DAILY TL;DR W/ CHESLINK

DECEMBER 25TH-29TH

December 26th

- BTC/BCH NEWS

- IN OTHER NEWS

MARKETCAP ANALYSIS

Recap from 11/20

Market Cap: $243,311,416,536

24h Vol: $7,403,167,283

BTC Dominance: 56.2%

As of 12/11

Market Cap: $462,879,608,891

24h Vol: $25,098,117,991

BTC Dominance: 61.7%

As of 12/20

Market Cap: $628,445,215,824

24h Vol: $52,537,317,094

BTC Dominance: 47.2%

As of 12/26

Market Cap: $588,891,066,956

24h Vol: $27,032,217,959

BTC Dominance: 45.6%

BTC NEWS

CBOE Data Says Bitcoin Downtrend Still Intact

• https://m.economictimes.com/markets/stocks/news/bitcoin-is-ready-to-lose-more-weight-reveals-cboe-data/articleshow/62247536.cms

The near month contract expiring on January 17, 2018, witnessed a steady rise in open interest (OI) accompanied by a price correction of almost 27 per cent to $13960 a contract (1 contract equals one bitcoin) last week. A rise in OI along with steep price correction is indicative of traders mounting huge bearish bets on a traded contract.

Bitcoin Recovery FOMO News Abounding

• http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11966037

• http://beta.latimes.com/business/la-fi-bitcoin-price-20171225-story.html

• https://www.investors.com/news/bitcoin-tries-to-rebound-again-after-last-weeks-meltdown-ethereum-litecoin-up/

• https://www.financemagnates.com/cryptocurrency/news/tenx-founder-julian-hosp-says-bitcoin-price-reach-60000-2018/

Bitcoin's market capitalisation — the price multiplied by the number of coins in circulation — dropped from about US$330 billion to a low of US$186b.

Although it recovered from some of the lost ground, it is still trading at levels seen on Friday afternoon.

TenX founder Julian Hosp shared his thoughts about where he believes Bitcoin is headed in the upcoming year. “I think we’re going to see bitcoin hitting the $60,000 mark, but I also think we’re going to see bitcoin hitting the $5,000 mark. The question is though, ‘Which one is it going to hit first?”

Satoshi’s Address Still Getting Donations

• http://ethereumworldnews.com/mystery-btc-creator-address-still-getting-donations/

The Genesis block of bitcoin, block zero, to date has received over 16.7 BTC presumably as donations or gestures of thanks to the creature and miner of block zero: Satoshi Nakamoto.

But perhaps these tippers think that’s a small price to pay for a token of gratitude to a mind or minds that may go down as among the greatest in human history — commensurate with Gutenberg and Einstein.

US Govt. Closes “Like Kind” Loophole – Now Taxed

• http://bitcoinist.com/cryptocurrency-investors-lose-tax-break/

The new U.S. tax code amends IRC Section 1031 (a)(1) regarding “like kind exchanges,” excluding all cryptocurrencies from a previous legal loophole and making all cryptocurrency trades a taxable event.

Coins held for less than a year are subject to regular income tax, which can range anywhere from 10 to 37 percent, depending upon personal income levels. Coins held for longer than one year are subject to long-term capital gains tax, which caps at around 24 percent.

Great Post on /r/EthTrader

Question: Hold BTC, ETH, or diversify? The case for a simple, diversified portfolio.

I was futzing around with some portfolio optimization models earlier and wanted to share. Without getting into the political side of the debate, there's a case to be made for diversifying your holdings (don't YOLO everything on the most-overcrowded trade ever: long BTC).

