Cryptocurrency markets are infamous for their high volatility, which can bring a lot of uncertainty and chaos into our everyday lives.

Furthermore, as opposed to traditional stock markets that work on specific hours and can be closed on demand, crypto markets are open all the time, they work non-stop, 24/7.

In this article, we will describe how to keep a rational mindset, and stick to your long-term investing goals during chaotic and uncertain times in crypto markets, with the help of automated crypto alerts, and without the need to endlessly watch charts or waste a lot of time.

Below are defined 5 common conditions that re-occur in crypto markets again and again. Because each condition is a generalized phenomenon that keeps on repeating, we can look at it rationally, as to a pattern.

- Bull Market (Uptrend)

- Bear Market (Downtrend)

- Range-Bound (Consolidation)

- FUD (Panic Selling)

- FOMO (Panic Buying)

By better understanding these generalized market conditions, we can eliminate crypto market’s negative side-effects from our daily lives. At the same time, by automatically monitoring cryptocurrency market situation with crypto alerts, we can be well-informed and ready to take action when the right time comes.

Bull Market (Uptrend)

During a bull market, the long-term market trend is directed upwards.

The price doesn’t shoot straight up but is climbing little by little, with setbacks along the way. During these bull market setbacks, we often see “buy the dip”, and “HODL” memes.

While the downside is limited, the upside is always bigger, and hence the price keeps increasing. This lasts for a relatively long period of time so that the long-term uptrend can be established.

Bitcoin bull market from Jan 2015 to Dec 2017

There can be short-term, and long-term bull markets.

We can say, that the longest bull market so far in crypto, is Bitcoin rising from $0.00 in 2009 to more than $69,000 in 2021. Of course, during this epic bull run, there were many bear markets, but that’s the topic of the next chapter.

Currently, in 2022, it is not clear if we are in a prolonged bull market that started in 2020, or in a bear market that started in 2021. Time will tell, as everything becomes clear when looking retrospectively.

To keep a balanced view during bull markets, set alerts for your long-term price targets. That will help you to stay off the charts, and not miss your price targets when they are reached.

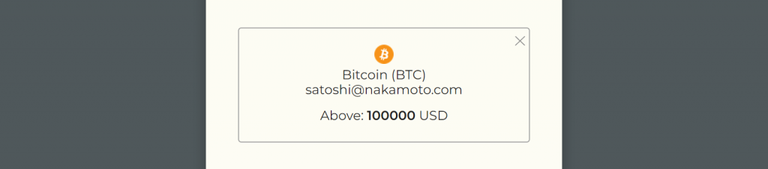

Many crypto influencers and financial analytics believe that in 2022 Bitcoin will reach 100k price and that the bull market will continue. So, if you think that we are currently in a prolonged bull market, the following crypto alert would make perfect sense.

Set your price target alert and safely forget charts

Having a long-term price target will help you not to make emotional decisions since usually, it’s better to stick to a long-term strategy. Price targets in your defined crypto alerts will always remind you about your long-term goals.

Bear Market (Downtrend)

During a bear market, the long-term trend is directed downwards, and therefore prices are going down. Similar to bull markets, bear markets can be prolonged. No one knows when the bear market will end, similarly as no one knows when the bull run ends.

Cryptocurrency bear market (2017-2018)

During a bear market, you may cut your losses and exit the market, or keep hodling your crypto assets, until (and if) they recover.

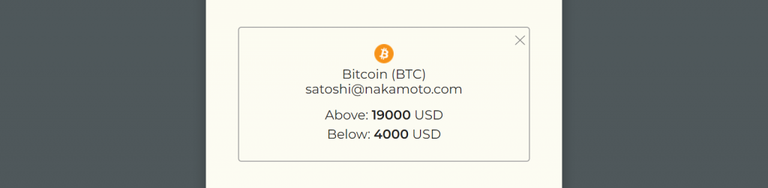

If you cut your losses at some price, you may want to re-enter the market at a lower price point. In such cases, set an alert for a lower price. If the market reaches your defined price target, you will be notified by the alert.

If, on the other hand, you keep on your crypto assets, and wait for the price to recover, simply set an alert for a higher price, and safely forget charts.

Set a single crypto alert that covers both low and high price targets

Range-Bound (Consolidation)

During the range-bound market, for a prolonged period of time, Bitcoin is trading between the upper, and lower trendlines. It’s a kind of consolidation period, during which there is not a lot of market activity. During these periods, we see similar memes as ‘c’mon, do something’.

BTC range-bound (May-August 2021)

Since most of the altcoins depend on Bitcoin price movements, other cryptocurrency prices also follow Bitcoin, more or less in a range-bound manner.

During these times, traders expect the price to break below the lower trendline, or above the upper one. Breaking above signals that the bull market will continue, and vice-versa.

Since there is not a lot of action happening during the range-bound period, it’s not wise to keep watching charts. Instead, better set up a crypto alert that will notify you when the coin price breaks the upper or lower trendline.

