.jpg)

“Banking is necessary, but banks are not.”

Five years ago, members of the Colendi team launched Ininal — “The Bank for the Unbanked” — with a dream of empowering all of Turkey’s citizens with financial tools. Our journey at Ininal touched over 1 million users, and we learned first-hand about the foundational inequalities of global banking and the great need for change. Almost 72% of the world’s population has either limited credit data or none at all, and have no access to credit or assessment systems.

Today, both financial institutions and credibility assessment systems have fallen behind the needs of a fast globalizing world. Addressing these long-standing inequalities has became the goal of Colendi — a dedicated technology bringing the digital and accessible means of credit scoring to the entire world.

Colendi is a blockchain-based, decentralized credibility evaluation and microcredit platform, fully compatible with participation banking requirements, as well as traditional financing methods. Colendi aims to provide a unique and global identity and a global financial reliability passport on the blockchain for every person in order to create a more democratic, transparent, inclusive and truly mobile creditworthiness measure.

Through its decentralized structure — built on machine learning algorithms — Colendi gathers and processes all digital data of a user in order to create a universal digital identity and comprehensive credibility image. Smartphone, social media, telco, retail history and many other aspects of a user’s data are evaluated in Colendi network in order to bring out the most comprehensive creditworthiness measure as a global financial passport.

Via its cutting-edge technology and global credibility identity, Colendi provides financial reliability information based on users’ own distributed data. The Colendi platform uses its decentralized intelligent scoring and fraud detection algorithms by evaluating their users’ real-life data to identify truly credible users, whether they they are banked or unbanked.

Colendi will enable various financial applications for unbanked individuals as well as an evolution of credibility assessment. Microcredit, installment shopping, P2P financing, and reliability checking will be the primary focuses in regards to financial use cases. Many more applications and systems will be built on top of Colendi protocol and credibility technology as the roadmap develops.

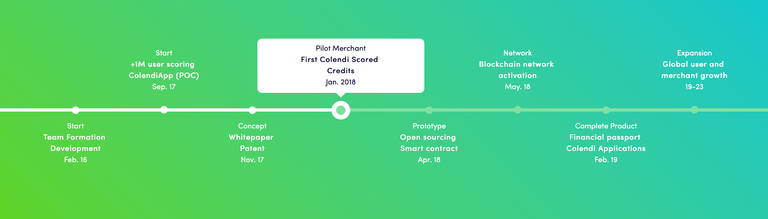

The Colendi journey began in 2016. Here’s a summary of what’s happened so far:

• Dedicated team was formed — Feb 16

• Development of Colendi main scoring technology has started — Feb 16

• **Over 1 million digital wallet users have been scored with Colendi algorithms! **— Sep 17

• Whitepaper has been published — Nov 17

• Patent applications were made — Nov 17

• First Retail Chain agreement has been made — Dec 17

• First Colendi Scored credits were lent! — Jan 18

Colendi has started its journey to transform credibility in a fast pace and both our team and most valued advisor pool are growing even faster! What will be heard from us is as follows:

• Colendi Token Sale! — Coming soon

• First Colendi Financial Passport and Credits on Blockchain — 2018 Q3

Now, join our Telegram account to be a part of the transformation:

Telegram

and visit our website to learn more about Colendi

Web Site

and for further information, please read Colendi Token paper:

Token paper

Stay connected!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/colendi/hello-world-hello-colendi-decentralized-credibility-and-microcredit-upcoming-ico-1fa5a3d8c4a2