Hello fellow Steemians and Crypto investors,

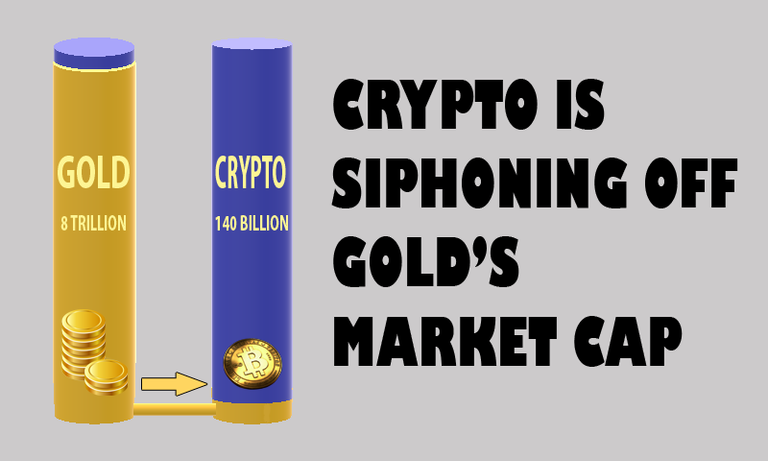

As I have been writing about for some time crypto seems to be siphoning off gold’s market cap. Bitcoin could increase 50x in price by stealing Gold’s thunder.

I found this very interesting article from Bloomberg Tech this morning describing how "preppers", some of the most hardcore Gold bugs out there, are beginning to diversify into Bitcoin and crypto currencies.

Is Crypto in a bubble, is Gold about to lose %50 of its market cap to crypto? What do you think?

Enjoy the article and don't forget to leave your comments bellow!

Trolls are welcome. Comment at will!

Bloomberg Technology

By Eddie Van Der Walt

November 20, 2017, 12:00 AM EST

- Doomsday preppers in North America bet on bitcoin

- Cryptocurrency is starting to impinge on gold's appeal

Wendy McElroy is ready for most doomsday scenarios: a one-year supply of nonperishable food is stacked in a cellar at her farm in rural Ontario. Her blueprint for survival also depends upon working internet: part of her money, assuming she needs some after civilization collapses, is in bitcoin.

Across the North American countryside, preppers like McElroy are storing more and more of their wealth in invisible wallets in cyberspace instead of stockpiling gold bars and coins in their bunkers and basement safes.

They won’t be able to access their virtual cash the moment a catastrophe knocks out the power grid or the web, but that hasn’t dissuaded them. Even staunch survivalists are convinced bitcoin will endure economic collapse, global pandemic, climate change catastrophes and nuclear war.

“I consider bitcoin to be a currency on the same level as gold,” McElroy, who lives on the farm with her husband, said by email. “It allows individuals to become self-bankers. When I fully understood the concepts and their significance, bitcoin became a fascination.”

At first glance, it seems counter-intuitive that some of bitcoin’s most ardent proponents are people motivated by the belief that public infrastructure will collapse in times of social and political distress. Bitcoin isn’t yet widely accepted as a method of payment and steep transaction costs make it inconvenient to use at vendors that do take it.

Preppers, as it happens, have a different perspective on what they see as the money of the future, which has surged 10-fold in the past 12 months as supporters lauded it as a digital alternative to rival the dollar, euro or yen.

Used to send and receive payments online, bitcoin is similar to payment networks like PayPal or Mastercard, the difference being that it runs on a decentralized network—blockchain—that’s beyond the control of central banks and regulators. It was born out of an anti-establishment vision of a government-free society, a key attraction for those seeking unhindered access to their capital in case a massive shock shuts down the banking system.

“People see bitcoin prices going to the moon. No one thinks gold is going to the moon”

“Not too long ago, people in the prepper community were actively warning against crypto, and now they’re all investing in it,” said Tom Martin, a truck driver from Washington who runs a social-media website for people interested in learning skills to survive disaster. “As long as the grid stays up, people will keep using bitcoin.”In addition to gold, silver and stocks, Martin invests in bitcoin and peers litecoin and steem because they’re easier to travel with, harder to steal and offer better protection in the event of the kind of societal breakdown that would unfold if a fiat currency like the dollar collapsed.

He’s among those confident that bitcoin can withstand even a complete blackout through the strength of the underlying blockchain, the anonymous public bookkeeping technology that records every single bitcoin transaction.

Discussions on the pros and cons of investing in crypto have popped up on survivalist forums like mysurvivalforum.com and survivalistboards.com this year as bitcoin rallied above $7,000. “Buy bitcoin” is now a more popular search phrase than “buy gold” on Google.

The buzz is starting to impinge on gold’s role as a store of value especially since, like the precious metal, there’s a finite supply of bitcoin, which proponents say gives it anti-inflationary qualities. Sales of gold coins from the U.S. Mint slid to a decade low in the first three quarters months of 2017.

“It’s definitely had some impact on the market,” Philip Newman, who does research on precious-metal coin sales and is one of the founders of research firm Metals Focus, said by phone from Washington. “People see bitcoin prices going to the moon. No one thinks gold is going to the moon.”

To attract investors who traditionally buy gold, several digital assets, like Royal Mint Gold and Anthem Gold, have been developed that are backed by physical gold stored in vaults.

Still, it’s hard to envision people walking around spending digital coins to buy Spam, canned beans or bottled water at a local supermarket when they don’t have electricity at home to charge their smart phones, let alone a working internet connection to access their digital wallets.

