Dear Steemit Friends,

Currently, China accounts for nearly 70 percent of the global hash power for bitcoin, a computing capacity that powers a network to solve the mathematical functions to mine the cryptocurrency. Recent rumors, which were later put to rest, have surfaced that the Chinese government wants to Ban any and all mining activities in China. Instead, it now seems that they want to discourage, but not outright disallow mining businesses. Instead, what they plan on doing is to make it more difficult and less beneficial for mining operations to operate by pressuring miners to abandon the business of mining by leveraging electricity prices, land use, tax, and environmental regulations, which these businesses have benefited from in the past.

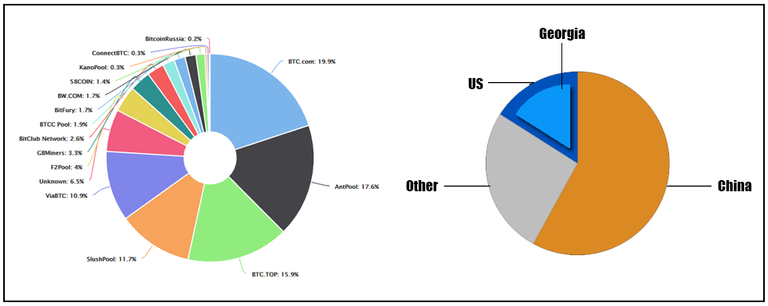

Nowhere is it cheaper to mine than in China, will probably change if the government succeeds in their plan. If you look at the latest breakdown from blockchain.info below, China makes up a majority of the overall global hashrate. What would happen if this hashrate was removed, or disappeared from the overall network?

As you can see above, a majority of the mining pools and operations reside in China, with the second largest group located in the US (Georgia making up a large chunk due to BitFury), and a 3rd larger group operating out of various other countries such as India, Iceland, Canada, Venezuela, etc. thus making a huge impact if China pools were to abruptly cease operations.

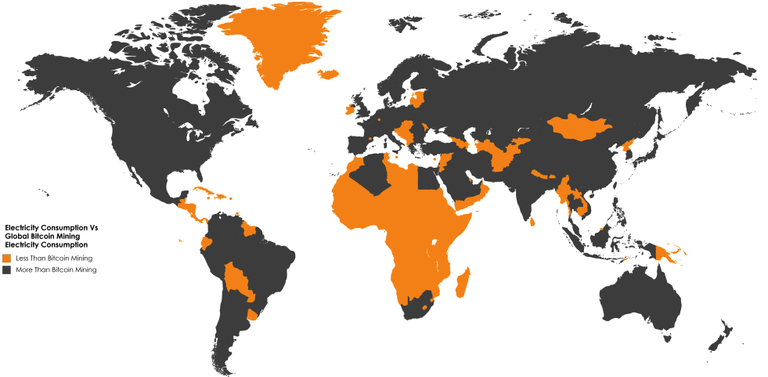

This, however, is an extreme situation and would probably never happen. If anything, we would see a gradual shift in geography and distribution of power over the entire network as the landscape shifts to adjust. We would probably see the overall hashrate fluctuate as businesses and hashpower shifts from region to region. Mining pools and Business owners will probably move operations to regions where it is more economical to do business as well as allow for other regions and miners to increase their own overall stake in the network. Mining tends to gravitate towards countries with cheaper electricity and resources and a good amount of new technology.

Another reason the impact would be minimal is due to the ecosystem that makes up Bitcoin and the blockchain ecosystem. Bitcoin doesn’t depend on miners for its survival, it depends on them for security. If you take miners those particular miners out of the equation, difficulty adjustments will kick in and soon miners in other countries will continue securing the network. Coining a term from Die Hard, It would take a "firesale" and perfect storm on several fronts to essentially do any harm to Bitcoin.

There is too much money invested in Bitcoin, blockchain, and other alternative currencies for it to just go away. Sure it can happen, but it would be very difficult. According to Quartz Media:

The latest crackdown on bitcoin mining comes amid China’s efforts to better distribute electricity to places where power is undersupplied. Already, some of the biggest bitcoin miners in China are moving operations overseas, with the US and Canada among popular options. But still, industrial players have doubts over how effective the state crackdown could be: For one thing, local governments have strong incentives to keep big mining firms running in their localities, given the huge tax and electricity bills they pay

A majority of the mining pools and businesses in China have told sources and news outlets such as Coindesk that they have received no information or direction to shut down mining operations or any changes in the way they conduct business. This does not mean it won't happen - take for instance the recent crackdown on exchanges in the past year.

Overall, rest assured that any changes in the Bitcoin ecosystem will only have minimal and short-term effects. It is in my opinion that any push to limit or shut down these operations will only have a small and temporary impact, but for most of us that continue to believe in Bitcoin and Cryptocurrencies, it is just an opportunity to increase our positions and make even more money. Every downside has its upside and this is just a small speedbump in our journey to grow.

So what would happen if we were to lose 2/3 of the world's Bitcoin Mining Network? A

My answer... Absolutely nothing!

What are your thoughts? Please let me know in the comments below and as usual, if you have any questions, inputs, or feedback, please feel free to share. I would also appreciate your support in the form of Upvoting, Following, and Re-steeming my post if you found it informative.

Image Sources: [1] [2]

Losing 2/3 of the miners would only have a temporary impact because after some time the difficulty is gonna get lower, I have been thinking how many chinese miners that mines ETH will turn of there rigs too :)

I agree - It would be good for us smaller personal home miners! Allow our minimal hash power to mean more.

Exactly :)

I agree. I don't think much would change that much offhand outside a short term market correction due to the loss of a large market. I've been secretly worried that China and/or Russia may try and manipulate bitcoin and other cryptos due to how much mining is taking place inside those countries.

I think there is already manipulation built in, especially for the larger mining operations. They can pump coins due to the huge amount of power and currency they control. Bitmain is a good example - they can virtually drive prices each time they release a new piece of hardware

The greatest manipulator is the USA govt. If they are unable to manipulate bitcoin ecosystem be it mining or trading or undermining the Internet connections to bitcoin nodes, no other govt would be successful.

yup. The government is now just looking for their cut

Nice post! :D Do you think the transaction cost would also rise as a result of losing the miners in China? Or is that more a factor of how many transactions are happening per second, regardless of the mining power.

I don't think the transaction fee would increase primarily because of a reduction in mining power since the number of transactions and block size plays a heavy role in that equation. Miners prioritize transactions with the highest fee per byte, which is why senders who are in a hurry will pay a higher fee to push their transaction to the front of the queue.

Oh okay interesting. So a bigger collection of miners might just be pushing the overall cost of mining up with electricity and equipment, and not necessarily making the network better for the users :P

I guess you could say that. It definitely makes it so people have to keep buying equipment to compete, and with that comes more electricity consumption.

This post has received a 5.86 % upvote from @upmyvote thanks to: @cloh76. Send at least 1 SBD to @upmyvote with a post link in the memo field to promote a post! Sorry, we can't upvote comments.

You got a 0.72% upvote from @upme requested by: @cloh76.

Send at least 2.5 SBD to @upme with a post link in the memo field to receive upvote next round.

To support our activity, please vote for my master @suggeelson, as a STEEM Witness