can repay all or part of your loan at any time by bank transfer or using crypto, including the assets deposited in your Nexo Wallet.

Congratulations on using Nexo’s instant crypto-backed loan for the first time! You have taken the very wise decision to gain access to instant cash and to HODL your crypto assets. To top even that, bear in mind that you have also improved your tax situation, as selling crypto assets at a profit triggers a tax event, while borrowing against them does not!

To participate in Nexo’s financial success, make sure to purchase NEXO Tokens on Huobi, one of the community’s most popular cryptocurrency exchanges, against BTC and ETH, as Nexo shares 30% of its profits with the NEXO Token Holders.

Nexo Dividends Explained

Pioneering financial innovation has been encoded into the DNA of Nexo’s Team for over a decade now. In an environment…

medium.com

Please, tell only your best friends!

This is the time to get started

I really think this is happening right on time no doubt about that.....

I really think this

Is happening right on time

No doubt about that.....

- benjamin12

I'm a bot. I detect haiku.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/nexo/getting-your-nexo-loan-in-three-easy-steps-f0d4bec5c7ea