Crypto alert example for a range-bound market

After you set the alert, you can safely forget charts, as there is no more need to keep checking them. The alert will inform you when your predefined conditions are met. Maybe Bitcoin will trade in the range for another month, but since you have an active alert, you don’t need to watch charts at all. You now have free time available which you can spend however you prefer.

FUD (Panic Selling)

During the FUD (fear, uncertainty & doubt) periods, panic selling can start in markets because of some potential “black swan” event, such as China banning Bitcoin, BCH flipping BTC, COVID-19 initial shock, and similar.

Some FUD is based on real-life facts or events, while other FUD can be fake news, propaganda, etc.

During these periods, the market becomes very sensitive and can react with sharp price decline because of some slightly negative or even neutral news, and then because of the free-fall effect, which generates additional FUD, the price can decline even further.

COVID-19 initial shock in March 2019

Because of the FUD-induced panic selling, the market can quickly plunge significantly, but usually, it also tends to recover quickly.

So in these FUD situations, if you receive a range-bound alert that the Bitcoin price is below your lower trendline, you do not necessarily need to react to it. You should double-check, maybe it’s just FUD. In such cases, the price can be significantly lowered for the short-term period because of panic sellers, but that doesn’t reflect the true value of an asset if its fundamentals stay strong.

In similar FUD situations, it can become harder to concentrate on your everyday life, family, work, stay productive, sleep well, etc. An irrational fear might keep you stuck at checking cryptocurrency prices.

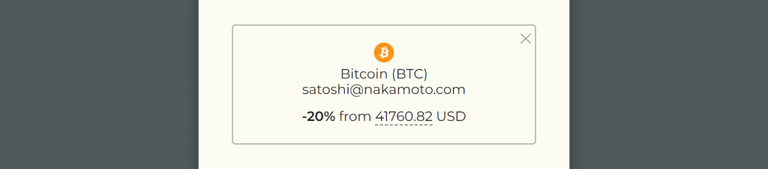

So, in order to regain freedom from charts, create a crypto alert which, for example, is -20% below the current price, if you can tolerate such a minus. You will then be able to leave charts safely, and continue with your day. While the alert is not received, you will always know that the price did not decline by more than -20%, and this knowledge can provide a real sense of security.

Crypto alert for -20% below the current coin price

And of course, if the FUD is happening during a bull market, you may want to “buy the dip”. So set the alert for your lower price target, and the alert will inform you when your defined conditions are met.

On the other hand, if you have a lower tolerance for risk, you may decide to sell if the price falls by more than 10-20%. Since there are no universal rules in investing, selling may also turn out to be a wise decision, since some innocent-looking FUDs can quickly (or slowly) spin out into a prolonged bear market, despite the fundamentals.

FOMO (Panic Buying)

During the FOMO (fear of missing out) periods, we can observe a parabolic price increase in a relatively short period of time. In such cases, there are many more buyers than sellers in crypto markets, and hence the price can increase very quickly.

FOMO aka panic buying in 2021

FOMO is quite the opposite of FUD. While the FUD is powered by fear and negative news, FOMO is powered by greed and hype.

FOMO lasts a relatively short period of time, and after the FOMO, there can be a sharp price decline. But not always, as there can be several FOMO events, with only mild setbacks in between.

Since FOMO events happen several times during a prolonged bull market, it is wise to stick to your long-term strategy. But if the FOMO happens near your target price, it might also be a good idea to sell during such a FOMO moment.

To catch these FOMO moments, you can use the Coinwink Portfolio multiple-coin alerts feature. These are percentage alerts, and they will inform you when any of your portfolio coins increase by a specified percentage in a 1h or 24h period. You can have 20 or more coins and tokens in your portfolio, and all of them will be tracked by the single multiple-coin alert. That’s a simple and reliable way to catch FOMO events.

Multiple-coin alert to track all Coinwink Portfolio coins at once

Conclusion

Since humans cannot predict the future, and there are no universal rules that can guarantee success in crypto markets, it is impossible to eliminate chaos and uncertainty from our lives completely.

Additionally, it is no longer possible to ignore cryptocurrencies altogether, because they are everywhere now. Every day we are bombarded with crypto-related messages through different media channels, and we can no longer choose not to participate in crypto in one way or another.

Instead of trying to ignore and avoid the market entirely, we can participate in it by being well-informed long-term investors with the help of the right tools and automation.

By embracing the chaos and uncertainty with the help of Coinwink email and SMS crypto alerts, it is possible to simplify and automate cryptocurrency market tracking, keep a rational mindset and a detached perspective, and concentrate on the long-term investing goals.

It is much easier to tolerate this chaos and uncertainty when you know that the crypto market is being monitored 24/7 according to your custom set of rules.

DISCLAIMER: The information provided in this article does not constitute any form of investment advice, recommendation, or endorsement by Coinwink. The information is general in nature and is not intended to address your particular requirements. You should consider seeking independent legal, financial, taxation, or other professional advice to check how the information relates to your unique circumstances.

This article was originally published on the Coinwink Blog.

Coinwink is a crypto alerts, watchlist and portfolio tracking app for Bitcoin, Ethereum and other 3600 crypto coins and tokens.

Don’t waste time manually watching crypto prices, use Coinwink.