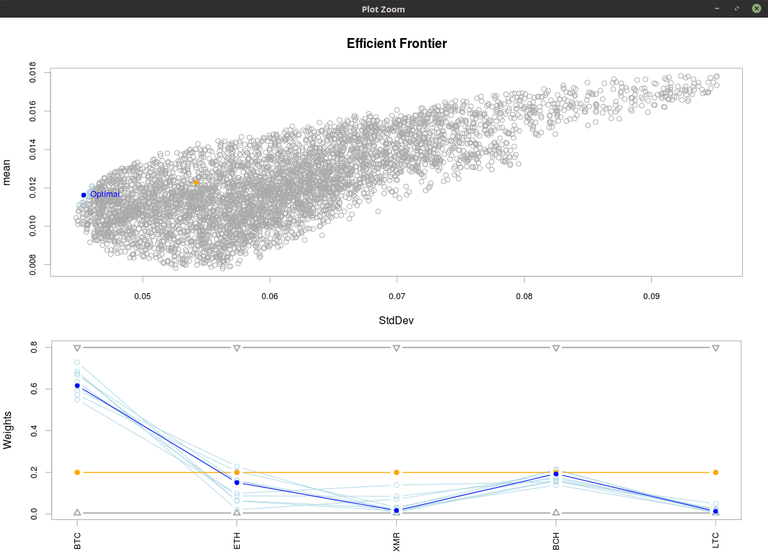

I set up a basic optimization problem such that the objective functions were to maximize portfolio return across a basket of assets (BTC, ETH, BCH, XMR, LTC) and minimize standard deviation* ("risk"). Box-constraint so that no one crypto could exceed 80% of total portfolio. Rebalance, weekly.

*in more complex models, you would be using VaR/ES

Run over the past ~4 months (2017-09-01, onwards), the model spit out:

Optimal Weights:

BTC ETH XMR BCH LTC

0.617 0.151 0.017 0.193 0.013

Here's what that looks like, relative to the efficient frontier (random sample of 5,000):

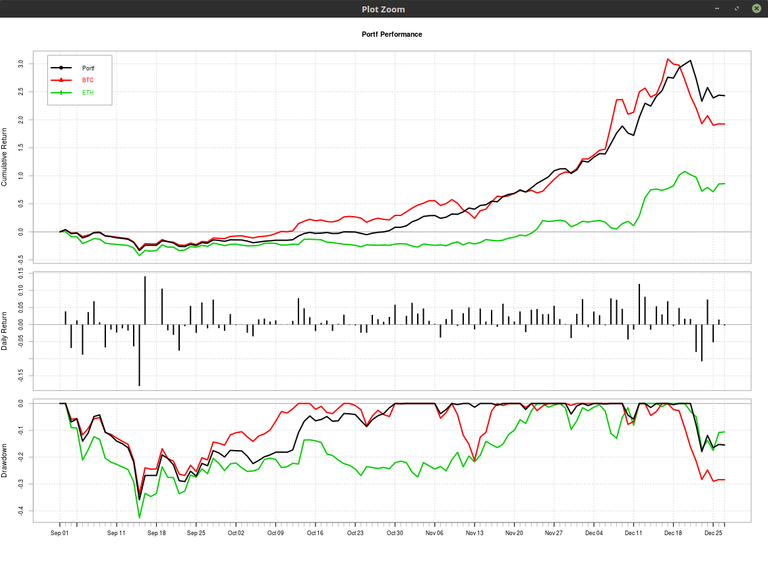

So, how did this portfolio perform, relative to holding BTC-only or ETH-only? See chart:

Metrics:

SharpeRatio.annualized(merge(portfRets, btcReturns, join='inner'))

Portf BTC

Annualized Sharpe Ratio (Rf=0%) 18.0036 10.82062

Return.annualized(merge(portfRets, btcReturns, join='inner'))

Portf BTC

Annualized Return 12.90769 9.087264

maxDrawdown(merge(portfRets, btcReturns, join='inner'))

Portf BTC

Worst Drawdown 0.3591361 0.3385638

Tl;dr: With a well-diversified portfolio, you can capture the same max-upside as holding BTC exclusively, but your risk metrics are better.

Interestingly and perhaps defying intuition, your drawdown on the latest correction is quantifiably much better holding a basket of crypto instead of only-BTC despite BTC being thought of as the benchmark asset.

Bitcoin Past Trends Applicable to Current Futures?

/u/SloppySynapses

• /r/BitcoinMarkets/comments/7m5lgr/daily_discussion_tuesday_december_26_2017/drrnu6x/

check this out to keep yourself grounded and prepared

Compared to the 2013 Bubble (using bitstamp prices):

day 9 after the bubble popped, we had a high of 77% of the ATH, so that would make today (2017/12/26) 's high be $15,219.

The next day it got to 85% ATH, which would make 2017/12/27 's high be $16,734.

Edit: If history repeats exactly, the day of ultimate sadness is 2019/02/03 with a high of $3,599. Then back up to 100% recovery on 2021/03/11

Bitcoin SURGING! GO FOMO!

