Markets trade the same. No matter how new, what is being traded and how "different it is this time!"

Why?

Human psychology is the same, we still freak out and panic sell after big market selloffs, and panic buy at the tops of big runs. It has happened time and again back through history, when you see a parabolic blowoff top you can expect the unwinding to look pretty similar.

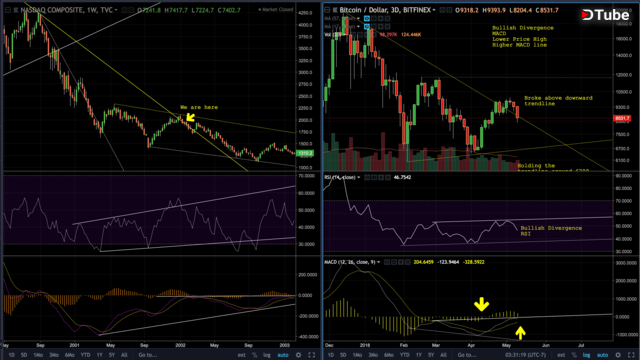

As it turns out the 1999-2004 time frame on the NASDAQ Composite index chart and the 2018 Bitcoin chart, look rather similar, if not downright identical.

In this video I take a look at how the current price action in bitcoin looks awfully familiar to a particular time in the NASDAQ before it had bottomed. From this we can predict timing of the bottom and how deep we will go.

This video is stream of consciousness from a trader (me) who has been trading successfully for about 20 years, trading during the dot com bubble, 9/11, Global Financial Crisis, Flash Crash, Brexit and still in the game.

This is not how I take on trades, I use an algorithmically based system that does the decision making for me, rather this is how I figure out where we are and how to apply different money management systems and well make stupid bets with friends on the internet about the future!

A bit about me and my trading Journey

How I became a professional trader

https://steemit.com/introduceyourself/@chris-d/how-i-became-a-professional-trader

Trading during 9/11 attacks

https://steemit.com/crypto/@chris-d/short-selling-when-the-world-is-falling-apart

A Day in the life of a professional trader

https://steemit.com/cryptocurrency/@chris-d/the-day-in-the-life-of-a-professional-trader

DISCLAIMER

This analysis is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. The research utilizes data and information from public, private and internal sources, including data from actual trades. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. The views expressed herein are solely those of the author as of the date of this report and are subject to change without notice. The author may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed.

▶️ DTube

▶️ IPFS