“I doubt bitcoin is a safe haven from an extreme-risk environment. In that sense, bitcoin isn’t gold,” said Charlie Morris, the London-based chief investment officer at Newscape Capital Advisors Ltd., which invests in cryptocurrencies and is building a price-discovery platform for them.

Bitcoin has also not reached the critical mass to be considered a viable currency to invest in, UBS Group AG’s Mark Haefele said in an interview. The total sum of all cryptocurrencies is “not even the size of some of the smaller currencies’’ that UBS would allocate to, he said.

Continue reading entire article from source: Doomsday Preppers Are Starting to Switch From Gold to Bitcoin

— With assistance by Dave Liedtka, and Samuel Dodge

CHECK OUT MY PREVIOUS POSTS:

BEWARE! Whales are pumping Bitcoin Cash and luring suckers in

"It's Been Dismal" - Gold Coin Sales Slump As 'Bugs' Bounce To Bitcoin

Bitcoin All-Time-High on Google Trends - 91% strong correlation with its price

Why China (or governments) can’t stop crypto

ETHEREUM’S RAIDEN VS BITCOIN’S LIGHTENING – What’s happening?

SEE THE CHARTS! Segwit progressing slow but already helping ease congestion in the Bitcoin network

Tell me what you think of this post in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Follow me for updates news and commentary on "sane" crypto investing.

Happy crypto investing!

This just means the bottum is close!

Kee stackin!

Hahah, good one! ;)

good one. I think cryptoes are future.

thanks

thanks sir for your nice post.

resteem and upvote

nicely updated the last information

keep it up..

Awesome work..

well done

really doing good job....

good work keeep it up

Awesome post like it!!

really nice one...

@cryptoeagle it is interesting to see how preppers are also moving part of their net income into bitcoin vs. gold. Thanks for sharing this great article. @gold84

Congratulations @cryptoeagle! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.cetusnews.com/tech/Can-Bitcoin-Survive-an-Apocalypse-.By3pBxgez.html

If crypto is "going to the moon" and I had "gold" I would sell the gold to buy crypto, take the moon ride, sell upon lunar landing and buy the beat down gold. It's beautiful and just plain nice.

Gold's 8 trillion market cap and huge yearly extraction of the mineral makes it almost impossible for it to double or triple in price anytime soon. The only way this could happen would be with the dollar hyperinflating and even then your value would be pretty much the same. With Bitcoin and crypto, on the other hand, the potential price increases are evident since they are capped and this is a nascent asset class so most of the big money is still not invested in them.

img credz: pixabay.com

Nice, you got a 20.0% @trafalgar upgoat, thanks to @cryptoeagle

It consists of $8.97 vote and $0.25 curation

Want a boost? Minnowbooster's got your back!

I think Bitcoin is really attracted to gold, it is a lot of work to do in various jobs, and everyone will benefit from it, thanks for your believable talk,

@followed and upvoted

Gold is unlimited and cryptocurrencies are finite which means that they can and will be of more value. However, I would suggest having multiple streams of different income/savings/investment, whatever you want to call it. Cryptocurrencies definitely, gold maybe, silver yes, fiat currency just a bit.

nothing to say...

just going up.

@best of luck..

thank's for sharing

It's curious that survivalists now see bitcoin as the go to. And more curious even is seeing that the article is from Bloomberg. Thanks for sharing!

They have always been fighting Bitcoin rather that diversify into it a small percentage. Now they will be forced to buy at high prices and panic sell Gold as it keeps losing market share to crypto currencies.

bitcoin is unstoppable, cryptocurriency is the best..

the future and thank goodness that we are part of it..good post, love to read it.This just means the bottum is close!

Kee stackin!

Exceptional find. I think that article applies to many cryptocurrencies, not only bitcoin. However, your point, which you made all along, is that bitcoin will be the new gold. I agree that we could see 50% of the gold market move into bitcoin. It is the largest, most well known blockchain and it will continue to serve as the defacto "store of wealth" in the digital realm.

As for the ability to buy canned food with bitcoin, who cares? Bitcoin most likely will not be the currency. Nevertheless, that means nothing. There are a ton of currencies that btc can easily be converted into (and with atomic swaps, it might be automatic). Let something else serve as cash...btc will be the place where people park their wealth.

This also makes the transaction times rather meaningless.

Gold is still valuable but it doesn't deserve an 8 trillion market cap in today's digital world. The best idea is to stay diversified. The Gold bugs and preppers' biggest mistake has been to completely dismiss Bitcoin rather than diversifying at least a %1-%10 of their wealth into it. regards Taskmaster!

LOL check this out...look at the third one...BCH...

https://steemit.com/cryptocurrency/@algons/cryptocurrencies-described-in-less-than-5-words

I agree although I feel the physical aspect of things will become less and less over the next 10 years as more of our lives go digital. The blockchain is going to swallow up a ton of stuff that is presently in physical form. Entire businesses will operate without much human interaction located entirely on the blockchain (this is BTS vision). To me, this environment is ripe for digital gold.

I just upvoted you! I found similar content that readers might..

Cryptocurrencies are the future and thank goodness that we are part of it..good post, love to read it..

wish i have those hands & keep upvoting such as this creative funny post!!

Thanks for sharing this..

thanks for telling about cryptocurriency, wish you a very beautiful time ahead my friend.

Very beautiful!

good

good

great work!

likeee it

awesome post.. good going!!

thats a nice post