• http://uk.businessinsider.com/bitcoin-price-value-surging-boxing-day-2017-12

The price of bitcoin surged more than 10% on Boxing Day to $15,338, as the volatile cryptocurrency recouped losses from the previous day, according to data from Markets Insider.

The cryptocurrency had lost almost 2% of its value on Christmas day. The movement was a modest lost after much sharper gains earlier in the week, when bitcoin plummeted from an all-time high of $19,843.

IN OTHER NEWS

Future of Blockchain Integration

• https://cio.economictimes.indiatimes.com/news/strategy-and-management/ai-blockchain-iot-cloud-rpa-and-3d-printing-will-be-the-game-changers-in-2018/62247932

Technologies like AI (artificial intelligence), Blockchain, IoT (Internet of Things), Cloud, RPA (Robotic Process Automation) and 3D printing are expected to evolve and will be the game changers in 2018 predicts Ritesh Gandotra, Director - Global Document Outsourcing, Xerox India

Open Trading Network

• https://usethebitcoin.com/open-trading-network-leverages-cross-chain-technology-become-first-ever-platform-unite-blockchain-networks/

Open Trading Network, the first 100% collateralized decentralized exchange, is breaking new grounds in the industry by making exchanges between the blockchain networks fast and secure like never before. The company’s vision is to build a set of applications aimed at making the crypto world open to the common man and all market participants.

The maiden product from the network, OTN. Wallet is in the final stages of development, and expected to be launched very soon. This multi-currency wallet will serve as a universal tool to store and exchange all types of cryptocurrencies or digital assets. Users will also enjoy several other important features such as fast and safe transactions, a balanced portfolio, direct exchange, P2P transfers, analytical tools, profitability reports, asset tokenization and detokenization, and much more.

XRB Pumping

• http://ethereumworldnews.com/raiblock-price-surging-revolutionary-cryptos-dominating/

Only in December, the pair XRB/USD has increased over 1700 percent in value from $0.35 to $6.50 [being its new all-time high] reaching a market cap of $864 million while dominating the BTC market for 41.33 percent.

It might be surprising reading minerless, but the way that RaiBlocks functions is that it is based on a crypto-architecture known as “block lattice”. The system goes beyond blockchain as Raiblocks is not just a long blockchain like the leading cryptos [Bitcoin or Ethereum], but it is a database of blockchains in which each user has their own blockchain that only they can add onto.

McAfee Coin of the Day Shill Pumps

• https://cryptovest.com/news/mcafees-crypto-picks-twitter-bots-fake-accounts-pumps--dumps-and-more/

John McAfee has managed to literally raise the dead with his daily coin picks, and after what he did with Verge (XVG), which grew from under $0.01 to over $0.25, he is at the center of massive hype, pumps and dumps, fake accounts and Twitter bots.

Last week, McAfee shared that he would be announcing a new coin every day as his recommendations for people who want to invest in projects that have strong future prospects. He started with Electroneum, then did DigiByte, then Reddcoin and today, on Christmas, he Tweeted about Humaniq.

It is not surprising that Twitter bots have been programmed specifically to pick coin names from McAfee’s Tweets and then have trading bots buy them up instantly before dumping them on human entrants.

Isreal Regulator Wants Ban on Crypto Related Stocks

• https://venturebeat.com/2017/12/25/israel-regulator-wants-to-ban-cryptocurrency-firms-from-stock-exchange/

“If we have a company that their main business is digital currencies we would not allow it. If already listed, its trading will be suspended,” Hauser said, adding the ISA must find the appropriate regulation for such companies.

Hauser did not identify any companies that would be affected by his ban, but at least two firms listed on the Tel Aviv Stock Exchange (TASE) now describe digital currencies or the technology behind them as essential to their business: Blockchain Mining and Fantasy Network.

It’s odd though because we recently saw the news about the Prime Minister siding with Bitcoin and trying to be more open with crypto.

SingularityNET ICO Sold in 1 Minute

• http://bitcoinist.com/gone-60-seconds-singularitynet-ico/

SingularityNET is a decentralized marketplace for artificial intelligence, and it may well have the record for the fastest selling ICO ever.

According to reports, the ICO was sold out within 60 seconds of going public, raising $36 million for the company behind the ambitious project. The team at Singularity reports that the crowdfunding was capped after receiving $361 million in investor interest on its whitelist from more than 20,000 previous investors.

Anyone can put an AI online, wrap it in our API, and announce it to the network and any business that needs AI as a service can request it.

Ardor PRESS Release